In Summary

XRP jumped 7% in 24 hours, nearing a $150 billion market cap, as its inclusion in US crypto reserves sparks controversy. The number of active addresses reached a record 1.16 million, indicating strong network participation that could support further price growth.

A potential Golden Cross could propel XRP above $2.74, but resistance remains, with support levels at $2.50 and $2.33.

Promo:

Trade on BYDFi and get a chance to win prizes like an iPhone 16, a Rolex watch, and more!

XRP has jumped over 7% in the past 24 hours, bringing its market capitalization close to $150 billion. The crypto community is currently debating how its inclusion in the US strategic crypto reserve will affect its long-term price action.

Attention is also turning to the upcoming White House Crypto Summit on March 7th, which could play a crucial role in shaping market sentiment. Whether XRP continues its upward momentum or faces renewed resistance will depend on these developments and whether technical indicators confirm a sustained bullish trend.

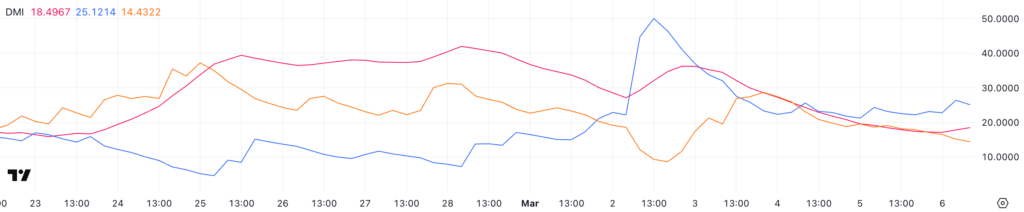

XRP DMI Shows Buyers Still in Control

XRP’s DMI shows its ADX currently at 18.49, down from 36.2 four days ago, suggesting the trend’s strength has weakened considerably.

The +DI (positive directional index) is 25.1, down from 50, while the -DI (negative directional index) has risen to 14.4 from 9.3.

This shift indicates that bullish momentum has faded while selling pressure has slightly increased, making it difficult for XRP to establish a strong uptrend.

The Average Directional Index (ADX) measures trend strength on a scale of 0 to 100, with readings above 25 signaling a strong trend and values below 20 suggesting weak or nonexistent trend momentum

XRP’s ADX at 18.49 indicates that the current attempt to form an uptrend lacks strength. The declining +DI suggests that buyers may be losing control, while the rising -DI shows sellers are gaining dominance.

If this trend continues, XRP could struggle to maintain upward momentum, but if the ADX rises again and the +DI recovers, bullish momentum could return.

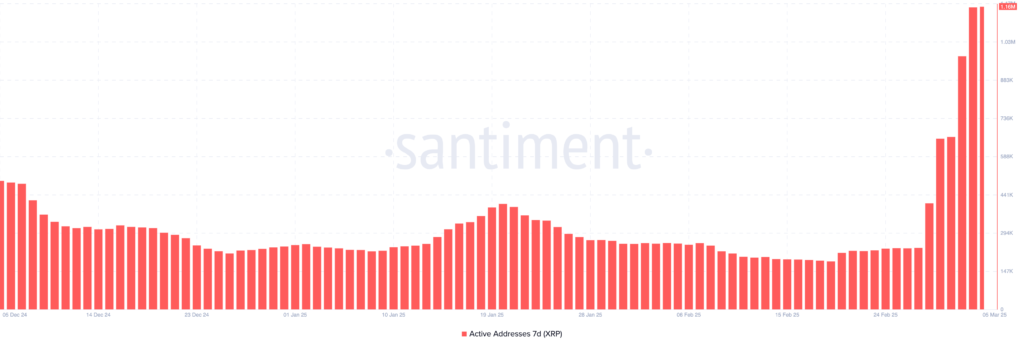

XRP’s Number of Active Addresses Just Hit an All-Time High

XRP’s 7-day active addresses have skyrocketed to 1.16 million, marking an all-time high.

This sharp increase comes after the metric was only at 236,000 on February 27th, indicating a significant surge in network activity over the past few days.

Tracking active addresses is important because it reflects user engagement, transaction activity, and overall demand for a cryptocurrency

An increase in the number of active addresses often signals growing adoption and interest, which can support price increases. While the crypto community is questioning whether XRP should be included in the US strategic crypto reserve, this surge in activity demonstrates strong network participation.

If this trend continues, it could help sustain bullish momentum for XRP, potentially driving the price higher.

Will a Golden Cross Trigger a Significant XRP Rally Soon?

XRP’s EMAs suggest that a Golden Cross may be forming soon, as the short-term moving averages continue to rise. If this bullish signal materializes, XRP’s price could test the resistance at $2.74, with a breakthrough potentially pushing the price to $2.99 and even $3.15.

However, this will depend on key developments, including the next steps related to the US strategic crypto reserve and potential announcements at the White House Crypto Summit on March 7th.

Tracy Jin, COO of MEXC, told BeInCrypto:

“The approach to establishing a strategic reserve is controversial and may require an executive order or Congressional authorization, which could undermine long-term policy stability. While Trump’s initiatives are expected to boost market confidence and attract institutional investment in the short term, there are still uncertainties about policy effectiveness, Congressional support, and international market reactions in the medium and long term. Investors should closely monitor these developments and adjust their strategies accordingly.”

On the other hand, if it fails to establish an uptrend and selling pressure increases, it could test support at $2.50, with a further decline potentially pushing it down to $2.33.

A stronger downtrend could push the price down to $2.06 or even below $2, testing the $1.95 level.

All information on our website is published in good faith and for general informational purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk, and they should re-evaluate it.

Read more: If you need a product to assist with tax issues and portfolio management in crypto, check out CoinLedger