In summary:

Sonic’s price is up 1.8% in 24 hours, with trading volume surging 500% to $114 million, supported by a strong ADX trend at 35.6.

The golden cross formation on the EMA lines signals further growth potential, but the BBTrend at -6.8 reflects increasing bearish pressure.

Sonic faces resistance at $0.87, with the potential to rise to $1.06, while support at $0.74 is crucial to avoid a bearish reversal.

Trade with leverage, NO KYC required, and receive rewards up to $1030.

The price of Sonic (formerly FTM) has increased by 1.8% in the past 24 hours, with trading volume surging 500% to $114 million. Technical indicators like the ADX and EMA lines suggest a strengthening upward trend, with the potential to test key resistance levels if momentum is sustained.

However, bearish signals from the BBTrend indicator point to mixed conditions, suggesting traders should be wary of a potential reversal.

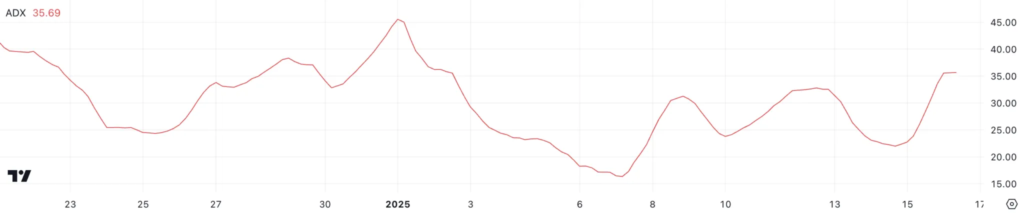

ADX Shows Strong Uptrend in Progress

The Average Directional Index (ADX) is currently at 35.6, a significant increase from 21.9 just two days ago. This surge indicates a strong and strengthening trend, as the ADX has surpassed the 25 threshold, which typically signals a strong trend. The recent formation of a golden cross adds further bullish confirmation, suggesting Sonic is positioned to extend its current uptrend.

The ADX measures the strength of a trend, with values below 20 suggesting weak or ranging conditions and values above 25 indicating a strong, pronounced trend. At 35.6, the ADX reflects solid momentum, supporting the continuation of the upward trajectory

This level of trend strength, combined with the golden cross, suggests that Sonic could see further price increases if buying pressure continues. However, any stalling in the ADX could indicate fading momentum, potentially leading to consolidation or a correction.

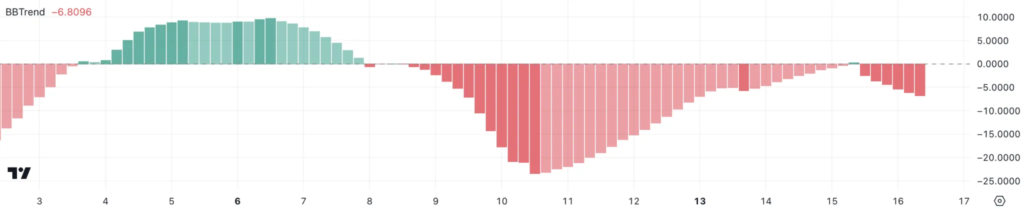

BBTrend is Declining

Sonic’s BBTrend indicator is currently at -6.8, a significant drop from -2.4 just a few hours ago. This sharp decline suggests increasing bearish pressure and a shift away from potential bullish conditions, pointing to weakening momentum in Sonic’s price action

The BBTrend is a technical indicator derived from Bollinger Bands, used to measure the strength and direction of a trend. Negative values indicate bearish conditions, while positive values reflect bullish momentum. Sonic’s BBTrend at -6.8 signals increasing bearish dominance, suggesting that Sonic may face downward pressure in the short term.

If the BBTrend remains negative or declines further, Sonic’s price could enter a steeper downtrend; however, a recovery toward positive values could signal a potential reversal.

S Price Prediction: Can it Reach $1 in January?

The EMA lines are showing signs that a new golden cross could soon form, potentially signaling a continuation of the upward trend. If this bullish crossover occurs, Sonic could test the resistance at $0.87, a crucial level for its price momentum.

Overcoming the $0.87 level could allow Sonic’s price to climb higher and test the $1.06 mark, representing a potential 34% increase from its current level.

On the other hand, mixed signals from the ADX and BBTrend suggest caution, as they could indicate weakening momentum or a potential reversal. If Sonic’s price fails to sustain its upward trajectory, it could test the support level at $0.74. A breakdown below this level would expose Sonic to further decline, potentially dropping to $0.61 and signaling a shift into a bearish phase.

Join the BeInCrypto community on Telegram to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger