What is coin mining? What does a coin mining machine include? How to calculate profit? Immediately save 4 effective coin mining experiences in this article.

What is coin mining?

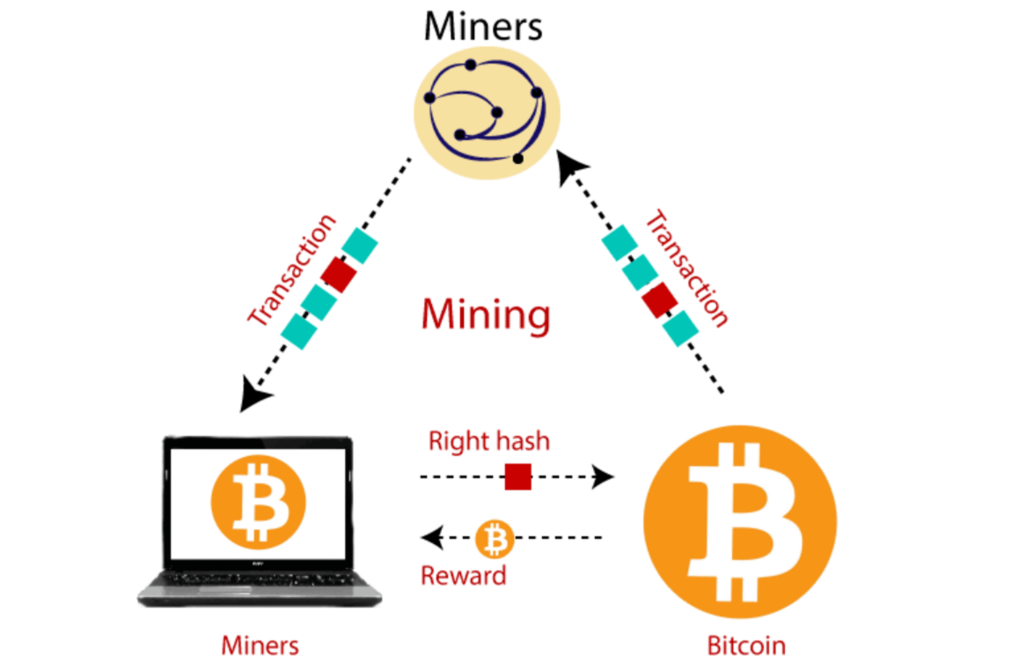

Cryptocurrency mining is the process of using the computing power of mining rigs to solve complex mathematical problems associated with a particular cryptocurrency. During the mining process, miners simultaneously confirm transactions on the blockchain network and create new blocks to be added to the blockchain.

Example: On the Bitcoin blockchain network, miners validate transaction information sent between users. This includes information such as the amount of BTC, transaction time, sending address, receiving address, etc.

After the validation is complete, this information is included in a block. When that block is full, a new block is created.

The purpose of mining coins

To answer this question, let’s recap how blockchain works:

- A blockchain system consists of transactions that are executed and recorded in individual blocks on the blockchain.

- To record transaction information onto a block, the blockchain requires a consensus mechanism.

- Some blockchains use a Proof of Work consensus mechanism. This means participants need to perform a certain amount of work on the network before being allowed to record information onto a block. This work usually involves solving complex mathematical problems on a computer. Those who perform this work are called miners, and the process is called mining.

Therefore, the purpose of mining is significant, as it directly contributes to the operation of the entire blockchain. Without miners, the blockchain system would not be able to function.

Is coin mining banned?

The answer to this depends on the country where you reside. Currently, there are no specific laws regarding cryptocurrency mining in Vietnam, so it can be said that it is not prohibited.

However, this also means that if you encounter scams or fraud during your investment or mining activities, the Vietnamese government will not guarantee or be responsible for protecting your rights!

4 things to know before mining coins

Cryptocurrency Mining

Cryptocurrency mining is the process of using the computing power of mining rigs to solve complex mathematical problems associated with a particular cryptocurrency. During the mining process, miners validate transactions on the blockchain network and create new blocks to be added to the blockchain.

Here are some key things to know before you start mining:

- Blockchains that use the Proof of Work (PoW) consensus mechanism require mining.

- People who use their computer’s processing power for mining are called miners.

- Hashrate is a unit that represents the computing power of a mining device. The higher the hashrate, the faster the device can solve algorithms and the more coins it can mine.

- Some mining rigs are optimized to mine only one (or a few) specific coins.

Types of Cryptocurrency Mining

There are several ways to mine cryptocurrency:

Mining for free with your phone

This is a very easy way to mine. All you need is a phone with a Wi-Fi connection to earn coins. The coins that can be mined with a phone are usually popular ones like BTC, ETH, and LTC.

Many of the apps that allow you to mine on your phone are games, so you can earn cryptocurrency while having fun. However, because it’s so easy and enjoyable, the amount of money you can earn is not significant.

Read more: Discover 10 crypto airdrop games on Telegram

Mining with a mining rig

This is the most common form of mining and is often featured in news articles. Terms like “miner,” “mining rig,” and even some FUD (fear, uncertainty, and doubt) in the crypto space all stem from mining with mining rigs.

This can be seen as a real money-making profession, but it requires a large amount of capital and can be affected by government regulations. A prime example is China’s ban on BTC mining, which forced miners to move to other countries.

Using Cloud Mining services

Cloud mining is similar to cloud storage services. It allows users to participate in cryptocurrency mining remotely without needing their own equipment.

There are two parties involved in this activity:

- Mining service providers: They provide mining rigs or sell hashrate remotely to buyers. Some providers offering this service include Minergate, Hashing24, Hashflare, and Genesis Mining.

- Service users (investors): These are the investors who pay to rent/buy these mining rigs or hashrate remotely. They receive a portion of the mined coins according to the contract.

What does a coin mining machine include?

A cryptocurrency mining rig requires the following basic components: CPU, GPU, RAM, hard drive, motherboard, memory chips, power supply, and internet connection.

- CPU (Central Processing Unit): The CPU’s primary function in a mining rig is to distribute tasks to the GPUs. Therefore, a high-end CPU is not necessary, as its role is limited to this specific task. However, it’s important to ensure compatibility between the CPU and the motherboard.

- GPU (Graphics Processing Unit): This is the most crucial component of a mining rig. It’s directly responsible for the mining process. The more powerful the GPU, the better the mining performance. This is the component you should prioritize for investment and upgrades.

Of course, the GPU must also be suitable for mining the specific cryptocurrency you’re targeting. Two major GPU manufacturers you might be familiar with are:

- NVIDIA: 1070, 1060, 1050ti, etc.

- AMD: RX 470, RX 580, RX 570, etc.

Furthermore, you should definitely pay attention to optimizing your mining operation. Consider the type of memory chips integrated into the GPU and their overclocking potential.

Example: Micron’s GDDR5X can be overclocked to 700 MHz (Memory Clock) and 100 MHz (Core Clock).

3. RAM: No need to invest in high-end RAM; just enough to work with the CPU and motherboard to run basic mining applications. 2GB of RAM is sufficient, as long as it can run a basic version of Windows.

- Hard Drive: Similar to RAM and CPU, you don’t need to invest much here. For compactness, choose an SSD with 80GB or 120GB of storage, which should be enough.

- Motherboard: You don’t need to invest in a high-end motherboard. However, it’s crucial to ensure maximum compatibility with the GPU and CPU to optimize mining performance. Also, if you want to connect multiple GPUs, choose a motherboard with enough PCIe slots.

- Memory Chips: Pay attention to the type of memory chips integrated into the GPU and their overclocking capabilities. The GPU section above provides more details on this.

- Power Supply: The power supply is another critical component of a mining rig. It’s responsible for providing power to all the other hardware components. A high-performance power supply will ensure the stability and longevity of the entire rig.

- Internet Connection: Of course, you need an internet connection to mine cryptocurrency. A stable connection is sufficient. There’s no need for a high-bandwidth connection, as all the mining processing is done on the hardware, not through continuous online interaction.

These are the basic hardware components needed to build a cryptocurrency mining system. However, there’s also the option of using specialized mining rigs. With these devices, you simply need to plug in the power and internet connection and start mining.

Examples include the Antminer S19 Pro and Antminer S17 Pro from Bitmain

Coin mining software

Most Effective Mining Software

Some of the most effective software for mining cryptocurrencies include CGMiner, MultiMiner, BFGMiner, BitMiner, Miner-Server, EasyMiner, and AWESOME Miner.

Software for Checking Memory Chips

This type of software helps you check which manufacturer’s memory chips are used in your graphics card, so you can determine the appropriate overclocking settings.

Example: GPU-Z

Software for Overclocking RAM and GPU

This software allows you to overclock your RAM and graphics card, optimizing your hardware for more efficient mining.

Example: MSI Afterburner

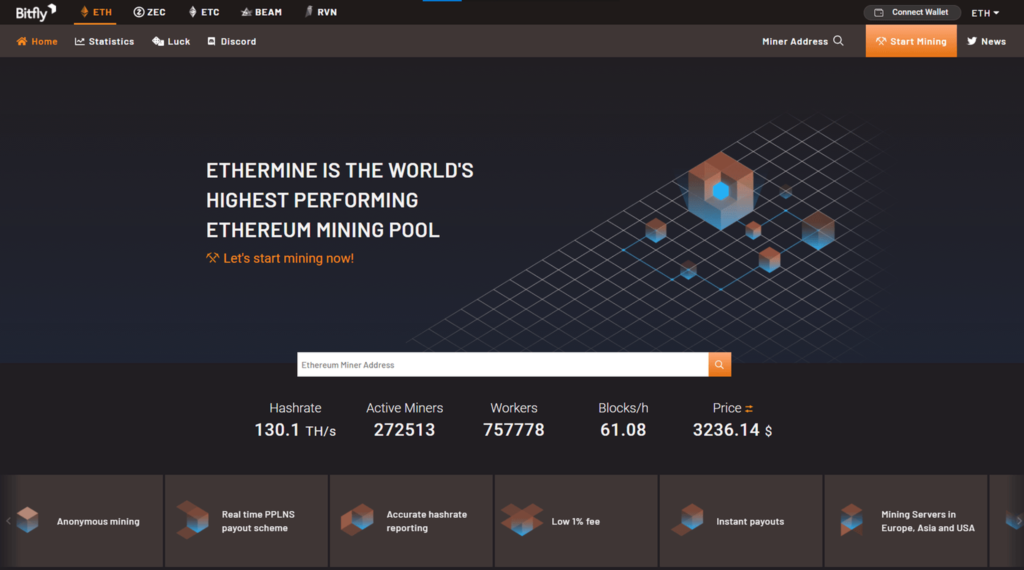

Ethermine

This is used to check how much ETH you have mined.

- TeamViewer: Option to install or not. This software allows remote monitoring and management of the machine, helping you handle any arising problems when needed.

How to calculate mining profits

Calculating Mining Profitability

First, you need to understand where mining profits come from. As explained earlier, miners perform two tasks when mining cryptocurrencies: confirming transactions and creating new blocks on the blockchain.

Upon completing transaction verification, miners receive a portion of the coins from the transaction fees paid by those who conduct transactions.

Additionally, when a block is created, the miner also receives coins from it. This reward is the incentive for miners to run their rigs daily and participate in mining.

To calculate mining profitability, you can visit dedicated websites like WhatToMine or CryptoCompare.https://www.cryptocompare.com/

Step 1: Select “Top Lists” ⇒ In the “Other” section, choose “Mining Calculator”.

Step 2: Select the coin you want to mine and the technical specifications of your mining rig.

Example: I will mine ETH using an Antminer G2 with the following specifications:

- Hashrate: 220 MH/s ± 10%

- Power consumption: 1200W

After entering the corresponding information into the empty fields, you will receive the results as shown in the table on the right.

According to the ETH mining profitability calculation with the parameters above, the estimated profit (excluding electricity costs) is:

- $17.23 per day

- $120.59 per week

- $516.83 per month

- $6,288.15 per year

This number can be multiplied many times over if you have greater hashing power (more mining rigs or more powerful rigs). Here are some things to keep in mind when calculating mining profitability:

- Mining profitability can change over time as it depends on the number of coins mined and the value of that coin. If the coin’s price increases, mining profitability also increases, and vice versa.

- The amount of coins mined also depends on the mining difficulty of the block. When the coin’s price increases, the demand for mining also increases, the difficulty increases, and the number of coins mined decreases.

Should You Mine “Shitcoins”?

First, you need to understand that “shitcoins” refer to coins created solely for the purpose of FOMO (fear of missing out), or with malicious intent to scam people. More simply, they are coins that are not popular or have unclear information.

Returning to the question of whether you should mine shitcoins, here are the reasons why you should not participate:

- Shitcoins usually have low liquidity; worse, after mining, there may be no or very few exchanges that accept them for trading.

- The risk of encountering scams is very high.

- Mining shitcoins is just like mining BTC; it takes time, money, and effort. So why not mine popular coins for sustainable profits instead of mining coins that are full of risk?

However, if you like adventure, you can still spend a little time and effort to earn some of these coins. Not all of them become worthless, and sometimes there are a few legitimate projects that no one pays attention to. In these cases, you might find “gold in the sand”.

What methods do attackers often use to take advantage of users’ computers to mine coins?

As cryptocurrency becomes more mainstream, hackers are creating numerous fake websites, apps, and software. If you’re new to crypto, it’s easy to fall prey to these scams.

Hackers might obtain your email or personal information and then send you emails containing malware. This malware can infect your computer’s CPU when you click on attachments in the email, allowing them to mine Bitcoin using your infected computer or, even worse, steal your assets.

Therefore, if you receive any suspicious emails, do not click on any links or attachments. Delete them immediately.

Learn more: Some common forms of phishing attacks in Crypto

4 effective coin mining experiences

Essential Steps Before You Start Mining Cryptocurrency

Determine your capital and goals

As mentioned earlier, there are many forms of cryptocurrency mining, so it’s essential to determine your capital and goals from the outset to avoid wasting resources.

If you want to make cryptocurrency mining your primary profession, you’ll need to invest heavily in equipment. But if you want to participate as a side hustle or just mine in your spare time, a smartphone might be sufficient.

Research the market

To know which cryptocurrency to mine, you need to spend some time researching the market. This will help you understand the credibility and profitability of each coin, allowing you to develop a reasonable plan.

Besides that, researching the market can also help you understand the demand and different ways to participate in the crypto space. Who knows, maybe mining is just a stepping stone, and you’ll find other ways to engage with crypto that are more suitable for you.

Control your emotions

It’s difficult to say when the right time to sell mined coins is because the market fluctuates constantly. You might sell at the peak right after mining, but you could also end up selling at the bottom.

In these situations, it’s crucial to control your emotions and develop a suitable profit-taking strategy. Regardless of market movements, make sure you don’t regret your decisions.

Beware of scams

A market full of profit also has potential risks, the most common of which is malware infection, as mentioned earlier. Therefore, you need to be careful about security and avoid clicking on unknown links.

Read more: List of 19 forms of fraud in Crypto

Pingback: Understanding Hash Functions in the Crypto Market - coinrin.com