In summary

Cardano’s price has increased by 7% in 24 hours, with a 17% weekly gain and nearly $2 billion in trading volume, indicating strong market activity.

Whale accumulation is on the rise as wallets holding 1 million to 10 million ADA reach a new monthly high, generating optimism for a sustained upward trend.

Cardano’s ADX shows increasing trend strength in the early stages, with key resistance at $1.119 and support at $1.03 determining its next move.

Trade with leverage, NO KYC required, and receive rewards up to $1030.Go to BingX now.

The price of Cardano (ADA) has increased by nearly 7% in the past 24 hours, bringing its 7-day gain to 17%. Trading volume has also risen considerably, increasing by roughly 25% in the past day and nearing $2 billion.

As whale accumulation increases and ADA approaches key resistance levels, market attention turns to whether the uptrend can strengthen or if a correction may be in store.

ADA’s Current Uptrend Lacks Strength

The Average Directional Index (ADX) is currently at 21.2, up from 18 two days ago, suggesting its trend is gradually strengthening. This morning, the ADX reached 22, temporarily surpassing the threshold that typically identifies the presence of a stronger trend. This increase is consistent with ADA’s current upward trajectory, indicating that while the trend is still in its early stages of development, it is showing signs of gaining momentum.

The ADX measures trend strength on a scale of 0 to 100, regardless of trend direction. Values below 20 suggest a weak or range-bound market, while values above 25 indicate a strong trend. With the ADX at 21.2, the trend is approaching significant strength but has yet to fully confirm its robustness

If the ADX continues to rise, it could signal that ADA’s uptrend is strengthening, increasing the likelihood that the price will continue to increase. However, if the ADX stalls or declines, it could suggest that the current rally is losing momentum and may transition into a period of consolidation.

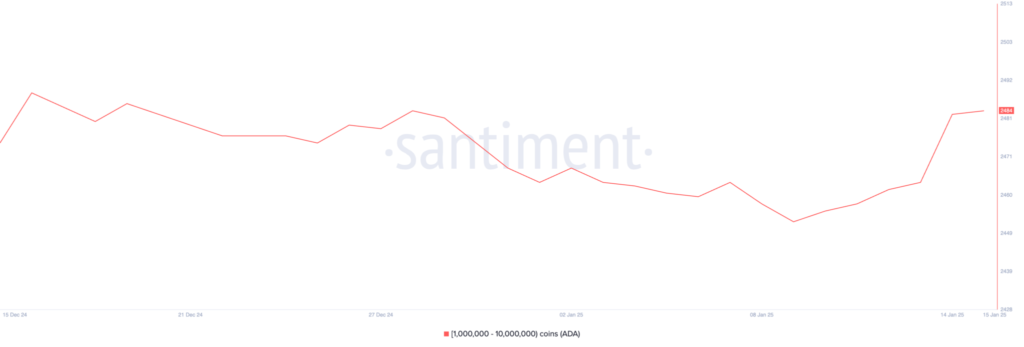

Cardano Whales Resume Accumulation

The number of Cardano whales — wallets holding between 1 million and 10 million ADA — reached a monthly low of 2,453 on Jan. 9. Since then, this number has steadily increased, currently sitting at 2,484, the highest since Dec. 28. This increase in the number of large holders suggests renewed interest and accumulation from influential market participants, which could significantly impact the price of ADA

Monitoring whale activity is crucial as their holdings and movements often have a significant impact on market trends. The recent increase in the number of whales could suggest growing confidence in ADA’s price potential, as these entities may be positioning themselves for future gains.

If this accumulation trend continues, it could create upward pressure on ADA, as circulating supply decreases and concentrated holdings often support price appreciation. Conversely, a reversal in this trend could signal a potential sell-off or weakening support.

ADA Price Prediction: Can it Spark a New Rally?

The Exponential Moving Average (EMA) lines are currently displaying a bullish structure, with shorter-term EMAs positioned above the longer-term EMAs. This arrangement reflects strong upward momentum and is further reinforced by the formation of a golden cross two days ago, a classic technical signal that often precedes sustained upward price movements

If the current uptrend continues, the price of Cardano could test the first resistance level at $1.119. A successful breakout above this level could pave the way for further gains, with $1.15 being the next target.

However, the support at $1.03 remains crucial for sustaining the upward momentum. A breakdown below this level could signal a reversal, potentially pushing the ADA price into a downtrend that could extend to $0.879, equating to a possible correction of up to 17.9%.

Join the BeInCrypto community on Telegram to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk