In summary:

The market capitalization of crypto AI agents has fallen by 13% in 24 hours to $6.42 billion, with major tokens like VIRTUAL and AI16Z suffering heavy losses.

Solana remains the leading chain for AI crypto projects, but its market dominance has declined as the sector faces a sharp correction.

Engagement with AI agents in the crypto space has dropped by 60%, and the launch of new crypto AI agents has almost ceased.

Trade on BYDFi for a chance to win an iPhone 16, a Rolex watch, and more!

Crypto AI agents have witnessed a sharp decline, with the total market capitalization dropping 13% in the past 24 hours to $6.42 billion. The largest tokens in this sector are struggling, with VIRTUAL, AI16Z, and FARTCOIN all recording significant losses over the past week.

Meanwhile, the growth of new crypto AI agents has slowed significantly, and engagement within the ecosystem has plummeted by 60% in just a few weeks. With investor interest and market activity waning, the sector faces a major challenge in regaining momentum unless a strong catalyst reignites demand.

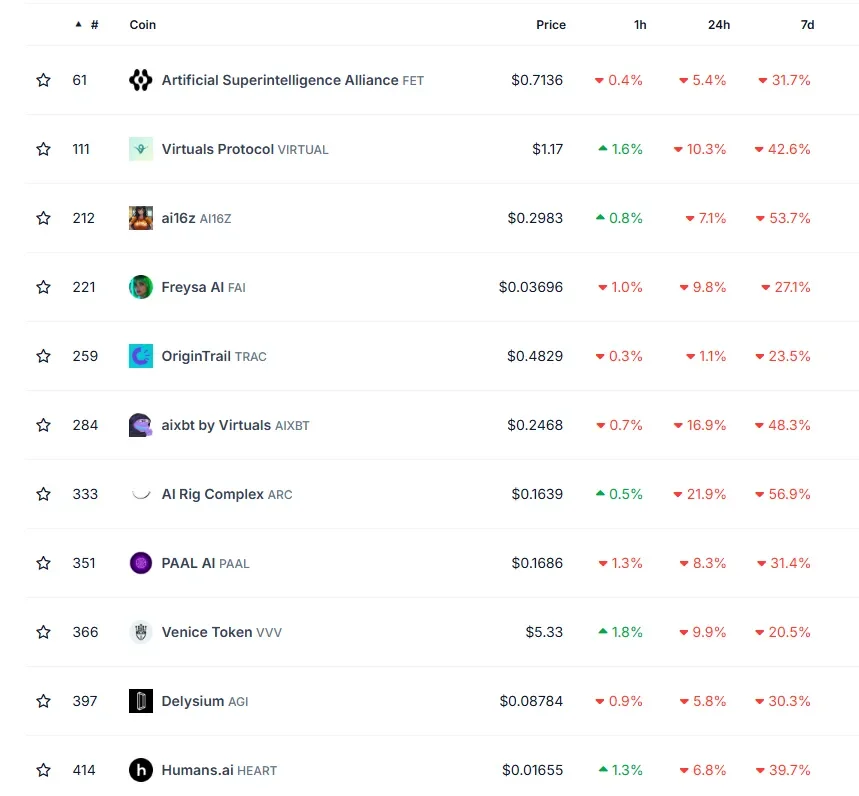

AI Agent Token Market Capitalization Declines

The crypto AI agent market has suffered a major blow, with its total market capitalization falling 13% in the past 24 hours to $6.65 billion. All of the top 10 AI agent tokens have recorded losses over the past seven days, with FARTCOIN down 61%, AI16Z falling 59%, and the largest token, VIRTUAL, losing 40% of its value.

This widespread sell-off highlights the ongoing weakness in the AI crypto sector, as investors continue to exit positions amid a correction, a trend that has been in play and accelerating since the launch of DeepSeek.

VIRTUAL, once the dominant artificial intelligence protocol, surpassed major competitors like TAO, FET, and RENDER when its market capitalization peaked at $4.6 billion on Jan. 1.

However, it has since faced a steep decline, with its current value standing at only $811 million. With this downturn, only five AI crypto agent tokens remain with a market cap above $300 million, and just 15 above the $100 million mark, demonstrating a widespread correction across the sector.

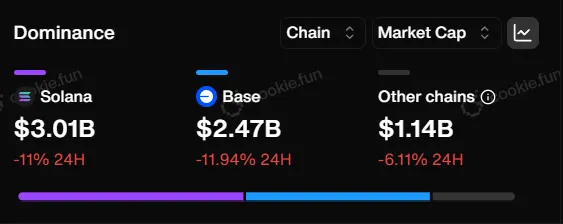

Solana Still Leads in the AI Agent Space

Solana remains the most dominant chain in the AI agent space, with its AI-related tokens boasting a combined market capitalization of $3.2 billion. However, this dominance has taken a hit, with the total value dropping 18.6% in the past 24 hours as the sector undergoes a broad correction.

Base chain ranks second, with its AI crypto agent tokens boasting a total value of $2.74 billion. Tokens like VIRTUAL, TOSHI, FAI, and AIXBT have been the main drivers of its growth in this sector. Interestingly, Ethereum is absent from the top spots, while other chains only account for a combined market capitalization of $1.19 billion.

Only two of the top 15 tokens reside outside of Solana and Base: ChainGPT (CGPT), operating on BNB Chain and currently holding a market cap of $118 million, and TURBO, operating on Ethereum with a market cap of $265 million.

Can AI Agents Regain Momentum?

The growth of crypto AI agents has slowed significantly after a surge in January. From Jan. 7 to Jan. 24, their numbers increased from 1,250 to 1,387, marking an 11% rise.

However, since then, growth has almost stalled, with only 13 new AI agents added, representing less than a 1% increase. This slowdown suggests that interest in launching new crypto AI agents is waning, potentially signaling a cooling-off period for the sector.

Furthermore, engagement within the ecosystem has plummeted, with the number of smart money wallets interacting with these projects falling from 19,069 on Jan. 17 to just 7,541 today—a staggering 60% decline. This decrease in activity highlights the waning enthusiasm, as fewer users appear to be actively trading or utilizing these agents.

With both new project creation and user engagement declining, regaining strong momentum in the short term seems challenging unless renewed interest or market-stimulating factors emerge.

Subscribe to BeInCrypto’s Newsletter to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger