Derivative tools are always used by many investors in the financial market, including in the crypto space. Below are the top derivative exchanges in the crypto market.

Criteria for Choosing a Crypto Derivatives Exchange

In the crypto market, there are many financial tools to help investors optimize profits, each with its own advantages and disadvantages. Among them, derivatives are the tools used by the vast majority of users, not only in the crypto market but also in the traditional market.

Obviously, the disadvantage of derivatives (Options, Margin, Futures) is that users can easily have their assets liquidated. In return, the advantage of this financial tool is that it helps users profit even when the market is in any phase, from uptrend to downtrend. For some professional investors, derivative tools are also used to apply tactics such as Delta Neutral, Carry Trade…

Accordingly, the criteria for choosing a derivatives exchange in crypto are based on the following factors:

- High liquidity to limit slippage.

- Reputable and safe.

- Supports a variety of assets.

- Low transaction fees. Currently, derivatives transactions always incur funding fees every 4-8 hours. Therefore, to optimize transaction fees, platform fees should be low.

- Incentives and airdrop opportunities: Some people participate in derivatives trading not only to Long/Short the market but also to receive additional rewards and optimize profits. Among them, airdrop hunting is also one of the main incentives of many derivatives exchanges.

Here are the top 6 derivatives exchanges in the crypto market:

- Binance Futures.

- Bybit Futures.

- Hyperliquid.

- Wasabi.

- Astherus.

- Reya Network.

Top 6 Crypto Derivatives Exchanges

Binance Futures

The largest derivatives product in the crypto market today is Binance Futures, from the Binance exchange. The platform offers a full range of derivatives services, including margin, options, and futures contracts for over 400 different token pairs. Moreover, Binance Futures allows investors to trade with leverage of up to 125x, with a variety of USD-M and COIN-M contracts. This gives investors flexibility in various strategies.

Launched in 2019, Binance Futures has consistently ranked among the largest derivatives products for many consecutive years. In September 2024 alone, Binance Futures maintained its leading position with a trading volume of $165 billion. And throughout 2024, the platform processed over $1 trillion in transactions, surpassing competitors like Huobi, OKX, BitMEX, and Bybit.

See more: Guide to Futures Trading on Binance.

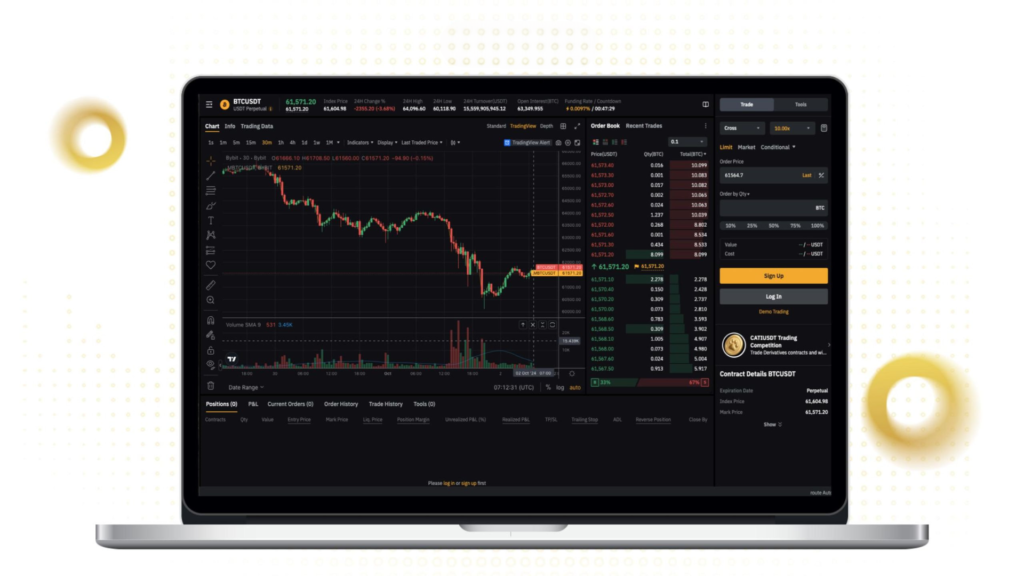

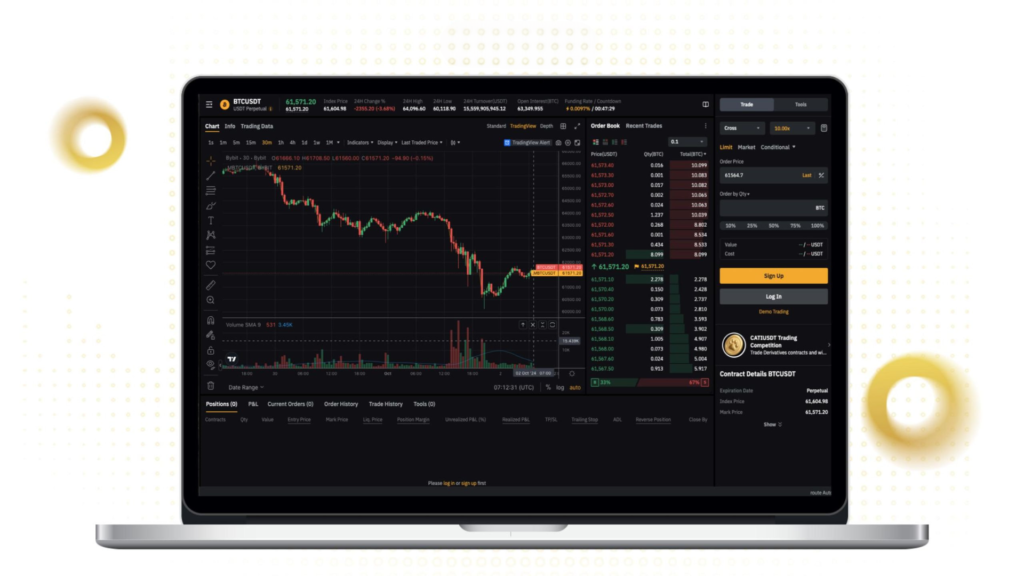

Bybit Futures

After the Binance CEX, Bybit is also among the largest centralized derivatives exchanges today. Founded in 2018 and headquartered in Singapore, with the goal of providing users with an easy-to-use trading platform, Bybit has quickly attracted a large number of users, reaching over 30 million registered accounts.

This exchange stands out with its derivatives products, including futures and perpetual contracts, allowing users to trade with high leverage, up to 100x for some assets.

Recently, Bybit has seen a significant increase in trading volume and market share. According to information from reliable sources, Bybit has surpassed Coinbase in trading volume, capturing 16% of the cryptocurrency market share, second only to Binance.

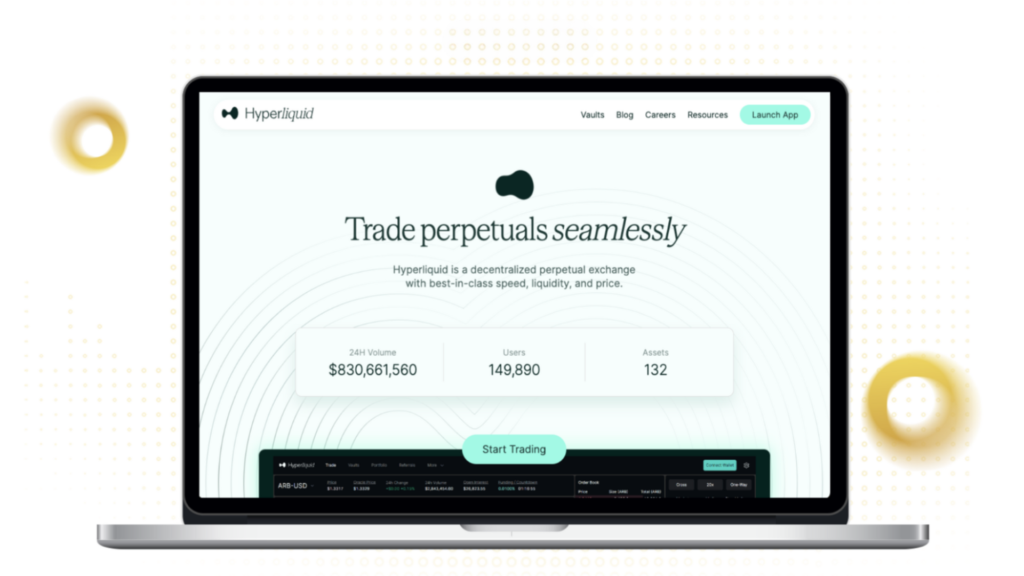

Hyperliquid

Hyperliquid is a decentralized derivatives exchange specializing in futures trading with fast order matching speeds and low transaction fees. What sets Hyperliquid apart from other derivatives products is that the project is built on the team’s own Layer-1 blockchain, with a processing speed of up to 100,000 TPS. By supporting over 100 different asset pairs, along with low transaction fees and high processing speed, Hyperliquid offers users a trading experience similar to centralized derivatives exchanges.

Currently, the platform allows users to trade with leverage of up to 50x. As of August 2024, Hyperliquid has reached a record trading volume of $4.3 billion per day. According to the project team, Hyperliquid does not profit from transaction fees but distributes all of them to the community through an insurance fund and liquidity providers (LPs).

In addition, Hyperliquid currently calculates airdrop points based on users’ trading volume. The more points, the greater the chance of receiving an airdrop.

Read more: Overview of Hyperliquid DEX.

Wasabi

The Wasabi derivatives protocol focuses on two networks: Blast and Ethereum. Unlike conventional exchanges, Wasabi also supports investors in Long/Short meme coins and NFTs, two high-risk but high-reward asset classes.

On June 17, 2024, Wasabi raised $3 million from many famous funds such as Alliance DAO, Spencer Ventures, and CoinGecko. Accordingly, the project quickly attracted much attention from the crypto community, making Wasabi the largest derivatives trading platform in the Blast ecosystem.

In addition, users can participate in trading on Wasabi to receive airdrops from the project and the Blast network with its season 2 airdrop. The more frequent and larger the trading volume, the more airdrop tokens received.

Astherus

At the MVB Season 7 event, Astherus was one of the four projects that received direct investment from Binance Labs. Astherus stands out as a project focused on supporting users in derivatives trading of liquid staking and restaking assets (LST and LRT) with leverage of up to 100x.

According to DefiLlama, LST and LRT have a market capitalization of over $45 billion, ranking among the top in the crypto market. Therefore, with profits from LST and LRT, investors can still utilize “leverage” and further enhance returns from these assets through Astherus.

As of September 2024, Astherus’ TVL has reached over $67 million across 3 networks: BNB Chain, Ethereum, and Solana. Additionally, Astherus currently has a mechanism for calculating airdrop points based on staked assets and trading volume on the platform.

Reya Network

Similar to Hyperliquid, the Reya derivatives exchange is developed on the project’s own layer-2 network. As a result, the platform inherits high transaction speeds and low network fees.

Reya Network aims to provide instant liquidity and better trading conditions for investors, thanks to its native payment system with the rUSD stablecoin. Reya is also attracting support from big names in the blockchain industry, including Coinbase Ventures and Framework, with a total of $10 million raised.

Currently, users can join Reya Network to increase their chances of receiving airdrops from the Reya derivatives exchange and the Reya Network itself.

Learn more: Top 6 reputable crypto exchanges for newbies.