In Summary

Hedera (HBAR) rises 6%, but a negative BBTrend signals continued bearish momentum.

The Ichimoku Cloud suggests a potential bullish reversal if buying pressure strengthens. HBAR could test the $0.24 resistance level, with the potential to rise to $0.32.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

Hedera (HBAR) has fallen over 4% in the last 24 hours, with a current market capitalization of $8.4 billion. Despite a brief surge earlier today, HBAR’s BBTrend remains negative, indicating that bearish momentum persists.

However, the Ichimoku Cloud shows potential for a bullish reversal if buying interest strengthens. If the short-term EMAs cross above the long-term EMAs, HBAR could test the resistance level at $0.24 and potentially rise above $0.30 for the first time since February 1st.

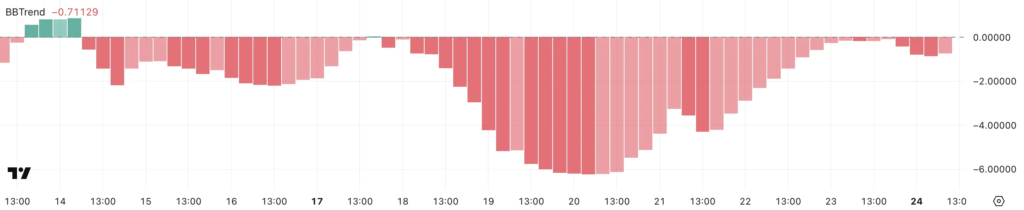

HBAR BBTrend Shows a Failed Bullish Trend Attempt

HBAR’s BBTrend is currently at -0.71 and has remained negative since February 18th, indicating that bearish momentum persists. This indicator peaked at a negative -6.21 on February 20th before gradually recovering to -0.06 yesterday, but has since declined again.

The BBTrend, or Bollinger Band Trend, measures the momentum and direction of the price relative to the Bollinger Bands. A negative value indicates that the price is trending towards the lower band, signaling bearish sentiment, while a positive value suggests bullish momentum towards the upper band

Hedera’s BBTrend at -0.71, down from -0.06 yesterday, indicates that bearish momentum is regaining strength after a brief recovery attempt. This reversal suggests renewed selling pressure, potentially leading to further price declines if the negative trend continues.

The failure to sustain a positive shift reveals weakness in buying interest, increasing the likelihood of continued price decreases for HBAR. If the BBTrend remains negative, HBAR could face additional selling pressure until a clear reversal emerges.

HBAR Ichimoku Cloud Shows Potential Bullish Trend Formation, But Not Yet Established

The Ichimoku Cloud chart shows that HBAR’s price recently crossed above the cloud, typically a bullish signal. However, the cloud ahead is thin and slightly negative, suggesting weak resistance.

The blue Tenkan-sen line is above the red Kijun-sen line, suggesting short-term bullish momentum. However, the proximity of these lines indicates a lack of strong trend confirmation.

The green Chikou Span is above the price, confirming the bullish sentiment, but its proximity to the candlesticks suggests hesitancy. A break above the cloud needs to be sustained to continue the uptrend. If the price falls below the cloud, it could invalidate the bullish breakout.

Overall, although the chart shows short-term bullish signals, the weak cloud and the narrow gap between the Tenkan-sen and Kijun-sen suggest caution, as the trend is not yet strongly confirmed.

Hedera (HBAR) Could Reclaim $0.30 If This Happens

HBAR’s EMAs show a prevailing bearish trend, with the short-term lines above the long-term lines, signaling continued selling pressure. This is incorrect. Short-term EMAs below long-term EMAs signal a bearish trend.

However, the Ichimoku Cloud suggests the possibility of a bullish reversal

If the short-term EMAs cross above the long-term EMAs, it could stimulate buying interest, leading to HBAR testing the resistance level at $0.24. Breaking through this level could push the price up to $0.29, and if momentum continues, HBAR could rise to $0.32, marking the first time surpassing $0.30 since February 1st.

Conversely, if the current downtrend continues, HBAR’s price could retest the support level at $0.19. A break below this level would indicate increased bearish momentum, potentially leading to a decline to $0.179.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger