Decentralized exchanges (DEXs) are an essential piece of the DeFi world. Currently, DEXs have been integrated and offer many additional features to help meet all users’ needs.

The rise of decentralized exchanges (DEXs) is rapidly reshaping the landscape of cryptocurrency trading. According to data from DefiLlama (here), in 2023 alone, DEX trading volume surged by over 150% compared to 2022, with a total trading volume exceeding $1.5 trillion.

Currently, over 50% of DEXs operate through smart contracts. Compared to centralized exchanges (CEXs), this eliminates reliance on third-party intermediaries, enhancing transparency and security for both projects and crypto investors. So, what are the top 5 most prominent DEXs today?

Criteria for Choosing the Right DEX

There are numerous DEXs on the market, categorized based on various criteria, such as:

- Order matching mechanism: AMM DEXs and Orderbook DEXs.

- Liquidity source: Liquidity Centers and DEX Aggregators.

- Trading type: Spot DEXs, Margin DEXs, and Derivatives DEXs.

In addition, some factors for evaluating a good, large, and reputable DEX include:

- Reputation: Reflected in the years of operation, provision of complete project information, clear and transparent operating model through documentation, communication channels (X, Medium, Discord, etc.).

- Safety & Security: Has the DEX ever been hacked? If so, what was the extent of the damage, and were users compensated?

- User Experience: Is the interface user-friendly, intuitive, and easy to use? Is the arrangement of features logical and reasonable? Is the processing speed smooth?

- Liquidity: Assessed through TVL (Total Value Locked) and trading volume. High liquidity helps reduce slippage during trading.

- Trading Fees: DEXs with high swap fees are suitable for those seeking profits through liquidity provision, as fees are redistributed to them as rewards. Additionally, gas fees on different blockchains are noteworthy, with Ethereum often having significantly higher gas fees compared to other blockchains like BNB Chain, Solana, Avalanche, Arbitrum, etc.

- Continuous Improvement: Continuous improvement demonstrates the project’s credibility and commitment to the market and community, while increasing competitiveness against other projects.

However, to choose a reputable DEX that suits your needs, you can answer the following questions:

- What type of asset do you want to trade, and on which blockchain? You can check Coingecko or CoinMarketCap for a list of DEXs in different ecosystems.

- What do you want to do on the DEX? Simply swap tokens or earn additional profits?

- If trading, do you want to trade spot, margin, or perpetuals? What type of DEX do you prefer? Order book or AMM, liquidity center or aggregator?

- If seeking profits, do you want to earn profits based on what type of asset (stablecoins or other coins), through liquidity provision, farming, staking, or liquid staking? What level of impermanent loss risk are you willing to tolerate (high or low)?

Top 5 Prominent DEXs in 2024

Based on the criteria and questions above, this article will present 5 prominent DEXs in 2024, categorized by sector and user needs, including:

- Uniswap: The most popular DEX on the Ethereum network, consistently ranking among the top in terms of trading volume and TVL. It was also the first DEX to implement the AMM mechanism and continues to improve its versions to provide the best user experience.

- Curve: A DEX optimized for the stablecoin market, offering various liquidity pools that allow users to earn profits through stablecoins with negligible impermanent loss.

- 1inch: A leading DEX Aggregator, providing the most optimal exchange rates and fees for token trading.

- PancakeSwap: A DEX for BEP-20 tokens on BNB Chain with a wide range of features. PancakeSwap was one of the first DEXs developed on BNB Chain and continues to hold the leading position in the ecosystem.

- dYdX: A DEX specializing in derivatives trading, primarily operating on Ethereum. At one point, dYdX’s 24-hour trading volume even surpassed that of Uniswap

Uniswap

Founded in November 2018 by Hayden Adams, Uniswap is an AMM DEX operating on the Ethereum blockchain and EVM-compatible blockchains. It hosts hundreds of ERC-20 token pairs, allowing users to provide liquidity and trade with rapid speed.

Uniswap pioneered the use of the AMM (Automated Market Maker) mechanism with the Constant Product Market Maker formula (x * y = k) to ensure optimal liquidity on the platform. Following Uniswap’s success, many DEXs on other chains have been forked from Uniswap (built upon Uniswap’s open-source code) to leverage the operating model and efficiency of this leading exchange.

It is also the largest DEX by trading volume and TVL in the DeFi market. According to data from DefiLlama on February 1st, 2024 (here), Uniswap currently has:

- Over $1.087 trillion in 24-hour trading volume.

- Over $4.064 trillion in Total Value Locked (TVL).

- Over $4.516 trillion in market capitalization.

To date, Uniswap has developed three versions with improvements in operating mechanisms, capital efficiency optimization, and user experience, including:

- Uniswap V1: The first version of Uniswap (2018), operating exclusively on the Ethereum blockchain, utilizing liquidity pools instead of order books like CEXs. However, it only allowed swaps between ETH and other ERC-20 tokens (ETH-ERC20 pools).

- Uniswap V2: The second improved version of Uniswap (2020), enabling swaps between ERC-20 tokens (ERC20-ERC20 pools). Trading fees within the liquidity pools are redistributed to LPs in the form of UNI tokens as rewards for liquidity provision.

- Uniswap V3: The latest improved version of Uniswap (2021), expanding to other EVM-compatible blockchains like BNB Chain, Arbitrum, Polygon, Avalanche, Optimism, Base, Celo, etc., and introducing the Concentrated Liquidity Mechanism (CLMM). This brings deep liquidity, reduced slippage, capital optimization, and diversified liquidity provision portfolios for LPs. Additionally, a portion of the trading fees is transferred to Uniswap’s treasury instead of being entirely distributed to LPs like in V2.

Learn more: Analysis of Uniswap V3’s Operating Model

Despite being one of the first AMMs and consistently maintaining its position as the number one DEX in the market, Uniswap continues to develop and improve the project to provide users with the best experience.

Advantages of Uniswap:

- Large, reputable, and long-standing decentralized trading platform in the market. Uniswap has never been hacked, with only a few instances of user losses due to phishing attacks ($8 million, details here) and sandwich attacks ($25 million, details here).

- Supports over 400 tokens.

- Integrates with over 300 dApps and web3 wallets.

- High daily trading volume and liquidity.

- Allows UNI token holders to participate in project governance through DAO.

- Enables users to provide liquidity and earn passive income effectively.

- Concentrated Liquidity Mechanism (CLMM) helps reduce slippage, provides deep liquidity, and optimizes capital efficiency for users.

- Multiple fee options for liquidity provision, including 0.05%, 0.3%, and 1%.

Disadvantages of Uniswap:

- Higher risk of impermanent loss when providing concentrated liquidity on Uniswap V3.

- High gas fees.

See more: Uniswap V3 User Guide

Curve Finance

Curve Finance is a DEX founded in 2017 by Michael Egorov, specifically designed for stablecoins (like DAI, USDC, USDT, TUSD, BUSD, FRAX…) or crypto assets pegged 1:1 with equivalent value (like sBTC, renBTC, wBTC, weETH, stETH…). Initially operating on Ethereum, Curve gradually expanded to other blockchains like Arbitrum, Avalanche, Polygon, Fantom, and more.

Stablecoins play a vital role in DeFi, helping to eliminate volatility and enabling the development of decentralized financial services such as lending and insurance. Therefore, focusing on stablecoins is not a limitation for Curve; on the contrary, it allows users to execute large transactions with negligible slippage and low gas fees.

Unlike Uniswap, Curve Finance offers users liquidity pools that can hold up to two, three, or even four tokens. This provides flexibility for users in liquidity provision and earning passive income while ensuring easy management, as the tokens in the pool are all stablecoins and stable assets.

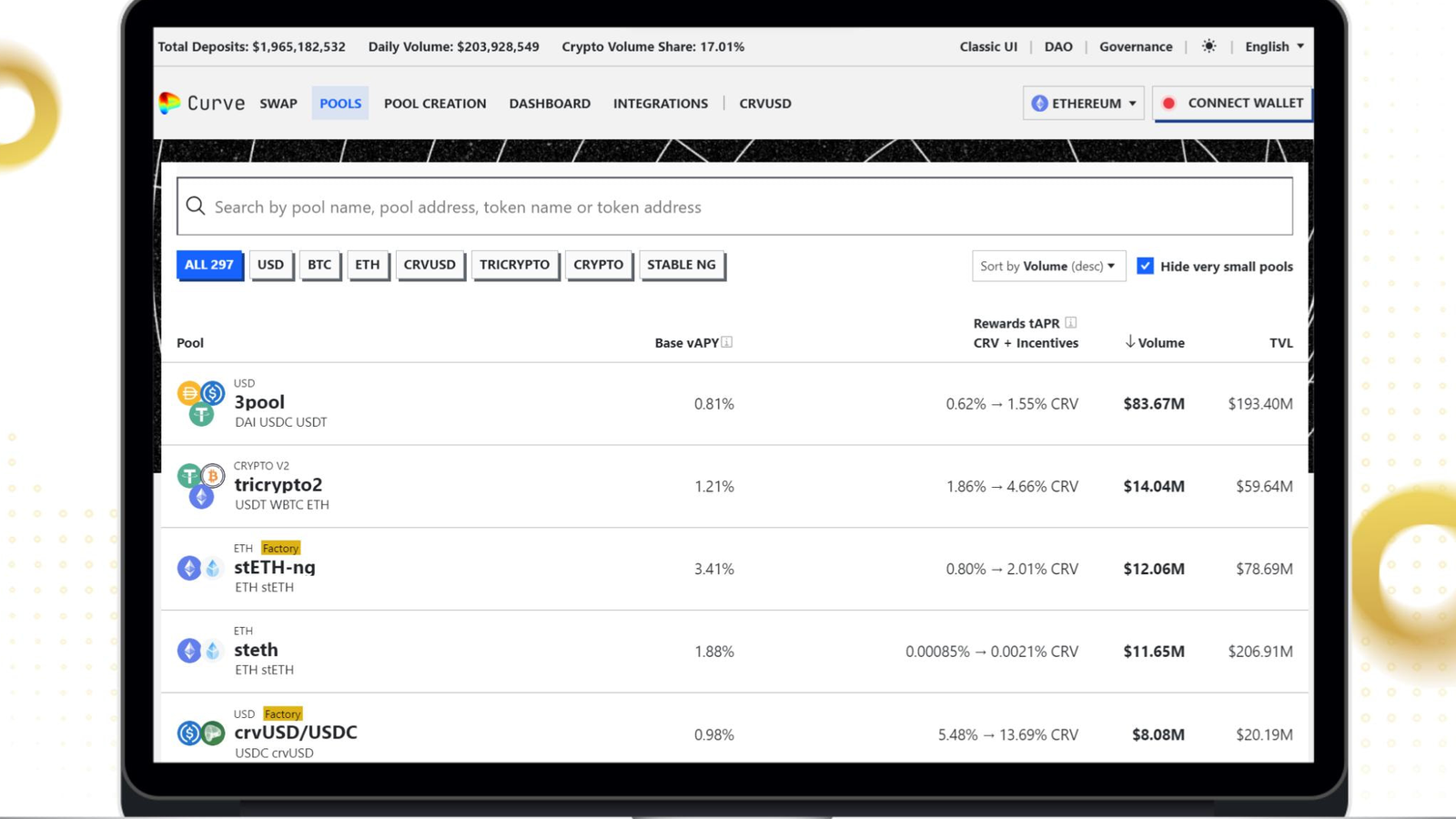

According to data from DefiLlama on February 1st, 2024 (here), Curve Finance currently has:

- Over $215.39 million in 24-hour trading volume.

- Over $2.332 trillion in Total Value Locked (TVL).

- Over $480.19 million in market capitalization.

Advantages of Curve Finance:

- Supports over 45 stable assets, including stablecoins, wrapped tokens, and more.

- Low trading fees, around 0.04%.

- Users holding CRV tokens (Curve Finance’s native token) can participate in CurveDAO and vote on project governance decisions.

- Offers a variety of pools with multiple choices in terms of the number and type of tokens for liquidity provision, thereby earning passive income without excessive worry about impermanent loss (as most pools consist of stablecoins with minimal price fluctuations).

- Smooth platform experience with minimal lag.

Disadvantages of Curve Finance:

- Gas fees for users trading tokens on the Ethereum blockchain are relatively high.

- Curve Finance’s interface is relatively complex and challenging to use for newcomers.

- The platform has experienced multiple exploits, resulting in significant losses for users, the largest being the Curve liquidity pool hack on July 30th, 2023, with total damages of $70 million.

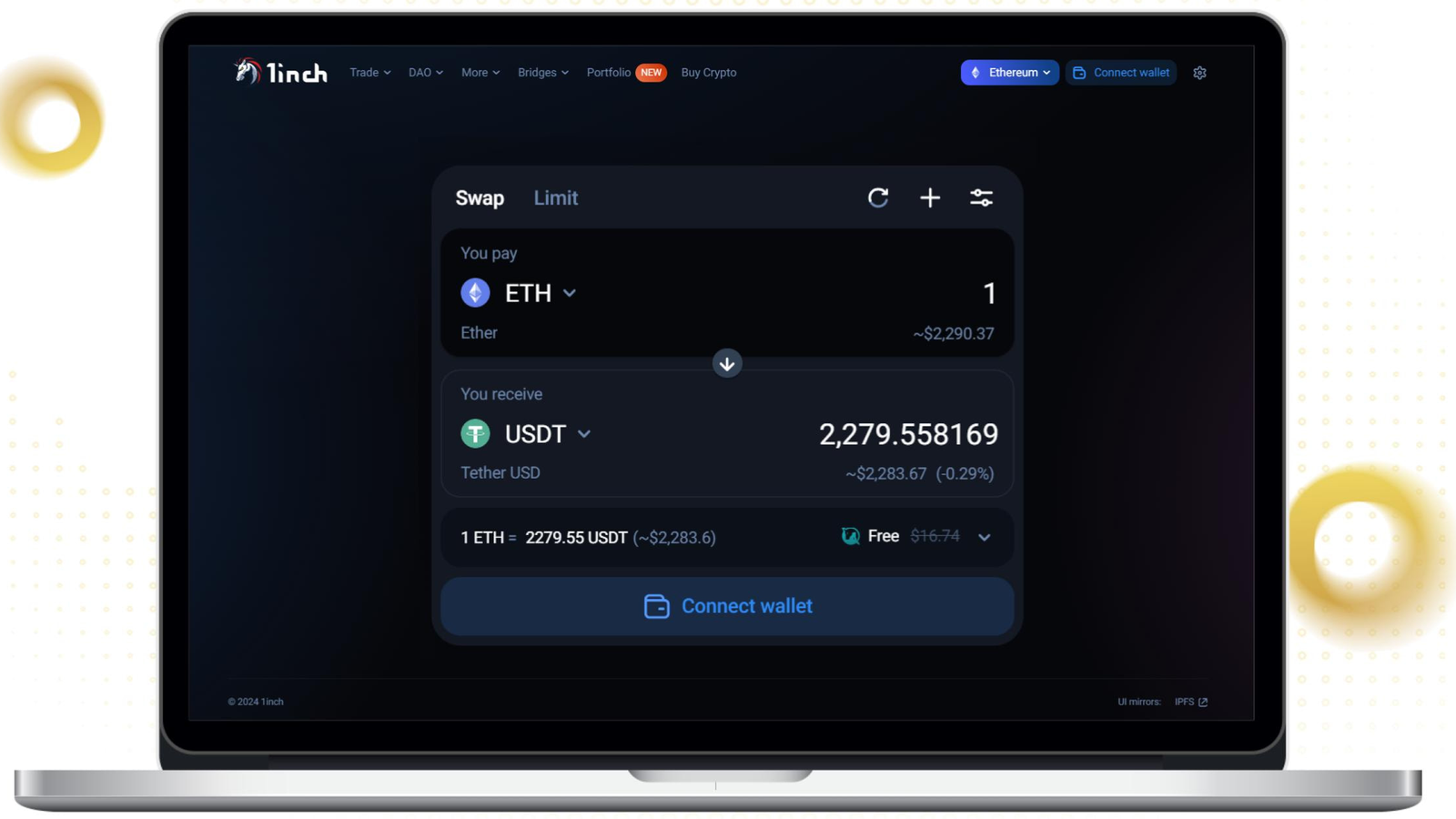

Linch

1inch is a leading DEX Aggregator that aggregates various DEXs in the market to find and provide the best exchange rates for users when swapping tokens, with the lowest transaction fees. 1inch supports over 492 liquidity sources from DeFi protocols across various blockchain networks, including Ethereum, Polygon, Arbitrum, Klaytn, zkSync, Base, Avalanche, Optimism, BNB Chain, and more.

According to data from DefiLlama on February 1st, 2024 (here), 1inch currently has:

- Over $4.61 million in Total Value Locked (TVL).

- Over $432.09 million in market capitalization

What makes 1inch attractive is that although it is not a DEX itself but just a DEX Aggregator, it offers a wide range of features and products to cater to users’ trading needs with deep liquidity and low, even gasless, fees. 1inch’s product suite includes:

- 1inch Aggregation Protocol: This protocol aggregates liquidity from multiple DEXs on over 11 different blockchain networks, allowing users to swap tokens with the best exchange rates and optimal swap fees.

- 1inch Fusion: An auction-based trading mode that allows order makers to avoid paying network gas fees (gasless). Instead, the fees are paid by order takers (also known as resolvers). Each order must be set within a specific price range (set by the maker) and is executed from high to low prices (Dutch auction, with the resolver choosing the price).

- 1inch Limit Order Protocol: This protocol allows users to place limit orders through the 1inch interface, customizing token type, buy/sell price, stop-loss, and order validity period. These limit orders can be executed by anyone, be it other users or the 1inch Aggregation Protocol. Furthermore, the 1inch Limit Order Protocol also charges no gas fees for order placement; fees are paid by the order executor.

- 1inch Liquidity Protocol: Liquidity pools that allow users to provide liquidity and earn profits in the form of 1INCH tokens. Through liquidity mining programs on the Liquidity Protocol, over 89.9 million 1INCH tokens have been distributed to LPs, with over 6.9 billion in total trading volume across the pools.

- 1inch Portfolio: This aggregates information about assets, balance fluctuations, and profit/loss percentages of a user’s wallet portfolio, with a simple, easy-to-understand, user-friendly, and intuitive interface.

- 1inch Wallet: A non-custodial wallet application that allows users to store tokens and connect with various dApps on different blockchains like Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Base, Avalanche, ZKSync Era, etc. 1inch Wallet also supports the Ledger Nano X hardware wallet, one of the most popular hardware wallets in the crypto market.

- 1inch RabbitHole: This feature is designed as a proxy specifically for MetaMask wallet users, helping to address the issue of sandwich attacks by sending users’ token swap transactions directly to validators, thereby avoiding putting the transaction in the mempool.

In addition, 1inch’s trading platform also integrates multiple bridges like BSC Bridge, Polygon Bridge, Optimism Bridge, etc., allowing users to conveniently and quickly transfer tokens between chains.

Advantages of 1inch:

- Supports over 400 tokens on 11 different blockchains.

- Some features allow for gasless trading.

- Has an efficient liquidity aggregation and scanning mechanism to provide the best exchange rates for users.

- Offers a variety of features, with the interface having both simple and advanced modes suitable for both newcomers and experienced market participants.

- Allows 1INCH token holders (1inch’s native token) to participate in project governance activities such as voting.

- High security; to date, the 1inch platform has never been hacked or attacked.

Disadvantages of 1inch:

- The platform’s user experience can sometimes be suboptimal, with slow loading speeds and lag when accessing features.

- Some features like 1inch Fusion and 1inch Limit Order Protocol are relatively complex to use and may not be suitable for beginners.

See more: 1inch User Guide.

PancakeSwap

Since its inception in September 2020, PancakeSwap has quickly become one of the most popular DEXs on the BNB Chain. Later, PancakeSwap also gradually expanded to support other major blockchains like Ethereum, Arbitrum, Base, and Linea.

PancakeSwap was originally forked from Uniswap V2 with the AMM mechanism and CPMM model, but instead of focusing on Ethereum, it shifted its focus to the BNB Chain ecosystem. PancakeSwap’s TVL almost always accounts for more than half of the total TVL across the entire BNB Chain. PancakeSwap has now been upgraded to its third version and allows for concentrated liquidity provision (similar to Uniswap V3).

According to data from DefiLlama on February 1st, 2024 (here), PancakeSwap currently has:

- Over $432.53 million in 24-hour trading volume.

- Over $1.943 trillion in Total Value Locked (TVL).

- Over $609.8 million in market capitalization.

When joining PancakeSwap, users will experience a smooth and fast trading platform with relatively low fees (a characteristic of the BNB Chain). Moreover, PancakeSwap can be considered an “all-in-one” platform as it provides a relatively complete range of essential DeFi features, from simple token swaps to perpetual trading and token bridging, from earning through liquidity provision and farming to liquid staking. Additionally, it offers a Gaming Marketplace, NFTs, and IFOs.

Besides the usual token and NFT trading features, some highlights of PancakeSwap’s features include:

- Add V3 Liquidity: Allows for concentrated liquidity provision (CLMM) similar to Uniswap V3, where users can customize the price range to provide liquidity with fee options including 0.01%, 0.05%, 0.25%, and 1%. With the same capital, compared to the traditional CPMM model, the CLMM model optimizes liquidity efficiency and increases user profits, while also increasing the risk of impermanent loss.

- Perpetual: Allows for perpetual contract trading with leverage of up to 250x. Users can open long/short positions at market or limit prices, customize take profit and stop-loss levels. However, the fees are relatively high, including two types: opening fees (0.08%) and execution fees (flexible).

- Bridge: Enables token transfers between different chains. In addition to PancakeSwap’s CAKE token bridge developed by LayerZero, the platform also integrates Axelar and Stargate bridges for transfers between EVM chains, along with Aptos Bridge, Celer cBridge, and Wormhole for token transfers on the Aptos blockchain.

- Buy Crypto: Allows users to purchase crypto (ETH, USDC, USDT, DAI, WBTC) using fiat currency (USD, EUR, GBP, HKD, etc.).

- Farm & Syrup Pools: Allows for liquidity provision to token pairs or individual tokens, with relatively high APY, potentially reaching over 2,000%.

- Position Manager: Enables users to stake tokens in optional pools, each managed by different protocols with different investment strategies to optimize capital efficiency and increase user profits.

- Liquid Staking: Allows users to stake tokens to receive liquid staking tokens (LSTs). Users earn an APR of around 0.5%, accumulated in the LST’s value, while also using LSTs to participate in DeFi activities such as swaps, lending, and yield farming for greater capital efficiency. PancakeSwap currently supports staking BNB to receive SnBNB and staking ETH to receive wBETH.

- Gaming Marketplace: A hub for play-to-earn games with various genres like combat and city building, allowing users to earn profits in the form of NFTs or CAKE tokens. Popular games on the platform include Pancake Protector and Pancake Mayor.

- IFO (Initial Farm Offering): Allows projects to raise capital through the PancakeSwap platform. To participate in IFOs and purchase tokens, users need to use LP tokens from providing liquidity to the CAKE-BNB pool. This way, PancakeSwap can drive up the price of CAKE while increasing liquidity for the CAKE-BNB pool.

Advantages of PancakeSwap:

- Supports over 50 DeFi tokens.

- Focuses on tokens within the BNB Chain ecosystem.

- Low transaction fees.

- High liquidity and low slippage during transactions.

- Wide range of features and products, catering to various user needs in DeFi.

- Intuitive and user-friendly interface with a smooth experience.

- As of February 1st, 2024, PancakeSwap has never been attacked or hacked.

Disadvantages of PancakeSwap:

- The concentrated liquidity mechanism offers higher returns but comes with a higher risk of impermanent loss.

- By offering too many features, PancakeSwap can be complex and confusing for newcomers to the crypto market.

See more: PancakeSwap User Guide.

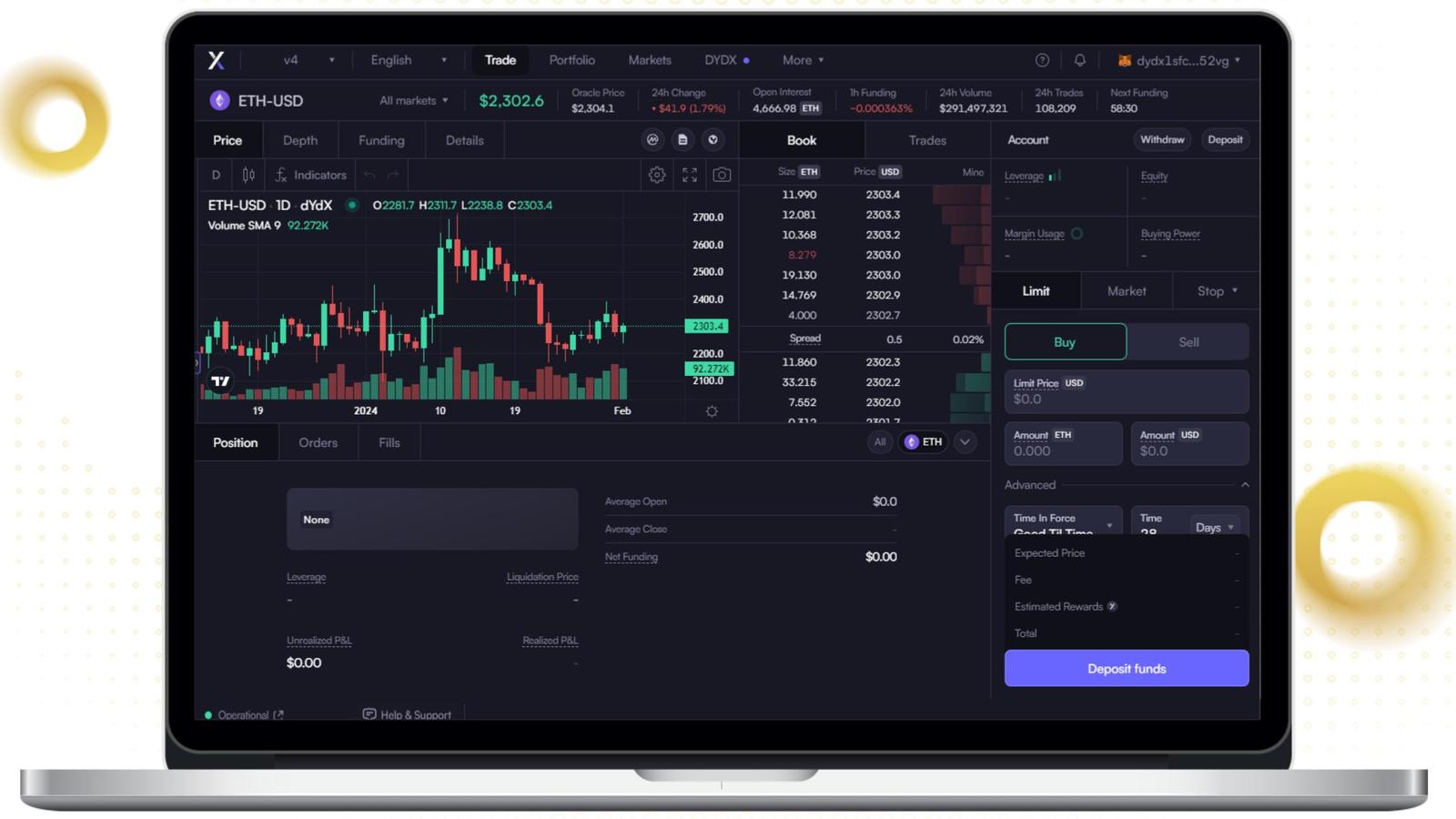

dYdX

Founded in 2017, dYdX is a leading DEX specifically designed for derivatives trading. Unlike the DEXs mentioned above, dYdX uses an order book matching mechanism, providing users with a more familiar and user-friendly trading experience.

To date, dYdX has undergone four iterations of its product:

- In its early years with V1 and V2, dYdX operated as a DEX on the Ethereum blockchain, allowing for decentralized spot, margin, and futures trading, eliminating third-party intermediaries like CEXs.

- In August 2021, dYdX developed V3 and transitioned to operating on StarkWare (a Layer 2 blockchain built on Ethereum) to increase scalability and improve transaction speeds, while also supporting cross-margin, allowing a single margin account to collateralize multiple positions (instead of isolated margin as before). According to dYdX’s founder, immediately after launching on L2, the platform’s trading volume increased fivefold to around $30 million per day.

- In November 2023, the project team launched dYdX Chain (an app-chain built within the Cosmos ecosystem) and the DYDX token. At the same time, the dYdX exchange was upgraded to V4 and operates on dYdX Chain. Two months later, trading volume on dYdX Chain increased to $500 million – $1 billion per day.

According to data from DefiLlama on February 1st, 2024 (here), dYdX currently has:

- Over $287.15 million in Total Value Locked (TVL).

- Over $1.003 billion in market capitalization.

However, it is undeniable that building on Ethereum brought a large user base to this decentralized derivatives exchange. To date, despite the launch of V4 on dYdX Chain, most of dYdX’s trading volume and value still resides in V3 on the Ethereum ecosystem.

dYdX allows users to execute peer-to-peer derivatives trades such as margin and perpetual contracts with over 36 assets, along with customizable leverage of up to 25x and limit, market, stop-loss, and take-profit orders.

Advantages of dYdX:

- Familiar, intuitive, and easy-to-understand order book interface.

- A pioneer in the Derivative DEX space, giving it a first-mover advantage.

- Continuous product improvement, demonstrating the project’s commitment and credibility to the community and crypto market.

- Has a mobile trading application, currently supporting iOS only, with Android support coming soon.

- Users holding DYDX tokens can participate in project governance.

- dYdX operates on a decentralized network like dYdX Chain, eliminating risks encountered on centralized platforms (CEXs) such as trade manipulation and front-running.

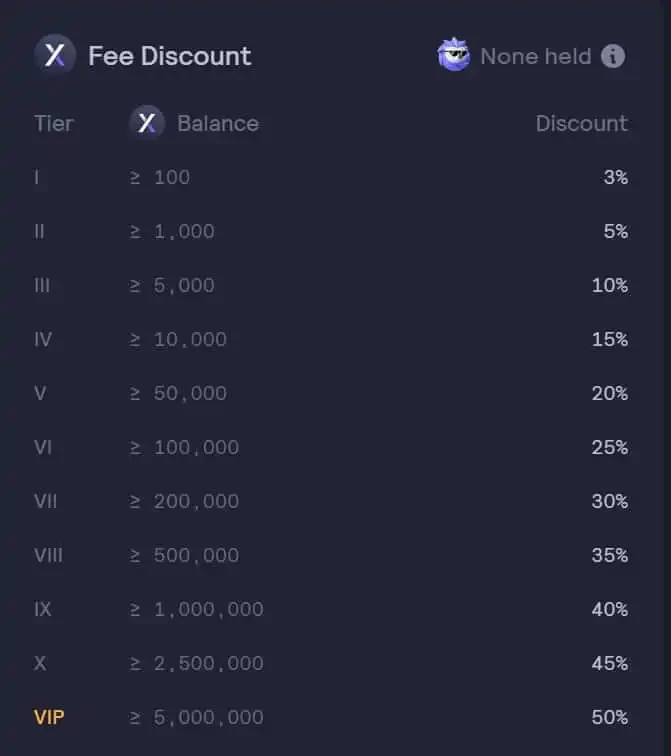

- dYdX Chain is built on the Cosmos SDK, allowing users to trade on dYdX without paying gas fees. Instead, they only incur fees based on trading volume (similar to CEXs). The exchange also has a fee discount policy based on the amount of DYDX tokens held by users; for example, holding 100-999 DYDX grants a 3% fee reduction

Disadvantages of dYdX:

- Due to the complexity of derivatives trading, dYdX may not be suitable for newcomers to the market.

- No support for spot trading. As of V4, dYdX has removed the spot trading feature, which has received negative feedback from existing traders on the platform.

See more: dYdX User Guide.