The crypto market is seeing a new trend called pre-market. This trend allows investors to predict the value of a token, increasing their position before the project launches the token. Below are the top pre-market platforms in the crypto market.

Criteria for Evaluating Pre-Market Platforms

In late 2023, the crypto community started paying attention to the pre-market, as this tool helps investors buy assets at a lower price before the project officially launches its token. For example, TIA in the pre-market was traded at a price of 2-3 USD, and after the Token Generation Event (TGE), TIA had a price range of 4-5 USD.

Although the pre-market offers users the opportunity to profit earlier than usual, the disadvantages of this market still make many investors concerned and limit their participation. Therefore, to ensure safety, here are some criteria for choosing suitable pre-market exchanges:

- High trading volume and liquidity: In my opinion, a good pre-market exchange should have a daily trading volume of at least 200,000 USD.

- Low transaction fees: Currently, there are two types of pre-market: OTC and Futures (derivatives). OTC fees usually range from 2% to 2.5% per transaction, while Futures have transaction fees of about 0.01% for makers and 0.05% for takers.

Read more: What is the pre-market? Advantages and disadvantages of the pre-market.

Below are the top 5 pre-market platforms, including 3 OTC exchanges and 2 Futures exchanges:

- Whales Market

- Bybit Pre-market

- Kucoin Pre-market

- Hyperliquid

- Aevo

Top 3 OTC Pre-Market Exchanges

Whales Market

At the time of writing, Whales Market can be considered one of the largest pre-market exchanges in the crypto market, with a trading volume of over $146 million (from December 2023 to July 2024) and a deposit volume reaching $77 million.

Not only demonstrating its “position” in terms of trading volume and popularity, Whales Market is also one of the exchanges that supports the most popular assets for users, such as Hamster Kombat, Layer3, and Dogs. Even in the context where most projects use crypto points for airdrops, Whales Market also has a “Points” feature, which allows users to trade points from various dApps.

Some believe that the “Points” feature is what sets Whales Market apart because the value of pre-market trading is usually calculated based on the project’s tokenomics. Meanwhile, Points allows users to determine value even when the project does not yet have tokenomics. The transaction fee for both functions is 2.5%.

In addition, Whales Market also has its own token, WHALES. Users can use WHALES for staking, earning interest, and reducing platform trading fees.

Read more: Overview of Whales Pre-Market and WHALES Token.

Bybit Pre-market

Bybit Pre-market is a product developed by the Bybit team, one of the largest CEXs currently with total assets of over $9.8 billion. Bybit’s pre-market feature was launched in March 2024, with its first asset being the AEVO token.

At the time of launch, Bybit Pre-market attracted a significant number of users, with the trading volume of the AEVO token reaching $1 million, while Whales Market only had a volume of around $300,000.

Unlike Whales Market, all transactions and activities on Bybit Pre-market are authenticated and managed by the Bybit team itself, instead of through smart contracts. This helps users avoid issues such as smart contract bugs and hacks.

Although Bybit Pre-market supports fewer trading assets than Whales Market, the platform still has a variety of tokens attractive enough to investors. Some examples include EIGEN from EigenLayer, HMSTR from Hamster Kombat, and CATI from Catizen. Depending on the asset being traded, Bybit’s fees range from 2% to 2.5%.

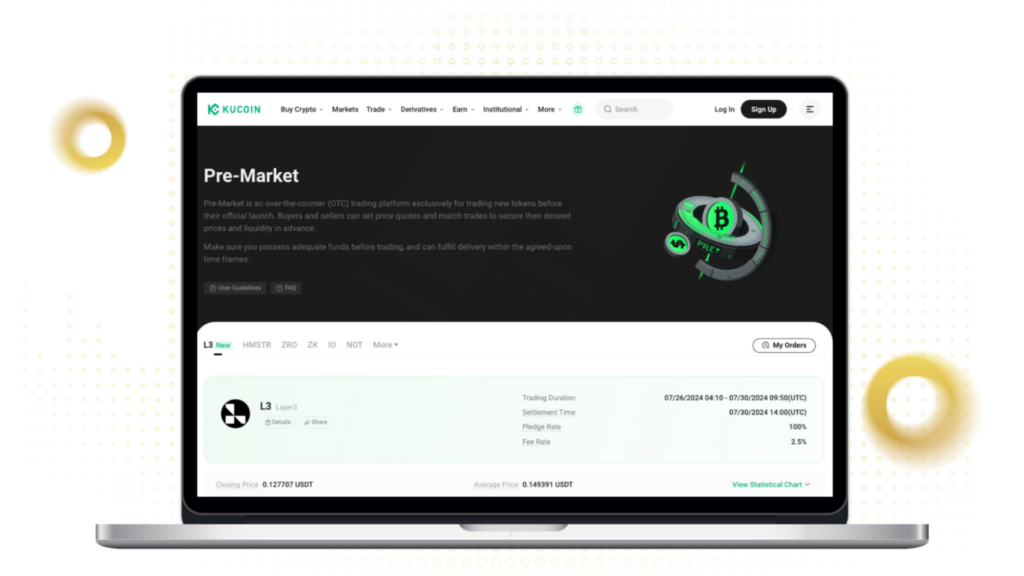

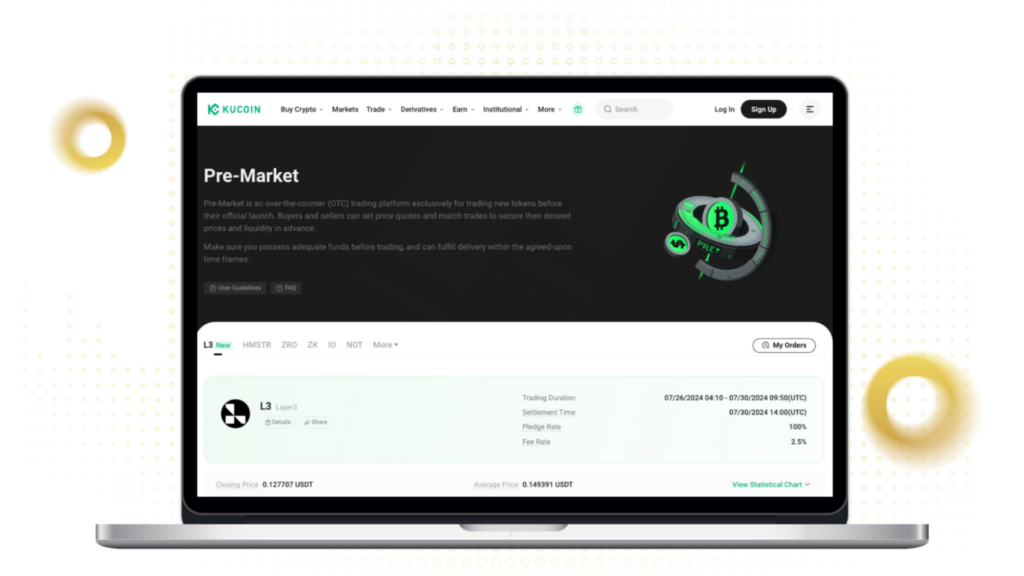

Kucoin Pre-market

Similar to Bybit Pre-market, Kucoin Pre-market is a product developed by the CEX exchange Kucoin. Launched in October 2023, the first token listed on Kucoin Pre-market was TIA from the Celestia project.

Some believe that Kucoin Pre-market was the exchange that marked the beginning of the pre-market trend, as TIA on Kucoin only traded between 2-3 USD. Meanwhile, the TIA token reached 5-7 USD just 1 month after TGE, bringing profits to those who bought pre-market with an ROI of 250%. Just a few months later, TIA even surpassed 20 USD. Therefore, the number of people interested in the pre-market started to increase from the end of 2023.

Despite being the project that started the trend, Kucoin Pre-market is showing signs of cooling down compared to Bybit and Whales Markets in both trading volume and the number of assets supported. In addition, Kucoin’s transaction fee is 2.5%.

Top 2 Futures Pre-Market Exchanges

Hyperliquid

Hyperliquid is a decentralized perpetual DEX built on its own network. Currently, Hyperliquid supports derivatives trading for a wide variety of tokens, with over 130 assets from non-EVM ecosystems like Solana and Starknet to EVM ecosystems like Ethereum and BNB Chain.

Hyperliquid’s standout feature is its use of its own network, resulting in low fees, high transaction speeds, and low slippage. However, the number of pre-market assets on Hyperliquid is relatively small, with currently only one pre-market token available: EIGEN from EigenLayer.

Hyperliquid’s transaction fees range from 0.01% to 0.035%.

Aevo

Similar to Hyperliquid, Aevo is a perpetual DEX, with a TVL reaching $70 million and a trading volume of $1 billion. Aevo stands out for supporting more pre-market assets than Hyperliquid, with 7 different tokens at the time of writing.

However, Aevo’s transaction fees are 0.1% to 0.25% for the pre-market, which is high compared to typical futures trading.

Read more: What is Binance pre-market? Guide to participating in Binance pre-market.