In Summary

ADP and nonfarm payrolls could determine BTC’s next move, with weak data increasing hopes for rate cuts and risk appetite. T

he Fed chair’s views on rate cuts could impact Bitcoin, with dovish signals boosting BTC prices and a hawkish tone dampening them. Increased credit utilization could limit Bitcoin’s appeal, while a slowdown could drive investors to seek BTC as a store of value.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

As Bitcoin (BTC) hovers near critical price levels, cryptocurrency investors are focused on a week packed with US economic data that could influence market sentiment.

From employment figures to remarks by Federal Reserve Chair Jerome Powell, these macroeconomic indicators could affect Bitcoin’s trajectory.

US Macroeconomic Data to Watch This Week

Cryptocurrency market participants, traders, and investors have numerous US economic events to monitor this week. This follows a notable shift in sentiment over the weekend, driven by US President Donald Trump’s move to authorize a cryptocurrency reserve.

The cryptocurrency market’s reaction to the president’s executive order reflects Bitcoin’s growing position within the US macroeconomic landscape. Below is an analysis of five key data points to watch and their potential impact on the world’s leading cryptocurrency.

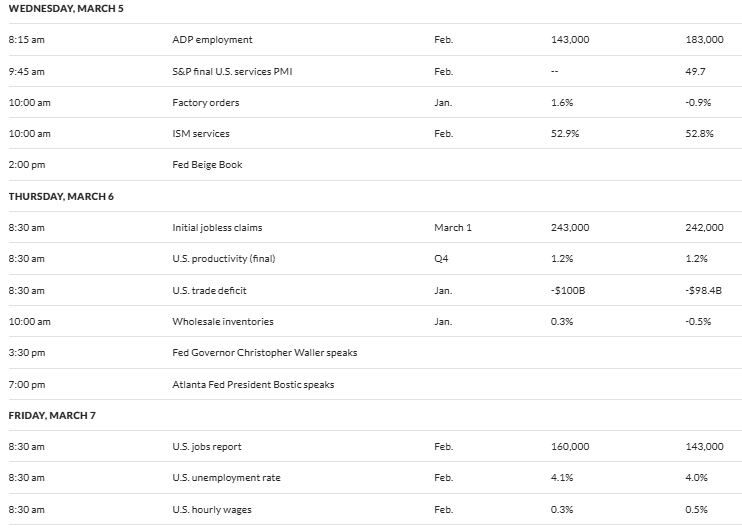

ADP Employment Report

This week kicks off with the ADP National Employment Report on Wednesday. This US economic data point is a key measure of private-sector job growth. Following the previous figure of 183,000, economists forecast February’s employment data to decrease to around 143,000. This reflects a cautious hiring environment, as President Trump’s economic policies remain a topic of interest.

A stronger-than-expected report could indicate labor market resilience, potentially boosting the US dollar and putting pressure on Bitcoin as investors move towards traditional assets. Conversely, a weaker figure could raise expectations for Federal Reserve interest rate cuts, lifting BTC as a risk asset.

The spotlight is on this week’s employment data, with ADP on March 5th expected at 143,000 and nonfarm payrolls on March 7th forecast at 160,000. If these numbers meet or exceed [expectations], bullish investors could drive a 1-2% increase, fueled by optimism in tech and belief in a soft landing,” one user commented.

However, the outcome remains uncertain, with historical trends showing mixed reactions in the cryptocurrency market to surprises from ADP.

Initial Jobless Claims

Thursday’s Initial Jobless Claims report will provide a real-time look at the health of the US labor market. Last week’s figure rose to 242,000, exceeding the 225,000 forecast, suggesting economic weakness.

According to data on MarketWatch, analysts anticipate a slight increase to around 243,000 for the week ending March 1st. A lower claims number could bolster confidence in the economy, potentially diminishing Bitcoin’s appeal as a hedge against uncertainty.

However, a higher claims number could raise concerns about a downturn, driving investors towards BTC as a safe-haven option.

US Unemployment Rate

Friday’s US jobs report, including the unemployment rate, is a key market event. Job growth is forecast at 160,000 for February, up from 143,000 in January, with the unemployment rate expected at 4.1%, higher than the previous 4.0%.

Strong job growth could diminish hopes for monetary easing, putting pressure on Bitcoin as higher interest rates make yield-bearing assets more attractive. Conversely, a disappointing report could strengthen BTC’s narrative as a hedge against economic weakness.

Jerome Powell’s Speech

The upcoming speech by Federal Reserve Chair Jerome Powell is also a wildcard. It encompasses US economic data that could influence crypto sentiment this week. His speech could set expectations for monetary policy.

His remarks, expected on Friday, will be analyzed for clues about interest rate cuts in 2025, especially after the Fed’s recent interest rate decision. Dovish hints—suggesting more aggressive easing—could push Bitcoin higher by weakening the US dollar and boosting risk appetite. A hawkish stance, emphasizing inflation control, could put pressure on BTC as borrowing costs rise.

Notably, Powell recently told the Senate Banking Committee that he is in no hurry to cut interest rates, maintaining a cautious economic approach. However, growing concerns among US policymakers about President Trump’s policies cannot be ignored.

Many members suggested that a range of factors underscored the need for a cautious approach to monetary policy decisions in the coming quarters,” the previous Fed minutes stated.

Consumer Credit

Friday’s Consumer Credit data will shed light on American borrowing trends, rounding out the week. After a $40.85 billion increase in December, a sharp rise could signal strong consumer confidence, potentially reducing Bitcoin’s appeal as disposable income flows elsewhere.

A slowdown in credit growth could indicate economic caution, driving investors towards BTC as a store of value amid uncertainty. However, data on MarketWatch shows a modest median forecast of $12 billion.

At the time of writing, Bitcoin is trading at $92,811, up over 8% since the Monday trading session opened. With these five data points approaching, volatility is inevitable.

“Although I anticipated US-backed cryptocurrency asset reserves focusing specifically on US blockchains, I did not trade on the news. This is a beta trade. Look at tokens that haven’t been added yet before the summit on Friday and consider holding some in your portfolio. This is a rather speculative trade because, although Trump hinted that more tokens would be added, those tokens that are not chosen will likely be adversely affected,” one X user quipped.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger