From the Tulip Mania in the Netherlands to the Dotcom Bubble, history has witnessed numerous speculative frenzies that have had significant consequences for the global economy. And the cryptocurrency market is no exception.

What is a Crypto Bubble?

A crypto bubble is a phenomenon where the prices of cryptocurrencies are inflated far beyond their intrinsic value. In essence, a crypto bubble is similar to other types of economic bubbles like the dotcom bubble, the real estate bubble, and the Tulip mania. They are all driven by various factors such as economic conditions, psychological factors, social trends, or simply the appearance of “black swan” events.

The phenomenon of bubbles in financial markets stems from the image of bubbles in real life. When bubbles get big enough, they burst, leading to sharp and sudden declines, causing significant losses for investors.

Crypto bubbles are also known by other names such as “Bitcoin bubbles,” “cryptocurrency bubbles,” or simply “crypto bubbles.”

However, unlike other traditional assets, the cryptocurrency market is highly volatile. Sometimes, sharp price drops are just corrections. Adjustments are an inevitable process that helps eliminate weak factors and create opportunities for the market to recover. Therefore, not every drop is a sign of a bubble bursting.

When Cryptocurrency Bubbles “Burst”

The 2017 Bull Run and the 2018 Crypto Winter

Going back seven years, in the early months of 2017, the total market capitalization of the entire cryptocurrency market fluctuated around $18 billion. By January 2018, this figure had reached $800 billion, an increase of more than 44 times.

And just a few months later, the crypto market lost up to 80% of its value. This decline was recorded as surpassing the dotcom bubble burst, an economic event that severely impacted the global financial market in the 2000s.

So, why did the crypto market grow so strongly in 2017?

It can be said that 2017 was a year that witnessed the emergence of many different factors, combining internal factors within the crypto market with the global economic context at that time, with some typical events such as:

- Loose monetary policy: Many central banks around the world implemented loose monetary policies to stimulate the economy, leading to capital flows into higher-risk investment channels such as cryptocurrencies. For example, in Vietnam, credit to support businesses increased by more than 18.17%, and lending interest rates fell below 4%… (Source: State Bank Magazine).

- Instability of traditional markets: With events occurring in 2016 and lingering into 2017, such as the Chinese stock market plummeting by more than 7%, Britain leaving the European Union, the US presidential election… These events caused investors to leave the stock market and seek other asset classes such as gold or BTC.

- The popularity of ICOs: The ICO fundraising model started in 2013, and four years later, ICOs really exploded. According to CoinDesk, total ICO fundraising increased from $295 million at the end of 2016 to over $3 billion in November 2017.

- Launch of BTC futures contracts on major exchanges: Such as the Cboe options exchange, the CME commodity exchange… and approved by the CFTC (Commodity Futures Trading Commission). This event marked a significant step in bringing cryptocurrencies into the traditional financial system.

These factors combined to drive investors to shift strongly to the cryptocurrency market. This led to a period of strong growth, with everyone talking about BTC and other cryptocurrencies. They gradually ignored fundamental and technical analysis and fell into a state of FOMO.

The Bubble When Inflated Too Much?

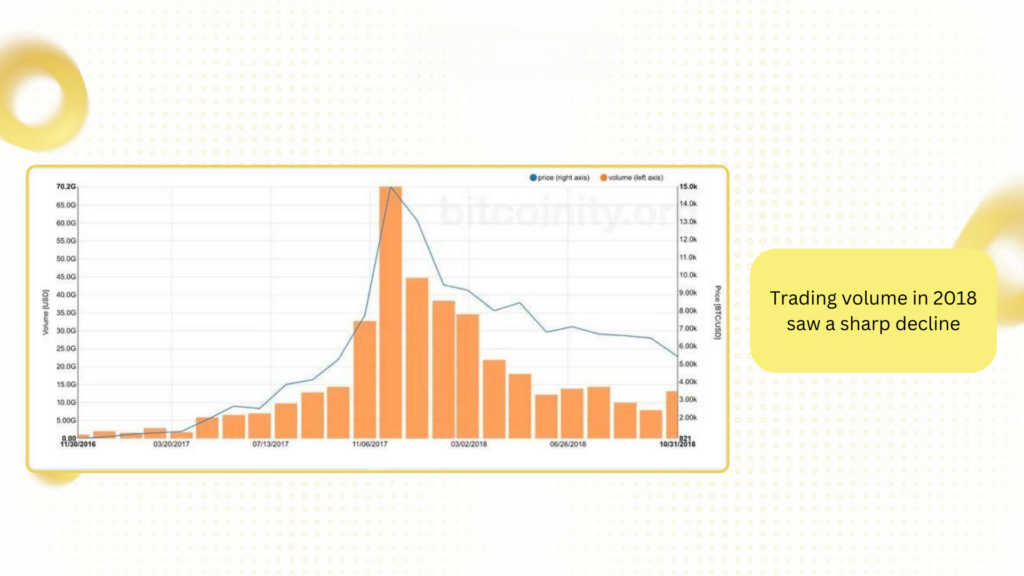

By mid-2018 and early 2019, the crisis began to unfold. Bitcoin dropped from over $19,000 in December 2017 to around $6,000 in February 2018. In December 2018, BTC continued to decline and bottomed out at around $3,000, leading to the collapse of most other cryptocurrencies.

Moreover, events that shocked investors occurred consecutively, such as the BitConnect exchange’s scam of the century, the ICO movement beginning to decline when some projects disappeared immediately after successful fundraising, the largest OTC cryptocurrency market in Japan – Coincheck being attacked and suffering losses of over $530 million…

As a result, many investors lost everything after the unstoppable FOMO wave. A series of cryptocurrency companies and startups faced the risk of bankruptcy because they could not raise more capital to pay off debts. Typically, the giant in the BTC mining industry – Giga Watt also could not withstand the price pressure and had to declare bankruptcy in November 2018, leaving debts of tens of millions of dollars.

The 2020-2022 Bubble

After the crypto winter of 2018, investors began to worry about the future of cryptocurrencies. According to statistics, the market fell into a state of “Extreme Fear” as the Fear & Greed Index recorded a score of 17/100. Financial experts from Wall Street and the US Securities and Exchange Commission (SEC) continuously warned investors about the risks of this market.

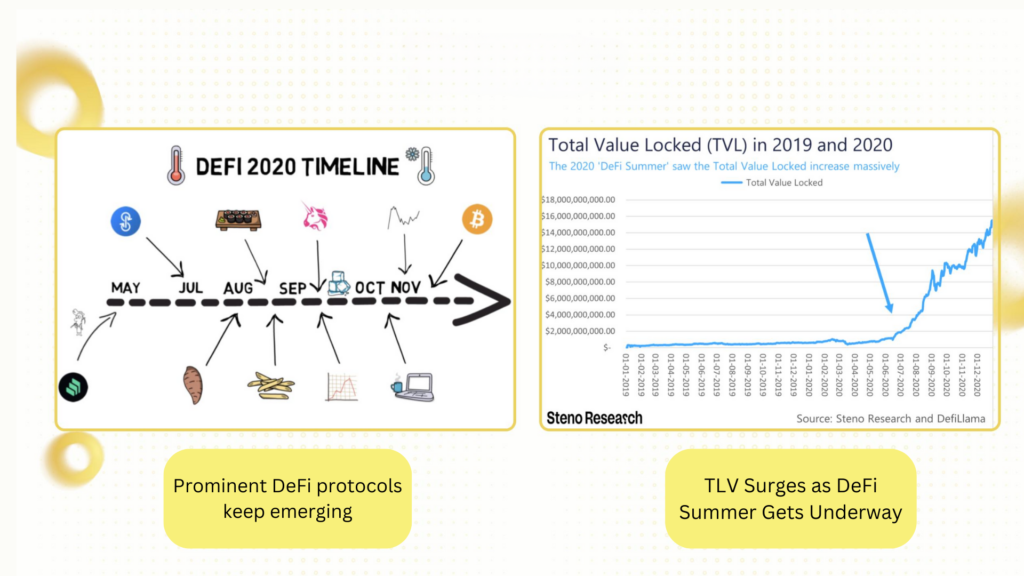

The aftereffects of the crypto winter continued until early 2020 when a landmark event took place, the “DeFi Summer.” At this time, DeFi protocols emerged en masse, accompanied by an explosion of new technologies and terms like lending & borrowing with the flagship project Compound, the rebase mechanism, yield farming, and more.

Soon after, positive news continuously emerged, such as Coinbase being listed on NASDAQ, Elon Musk publicly supporting cryptocurrencies, the price of BTC increasing sharply from around $5,000 in March 2020 to over $39,000 in January 2021… Investors started to become optimistic and returned to a FOMO state as the Greed Index rose, reaching over 80 points. Finally, BTC reached an all-time high (ATH) of $69,000 in November 2021.

After peaking in November 2021, the crypto market witnessed a strong correction immediately afterward, with BTC and ETH falling by more than 30% and 23%, respectively, in just one month. Along with that, the general downtrend of the global financial market began to lead to sharp declines.

This decline became even more pronounced in early 2022 when The Washington Post reported that: “The cryptocurrency bubble will burst, leading to losses even greater than the previous 2018 crypto winter.” Immediately after were continuous negative events:

- The Terra-Luna Crash: In May 2022, the Terra ecosystem experienced an unprecedented crisis when the stablecoin UST lost its peg and dropped from $1 to $0.1. The collapse of UST caused its supporting coin Luna to drop to near zero, wiping out over $45 billion in market capitalization in just one week.

- The FTX Cryptocurrency Exchange Bankruptcy: This event led to a series of consequences as investors were unable to withdraw their money, BTC and ETH prices plummeted by more than 50%, and nearly $500 million was liquidated from the market…

To date, many people still compare the winter of 2022 with the winter of 2018 to see which period was more severe. However, in general, both crypto bubble bursts led to harsh consequences. Therefore, considering and recognizing which stage the market is in (market cycle) will help investors more easily recognize when a bubble is forming.

Read more: What are the signs of a Crypto Winter?

4 Stages of Crypto Bubble Formation

Bubble “Inception”

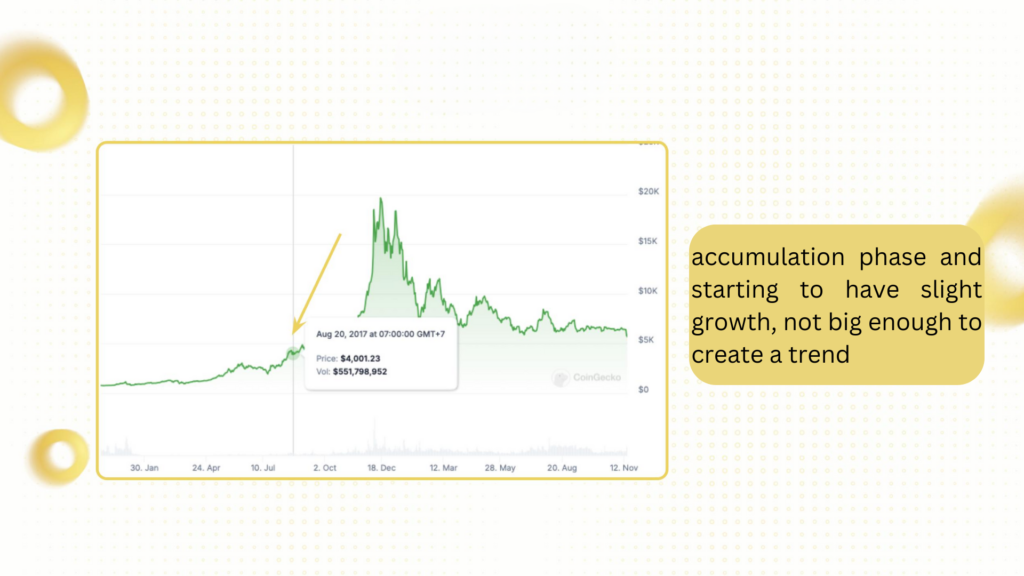

The early stages of an economic bubble are often characterized by a shift of investment capital from traditional channels such as stocks and real estate to newer, more potential channels.

At this time, crypto begins to take center stage and is included in many investors’ portfolios. They start using fundamental and technical methods to assess the growth potential of the market.

However, investors often participate on a small scale, viewing cryptocurrencies as an asset for long-term accumulation. According to a 2022 survey by the Ontario Securities Commission (OSC) in Canada, more than 36% of cryptocurrency assets are held by investors with less than $1,000 invested.

Although prices in this period gradually increase over time, the capital inflow into the market is still not large enough to create a clear trend.

Are We All Warren Buffett Now?

After a long period of accumulation and quietude, the market begins to shift to the next phase. During this phase, positive news starts to emerge. New technologies that are said to have the potential to change the world are born, the media begins to talk more about the potential of blockchain, adjustments to monetary policies are made…

All of the above factors combine to create optimism among investors. The number of new entrants to the market increases, the flow of money into the market is also strongly stimulated, the value of crypto assets continuously reaches new highs…

People begin to fall into a state of FOMO and gradually ignore fundamental analysis techniques. At this time, they continuously buy assets with a speculative mindset rather than an investment mindset. This creates an imbalance in the law of supply and demand, leading to asset prices being inflated beyond their actual value.

Learn more: Warren Buffett’s lessons for investors

Crisis Strikes

When the bubble becomes inflated, “Everyone dreams that we are all billionaires.” This is also the time when just a few triggers can cause the bubble to burst.

Factors that can occur during this period include negative economic or social news, or stricter regulatory measures. Or unforeseen incidents can happen, such as the collapse of Terra-Luna in 2022, attacks on exchanges, etc.

When investors notice that prices are starting to decline, they often start selling assets to protect themselves from losses. This behavior, occurring continuously and on a large scale, will lead to panic selling in the market.

Back to Reality

After a crisis occurs, the cryptocurrency market typically stabilizes at a low price, forming a bottom. This is a period where investor sentiment is generally very pessimistic, with many losing confidence and becoming cautious about investing in the market.

However, it is during this phase that opportunities begin to emerge for long-term investors. When the price has bottomed out and begins to show signs of stabilization, selling pressure gradually decreases, giving way to positive signals.

The emergence of good news, new technological breakthroughs, or simply the market having absorbed all the previous bad news can trigger a new buying wave, marking the beginning of a new cycle, or perhaps a return to the first stage of “bubble inception.”

In summary, the formation of asset bubbles, especially in the field of cryptocurrencies, is not entirely negative. Although the bubble bursting phase often causes severe consequences, such as loss of assets and decreased investor confidence, it also acts as a stabilizing mechanism in the market.

Crypto bubbles can accelerate the process of innovation and technological development, while helping to filter out potential projects. When the bubble bursts, weak projects will be eliminated, making way for quality projects, thereby contributing to a more mature and sustainable market.

Read more: What is the Tulip bubble? When a flower becomes “gold.”