Bitcoin is the world’s first cryptocurrency, launched in 2009. To this day, Bitcoin remains an attractive investment channel for investors

So, what is Bitcoin investment? What are the benefits and risks of investing in Bitcoin? How much money do I need to invest in BTC? What can I do to have an effective Bitcoin investment strategy and experience?

Guide to Bitcoin Investment

Bitcoin investment is the act of buying Bitcoin with the expectation that its value will increase in the future to make a profit. Basically, investing in Bitcoin is not much different from investing in other assets, such as stocks, gold, real estate, etc., when investors buy at a low price and expect to sell at a higher price.

Usually, before participating in Bitcoin investment, each person needs to research to have an investment strategy that suits their needs and purposes. Then, investors need to buy, store and sell Bitcoin according to different plans and times depending on the predetermined strategy.

There are currently many ways to buy and sell Bitcoin in Vietnam:

- The most convenient and effective way is to trade BTC directly on centralized cryptocurrency exchanges, such as Binance, Coinbase, Bybit, etc.

- In addition, investors can also trade BTC through intermediary platforms, OTC, P2P, etc.

For detailed instructions on how to trade Bitcoin through the above methods, see: Where to buy Bitcoin?

However, determining an investment strategy is still the most important step to start the Bitcoin investment process, as it depends on and is greatly influenced by the needs, profit goals, risk tolerance, and profit margin of each person. At the same time, choosing an appropriate strategy will help investors have a stable mentality and make more accurate decisions when investing.

Bitcoin Investment Strategies

Long-term Bitcoin investment: Hold

Hold is a popular form of investment for those who believe in the long-term development potential of Bitcoin, and also requires patience from investors. They will buy Bitcoin and keep it no matter how the price fluctuates, with the expectation that the price will increase sharply in the future.

In the crypto market, this form is also known as “HODL”, short for “Hold On for Dear Life”, referring to the fact that investors will buy and hold Bitcoin for a very long time regardless of whether the BTC price increases or decreases. Typically, they will hold BTC for 5-10 years or longer.

For example: The price of BTC in 2023 is about 30,000 USD.

- If you buy 1 BTC for 1,000 USD from 2017 and hold it until now, the investor has made a profit of 29,000 USD.

- If you buy 1 BTC for 100 USD from 2013 and hold it until now, the investor has made a profit of 29,900 USD.

Investors can also use the DCA (Dollar-cost averaging) strategy to divide the amount invested in Bitcoin into many parts with different prices, instead of investing all the capital at once and at one price.

Short-term Bitcoin investment: Trading

Trading is a more advanced form of Bitcoin investment, where investors must constantly monitor the market (daily, hourly) and identify BTC price trends. This identification also requires knowledge of technical analysis to analyze charts and assess the market.

Essentially, when trading, investors will:

- Buy (Long) BTC when they see an uptrend in price.

- Sell (Short) BTC when they see a downtrend in price.

This form of investment may be riskier due to the volatility of Bitcoin prices; however, it can also increase profits faster than the Hold method mentioned earlier. To reduce risk, investors should apply the principles of Take Profit (TP) and Stop Loss (SL) accordingly when placing trading orders.

For example: An investor buys BTC at 25,000 USD, sets a TP level of 30,000 USD and an SL level of 20,000 USD. This means that:

- When the BTC price rises to 30,000 USD, the system will automatically sell BTC to take profit for the investor.

- When the BTC price drops to 20,000 USD, the system will automatically sell BTC to limit the loss within an acceptable level for the investor.

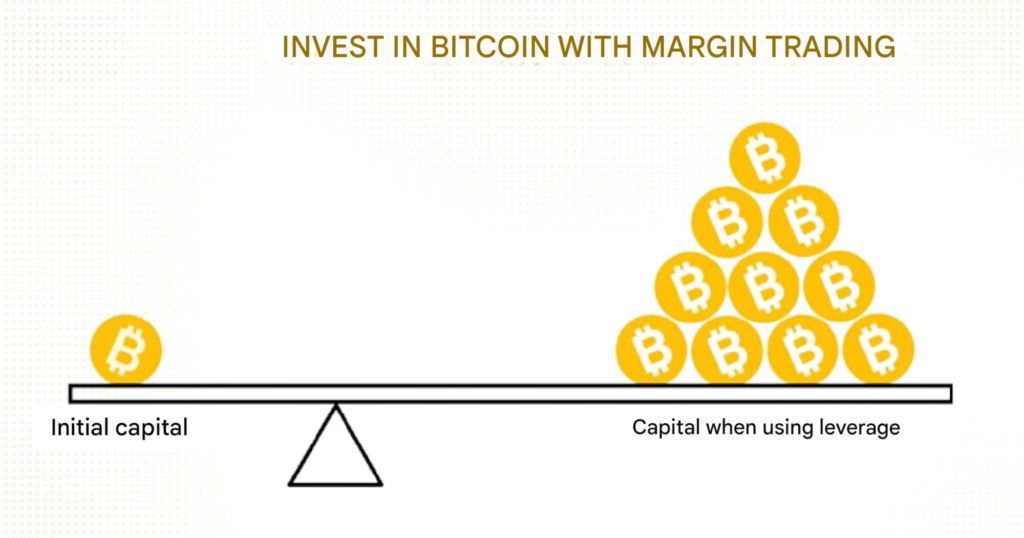

In addition, investors can also trade in the form of margin trading. This form allows investors to use “financial leverage” based on borrowed capital from a third party (such as an exchange). From there, they can trade with a larger amount of money than they have, generating higher profits and of course the risk will also be higher than normal trading.

Some popular trading strategies include:

- Arbitrage trading: This is price difference trading, where traders make a profit by buying an asset on one exchange and selling it on another when they discover a price difference between the two exchanges.

- Scalping: Also known as surf trading, traders will enter and exit the market in a few seconds to a few minutes continuously, with the goal of seeking profit from small movements in the market. The trading frequency of the scalping strategy can be up to several hundred orders per day.

- Swing trading: Traders hold positions for a few days to a few weeks, hoping to find profits through medium-term fluctuations and only enter orders when the success rate is often higher than 70-80%.

- Trend trading: Trend trading is trading in the direction of the price by drawing trend lines, which is equivalent to trading in the direction of the main cash flow – the amount of supply/demand in the market.

Other BTC investment strategies

In addition to simply holding or trading Bitcoin, investors also have a number of other investment options such as:

- Investing in a Bitcoin Exchange Traded Fund (Bitcoin ETF): A group of assets related to Bitcoin or Bitcoin price (such as Bitcoin futures trading), offered on traditional stock exchanges by companies brokerage firms, traded in the form of an ETF. For example: Purpose Bitcoin (BTCC), CI Galaxy Bitcoin (BTCX), VanEck Bitcoin ETN (VBTC)…

- Investing in a Crypto Index Fund: A type of mutual fund that tracks a specific index of a basket of cryptocurrencies, such as the 10 or 20 coins with the highest market capitalization. Some funds include: Grayscale’s Digital Large Cap Fund, Bitwise’s 10 Crypto Index Fund, eToro Smart Portfolios…

- Investing in a Bitcoin mining rig: Miners use the computing power of computers to verify and record Bitcoin transactions, while creating a new block for the network, in return, they receive a block reward. is BTC. However, this is considered the most expensive and difficult strategy when investing in Bitcoin, investors need to research and consider carefully before investing in Bitcoin in this form.

Learn more: How to mine Bitcoin?

Experience effective Bitcoin investment

Manage investment risks

Bitcoin is a cryptocurrency with high price volatility, leading to high risks that this investment brings. Therefore, investors should predetermine the level of risk they can accept and only invest an amount of money that can be lost without affecting personal finances.

Learn more: 5 methods of risk management in Trading

Allocate investment capital reasonably, avoid “all-in”

A principle in investing is not to “all-in” (put all your capital) into any one asset. Because then investors are completely dependent on them, assuming in the worst case, that asset suddenly loses value or depreciates sharply, it will lead to them losing all their investment capital.

Besides, Bitcoin is a decentralized asset and is not guaranteed by law, considering the case that the value of Bitcoin falls to 0, there is no state agency to protect the interests or support investors.

Therefore, Bitcoin investors should:

- Start with a small amount of capital to get acquainted and find an investment strategy that suits them.

- Allocate investment capital reasonably, by diversifying the investment portfolio with many types of assets such as other cryptocurrencies, gold, real estate, securities, etc.

Read more: 3 steps to design an effective investment portfolio

Always keep your Bitcoin wallet safe

Security is the most important factor when investing in Bitcoin. Some notes for safe Bitcoin storage:

- Storing BTC in a cold wallet (such as a hardware wallet, paper wallet) will help protect assets better than a hot wallet.

- Choose reputable exchanges and wallets.

- Always enable 2FA and perform KYC before trading on the exchange.

- Ensure that you do not share personal wallet information or private keys with anyone, and store them in a safe and secure place.

- Do not access strange advertising links, unofficial websites, etc., as they may be places that spread malicious software (malware) to devices to steal investors’ assets.

Choose a reputable exchange

A reputable exchange will help investors feel more secure in storing and trading Bitcoin assets, for a number of reasons:

- Increase the ability to protect investment capital: Reputable exchanges often have strict security systems and measures, helping to minimize risks related to losing money due to hacker attacks.

- Transparency and legality: Centralized exchanges (CEXs) still have to meet the legal regulations and standards of an exchange. This helps ensure that the exchange complies with the law and creates a safe investment environment for investors.

- Provide a stable and continuous trading system: Allows investors to trade 24/7 without interruption.

In general, choosing a reputable Bitcoin exchange not only helps maximize investment benefits but also limits risks, creating favorable conditions for investors to participate in the market safely and efficiently. Before choosing an exchange, investors can read reviews from other users to get an overview of the reputation of the exchange.

See also Top 6 reputable Bitcoin exchanges in the crypto market.

Equip knowledge, regularly update news

Equipping knowledge related to fundamental analysis, technical analysis, risk management, capital management, etc. helps investors avoid negative psychology when trading such as FOMO and FUD, and at the same time make better investment decisions

In addition, one of the factors that can affect the volatility of Bitcoin prices (which can be good or bad) is news, such as:

- Legal regulations related to Bitcoin: New regulations on Bitcoin from countries can cause large fluctuations in prices. Typically, at the end of September 2021, when China announced restrictions on cryptocurrencies, the price of Bitcoin dropped from more than 47,000 USD to 42,000 USD.

- Changes in Bitcoin technology: The Segwit update in 2017 caused the price of Bitcoin to increase from 1,850 USD to 2,600 USD in just one week.

- News from large organizations: In May 2021, Tesla announced that it would temporarily suspend accepting Bitcoin to pay for the company’s cars, causing the price of BTC to drop by more than 50% in 1 month, from 60,000 USD to 30,000 USD.

- Global economic events: Events such as stock market volatility, economic crisis, or even the COVID-19 pandemic can all change the price of Bitcoin in a negative direction.

- Security incidents: A security incident on a major cryptocurrency exchange can reduce confidence in Bitcoin in general, causing a decline in BTC price.

Benefits & Risks When Investing in Bitcoin

Bitcoin investment is the act of buying Bitcoin with the expectation that its value will increase in the future to make a profit. Basically, investing in Bitcoin is not much different from investing in other assets, such as stocks, gold, real estate, etc., when investors buy at a low price and expect to sell at a higher price.

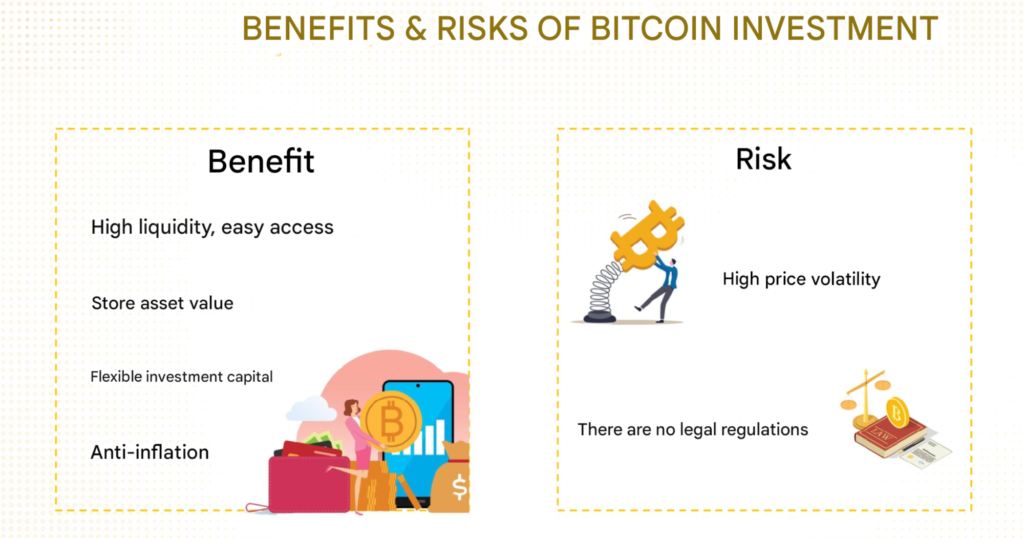

Being aware of the benefits and risks will help investors have a reasonable strategy and expectations for the assets they will invest in. Here are some benefits and risks of Bitcoin investment to know:

Benefits

- High liquidity: Bitcoin is the coin with the highest liquidity and capitalization in the crypto market, so users are less likely to slip when trading BTC.

- Easy access: Bitcoin operates on blockchain technology, a globally distributed and public system. Therefore, anyone in any country can buy and invest in Bitcoin 24/7.

- Flexible investment capital: Each Bitcoin can be divided into 100,000,000 satoshi (sats) units. This feature makes investing more flexible because investors do not need to buy 1 full BTC, they can buy a part of BTC depending on the financial ability of each person.

- Anti-inflation: The total supply of Bitcoin is limited (21 million BTC), so the inflation rate of Bitcoin is also predetermined (12.5%/year). After Bitcoin halving events, the inflation rate will also gradually decrease to 0.

- Storage of asset value: Bitcoin is considered “digital gold”, along with the above properties, Bitcoin becomes a place to help store the asset value of investors effectively.

Risks

- Price fluctuation risk: Bitcoin has a higher price volatility than other assets. Therefore, investors can receive high profits and at the same time will have to bear high risks.

- Legal risks: The nature of Bitcoin is decentralized and not under the management of any state agency or government. This leads to the fact that there are no legal regulations to protect Bitcoin investors in matters related to fraud or misappropriation of assets

Frequently Asked Questions When Investing in Bitcoin

How much money do I need to invest in Bitcoin?

The price of BTC can be up to tens of thousands of USD, however, the nature of Bitcoin is that it can be divided into many units, investors can even spend only 10 USD to buy BTC.

For example: Suppose the price of BTC is 25,000 USD. Ky used 10 USD to buy 0.0004 BTC. So Ky has become a Bitcoin investor.

Therefore, Bitcoin investment does not require a specific minimum capital, it completely depends on the financial situation, investment goals and risk tolerance of each person. The more investment capital, the higher the ability to profit and lose.

In addition, investors should consider using only idle money to invest in Bitcoin, which is the amount of money you can afford to lose without affecting your financial situation.

Should I invest in Bitcoin?

Before considering the decision to invest in Bitcoin, investors should carefully consider the goals and identify what they want to achieve, based on the following notes:

- Bitcoin is a high-risk investment because of its volatility. The price of Bitcoin can increase or decrease significantly in a very short period of time – even within a few hours. Therefore, Bitcoin is considered a “High Risk, High Return” investment channel.

- The value of Bitcoin is not linked to the profits of any company like stocks, but it depends on market demand. When there are many buyers, the price of BTC will increase. When there are few buyers, the price of BTC will decrease.

- Bitcoin has no intrinsic value. That is, it is not backed by any physical asset (such as gold, silver) and there is no regulatory body to ensure that the value of Bitcoin will be stable.

As mentioned earlier, investing in Bitcoin depends on each person’s risk tolerance. However, if you are looking for a safe investment channel with stable profits, Bitcoin does not seem to be the right choice.

Is Bitcoin investment safe?

Whether or not Bitcoin investment is safe depends on the perspective and perspective of each person.

Many people think that Bitcoin has no value and is just a scam for “gullible” people. This is a completely subjective opinion and has not been thoroughly researched.

The value of Bitcoin lies in blockchain technology and the features it brings. Bitcoin transaction information is completely transparent and public. Bitcoin is also listed on many large and reputable exchanges around the world. In El Salvador, Bitcoin is also accepted as a legal currency. Even many large businesses like Microsoft, Apple, Rakuten, Starbucks, Amazon… have accepted payment in Bitcoin.

However, if considered from the perspective of comparing with other assets such as stocks, gold, real estate, etc., Bitcoin will be less secure. Because Vietnam and many countries around the world do not have a clear legal framework for Bitcoin and cryptocurrencies. As mentioned above, if there is any problem in the transaction process, investors will not be protected by law. This is also an opportunity for individuals and organizations to take advantage of Bitcoin to defraud investors.

Is Bitcoin investment legal?

Vietnamese law currently has no legal regulations on cryptocurrency trading in general or Bitcoin in particular.

However, the State Bank of Vietnam has affirmed that Bitcoin and other cryptocurrencies are not legal means of payment in Vietnam. Accordingly, issuing, supplying, and using Bitcoin as a means of payment are prohibited acts in Vietnam.

At the same time, Bitcoin and cryptocurrency trading activities are also increasingly controlled by state management agencies, to limit risks related to money laundering through cryptocurrencies.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger