NFT Staking is paving a new path where digital collectors can not only hold NFTs in their wallets but also earn rewards from them.

What is NFT Staking?

NFT Staking is the process of locking up an NFT into a platform or blockchain protocol to earn rewards, typically in the form of tokens or other benefits. Instead of holding NFTs in a wallet without any economic benefit, users can “stake” their NFTs to generate passive income while retaining ownership of those assets.

Essentially, you deposit your NFT into a smart contract on a blockchain and receive rewards in return. Rather than just holding NFTs in your wallet as collectibles, staking allows you to earn yield from those digital assets, similar to staking cryptocurrencies in DeFi.

NFTs were previously mainly considered collectibles or in-game items. However, with the advent of NFT Staking, these digital assets have been upgraded into true financial instruments.

NFT Staking benefits both NFT holders and blockchain projects. Holders can leverage the value of their NFTs without selling them, optimizing their assets and generating passive income. Meanwhile, blockchain projects can use NFT staking to increase community engagement, encourage long-term user participation, and incentivize development.

In ApeCoin Staking, Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) holders stake their NFTs to earn APE tokens, turning their NFTs into a source of passive income within the Yuga Labs ecosystem.

According to a report from the Ape Foundation, over $30 million worth of APE was staked on the first day of staking (December 12, 2022). This demonstrates the strong community interest in this activity.

How NFT Staking Works – Two Common Models

NFT Staking allows NFT holders to lock their digital assets into platforms or blockchain protocols to earn rewards. Depending on the operating method and development goals, NFT Staking is currently implemented using two main models:

Model 1: Third-Party Platforms Integrating Staking Services

- Third-party platforms offer NFT staking services, operating independently of the NFT issuing projects.

- Users can stake NFTs from various collections to earn rewards, usually platform tokens or new NFTs.

- These platforms act as intermediaries, helping to optimize the utility and benefits of NFTs.

However, in exchange for the convenience mentioned above, the rewards are often not closely tied to the original NFT’s internal ecosystem, diminishing the collection’s exclusive value. Additionally, there are service fees or transaction fees, which reduce the overall profit for users.

Overall, this model is suitable for new users and investors who prefer flexibility and security when staking.

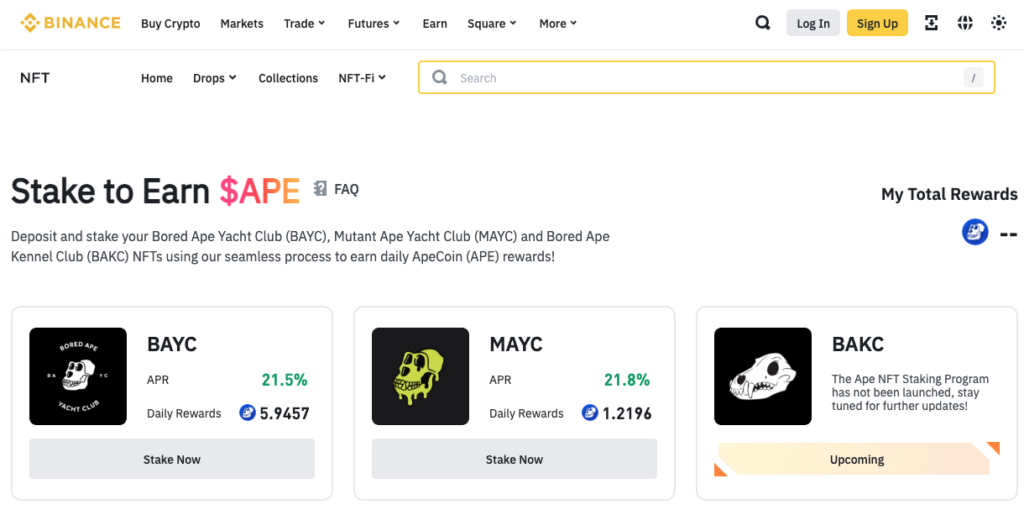

Binance NFT

Binance NFT Marketplace integrates NFT staking functionality for several prominent collections such as Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC). Users simply deposit their NFTs into the platform and receive rewards in the form of native tokens or other NFTs.

Benefits:

- Convenient and secure thanks to Binance’s robust security system.

- A diverse selection of NFT collections available for staking.

Read more: Guide to Using the Binance NFT Marketplace

MOBOX

MOBOX combines DeFi and NFTs to offer staking services for MOMO NFTs. Users stake their NFTs to earn MBOX tokens, which can then be used within the MOBOX GameFi ecosystem or traded on the market.

Benefits:

- Enhances the liquidity and utility of the project’s NFTs.

- Generates passive income for holders.

Model 2: Projects Develop Their Own NFT Staking Products

- Projects develop their own staking products to increase the utility and value of NFTs within their ecosystems.

- Staking often comes with benefits such as native token rewards, access to special features, or other perks.

- The main goal is to develop the NFT ecosystem and retain the community in the long term.

Another aspect to consider is that the liquidity of these projects is often lower than that of third-party platforms, as NFTs can only be staked within the project’s ecosystem.

Additionally, users face higher risks as security issues or project collapse can occur.

It can be seen that the main purpose of this model is to increase the intrinsic value of the NFT collection and is suitable for long-term investors who believe in the project’s development potential.

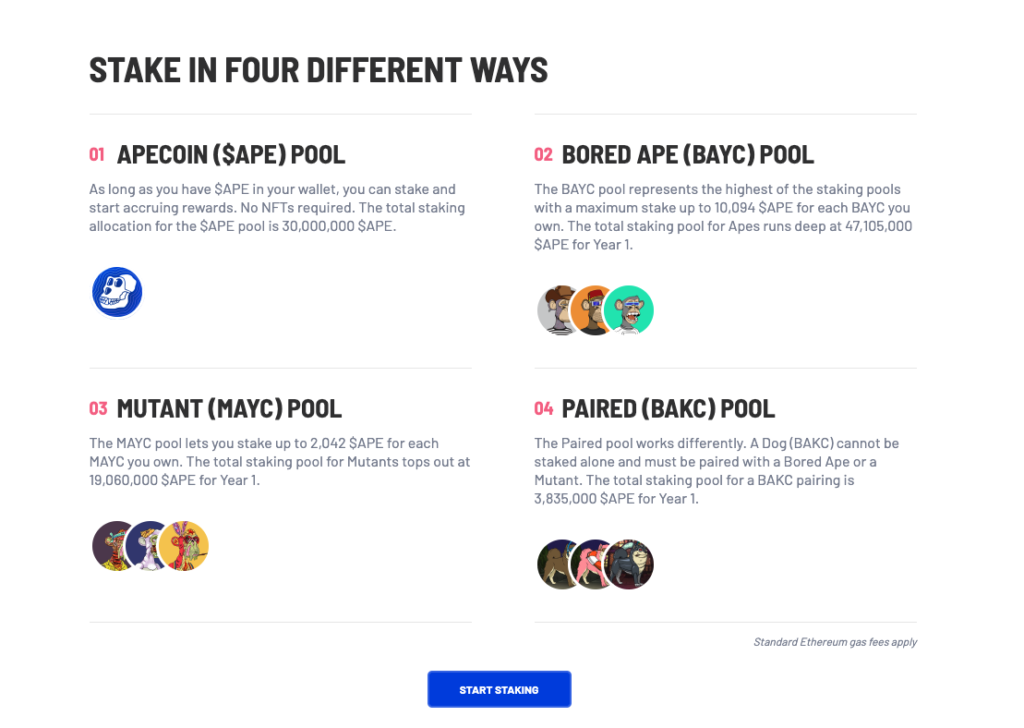

ApeCoin Staking – Bored Ape Yacht Club (BAYC)

The BAYC ecosystem has developed a staking feature through the ApeCoin Staking platform, allowing Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) holders to stake their NFTs to earn APE tokens as rewards.

Operating mechanism:

- NFT holders deposit their assets into the ApeCoin platform’s smart contract.

- APE tokens are distributed based on the staking duration and the number of NFTs staked.

Benefits:

- NFT holders generate passive income through APE tokens.

- The BAYC ecosystem retains its community and creates motivation for project development.

CyberKongz – Bananas Token (BANANA)

CyberKongz, a popular NFT collection, developed an NFT staking mechanism that allows holders to earn BANANA tokens as rewards.

Operating mechanism:

- Each Genesis CyberKongz NFT generates 10 BANANA tokens per day when staked.

- BANANA tokens can be used to upgrade NFTs or participate in other activities within the ecosystem.

Benefits:

- Increases the utility and value of the CyberKongz collection.

- Encourages the community to hold NFTs long-term.

Applications of NFT Staking in Crypto

NFT staking is becoming increasingly popular in areas such as blockchain gaming, DeFi, and the metaverse. In blockchain games, players can stake NFT items or characters to earn rewards and increase the utility of their assets.

On December 12, 2022, the Ape Foundation launched a staking feature for ApeCoin, allowing users to stake APE or NFTs from Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) to earn rewards. In the first day alone, over $30 million worth of APE was staked. This demonstrates strong community interest in staking, especially when combined with NFTs and the native token of the ecosystem.

Furthermore, the launch of the staking feature positively impacted the value of ApeCoin. After the staking announcement, the price of APE increased by over 31%, reaching $4.15.

In DeFi, NFT staking is integrated into protocols to provide rewards, generate liquidity, or support other financial activities. In the metaverse, NFT staking often involves virtual land or other digital assets, creating value and benefits for users.

Moreover, using NFTs as collateral in DeFi protocols allows users to borrow funds or participate in other financial activities, expanding the usability of NFTs within the crypto ecosystem.

For blockchain projects, NFT staking helps increase engagement and build strong communities. By encouraging users to lock up their NFTs, projects can reduce selling pressure, stabilize the market, and create conditions for sustainable development.

However, participants need to understand the operating mechanisms, benefits, and risks to maximize the opportunities that NFT staking offers. Therefore, thorough research and choosing reputable platforms are essential to optimize the benefits from this activity.

Challenges and Risks of NFT Staking

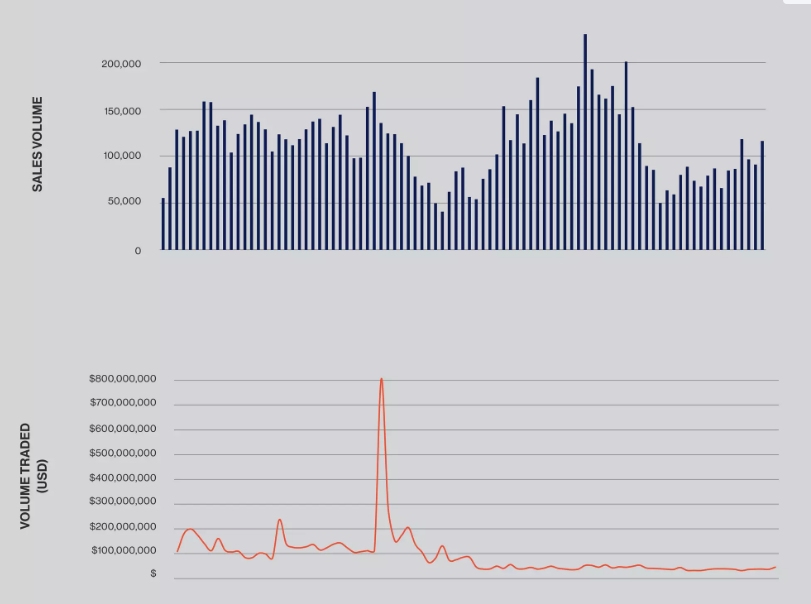

Despite its many benefits, NFT staking also faces several challenges. One of the biggest risks is the dependence on the value of the NFT and the reward token. The value of NFTs and reward tokens received from staking activities can fluctuate significantly due to the nature of the cryptocurrency market. When the market declines, staking rewards may not be enough to offset losses from the decrease in the price of the NFT or reward token.

CyberKongz Genesis NFT: Holders receive 10 BANANA tokens per day when staking. However, during the 2022 market downturn, the price of the BANANA token fell from $80 in September 2021 to $2 in June 2022, significantly reducing actual returns.

BAYC – ApeCoin Staking: The price of the APE token reached a peak of $26 in April 2022 but dropped to around $1.5 – $2 in early 2023. This caused staking yields to plummet, impacting investor returns.

Furthermore, NFT staking requires users to lock up their assets for a period of time, meaning they cannot use or trade their NFTs during this period. This can lead to missed opportunities when the value of the NFT increases or attractive trading opportunities arise.

According to a report by NonFungible.com, in Q2 2023, NFT trading volume in the market decreased by 38%, indicating that NFT liquidity is facing challenges amid the market downturn. If users lock their NFTs into staking during this period, they will lose the opportunity to exit the market when prices fall.

Furthermore, users also face risks associated with vulnerabilities in smart contracts or potential attacks. In March 2022, the TreasureDAO platform on Arbitrum was hacked, resulting in the theft of over 100 NFTs from popular collections like Smol Brains, with estimated losses exceeding $1.4 million.

NFT Staking offers great opportunities to generate passive income and increase the utility of NFTs. However, risks such as price volatility, low liquidity, security vulnerabilities, and project risks are factors that users need to carefully consider before participating.

To mitigate risks and optimize benefits from NFT Staking, investors should:

- Thoroughly research the project and choose reputable staking platforms.

- Monitor the market to assess price fluctuations of NFTs and reward tokens.

- Check the security of smart contracts before locking NFTs into platforms.

By understanding the risks and benefits, users can make informed decisions and leverage the full potential that NFT Staking brings to the crypto ecosystem.

See more: What is DYOR? Effective Crypto Research Sources.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger