In this article, we will further analyze the concept of crypto crash, the main causes leading to this event, its impact and review prominent crashes in history.

What is Crypto Crash?

A crypto crash is a phenomenon where the value of the entire cryptocurrency market or specific coins experiences a sharp decline within a short period, usually just a few hours to a few days. These crashes are often accompanied by a significant loss in market capitalization, creating panic and a sell-off among the investor community.

Crypto crashes don’t just happen to small coins; even major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are frequently affected.

For example, in November 2022, Bitcoin plummeted from $21,000 to $15,000 in just a few days due to the collapse of the FTX exchange. This is considered one of the most severe crashes in the recent crypto market

Causes, impacts and major Crypto Crashes in Crypto

Crypto crashes often occur due to a combination of factors. Here are some of the main causes:

Regulatory Crackdowns

Regulations are a double-edged sword for the crypto market. While reasonable regulations enhance transparency and protect investors, strict regulations or outright bans can shake market confidence.

In the crypto world, confidence is paramount, keeping the cryptocurrency market stable. However, when governments intervene by tightening regulations or banning trading, investors, especially newcomers, react by selling off assets to minimize risk. This not only reduces the value of major coins like Bitcoin and Ethereum, but also leads to a decline in overall market capitalization.

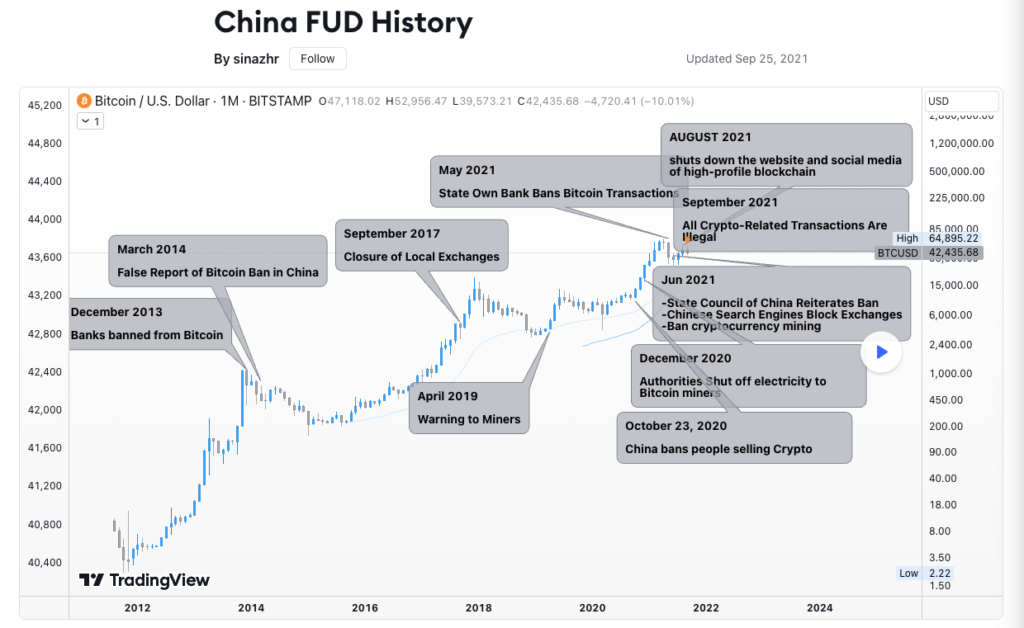

In May 2021, China – a country that accounts for a significant portion of global cryptocurrency mining and trading – announced a complete ban on crypto mining and trading. This action immediately sent shockwaves through the market:

- Following the announcement, Bitcoin’s price plummeted from $64,000 to $30,000 in just one month, losing over 50% of its value.

- According to data from CoinMarketCap, the global cryptocurrency market capitalization dropped by more than $400 billion within 24 hours of the announcement. This was one of the largest declines in crypto market history.

Investors worldwide feared that the ban from China would create a domino effect, leading other countries to tighten regulations. As a result, many rushed to sell off their assets, leading to even greater downward pressure on prices.

Milestones in Chinese Government Announcements on Bitcoin and Crypto Regulations

China is not the only country to have implemented strict regulations contributing to crypto crashes. Other countries have also played a role:

- India (2021): Rumors of a complete ban on cryptocurrency trading caused panic in the Indian market, diminishing the value of popular coins like Bitcoin and Ethereum.

- United States (2023): The SEC (Securities and Exchange Commission) increased its scrutiny of cryptocurrency exchanges and projects, dampening institutional investor participation.

Read more: The SEC is pushing the entire crypto industry in the US to a dead end.

The Collapse of Major Projects

In the crypto market, large projects often play a systemic role, not only in maintaining investor confidence but also in ensuring the stability of the entire market. When a major project fails, it not only harms those directly involved but also creates a domino effect, leading to the decline of many other assets.

In May 2022, Terra/LUNA—one of the major blockchain projects with its stablecoin UST—experienced a collapse when UST lost its peg to the US dollar. This stablecoin maintained its value through an algorithmic mechanism reliant on LUNA, but when UST started to devalue, this mechanism couldn’t control the sell-off.

The collapse of Terra/LUNA was not limited to the project itself but caused widespread effects across the entire crypto market:

- According to CoinMarketCap, the total cryptocurrency market capitalization fell by over 500 billion USD within days of the event.

- More than 60% of individual investors holding LUNA lost all of their asset value, according to Glassnode. This created a wave of sell-offs, decreasing the value of many other major coins like Bitcoin and Ethereum.

- The failure of UST reduced confidence in the entire stablecoin market, causing USDT (Tether) and USDC to also experience temporary downward pressure.

- The event raised doubts about the sustainability of algorithmic stablecoins, increasing regulatory pressure on the entire industry.

- Large funds like Three Arrows Capital (3AC), which had significant investments in Terra, faced insolvency and subsequently went bankrupt in June 2022.

- Projects and dApps dependent on the Terra/LUNA ecosystem went bankrupt or had to cease operations due to a lack of liquidity.

The collapse of Terra/LUNA in May 2022 was a costly lesson for the cryptocurrency market, demonstrating the extent of damage a major project can cause.

Read more: 5 “Unforgettable” Lessons from the UST & LUNA Crash.

Market Psychology and Panic Selling

In the crypto market, herd mentality is a powerful driving force. When asset prices decline, investors often worry about the possibility of further, deeper declines. This leads to mass sell-offs, creating even greater downward pressure on prices. This phenomenon occurs not only among small retail investors but also among large institutions, increasing the volume of sell orders in the market.

The Negative Feedback Loop:

Price Decrease → Investors Panic Sell → Increased Sell Volume → Further Price Decrease

Panic spreads, dragging the entire market down with it.

The bankruptcy of the FTX exchange was one of the most shocking events in crypto history, clearly demonstrating the impact of panic selling on the market. After FTX was unable to process user withdrawal requests and was accused of financial fraud, confidence in the exchange quickly collapsed. This triggered a wave of panic selling across the entire market.

Within three days of the FTX bankruptcy news, Bitcoin’s price dropped from $21,000 to $15,000, a decline of over 28% in a short period. The global market capitalization lost over $200 billion, dragging down the prices of most major coins like Ethereum (down 20%) and Binance Coin (down 15%).

According to a report from The Block, over 1 million wallet addresses executed Bitcoin sell-offs during this period, pushing trading volume to over $3 billion per day – an unusually high figure reflecting investor panic.

See more: The rise and fall of FTX – “The fortune” of 32 billion USD “turned into nothing”.

Leverage liquidation and selling pressure

Leverage allows investors to trade with significantly more capital than they actually have, aiming to increase profits. However, this also amplifies risk. When the value of an asset falls below the minimum margin requirement (margin call), exchanges will automatically liquidate the investor’s assets to cover the loss.

When many leveraged positions are liquidated simultaneously, the sell volume increases dramatically, further driving down the price. This triggers even more liquidations, creating a negative price spiral.

The FTX collapse mentioned earlier also illustrates the severe impact of leverage. Within 24 hours, over $5 billion in leveraged positions were liquidated across the market, according to a report from Coinglass.

- Bitcoin’s price plummeted from $21,000 to $15,000 in less than a week, a drop of over 30%.

- Altcoins suffered even heavier losses, with many falling by over 50%, like Solana (SOL), which dropped from $32 to under $14 in the same timeframe.

Speculative Bubbles and Market Corrections

Crypto crashes often occur after periods of bubble-like growth, when market values are pushed to unsustainable highs. These periods are usually driven by excessive expectations, FOMO (Fear of Missing Out), and large speculative inflows from both individual and institutional investors.

When the factors supporting the bubble disappear, the market undergoes a sharp correction, causing a decline in asset values and market capitalization.

One prominent example of a speculative bubble in the crypto market was the 2017-2018 period:

- In December 2017, Bitcoin peaked at nearly $20,000, a massive increase from around $1,000 at the beginning of the year. FOMO spread as millions of retail investors entered the market, pushing the global market capitalization to over $800 billion, according to CoinGecko.

- Within just two months, Bitcoin fell below $6,000 in February 2018, losing over 70% of its value. Ethereum dropped from $1,400 to under $100 in 2018. Total market capitalization fell by more than 50%, to $300 billion. Many altcoins also experienced significant drops, some losing over 90% of their value.

The 2018 bubble burst was also accompanied by announcements of tightening regulations from countries like South Korea and China, causing investor panic.

Technical Issues and Hacks

Technical glitches or hacks are always potential threats to the security of crypto assets. When major exchanges or blockchain projects are attacked, it not only causes loss of assets but also shakes investor confidence in the market’s security. This often leads to mass withdrawals and sell-offs, causing asset prices to plummet in a short period.

In 2014, Mt. Gox—the world’s largest Bitcoin exchange at the time, handling over 70% of global Bitcoin transactions—was hacked, losing 850,000 BTC (equivalent to over 450 million USD at the time).

- After the hack, Bitcoin’s price plummeted from $1,000 to $200, losing 80% of its value within a few months.

- This event diminished confidence in the security of exchanges and led many investors to exit the market, resulting in a “crypto winter” that lasted from 2014 to 2016

How to deal with Crypto Crash?

Even with lessons learned from the past and preventive strategies in place, completely mitigating the effects of a crypto crash remains a significant challenge. It not only depends on financial strategies but also requires a strong mindset. So, can you effectively deal with a crypto crash? The answer lies in mental preparation and appropriate strategies.

Mental Preparation: The Deciding Factor

- Understand that Crypto Crashes are Inevitable: Crypto crashes are not an unusual phenomenon but rather a part of market cycles. Accepting that these periods will occur helps you maintain a stable mindset. The crypto market is known for its high volatility, where asset values can increase or decrease by more than 50% in just a few days. Factors such as regulations, negative news, or the collapse of a major project can all send the market into a panic.

- Avoid Getting Caught Up in Herd Mentality: During crashes, FUD (Fear, Uncertainty, Doubt) often spreads quickly. Even experienced investors can easily get caught up in the sell-off vortex, losing their ability to make objective decisions.

Essential Actions for All Market Conditions

While the impact of a crypto crash cannot be completely avoided, investors can take steps to minimize losses:

Financial Preparation

- Smart Capital Management: Don’t invest all your assets in crypto; keep a portion in other investments like stocks or real estate.

- Reserve Cash or Stablecoins: This provides flexibility to buy when the market experiences a sharp decline.

Knowledge Enhancement

- Learn Technical Analysis: Study chart patterns, indicators, and other tools to understand market trends.

- Read On-Chain Data: Gain insights into network activity, transaction volume, and other metrics that can signal potential market shifts.

- Understand Your Investments: Thoroughly research the projects you invest in, including their technology, team, and roadmap.

- Stay Informed: Keep up-to-date with market news and trends to anticipate potential volatility.

Build a Support Network: Join trustworthy crypto communities on Telegram or Discord to stay informed and share experiences.

Accept Risk and Opportunity: Crypto crashes can be opportunities to accumulate assets at low prices. However, only invest when you understand and are willing to accept the risks.

Conclusion

No one can completely avoid the impact of a crypto crash, but investors can minimize losses and capitalize on opportunities through risk management and mental preparation.

The most important thing is to understand that the cryptocurrency market is highly volatile, and downturns are just a part of its development cycle. Always be mentally prepared, invest with a plan, and be patient to overcome the most challenging times.

Read more: Who are you in the Crypto market? Let’s start right!