In summary:

Dogecoin remains below $0.33, down 2% in 24 hours, while trading volume has decreased by 36%, indicating weak market momentum.

The Ichimoku Cloud and EMA structures confirm a bearish trend, with DOGE struggling to break through key resistance levels.

The BBTrend remains negative but is improving, suggesting fading bearish momentum, although DOGE still faces downside risks.

Trade on BYDFi for a chance to win an iPhone 16, a Rolex watch, and more!

Dogecoin’s (DOGE) price has been relatively stagnant over the past 24 hours, down roughly 3%. Trading volume has decreased by 36% to $1.65 billion despite Neptune Digital Assets purchasing $370,000 worth of DOGE. The price has been stuck below $0.33 for nearly a week, struggling to generate upward momentum.

Technical indicators continue to paint a bearish picture, with the Ichimoku Cloud and EMA lines reinforcing downside risks. Unless DOGE can break through key resistance levels, the trend remains weak, leaving the potential for further decline.

Ichimoku Cloud Shows Bearish Outlook

The Dogecoin Ichimoku Cloud chart reveals a bearish outlook, with the price trading below the cloud. The future cloud remains red, signaling continued downward pressure and suggesting resistance levels could remain strong in the short term. The Conversion Line (green) is currently moving sideways near the Base Line (red), suggesting a period of consolidation rather than an immediate trend reversal.

However, with the price failing to generate momentum above these lines, bearish sentiment prevails, despite Canadian crypto firm Neptune Digital Assets announcing a $370,000 DOGE purchase in December

Furthermore, the lagging span (green) remains below price action, confirming that the DOGE price is still in a downtrend. The cloud ahead is also sloping downwards, reinforcing the possibility that bearish momentum may continue.

If the Base Line flattens while the Conversion Line moves up, it could indicate a potential trend shift, but for now, DOGE remains in a weak position with no clear signs of recovery.

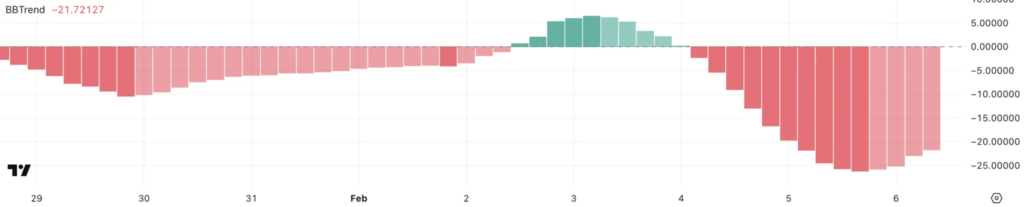

BBTrend Remains Negative, But Rising

The current BBTrend is -21.7, having remained negative for the past two days. It peaked at -26.1 yesterday before starting to lose strength, signaling that bearish momentum is still present but weakening slightly.

The BBTrend is an indicator that measures trend strength based on Bollinger Bands. Positive values indicate bullish momentum, and negative values suggest a bearish trend. The further away the value is from zero,

With DOGE’s current BBTrend at -21.7, down from -26.1 yesterday, this suggests that while the bearish trend persists, selling pressure is starting to ease. A continued upward move in the BBTrend could indicate that bearish momentum is fading, potentially leading to consolidation or a minor recovery.

However, as long as the BBTrend remains negative, the overall trend remains bearish, meaning DOGE’s price may struggle to generate significant upward momentum unless there is a more substantial shift in dynamics.

DOGE Price Prediction: Will it Break the $0.36 Resistance?

Dogecoin’s EMA lines paint a bearish picture, with shorter-term EMAs below the longer-term EMAs. This arrangement suggests the current downtrend remains strong, and if negative momentum continues, DOGE could test the $0.20 level. A breakdown below this support could send Dogecoin’s price tumbling further to $0.14, marking its lowest point since Dec. 10, 2024.

On the other hand, if the trend reverses, DOGE could attempt to reclaim the $0.30 level as resistance. A successful breakout above this level could lead to a retest of the $0.36 mark, a crucial level that DOGE failed to surpass in late January.

If bullish momentum strengthens, the DOGE price could climb as high as $0.40, representing a potential 54% increase. However, until the EMAs shift to a more bullish formation, the overall trend remains bearish.

Subscribe to BeInCrypto’s Newsletter to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk..

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger