In Summary

Ethereum recorded $20 million in spot market inflows after 10 days of outflows, signaling renewed investor confidence. ETH price rose 4% to $2,290, driven by bullish market pressure ahead of the White House Crypto Summit.

Increased ETH open interest and a positive MACD indicator suggest ongoing market participation and potential for price increases.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Ethereum has recorded spot market inflows for the first time in 10 days. This indicates a recovery in investor confidence ahead of the White House Crypto Summit scheduled for March 7th.

At the time of writing, ETH is trading at $2,290, marking a 4% price increase in the last 24 hours. With growing bullish pressure in the market ahead of the meeting, the altcoin could continue to rise in the short term.

ETH Records $20 Million Spot Inflows After 10-Day Outflow Streak

According to Coinglass, ETH spot market inflows totaled $20 million on Thursday. This comes after the leading altcoin saw 10 consecutive days of spot market outflows, exceeding $600 million.

When an asset that previously recorded significant outflows begins to record inflows, it indicates a shift in investor sentiment. It signifies that renewed buying interest is replacing the previous selling pressure. ETH’s spot market inflows suggest that demand for the asset is increasing, as buyers are willing to purchase it at current market prices, positioning it for further growth.

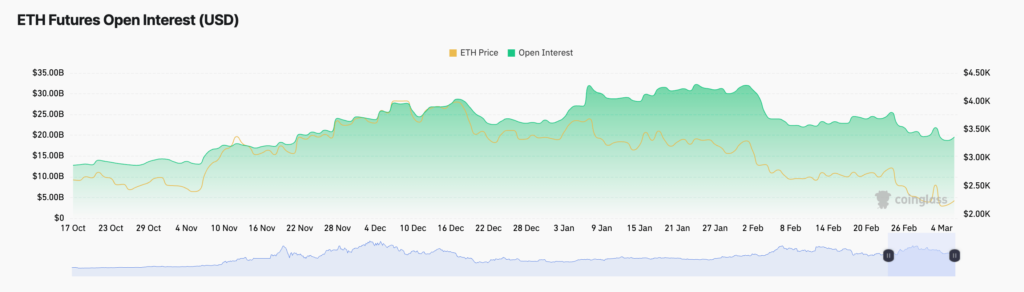

In addition, Ethereum’s open interest is also rising, suggesting an increase in trading activity. At the time of writing, this figure stands at $20 billion, up 4% in the last 24 hours.

An asset’s open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. ETH’s rising open interest reflects increased market participation and capital inflows into its futures market, reinforcing the current bullish trend.

Ethereum Aims for $2,361 as Indicators Confirm Increasing Buying Pressure

On the daily chart, indicators from ETH’s Moving Average Convergence Divergence (MACD) reflect the growing demand for the coin ahead of Friday’s Crypto Summit. At this point, the coin’s MACD line (blue) is preparing to cross above its signal line (orange).

When this momentum indicator is set up this way, it suggests a potential bullish crossover as upward momentum strengthens. This is considered a buy signal, increasing the likelihood of further price increases. If demand for ETH rises, its price could reach $2,361.

Conversely, if a correction occurs, ETH’s price could fall below $2,000 to trade at $1,990.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger