In Summary

Pi Network’s DMI indicates increasing bearish momentum as sellers take control, while the RSI remains neutral, signaling market indecision.

Pi could surpass $2 and test $3 if buying pressure significantly increases, but the upcoming unlock of 188 million tokens could pose downside risks. A drop below $1.51 could signal further losses, while a bullish reversal requires stronger momentum and a shift in trend indicators.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Pi Network (PI) is in a consolidation phase after reaching a new peak in late February, with technical indicators showing mixed signals. The DMI chart shows sellers are attempting to maintain control, as +DI declines while -DI rises, signaling increasing bearish momentum.

Meanwhile, the RSI remains neutral, fluctuating between 45 and 55, indicating a lack of strong movement in either direction. If a strong uptrend emerges, PI could surpass the $2 threshold and potentially test the $3 level, but downside risks remain, especially with the unlock of 188 million tokens this month.

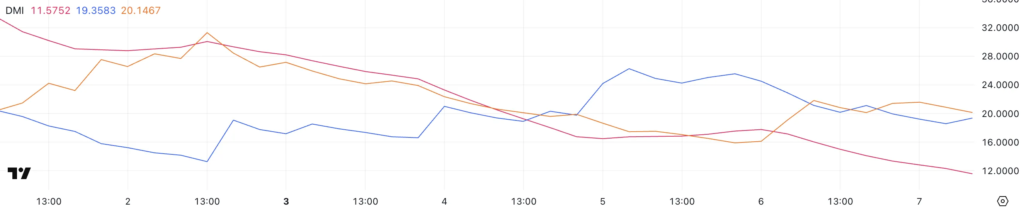

Pi Network DMI Shows Sellers Are Trying to Maintain Control

Pi Network’s DMI chart shows its ADX has declined to 11.5 from 17.7 the previous day.

The Average Directional Index (ADX) measures trend strength on a scale from 0 to 100, with values below 20 indicating a weak trend and above 25 indicating a strong trend.

A declining ADX suggests that the current trend, whether bullish or bearish, is losing momentum and is less likely to continue in the short term

Simultaneously, PI’s +DI has decreased from 24.5 to 19.3, while the -DI has increased from 16.1 to 20.1. This shift indicates that bearish momentum is strengthening as selling pressure outweighs buying pressure.

If this trend continues, PI may struggle to generate upward momentum and could face further price weakness.

For a bullish reversal, the +DI would need to regain dominance over the -DI along with an increase in the ADX, confirming a stronger trend direction.

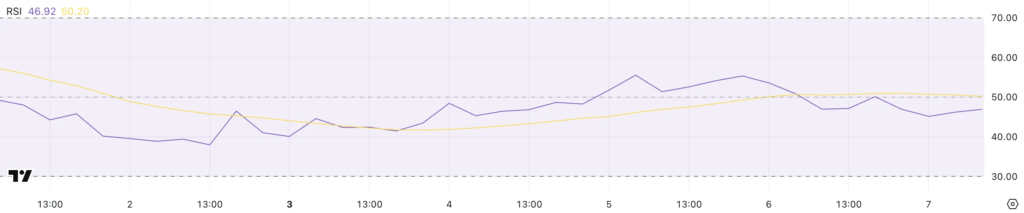

PI RSI Has Been Neutral For 8 Days

Pi Network’s RSI is currently at 46.9, maintaining a neutral stance since February 27th and fluctuating between 45 and 55 over the past three days

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and magnitude of price movements on a scale of 0 to 100.

A reading above 70 indicates overbought conditions, suggesting a potential correction, while a reading below 30 signals oversold conditions, suggesting a potential rebound. A neutral RSI between 45 and 55 generally reflects a lack of strong momentum in either direction.

With PI’s RSI at 46.9, the market appears to be indecisive, lacking clear bullish or bearish momentum. This suggests that Pi Network’s price may remain range-bound without a significant shift in buying or selling pressure.

For a more bullish outlook, the RSI would need to move above 55, signaling increased buying interest, while a drop below 45 could indicate growing bearish momentum, potentially leading to further price declines

Recently, the coin surpassed 4 million followers on X; however, a Binance listing has yet to materialize, which may be contributing to further selling pressure.

Pi Network Could Rise Above $3 If Strong Uptrend Emerges

Pi Network has been in a consolidation phase for the past few days after reaching a new peak in late February.

Consolidation phases often indicate a temporary pause in price movement as traders assess the next direction, with the possibility of either a continuation of the previous trend or a reversal.

If buying pressure returns and Pi Network resumes its uptrend, it could test resistance around the $2 level. A break above this level, combined with strong momentum, could push Pi towards $3 and potentially even higher, marking new highs.

However, if the uptrend fails to materialize and selling pressure increases, PI’s price could enter a correction phase. In this scenario, the price could fall towards $1.51. Its subsequent price movements may be driven by the unlocking of 188 million tokens, which will take place this month.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger