In summary:

Solana reclaims the $200 mark but faces uncertainty as outflows reach an 18-month high, signaling weak retail investor confidence.

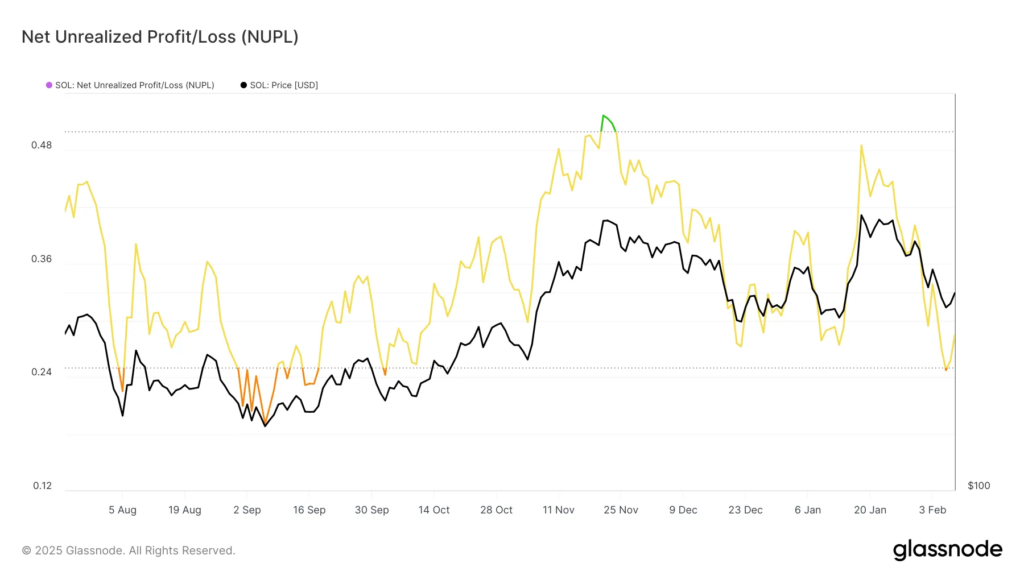

The Net Unrealized Profit/Loss (NUPL) indicator has entered the Fear zone, historically a sign of a potential price reversal and suggesting a possible recovery.

SOL needs to break through $221 to confirm a bullish trend; failure to hold $183 could invalidate the bullish outlook and lead to further losses.

Promo: Trade on BYDFi for a chance to win an iPhone 16, a Rolex watch, and more!

Solana (SOL) experienced a sharp decline, falling below the $200 mark earlier this week. This drop occurred amidst broader market volatility, leaving investors uncertain about the altcoin’s next move.

However, the recent decline could present a bullish opportunity, provided that investors shift their perspective and capitalize on the dip.

Solana Investors Uncertain

The Net Unrealized Profit/Loss (NUPL) indicator has fallen into the Fear zone, retreating from the Optimism zone. This shift indicates that investor sentiment has weakened, contributing to the increased selling pressure. Historically, similar dips into the Fear zone have often signaled a price reversal, suggesting a potential recovery.

If past trends continue, Solana could see a rebound in the coming days. Previous instances where the NUPL fell to this level have spurred renewed buying interest, supporting a price recovery. A shift in sentiment could provide the necessary momentum for SOL to reclaim lost ground and reestablish bullish momentum

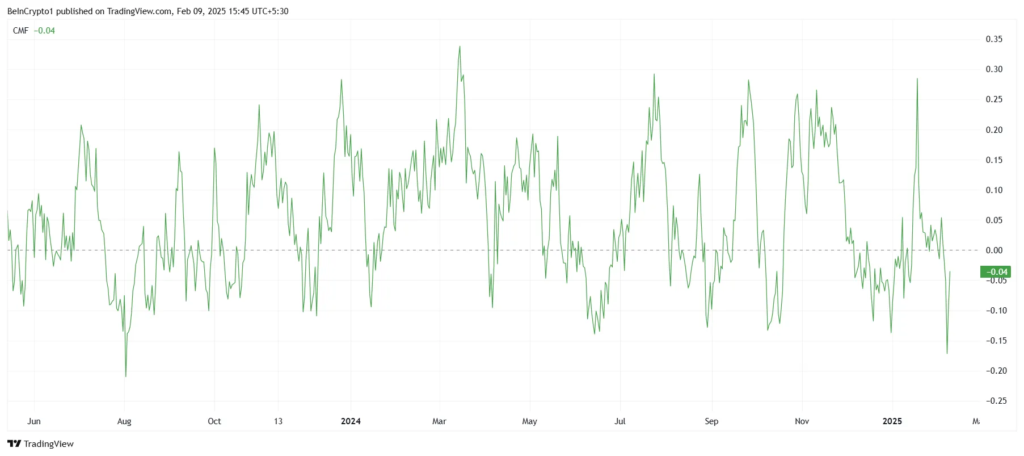

Solana’s Chaikin Money Flow (CMF) has plummeted to an 18-month low. This decline reflects a surge in outflows, marking the most significant capital flight from the asset since August 2023. The increased selling activity suggests lingering skepticism among investors, impacting SOL’s ability to sustain upward price movements.

Persistent outflows typically signal bearish momentum as traders move capital away from the asset. For a trend reversal to occur, Solana needs to attract renewed buying pressure. If investors regain confidence, the price could stabilize, paving the way for potential short-term gains.

SOL Price Prediction: Growth Ahead?

Solana’s price has increased by 6% in the past 48 hours. While this is a minor recovery, it is still insignificant compared to the 27% drop the altcoin has endured over the past three weeks. Further bullish momentum is needed for SOL to establish a sustainable uptrend.

Currently trading at $202, Solana has successfully reclaimed the $200 support level. This threshold is crucial in determining the asset’s short-term direction. If SOL can break through the $221 mark, it would confirm that a recovery has begun, increasing the potential for further gains

However, if investor skepticism persists, Solana could face renewed selling pressure. Falling below the $183 support would invalidate the bullish outlook, leading to prolonged losses. The coming days will be crucial in determining whether SOL can sustain the recovery or will succumb to further decline.

Subscribe to BeInCrypto’s Newsletter to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger