In summary:

The price of ETH has fallen by 18% over the past month, pushing the percentage of supply in profit down to just 64.19%, its lowest level since October.

Investor confidence has weakened as ETH’s open interest has declined by 31% since February 2023, signaling decreased market participation.

The crucial support level at $2,553 is under pressure; a breakdown could send ETH toward $2,224, while a reversal could propel it to $2,811.

Promo: Trade on BYDFi for a chance to win an iPhone 16, a Rolex watch, and more!

The price of Ethereum (ETH) has fallen by 18% over the past month. As the price continues to decline, the percentage of ETH supply in profit has dropped to its lowest level since October, highlighting the growing challenges for this altcoin.

With increasing selling pressure, ETH investors may see more short-term losses on their holdings.

36% of Ethereum Holders Are at a Loss

ETH’s double-digit decline has pushed its price below a crucial support level formed at $3,000. Currently, the altcoin is trading at $2,640 and remains under significant bearish pressure.

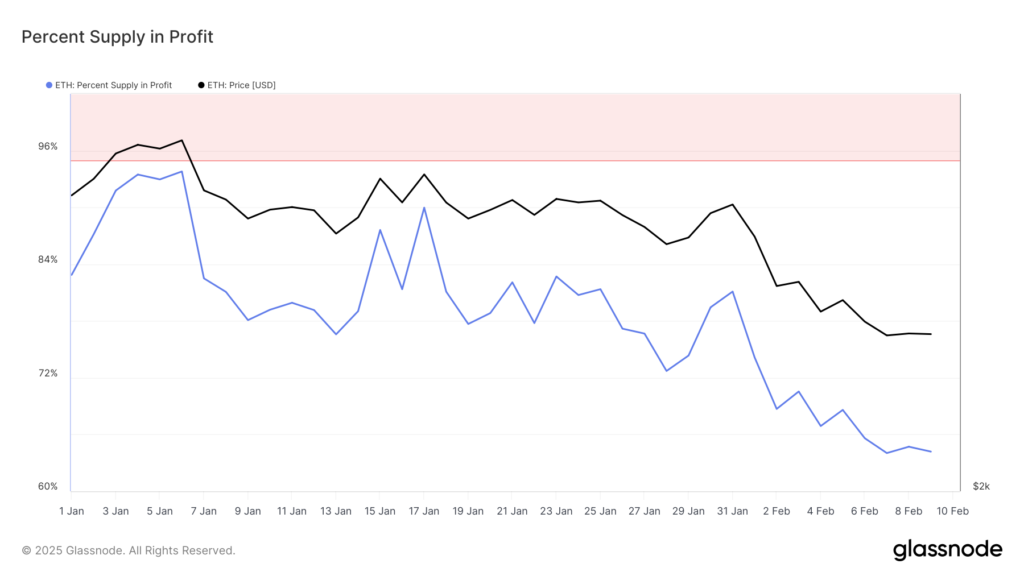

The recent price drop has pushed many Ethereum holders into a loss position. According to Glassnode, the percentage of ETH’s circulating supply in profit has fallen to its lowest point since October. Currently, only 64.19% of Ethereum’s total circulating supply is in profit. In other words, 48 million ETH out of the total 121 million ETH remain profitable

For comparison, on Jan. 1, 83% of ETH’s total circulating supply was in profit. When the percentage of an asset’s circulating supply in profit decreases, a larger portion of holders are facing losses, as the asset’s market price has fallen below their purchase price. This decline often signals waning investor confidence and could point to potential risks for the asset’s price.

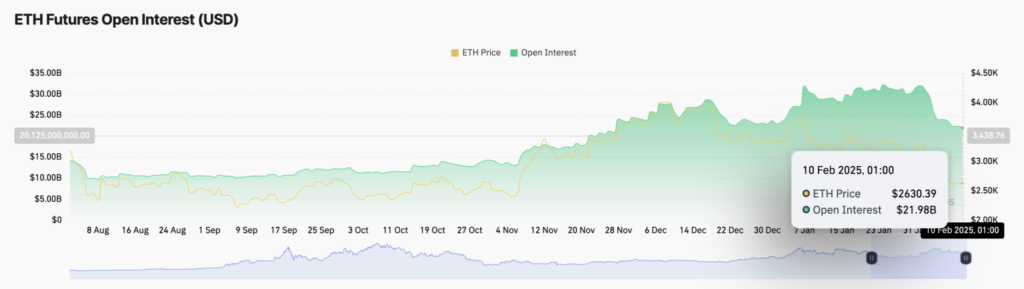

Notably, ETH’s open interest has also been declining, confirming the decrease in investor confidence. At the time of writing, it stands at $22 billion, a 31% drop since the beginning of February.

Open interest measures the total number of outstanding contracts (long or short), such as futures or options, that haven’t been settled. When open interest declines like this, it indicates a decrease in market activity or investor participation, which could suggest declining confidence or a shift in market sentiment.

ETH Price Prediction: Decline to $2,224 or Reversal to $2,811?

On the daily chart, ETH is trading at the lower boundary of a descending channel, forming support at $2,553. If the sell-off gains further momentum, bulls might not be able to defend this level, leading to a continued decline in ETH’s price. In that case, the coin’s value could fall to $2,500 or lower, towards $2,224.

However, if the current market trend reverses, this bearish prediction would be invalidated. In that case, the ETH price could resume its upward trajectory and climb toward $2,811.

Subscribe to BeInCrypto’s Newsletter to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger