Looking back at recent token launches, it’s evident that the appeal of EigenLayer in particular, and the restaking trend in general, is waning.

Puffer Finance Token Launch Disappoints

After 8 months of allowing users to deposit ETH into the project to earn Puffer points, the project announced its tokenomics:

- Total Supply: 1 billion PUFFER

- Airdrop Season 1: 7.5% (75 million PUFFER)

- Airdrop Season 2: 5.5% (55 million PUFFER)

- Early Contributors and Advisors: 20% (200 million PUFFER)

- Ecosystem and Community: 40% (400 million PUFFER)

- Protocol Guild: 1% (10 million PUFFER)

- Investors: 26% (260 million PUFFER)

The initial circulating supply at TGE is 102.3 million PUFFER, accounting for 10.23% of the total supply.

Some information regarding the PUFFER airdrop event:

- The airdrop does not follow a linear distribution system, but instead utilizes a tiered system.

- Smaller accounts will receive additional tokens as an incentive.

- There is a minimum allocation for all users.

Despite efforts to design the airdrop in the most reasonable way possible, Puffer still left early supporters of the project disappointed. Many users with hundreds of thousands of points only received the minimum amount of 70 PUFFER (approximately $20). After deducting transaction fees, users only received a mere ~$8.

Read more: Puffer Finance – Details of the native LRP protocol and PUFFER token

The issue not only affected small investors, but also Justin Sun, who despite staking 59k ETH (~$151 million) only received 3.9M PUFFER (~$1.32 million). The effective return for Justin’s 8-month holding period is approximately 1%, not to mention the decline in ETH price since the start.

Waning Appeal of EigenLayer Ecosystem and Restaking

Puffer Finance was one of the last remaining hopeful projects within the EigenLayer ecosystem of liquid restaking protocols, due to its early appearance and backing from Binance Labs.

However, looking at what has transpired with the tokens of projects in this ecosystem, it’s clear that this is no longer fertile ground, especially for retail investors.

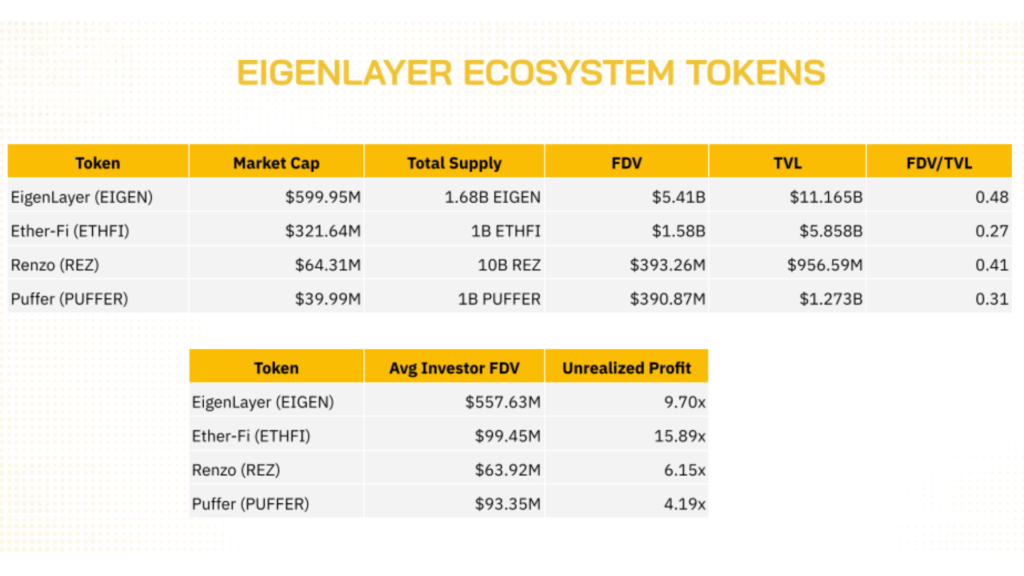

Most tokens from these liquid restaking projects only unlock a small amount at the initial stage, leading to a market capitalization that is relatively smaller compared to the Fully Diluted Valuation (FDV). Users have become wary of this trend of high FDV and low float.

Excluding the repetition of ETH across liquid restaking platforms, subsequent projects launching tokens have exhibited higher FDV/TVL ratios compared to the first project, Etherfi.

The FDV/TVL ratio represents the relationship between a project’s valuation and the value of assets it holds. A lower ratio suggests the project is undervalued relative to its intrinsic worth.

Most liquid restaking projects within the EigenLayer ecosystem have attracted participation from venture capital funds. Based on the amount invested by VCs and the percentage of tokens they receive in return, it’s possible to calculate the average FDV at which these investors purchased their tokens (Avg Investor FDV).

By comparing the Avg Investor FDV to the current FDV, we can determine the unrealized returns for venture capital funds in the restaking sector on EigenLayer. It’s readily apparent that Puffer and Etherfi have the same purchase price for VCs, but the returns generated are vastly different.

Later projects show progressively lower returns, even for venture capital funds. EigenLayer, despite being the core project, has only generated lower returns than the first project to launch a token, Etherfi, up to the present time.

This clearly indicates that the appeal of restaking is steadily declining, even though the quality of the projects is not significantly different.

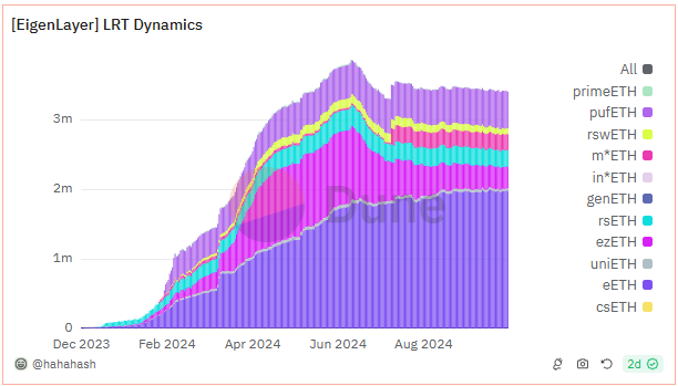

This situation is also reflected in the number of Liquid Restaking Tokens (LRTs) on EigenLayer. The amount of ETH and TVL on EigenLayer has been decreasing from its peak at the end of June. Most LRTs have lost market share, with the exception of Etherfi’s eETH.

Why Tokens in the EigenLayer Ecosystem Are Receiving Less Attention

The declining appeal of tokens within the EigenLayer ecosystem is partly due to the poor performance of EIGEN itself after its Token Generation Event (TGE). This stems from two main reasons:

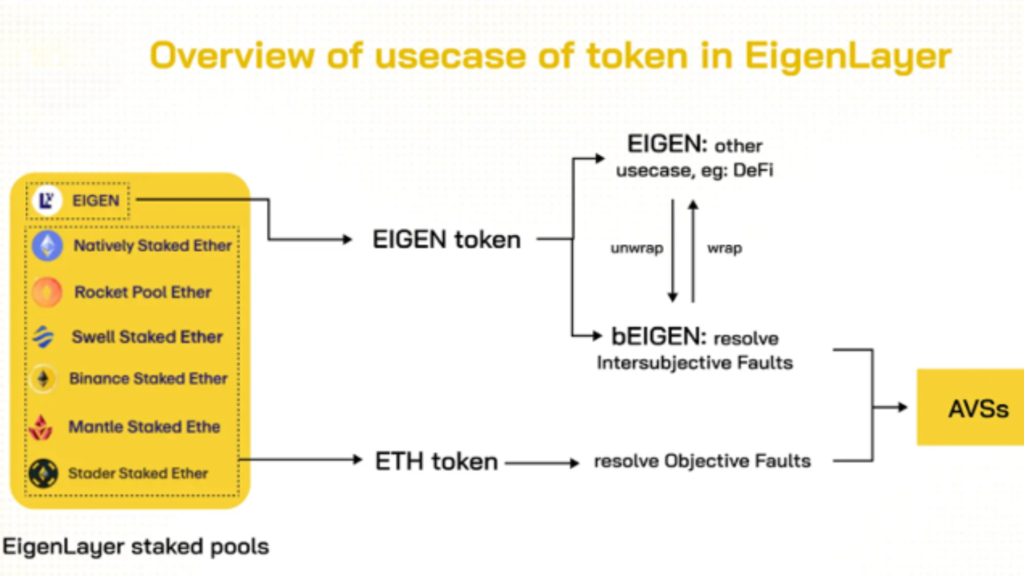

1/ Complex Token Utility

EigenLayer introduces EIGEN as a “Universal Intersubjective Work Token,” a very new and complex concept that is not easily understood or accessible to those unfamiliar with EigenLayer.

The primary function of the EIGEN token, in its simplest terms, is to mediate and resolve issues arising within Actively Validated Services (AVS).

These issues are often Intersubjective Faults – problems related to the technical and operational aspects of the network. This also means that retail investors rarely have a need for the EIGEN token.

*Intersubjective Faults: These include observable errors that cannot be attributed through smart contracts because they occur outside the VM environment. Examples include oracle price discrepancies and data integrity issues at the Data Availability (DA) layer.

For the EIGEN token to see wider use, the key lies in the development of the AVS ecosystem. Revenue generated by AVS is directly allocated to EIGEN stakers, tying it to the token’s value. However, the current appeal of projects on AVS is not particularly strong, requiring a significant boost similar to what was seen with TIA (Tokenized Infrastructure Assets).

The utility of other tokens within the LRT group is also quite limited, mainly confined to governance rights.

2/Selling Pressure from Airdrops

Like many airdropped tokens, EIGEN faces significant selling pressure upon listing due to retail investors lacking specific use cases. The initial market supply of EIGEN is 185 million, of which 46% comes from airdrops.

EIGEN tokens are also concentrated among institutional investors and crypto whales (Blockchain Capital and Galaxy Digital). Among individuals, Justin Sun and GCR hold $8.75 million and $1.06 million worth of EIGEN airdrop, respectively.

What Awaits the Restaking Sector?

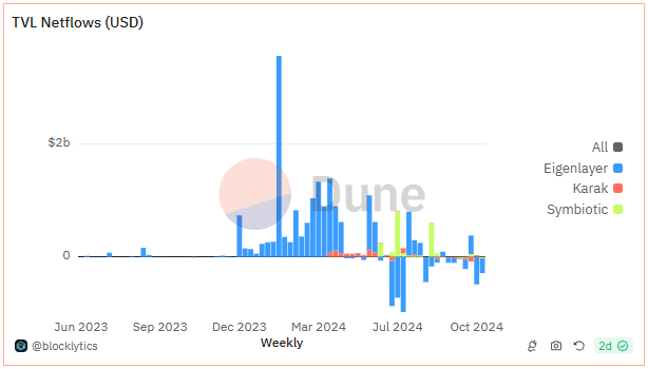

Following the launch of tokens by EigenLayer and related projects, and with their performance progressively declining, users are starting to gravitate towards newer restaking platforms like Symbiotic and Karak.

Immediately after launching and opening up deposits, Symbiotic quickly attracted over $1.6 billion in Total Value Locked (TVL) and reached its deposit cap. However, Symbiotic has a lower valuation, smaller funding rounds, and a smaller market size compared to EigenLayer.

It’s difficult to expect Symbiotic to outperform EigenLayer without taking a different approach. As of now, Symbiotic is more focused on use cases for DeFi, but its market approach remains quite similar to EigenLayer.

Read more: EigenLayer vs Symbiotic and Karak: The Restaking Race Begins