Aave and Polygon – once a symbol of successful partnership in DeFi, are now on the verge of separation. Polygon’s controversial proposal was the final straw

The Once Cozy Relationship Between Aave & Polygon

Aave – the leading lending protocol in the crypto market during the DeFi boom of 2020-2021 – To avoid the “neck-breaking” high gas fees on Ethereum, in early April 2021, Aave began expanding its operations to Polygon, which was then a popular sidechain solution in the community.

In mid-April 2021, the relationship between the two sides became even closer when Polygon offered Aave a major incentive: a liquidity mining program worth $40 million.

During the one-year program, Polygon allocated up to 1% of the total supply of MATIC tokens (now POL) as rewards for users of Aave on the Polygon network. Quickswap, the leading DEX project on Polygon, also spent $5 million in QUICK tokens to support liquidity for tokens in the Aave ecosystem.

After the announcement of the event, the development teams of Aave and Polygon did not cease to praise each other. Stani Kulechov, founder of Aave, commented on Polygon’s role in the development of DeFi as follows:

“DeFi was born to create a more sustainable and equitable financial system than traditional finance. DeFi is great, but if it’s only for people with five-figure accounts or more, it’s no longer true to the mission of bringing finance to everyone. Polygon is different; this platform opens the door to bring DeFi closer to many people around the world.”

At the same time, Sandeep Nailwal, co-founder and COO of Polygon, also said that he was “very happy that the strong communities of Polygon and Aave have come together, sharing the same vision of supporting the Ethereum ecosystem and building the open-source network together.”

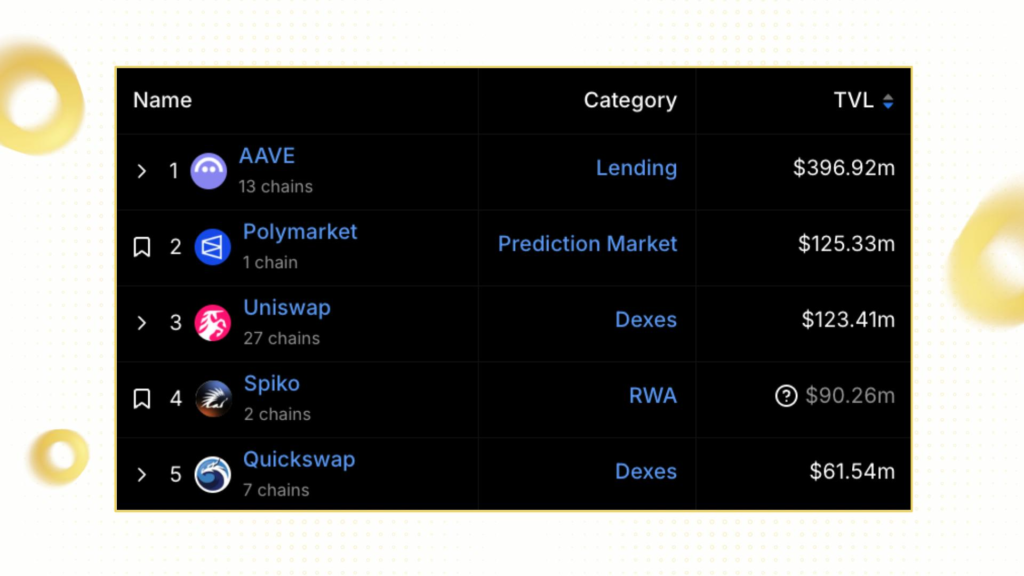

After expanding to Polygon, Aave became a pillar in the ecosystem. To date, Aave still has a TVL of nearly $400 million on Polygon, maintaining its position as the leading DeFi dApp and far surpassing other projects.

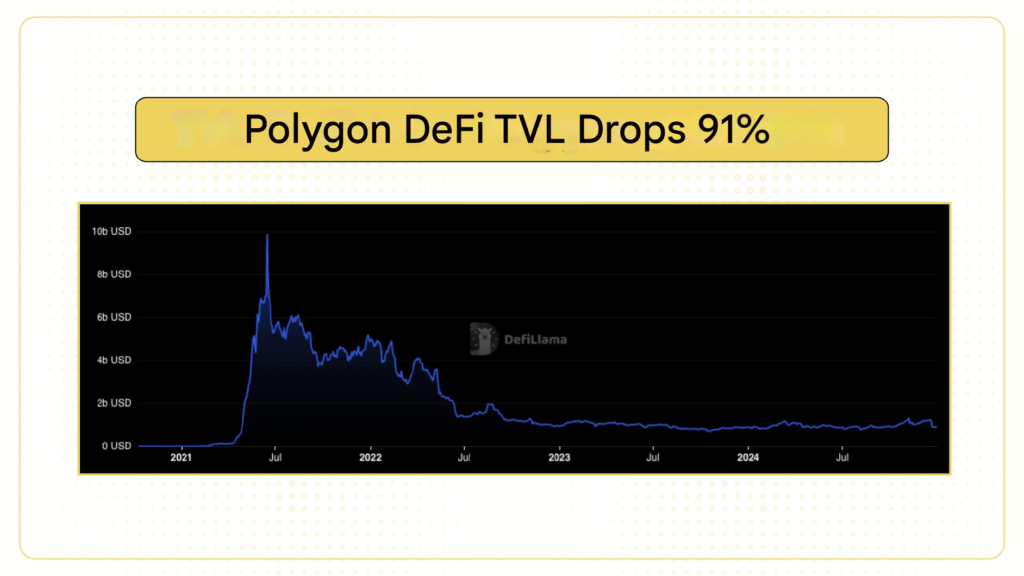

Polygon Leadership Seeks New Directions as DeFi TVL Falls 91%

Following major market events in 2022, Polygon’s situation worsened as three veteran members consecutively chose new paths. In March 2023, Anuraj Arjun – one of the co-founders – left the company after 5 years to focus on Avail, a modular blockchain project spun out from Polygon Labs.

Next, Ryan Wyatt also announced his resignation as President of Polygon Labs. A few months later, he moved on to become CGO for Optimism – a popular Layer-2 project on Ethereum and a competitor to Polygon.

Then in October of the same year, Jaynti Kanani – one of the key founders – also announced a reduction in his role at Polygon to focus on new projects. The personnel crisis was not limited to the senior team: earlier, in February 2023, Polygon announced a 20% reduction in staff in a restructuring.

Besides personnel issues, Polygon’s products have also not been very promising. In April 2024, the strategic product Polygon zkEVM suffered a 12-hour “network outage.”

Currently, the DeFi TVL on Polygon PoS has decreased by 91% compared to its ATH in 2021, leaving only $877 million and pushing this blockchain out of the top 10 in DefiLlama’s rankings. Lido Finance also recently announced it was discontinuing support for Polygon due to too few users.

The Last Straw with a Controversial Proposal

Amid this unfavorable situation, on December 12, 2024, a group consisting of Allez Labs, Morpho Association, and Yearn submitted a proposal to profit from the $1.3 billion in stablecoins (DAI, USDC, USDT) currently sitting “idle” on the Polygon PoS bridge.

This group proposes to exploit the potential of these assets through staking strategies, which are expected to generate profits of approximately $70 million to $91 million per year.

More specifically, the strategy uses ERC-4626 vaults to manage and optimize returns from stablecoins. DAI will be deposited into Maker’s sUSDS vault, while USDC and USDT will be managed through Morpho Vault.

This proposal immediately met with much opposition. The account Mikko Ohtamaa argued that the proposal would “set a dangerous precedent where assets are double-counted: USDC is bridged by users to be used in lending services on Polygon, but that same USDC is then put into Morpho on the mainnet.”

Ernesto Boado, former CTO of Aave, criticized, “Polygon is a blockchain infrastructure layer but takes users’ money to invest, while users just want to bridge to that network,” and “risk managers have now become profit hunters.”

Aave’s Unexpected Reaction

On December 13, 2024, due to concerns about bridge vulnerabilities and the risk of bad debt, Marc Zeller – founder of Aave Chan Initiative and former Integrations Lead at Aave – unexpectedly put forward a proposal that could lead to Aave’s withdrawal from the Polygon network.

Specifically, the proposal calls for adjusting the loan-to-value (LTV) ratio to 0% for many assets on Aave on the Polygon network, to prevent users from borrowing against these assets. Furthermore, if the proposal is approved, Aave will also transfer the platform’s governance mechanism from Polygon to another Layer-2.

By December 18th, Sandeep Nailwal announced the failure of the proposal to stake idle assets, claiming it as a success for Polygon in empowering the community to make decisions, and because this proposal did not suit the community, “I also do not support it.”

He also did not forget to criticize the “double standard” that Aave had set, as Aave had previously made a similar proposal to Morpho and had “actively campaigned to move assets on the bridge into Aave.”

A few hours later, Stani Kulechov of Aave spoke out: “The Polygon team (with support from partners) proposed using user funds on the Polygon bridge to invest in DeFi, yet lacked adequate risk protection measures. The partners were selected by Polygon in secret, and some argue that they even received large token deals.

After carefully reading the proposal, Polygon users were concerned when they realized the risk that their funds could be double-spent.”

Stani expressed Aave’s concerns about Polygon’s actions, considering that Aave has its governance mechanism on this blockchain. He explained that the proposal put forth by Aave Chan Initiative was a necessary action to protect user assets, fearing a repeat of the Harmony bridge hack.

Finally, Stani, who is usually tight-lipped, made the most scathing and direct criticism of Polygon: “The Polygon team abandoned the proposal, pretending they didn’t support it, and blamed Aave for its failure. They also fabricated many inaccurate claims about Aave’s infrastructure.”

Is Aave’s Departure the End for Polygon?

According to the governance process, within the next month, the Aave community can vote on-chain for the proposal to leave Polygon. The scenario of Aave leaving is prevailing, as Aave Chan Initiative and EzR3aL – two “delegates” actively supporting the departure – hold more than 60% of the total votes in recent polls.

Aave currently accounts for about 40% of Polygon’s TVL. Aave’s departure is a significant loss for Polygon, while Aave “loses” less since TVL on Polygon only accounts for 2% of this lending platform’s total TVL.

Aave’s decision also sets a precedent for other protocols to consider leaving Polygon if they feel unprotected or pressured by unreasonable proposals.

“I don’t want to live in a world where Aave decides to leave,” lamented Marc Boiron, CEO of Polygon Labs.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger