In Summary

LINK’s price increased by 11% over seven days, with a market capitalization of $10.3 billion, trailing Pi Network at $12.7 billion. DMI indicators show a weakening trend with -DI crossing above +DI, suggesting a potential shift towards a downtrend.

The BBTrend turned positive at 3.69, indicating potential bullish momentum building.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Chainlink (LINK) has recently shown mixed technical signals, with some indicators turning bearish while others suggest potential future gains. With a price increase of 11% over the past seven days, Chainlink is on track to surpass Pi Network in market capitalization, but this may be delayed for now.

With LINK barely moving in the last 24 hours, its market capitalization currently stands at $10.3 billion, and Pi Network’s at around $12.7 billion. The coming days will be crucial as several technical indicators reach key inflection points that could determine whether LINK continues to rise or faces a correction.

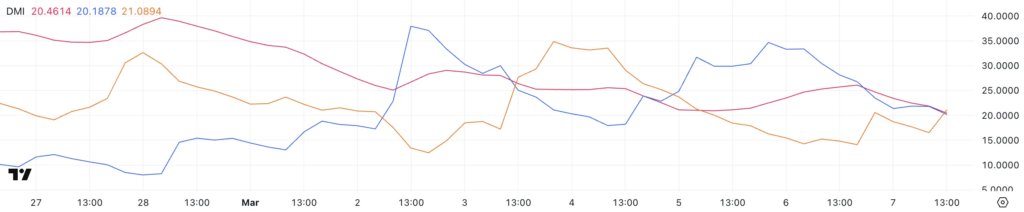

Chainlink’s DMI Shows Sellers Have Taken Control

According to Chainlink’s DMI chart, its ADX (Average Directional Index) has decreased from 26 yesterday to 20.46 today. This decline indicates that trend strength is weakening, regardless of direction.

The ADX is a component of the Directional Movement Index (DMI) that measures trend strength on a scale of 0-100, without indicating direction. Typically, readings above 25 indicate a strong trend, 20-25 indicates a developing trend, and below 20 reflects a weak or absent trend.

Chainlink’s ADX moving from above 25 to just above 20 signals that the previous strong trend is losing momentum and transitioning to a neutral or ranging market.

The +DI (Positive Directional Indicator) has decreased significantly from 33.3 to 20.1, while the -DI (Negative Directional Index) has increased from 14.2 to 21. This crossover, with the -DI now above the +DI, suggests a potential shift from bullish to bearish momentum.

Combined with the weakening ADX, this technical picture suggests a potential bearish reversal or continuation pattern forming for LINK’s price. Traders may anticipate further downward pressure in the short term, although they should watch for signs of stabilization or reversal as the trend weakens.

If the ADX continues to decline below 20, LINK could enter a consolidation phase rather than a strong directional move.

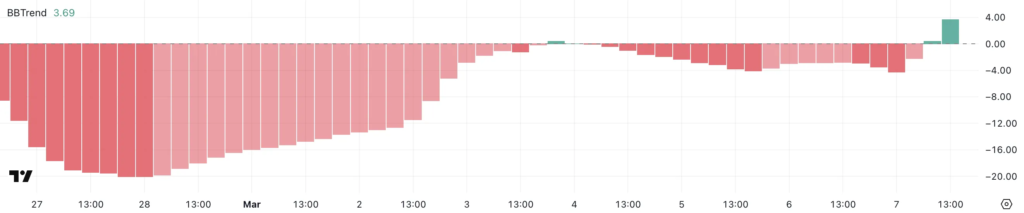

LINK BBTrend Now Positive After Being Negative for Days

LINK’s BBTrend has now turned positive, reaching 3.69 after being in negative territory since March 4th. A significantly negative reading of -20 was recorded on February 28th.

The BBTrend (Bollinger Bands Trend) indicator is a momentum oscillator that measures the relationship between price and Bollinger Bands to determine the strength and direction of a trend. It calculates how the price is moving relative to the Bollinger Bands, which themselves represent standard deviations from a moving average.

When the BBTrend is positive, it suggests the price is moving above the middle band and potentially heading towards the upper band, indicating bullish momentum

Conversely, negative readings suggest bearish pressure with the price moving below the middle band towards the lower band. The recent shift to a positive BBTrend value of 3.69 for LINK could signal emerging bullish momentum after a period of downward pressure.

This reversal, coming after a prolonged negative period that bottomed out at -20, could indicate a significant shift in market sentiment.

However, traders should confirm this signal with other indicators, as the relatively modest positive reading of 3.69 suggests that the bullish momentum is still developing rather than firmly established.

Can Chainlink Revisit $20 in March?

LINK’s Exponential Moving Averages (EMAs) are currently trending downward, potentially forming a death cross in the near future.

If this bearish pattern materializes and Chainlink’s price breaks below the key support level at $15.79, we could see further downward movement.

In this scenario, LINK could fall to test the psychological and technical support levels at $14 and possibly even $13.45, representing significant declines from the current price.

Conversely, the recent positive shift in the BBTrend suggests that increasing buying pressure may be building. If this bullish momentum continues to strengthen, LINK could challenge the immediate resistance level at $17.64

A decisive break above this level would open the path to testing higher resistance zones at $19.79 and subsequently $22.31. In a strongly bullish scenario where upward momentum accelerates, Chainlink could reach $26.4, marking the first time trading above $25 in over a month.

This technical structure presents a clear inflection point for LINK, with convincing breaches of either the $15.79 support or the $17.64 resistance likely determining the next significant price movement.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger