In 2024, projects began to mobilize capital from the community in a relatively new form, which is Node Sale. So what is Node Sale? What are the advantages and disadvantages of the Node Sale model?

What is Node Sale?

Node Sale is a fundraising method in which Web3 startups attract investment by selling the right to operate nodes to the community. The goal of a Node Sale is not only to raise capital but also to encourage users to participate in running the network from its early stages to earn rewards, while increasing decentralization and security.

Before the Node Sale model emerged, node operation was mainly carried out by the project team and its partners. Users were typically only allowed to participate in running nodes when the project had reached a certain stage in its development roadmap.

In 2024, numerous projects have raised capital through Node Sales, with the total amount reaching hundreds of millions of USD. Notable examples include Aethir, which successfully raised 130 million USD, and Sophon, which raised 60 million USD.

How does Node Sale work?

How Node Sales Work

Here’s a breakdown of how Node Sale fundraising operates:

Node Sale Launch:

- Projects can conduct Node Sales on their own platform or through intermediary platforms like Impossible Finance.

- When using an intermediary platform, the project must meet legal and technological standards set by that platform.

- For projects organizing their own Node Sales, there’s a risk of non-compliance with legal regulations.

Purchasing Node Operation Rights:

- Investors participate by purchasing the “right” to operate a node from the project. At this stage, in addition to preparing capital to purchase the node, investors also need to ensure adequate technical infrastructure, such as suitable hardware and configuration, to deploy the node according to the network’s requirements.

Deployment and Rewards:

- After the sale is completed, investors are allowed to deploy nodes on the project’s network.

- Rewards for operating a node may include revenue from transaction fees, commissions, etc. In some projects, investors may also have the opportunity to receive airdrops for running a node, like with Xai.

Similarities to Token Sales

In general, the Node Sale operating model is similar to Token Sale formats like ICOs and IDOs. These formats are typically characterized by simplicity and ease of participation, with investors simply contributing capital and receiving tokens or nodes from the project. In terms of legal considerations, Node Sales are also similar to Public Sales in that they must comply with legal regulations.

The difference between Node Sale and Token Sale

Token Valuation and Pricing

Node Sales and Token Sales share similarities in their buying and selling aspects, but there are several key differences between the two models. Firstly, the sale structure of a Node Sale is often divided into multiple tiers and rankings, allowing investors to purchase at various price points. For example, in the Sophon project, the price is divided into 14 categories, ranging from 0.0813 ETH to 0.3136 ETH.

Although Token Sales also have different price tiers, the number of tiers and the price difference between them are much lower compared to Node Sales, typically with only 2 to 4 tiers and a price difference of no more than 50%.

Having too many price points can also make it difficult for investors to determine the token valuation (FDV) of a Node Sale. Here’s how to determine the price in a Node Sale:

- First, users need to determine the number of tokens earned by a node. Typically, the number of tokens allocated to a node is based on the project’s tokenomics or token inflation rate. Additionally, nodes also earn transaction fees on the network.

- After determining the number of tokens per node, users multiply the token price (reference price) by the number of tokens per node and then multiply that by the total number of nodes sold. Finally, investors can determine the fully diluted valuation (FDV) of the token being sold.

*FDV is calculated using the formula: token price multiplied by the total token supply.

Read more: What is FDV? The role of fully diluted capitalization in crypto.

Reward Structure

One of the key differences between Node Sales and Token Sales lies in how rewards are designed. While Token Sales allow investors to contribute capital and receive a set amount of tokens within a specific timeframe, Node Sales enable investors to earn network fees and a portion of the total token supply allocated by the project.

The amount of rewards received depends on the total number of nodes operating on the network. These rewards are distributed gradually over time, similar to a linear vesting mechanism from an investment perspective.

Furthermore, some projects restrict early withdrawal of rewards, which may incur additional fees or result in a partial loss of rewards, to encourage participation and long-term commitment from investors.

For example, in the Aethir project, users receive vATH tokens for running a node. If investors wish to withdraw, these vATH tokens will be converted to ATH after 120 days from the request date. In the case of early withdrawal, investors will incur a 75% penalty and lose the right to receive additional rewards.

Project Types

As mentioned above, Node Sales are intended for users who invest in and run project nodes. Accordingly, to meet the need for running nodes, projects are typically in blockchain “niches” or infrastructure areas such as DePIN, Layer 1, Layer 2, etc.

Depending on the project, the type of node offered for sale will have different characteristics and roles, leading to differences in rewards and profits. For example, in Xai’s Node Sale, Sentry Nodes play the role of connecting with Validators from other networks. Therefore, the rewards for those operating Sentry Nodes come not only from the tokenomics mechanism but also include transaction fees and a small portion of the profits from the Validator’s staking activities.

Advantages and disadvantages of Node Sale

Advantages

Although Node Sales have only emerged recently, this fundraising model has demonstrated advantages that have led to its adoption by many projects. These advantages include:

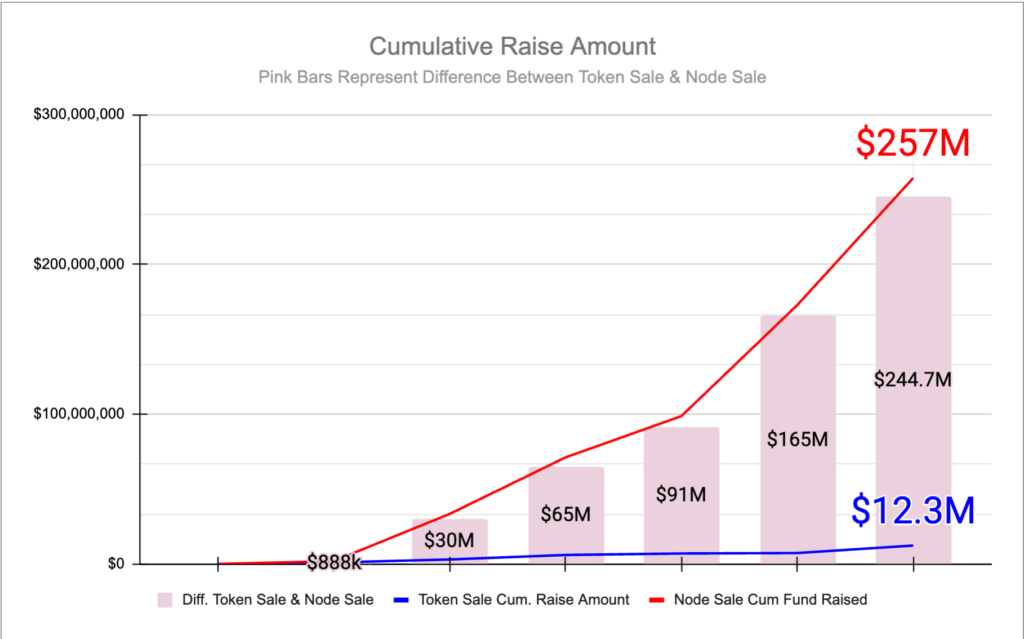

- Potential to raise more capital: Compared to Token Sales, Node Sales can raise more funds with the same number of tokens sold. According to 0xKapital, co-host of FlywheelDeFi, Node Sales can help projects raise 6 times more capital than usual. This is attributed to the structure of the price ranges between different tiers, which are relatively large, leading to Node Sales consistently raising more capital than traditional methods.

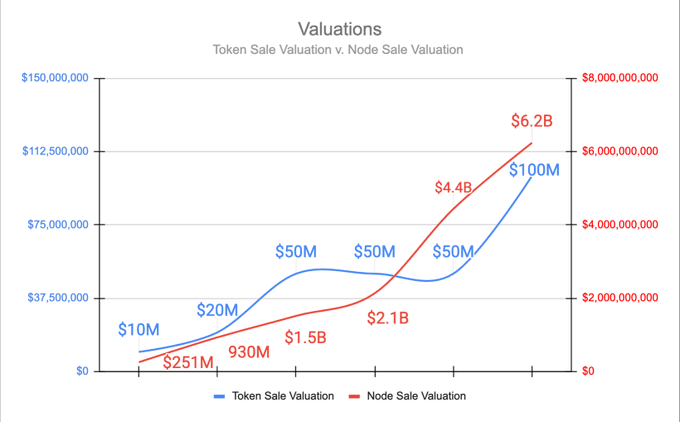

Higher Valuation (FDV)

With an operational structure where the price ranges between tiers are high, Node Sales result in a higher token valuation for the project than usual. Even when the number of tokens sold is equivalent to a Token Sale model, the valuation of a Node Sale can still be at least 16 times higher than a Token Sale

Long-term commitment to the project: As mentioned above, the Node Sale model requires investors to actively participate in network activities, even after the fundraising stage. This differs from Token Sale models where, after the fundraising phase, most investors simply wait to receive tokens without participating in or committing to any network activities.

Decentralization: Selling nodes to the community helps the network become more decentralized and secure, limiting the case where the network depends on a single entity, such as the project team or partners.

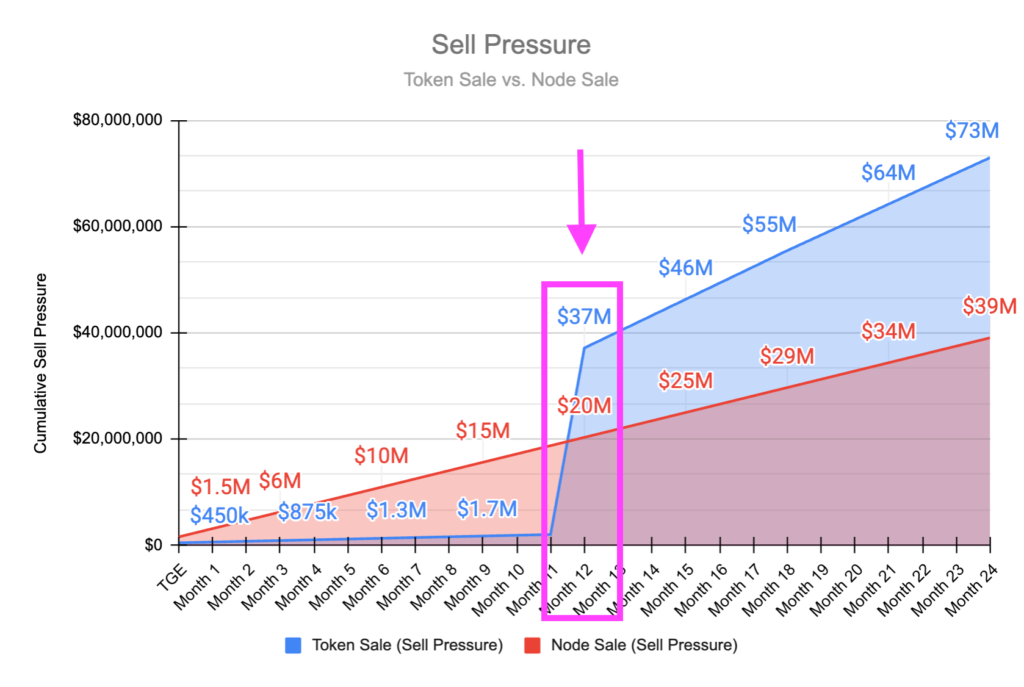

Lower selling pressure in later stages: Compared to the Token Sale model, Node Sale results in higher selling pressure in the initial stages. However, in later stages, Token Sale leads to higher selling pressure due to token unlocks from individuals participating in whitelist, private sales, etc., which often occur in the later stages of the project.

Disadvantages

Despite offering long-term benefits for the project team, the drawbacks of this model are not favorable for most investors. Specifically, the structure with large price gaps between tiers and a high number of participation tiers makes it difficult for investors who purchase nodes in later stages to recoup their investment. Even with a valuation up to 16 times higher than usual, it may take many years to break even at the later stages.

For example, individuals participating in the 8th tier of Sophon’s Node Sale (with an FDV equivalent to 600 million USD) would take up to 36 months to recoup their node purchase investment.

Additionally, investors participating in a Node Sale need to meet hardware and VPS requirements. Therefore, in addition to the cost of purchasing the “right to operate,” investors will incur additional fixed costs for operation.