Yield-bearing stablecoin not only brings stability but is also an effective profit tool in the crypto market. The combination of this feature and DeFi protocols is shaping a future of decentralized finance that optimizes capital efficiency.

What is Yield-Bearing Stablecoin?

A yield-bearing stablecoin is a type of stablecoin that has the ability to generate yield (interest) directly when users hold them.

While traditional stablecoins maintain price stability by pegging to fiat currency or other assets, yield-bearing stablecoins go a step further by integrating mechanisms to earn interest or rewards.

This is typically done through lending protocols, where the stablecoins are lent out to earn interest, or through staking, where they participate in the blockchain network to earn rewards.

The fundamental principle of yield-bearing stablecoins is to leverage their inherent stability to participate in financial activities that generate higher returns. This allows investors to enjoy both the stability of their investment and the opportunity to earn additional income.

This innovative approach is attractive in the cryptocurrency market, where traditional investments often face high volatility.

How are Stablecoins and Yield-Bearing Stablecoins Different?

- Traditional stablecoins: You buy stablecoins like USDT or USDC to preserve value. They are like depositing USD into a wallet, but they don’t generate any interest.

- Yield-bearing stablecoins: In addition to maintaining price stability, they automatically help you earn a return, similar to depositing money into a savings account and receiving interest.

How Yield-Bearing Stablecoins Work

Price Stabilization Mechanisms of Yield-Bearing Stablecoins

Yield-bearing stablecoins are designed to maintain price stability, typically pegged to a fiat currency like the US dollar. This stability is maintained through mechanisms similar to those used by traditional stablecoins, including:

- Asset collateralization: The stablecoin is backed by real-world assets.

- Algorithmic control: Algorithms are used to adjust supply and demand to maintain price stability.

Classifying Yield-Bearing Stablecoins Based on Price Stabilization Mechanisms

Yield-bearing stablecoins are a form of tokenized Real-World Assets (RWAs). They can be classified into two main groups based on their yield distribution mechanism:

- Rebase tokens

- Non-rebasing tokens

Rebase tokens: These tokens have balances that automatically adjust. In this case, rebasing distributes token rewards (accrued interest) in the form of additional tokens. At the same time, price stability (pegged 1:1 with USD or another asset) is maintained.

Examples of yield-bearing stablecoins backed by real-world assets (RWA-backed) include:

- USDY (Ondo)

- BUIDL (BlackRock)

- USDM (Mountain Protocol)

Additionally, eUSD (Lybra) is a special case that uses staked assets as collateral.

Non-rebasing tokens: These tokens do not automatically adjust balances in the wallet. Instead, yields are distributed through mechanisms such as staking, derivatives, or DeFi protocols. Users still receive returns, but the operation is simpler and does not change the number of tokens in their wallets.

Read more: What is Rebase Token? The type of token that regulates supply

Where Does the Yield Come From?

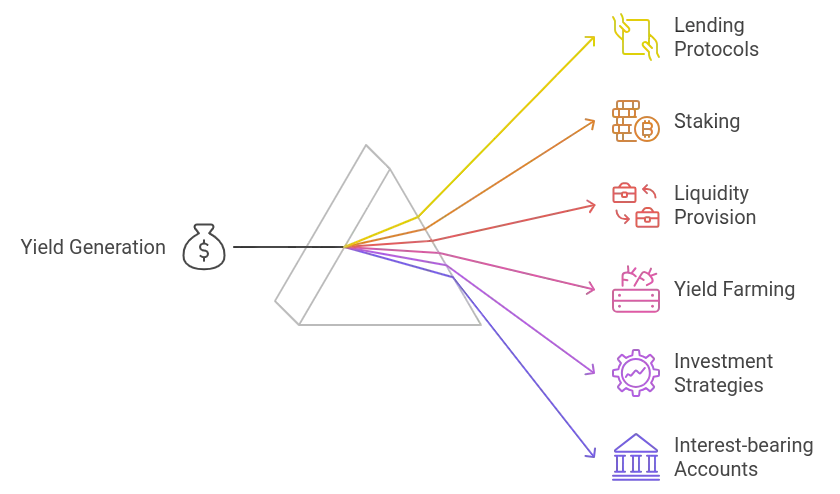

When you hold yield-bearing stablecoins, your assets are put to work in decentralized finance (DeFi) protocols to generate returns. Common yield generation mechanisms include:

- Liquidity Provision: Your assets are added to liquidity pools, where trades are executed, and you earn rewards in the form of trading fees.

- Lending and Borrowing: DeFi protocols like Aave, Compound, and MakerDAO allow users to lend and borrow stablecoins. Interest from these loans is distributed to lenders.

- Staking and Liquidity Mining: Some protocols reward users with interest for staking their stablecoins or providing liquidity to pools.

- Auto-compounding: Some yield-bearing stablecoins automatically reinvest profits into DeFi protocols to optimize interest rates.

Let’s say you use 100 USDC to purchase a yield-bearing stablecoin like aUSDC (from Aave). Here’s what happens:

- You hold 100 aUSDC in your wallet, and Aave receives 100 USDC.

- Aave uses this USDC to lend out to borrowers at an interest rate of 4% per year.

- After one year, your wallet will automatically have 104 aUSDC, reflecting the principal and earned interest.

- You don’t have to do anything besides hold the stablecoin in your wallet.

The profits or interest earned are usually distributed periodically to the holders. This process is often automated through smart contracts or mechanisms built into the stablecoin’s design.

However, the returns from yield-bearing stablecoins depend on DeFi protocols and can fluctuate based on market conditions. Therefore, users should understand the operating mechanisms and associated risks before investing.

Some popular Yield-Bearing Stablecoins

Real-World Asset-Backed Stablecoins (RWA-Backed Stablecoins)

These stablecoins generate yield from the underlying collateral, such as US Treasury bonds. Some popular examples include:

- BUIDL (BlackRock)

- USDY (mUSD)

- USDM (Mountain Protocol)

Interest is paid to users in the form of additional tokens, automatically transferred to their wallets. The distribution frequency varies depending on the stablecoin:

- USDY and USDM pay interest daily.

- BUIDL pays interest monthly.

For example, if a user holds 100 USDM with an interest rate of 5% APY, after one year, the balance in their wallet will increase to 105 USDM, thanks to the new tokens automatically distributed daily.

eUSD (Lybra)

The eUSD stablecoin is collateralized by liquid staking tokens (LSTs) like stETH or rETH. Users deposit ETH or LSTs into Lybra as collateral.

LSTs automatically generate yield through a rebasing mechanism, which is then converted to eUSD.

Users receive interest in the form of eUSD daily, calculated based on the APR of the LSTs, the eUSD supply rate, and the collateralization ratio.

Notably, users can borrow eUSD against their collateral without paying interest, then use the eUSD to buy more ETH or participate in other DeFi activities, further generating profits.

DAI (MakerDAO)

DAI is one of the oldest yield-bearing stablecoins, issued by MakerDAO and collateralized by assets like ETH, USDC, and US Treasury bonds. MakerDAO generates revenue from:

- Stability fees on DAI.

- Interest from lending based on crypto collateral.

DAI holders do not automatically earn interest. To receive interest, they must deposit DAI into the Maker Protocol system to convert it to sDAI. The value of sDAI gradually increases to reflect the accrued interest.

This differs from rebase tokens, where profits automatically accumulate without any further action from the user.

USDe (Ethena)

USDe is a new yield-bearing stablecoin from Ethena, using a combination of LSTs and a delta-hedging strategy to generate yield.

- Users deposit ETH, LSTs, or USDT as collateral to receive USDe.

- Similar to DAI/sDAI, users need to stake USDe to receive sUSDe, where the value of sUSDe gradually increases to reflect the accrued interest.

Yield generation mechanism:

- Profits are not paid directly but accumulate in the staking contract, only unlocked when users unstake USDe.

- This mechanism helps optimize returns for long-term holders.

With the continuous development of DeFi and crypto assets, yield-bearing stablecoins will continue to play an important role in improving capital efficiency and expanding the decentralized finance ecosystem