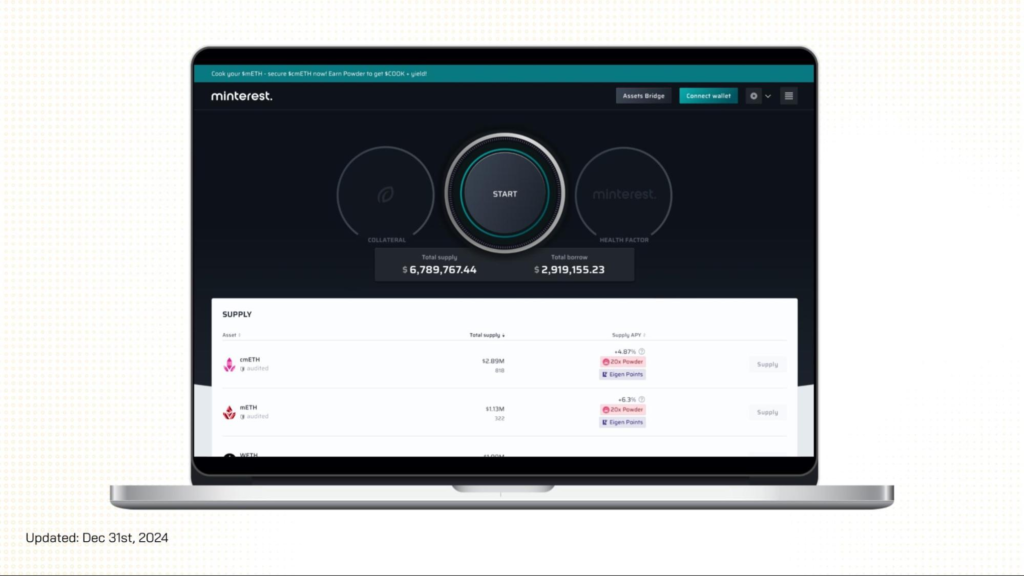

The lending & borrowing sector has always played a crucial role in DeFi, where users can optimize their capital efficiency. The Minterest platform also belongs to this sector, standing out with its intuitive and user-friendly interface.

What is Minterest?

Minterest is a lending & borrowing platform operating on 3 networks: Ethereum, Taiko, and Mantle. The platform allows users to provide liquidity to earn interest, or collateralize assets to borrow cryptocurrencies.

According to the project, Minterest converts 100% of the revenue generated from transaction fees into rewards for users who stake MINTY tokens.

How Minterest Works

There are 3 main roles involved in Minterest’s operating model:

- Liquidity Provider: Provides assets to Minterest’s liquidity pools to earn interest. Liquidity Providers can also become Borrowers by using their supplied liquidity as collateral to borrow.

- Borrower: Can only borrow after collateralizing assets into the protocol. Borrowers need to pay attention to the following metrics: collateral factor, utilization rate, and reserve factor to ensure a smooth borrowing process and minimize risks.

- Collateral factor: The maximum limit a user can borrow based on the value of the collateral. The higher this ratio, the more users can borrow compared to the value of the collateral.

- Utilization rate: An indicator showing the average percentage of assets borrowed by users from the pool. The higher this rate, the more the borrower’s solvency is affected if the value of the collateral decreases.

- Reserve factor: A metric set by the protocol to ensure that there are always enough reserve assets to cover loans when necessary.

- Liquidator: Responsible for handling liquidations on the protocol. Liquidation occurs when a borrower’s collateral falls below a predetermined threshold. At this point, the liquidator has the right to purchase all of the borrower’s collateral at a discount ranging from 40-50%, also known as the liquidation fee.

In addition, Minterest also has an automatic liquidation mechanism (solvency engine) to help ensure the stability of the protocol. This mechanism will automatically trigger the liquidation process when needed.

In summary, Minterest’s operating model is as follows:

Users deposit assets into the protocol to become liquidity providers and earn interest or use them as collateral to borrow. In the case of borrowing, the collateralization ratio will vary depending on the type of collateral and the type of asset to be borrowed. If the collateral fails to meet the margin requirement, the loan will be liquidated.

100% of the transaction fees for the above activities are used to buy back MINTY tokens circulating in the market. All MINTY tokens bought back from transaction fees will be redistributed to two groups:

- Users who stake in the protocol

- Liquidity providers

However, at the time of writing, Minterest has not yet launched the MINTY token. Therefore, users participating in lending and borrowing activities on the platform can earn points. Points will vary depending on the network and asset pool. For example:

- Mantle Network: Earn points from EigenLayer by providing liquidity to the cmETH pool (Mantle’s liquid restaking token).

- Taiko: Earn points from Taiko through the TAIKO asset pool.

In addition, among the 3 networks that Minterest supports, Mantle Network records more active lending and borrowing activities with a total liquidity supply of over $2 million, while Taiko has just over $200,000 and Ethereum only about $70,000.

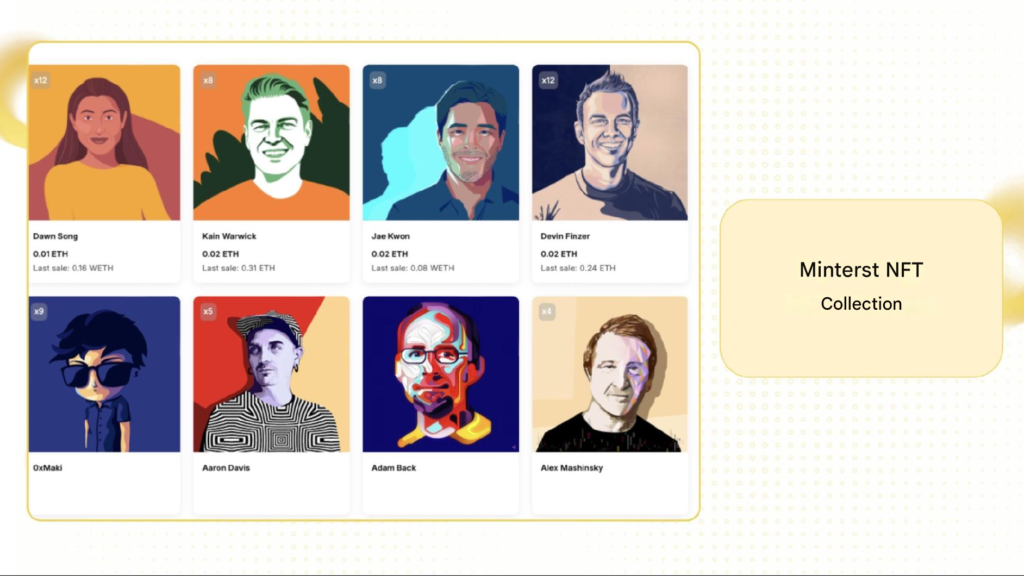

Minterest’s NFT Collection

Besides its core lending & borrowing product, Minterest also develops an NFT collection to increase utility for users. The Minterest NFT collection includes 3,000 NFTs, divided into 12 different rarity levels. Owning a Minterest NFT grants the following benefits:

- Increased rewards from lending & borrowing activities on the protocol

- Access to features before they are officially launched

- Rewards from special events of the project

Note: The NFT tier determines the level and duration of the user’s boosted yield benefits. The boosted yield ranges from 20% to 50% depending on the tier of the NFT held.

Currently, Minterest NFTs are being sold on OpenSea with a floor price of around 0.01 ETH.

What is Minterest’s Token?

MINTY Token Key Metrics

- Token Name: Minterest

- Ticker: MINTY

- Token Standard: ERC-20

- Token type: Governance

- Total Supply: 65,902,270 MINTY

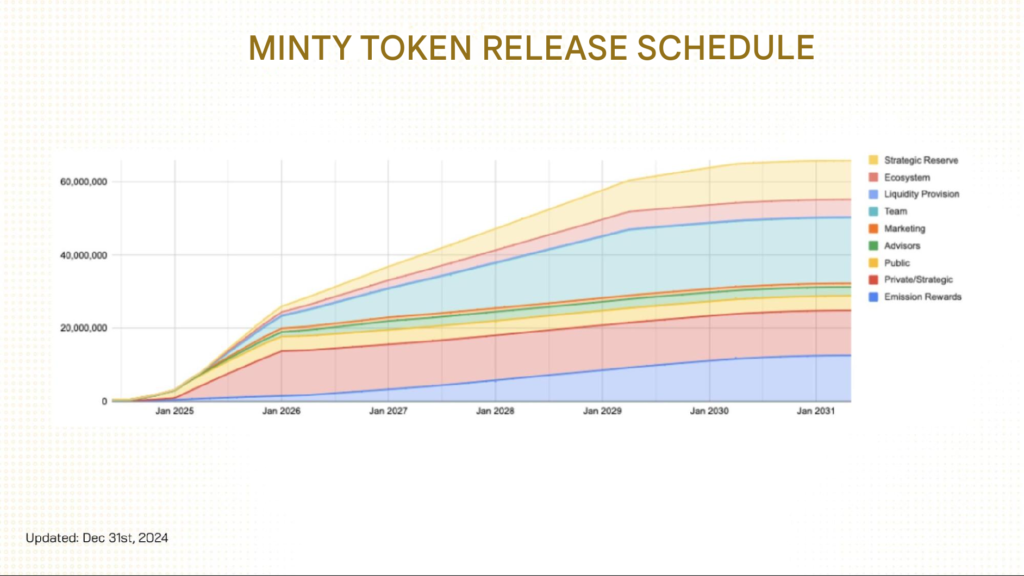

MINTY Token Release Schedule

The MINTY token release schedule is as follows

Minterest’s Team, Investors, and Partners

Project Team

Most members of the Minterest team have many years of experience in the technology field. Specifically:

- Kyn Chaturvedi: CEO of Minterest. Previously, he held the position of CBDO at TomoChain – a layer-1 blockchain. In addition, he also has over 15 years of experience working as a game developer.

- Denis Romanovsky: CTO of Minterest. He has many years of experience as a protocol architect developer.

- Veiko Krünberg: CMO of Minterest. He has over 20 years of experience in the marketing field.]

Investors

In September 2021, Minterest successfully raised $6.5 million in a Seed round. Investment funds participating in this funding round include KR1, DFG, CMS, and others.

Similar Projects

- Scallop: A borrowing & lending protocol on Sui, allowing users to experience optimized borrowing through the Trilinear model.

- Texture: A borrowing & lending platform on Solana, enabling users to collateralize a variety of crypto assets, such as meme coins and liquid staking tokens

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger