In summary

The head and shoulders pattern predicts BTC could drop to $74,100 if it breaks the neckline below $90,000, but could exceed $122,000 if the neckline holds.

The bull flag pattern suggests accumulation before a major breakout, with price action repeating through ranges lasting 8–25 weeks.

The Banana Zone indicates that BTC is in an accumulation phase before entering a strong growth cycle with a “banana” price structure..Go to BingX now.

Bitcoin (BTC) is trading above $90,000 and continues to receive positive news as the most crypto-friendly US presidency and Congress in history is about to begin. However, many skeptical and optimistic analyses have surfaced among experienced investors.

Here are the most talked-about Bitcoin price model scenarios for the first quarter, compiled by BeInCrypto.

#1. Head and shoulders price model suggests a decline in Q1 2025

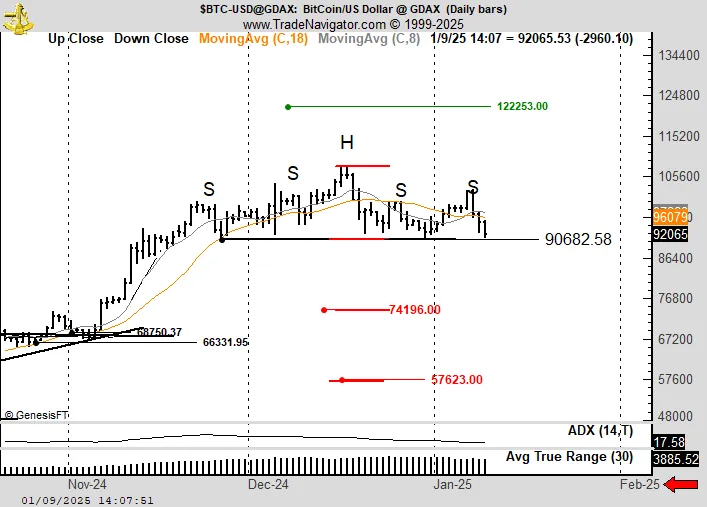

The first scenario that has caught the community’s attention is the head and shoulders price model. This pattern has been monitored and shared by veteran trader Peter Brandt in a recent comment. According to technical analysis theory, this price model predicts a market reversal.

However, the prediction only officially takes effect when the neckline of the pattern is broken, i.e., the Bitcoin price falls below the $90,000 zone. If that happens, Peter Brandt suggests that BTC could drop to $74,100 or even deeper to $57,600. If the neckline holds, the BTC price could completely surpass the peak and establish a high above $122,000.

This pattern is also being monitored by investor Ali Martinez, who emphasizes the importance of BTC closing above $100,000.

“I am cautiously optimistic because, as we all know, Bitcoin may be forming a head and shoulders pattern, forecasting a correction down to at least $78,000. This is why a strong close above $100,000 is very important to invalidate this bearish pattern,” Ali Martinez stated.

#2. Bitcoin is forming a bull flag pattern in the weekly timeframe

Instead of observing the daily timeframe like Peter Brandt, investor Mags observes the fluctuations in the weekly timeframe and compares them with Bitcoin’s price patterns in the past. In this way, Mags noticed that Bitcoin often moves sideways to accumulate after a rally, and this sideways process can last from 8 weeks to even 25 weeks.

“Since bottoming at $15,500, each rally has been followed by a period of accumulation within a range. Each range equates to sideways price action, and fakeouts occur (in both directions), followed by a breakout. Currently, we are in the 6th range, and if this pattern repeats, a major breakout is imminent. Don’t miss this local bottom again!” — Investor Mags predicts.

Based on technical analysis theory, the range that Mags mentioned corresponds to the bull flag pattern, and the “fakeouts” are when BTC exhibits “false breakout” behavior, causing many traders to get caught in stop-losses.

#3. Bitcoin is entering the “Banana Zone”

Another model that has been shared recently by many influential traders on X is the “Banana Zone.” According to the description by Raoul Pal, Founder and CEO of Real Vision, the “Banana Zone” consists of 3 phases.

Phase 1 is when Bitcoin breaks out and sets a high, then moves sideways, which is happening now and does not last long. Phase 2 will be Altcoin Season and everything will go up. Phase 3 is the final explosion. The combination of these 3 phases creates a kind of soaring price pattern likened to a “banana”.

Investor The Bitcoin Historian has listed the times the “Banana Zone” has appeared in cycles from 2011 to the present. The above chart claims that the current state of the market is just a temporary “Boring Zone” before the “Banana Zone” completes the remaining stages.

“Bitcoin is always boring before it goes parabolic,” The Bitcoin Historian stated.

See also: Expert points out macro risks facing the crypto market in 2025

Join the BeInCrypto community on Telegram to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.