What is FTX? What advantages does FTX have over other exchanges currently on the market? How do you use FTX?

A growing number of people are interested in and want to trade cryptocurrency derivatives. Along with that, exchanges are also quickly grasping this demand to offer derivative trading products to users.

In today’s article, I want to introduce you to FTX exchange – specializing in derivatives.

Update on November 12, 2022: Sam Bankman-Fried officially resigned as CEO of FTX, and FTX and Alameda Research filed for bankruptcy.

What is FTX?

On November 10, 2022, FTX announced it was halting user withdrawals and advised users not to deposit funds into FTX.

Details of the event: Binance “rescues” FTX: The full drama between Binance and FTX

FTX is a leading exchange specializing in cryptocurrency derivatives such as: Spot (instant trading), Futures Contracts, Options, Leveraged Tokens (Margin), and OTC.

Founded by Alameda Research – one of the largest market makers and liquidity providers in the world, FTX is an exchange built by investors, for investors. FTX is committed to building the best derivatives exchange by:

- Solving the biggest pain points of leading futures exchanges: System overloads, clawbacks, lack of liquidity, poor quality products, etc.

- Developing new products to serve the evolving needs of the market.

- Listening and responding to community feedback quickly: FTX is built for traders, with the goal of creating a platform strong enough for both professional trading firms and first-time users.

Basic Information about FTX

- Launch date: April 2019

- Products: Spot contracts, Futures contracts, Leveraged Tokens, OTC, Prediction markets, Options, Staking

- Platform token: FTT Token

- Headquarters: Hong Kong

- Owner: Sam Bankman-Fried, also the owner of Alameda Research

Alameda Research was founded in October 2017. It manages over $100 million in digital assets and trades between $600 million and $1.5 billion per day. Alameda Research is also the main backer of FTX.

In July 2021, FTX successfully raised a large amount of capital, up to $900 million, and FTX was then valued at $18 billion.

FTX Exchange Review

Advantages

- The exchange’s trading markets cater to a wide range of current user needs, including: Derivatives (futures contracts), margin trading (leveraged trading), Options, OTC, and more.

- Depositing and withdrawing coins is free.

- The platform currently supports multiple languages, making it easier for users to trade.

- FTX has an API gateway that makes it easy to link exchange accounts with portfolio applications or trading bots.

- FTX has its own platform coin, FTX Token (FTT), which currently has a large market capitalization and has experienced significant growth since its launch.

- Staking FTT provides various benefits, including free ERC-20 token withdrawals.

- Provides full API keys for those who want to use third-party tools for trading.

- Offers a sub-account feature, convenient for users who want to separate their portfolios without creating another account.

Disadvantages

- The platform can sometimes lag if there are strong market movements, leading to many people participating in margin trading, depositing, and withdrawing funds.

- The desktop interface, according to some individuals, is not visually appealing.

- Transaction history is not displayed in detail.

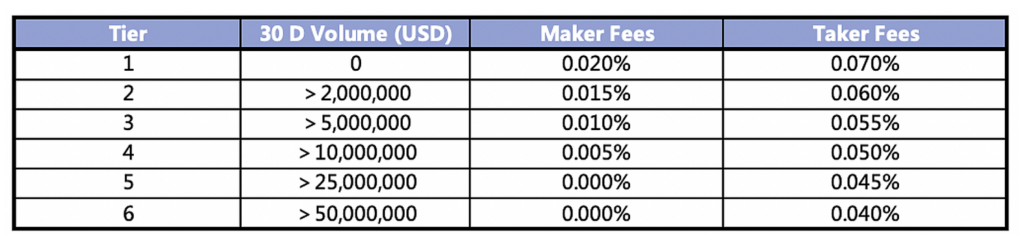

Fees on FTX

Trading Fees

FTX has a tiered fee structure. Spot and Futures trading fees on FTX are as follows:

In addition, FTX offers discounts for FTX Token (FTT) holders. The current discount is based on the user’s FTT holdings. You can see details about FTX’s fee updates.

Deposit and Withdrawal Fees

As of now, users do not have to pay any fees when depositing and withdrawing coins on FTX. This means you only need to pay the transaction fees on the blockchain network. This is considered a strong advantage to attract a large number of users to FTX. However, in the future, the exchange may add withdrawal fees.

will update you with the latest information. This is because sooner or later, exchanges will usually charge withdrawal fees.

Other Fees

FTX currently offers a number of fee incentives:

- Leveraged tokens have a creation and redemption fee of 0.10% and a daily management fee of 0.03%.

- Using leverage of 50x or higher increases trading fees by 0.05%. Half of this is paid to the insurance fund.

- There are no OTC trading fees.

Guide to Registering an FTX Account

The Insights TV team has created a “FTX Masterclass” series to help you register, secure, and use FTX from A to Z. Don’t miss this series [here – insert link to video series].

Preparation Before Registering on FTX

To ensure a quick registration process, prepare the following items in advance:

- Frequently used email address.

- Photos of your ID card, including: 1 photo of the front, 1 photo of the back, and 1 selfie with the front (I will provide detailed instructions later). You can use an ID card or driver’s license.

- Phone with Google Authenticator app installed.

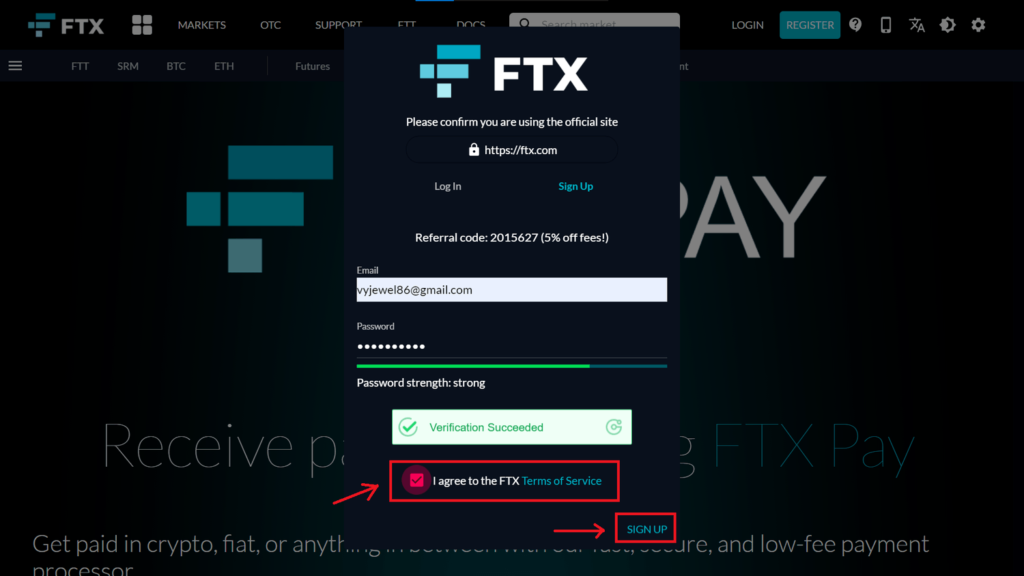

Step 1: Register a Trading Account on FTX

First, visit the FTX website.

Then enter your email address and password ⇒ Select “Click to Verify”.

Note: You must type directly and cannot copy-paste into these information fields. Your password must meet the following two conditions:

- Must contain at least one special character (! @ # $ % ^ & *).

- Must have at least one lowercase and one uppercase character.

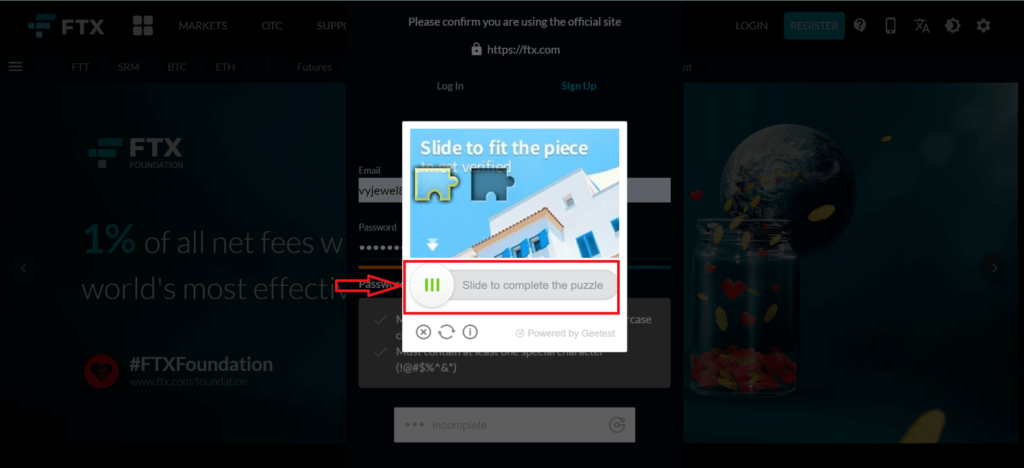

Drag the circle to fit the puzzle piece above into the empty space.

Next, select “I agree to the FTX Terms of Service” to confirm that you agree to FTX’s terms of service. Then select “Sign Up”.

That’s it! You have successfully registered an FTX account. With this account, you can withdraw up to $1,000 per day.

However, I recommend that you complete KYC verification in the next step to better secure your account and remove withdrawal limits.

Step 2: Identity Verification – KYC

First, you need to know what KYC is. KYC (Know Your Customer) is the process of collecting identifying information related to the customers of a service. Basic information typically collected includes a portrait photo, ID card number, passport, address, and so on.

The purpose of KYC is to screen out individuals who do not meet certain criteria from using a particular service. These criteria can vary depending on the platform.

To complete the KYC process on FTX, follow these steps:

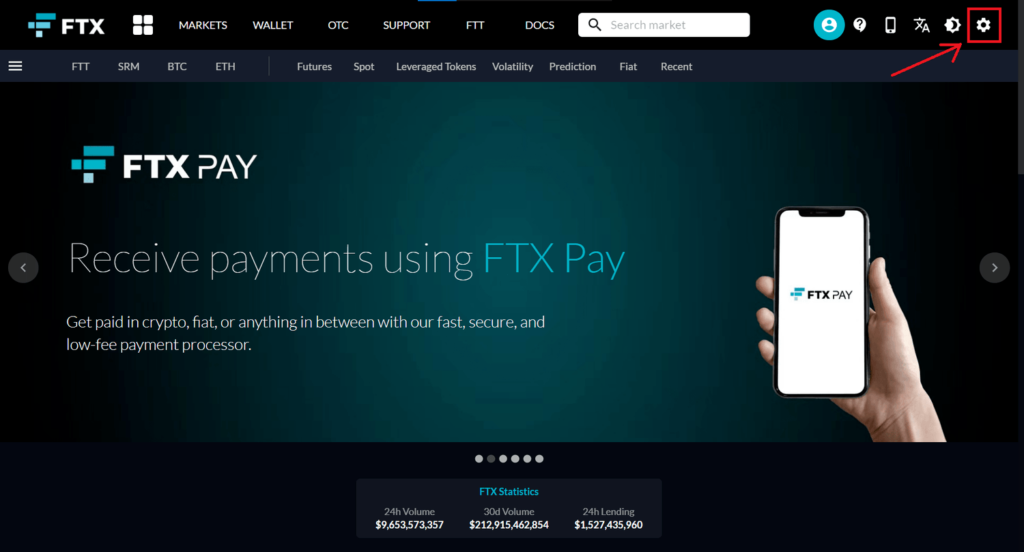

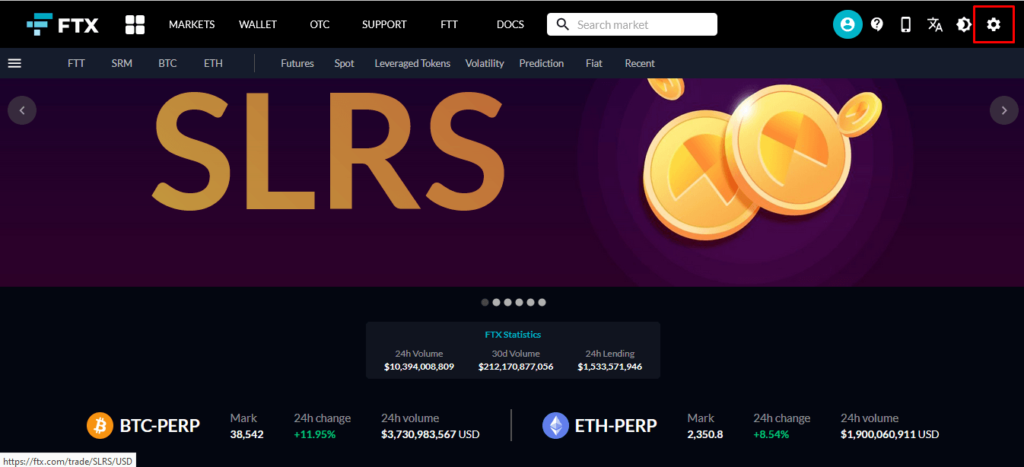

From the FTX homepage, select the “Settings” icon as shown below.

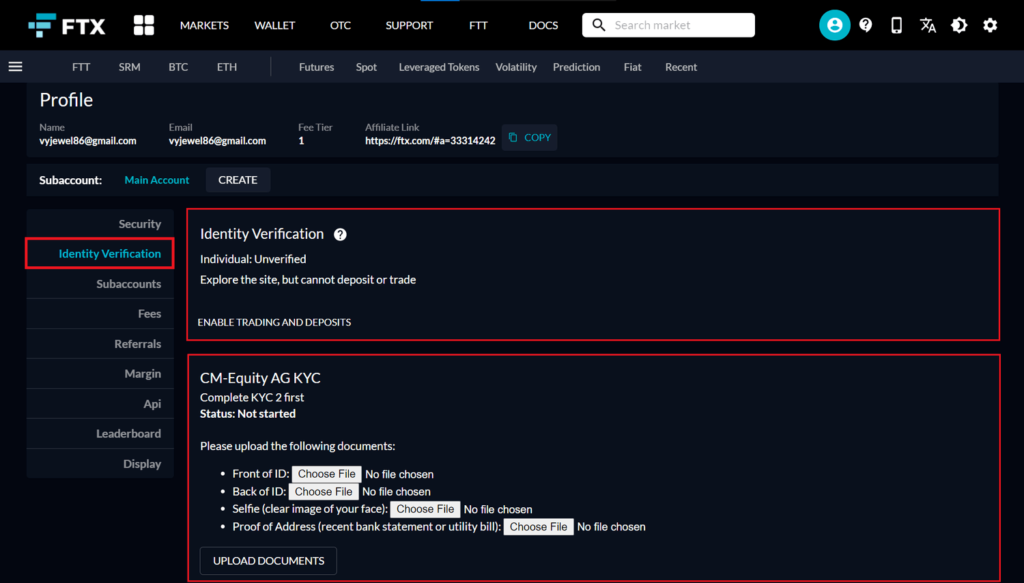

Here, there are two verification areas you need to complete:

- Identity Verification: You need to verify your identity before you can deposit funds or trade on the exchange.

- CM-Equity AG KYC: Complete 2-step KYC – These are the documents you need to upload to perform identity verification.

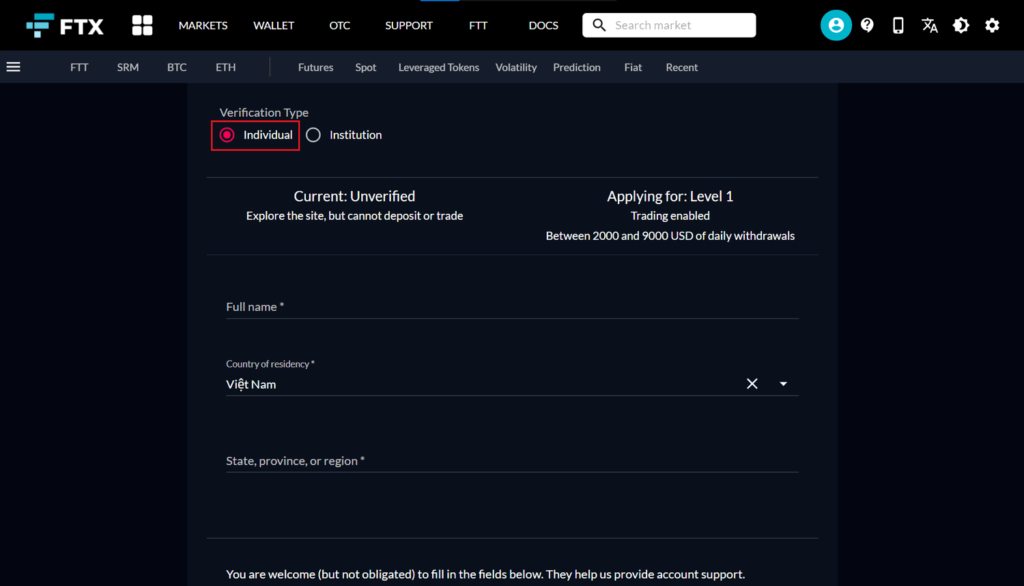

Select “Enable Trading and Deposits” to verify your identity. Here, you need to fill in all the information to complete Level 1 verification, including:

- Verification Type: Verify whether the account is for an individual or an organization.

- Full name: Your full name.

- Country of residency: Your country of residence.

- State, province, or region: The state, province, or region where you live.

- The following information is optional:Your preferred chat app,chat handle.

After completing Level 1 verification, your account can withdraw between $2,000 and $9,000 per day.

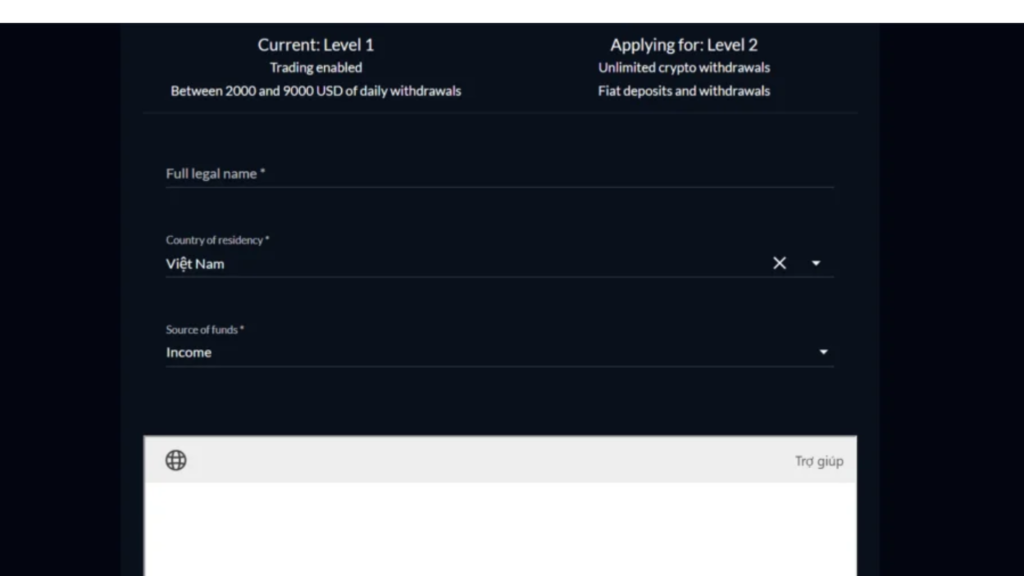

After filling in the information, select “Submit Information“. FTX will then proceed to Level 2 verification with the following information:

- Full legal name: Your full legal name.

- Country of residency: Your country of residence.

- Source of funds: You can choose “Income” or “Trading“. If you select “Other“, please specify/describe the source of your personal assets, residential address, or business address.

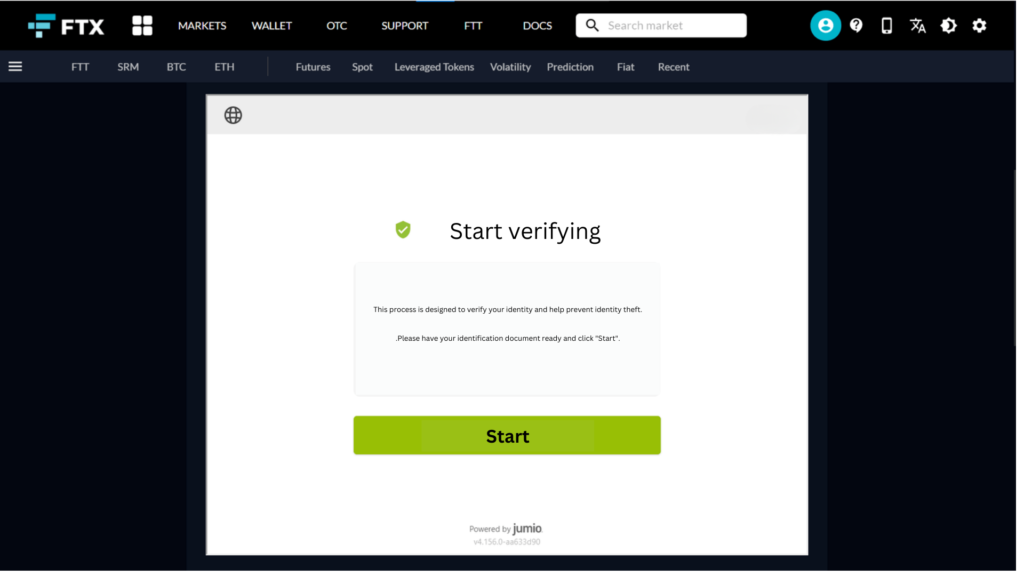

Next, you’ll need to verify your identity by selecting “Start“.

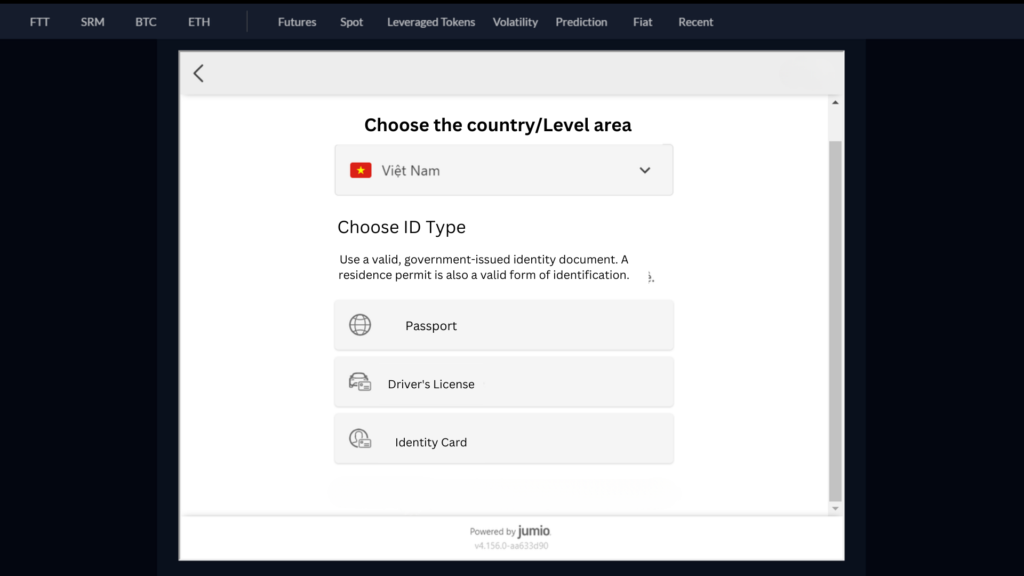

Select the “Country/Region of issuance” and “ID Type“. Here, I will select “Vietnam” and “Identity Card”

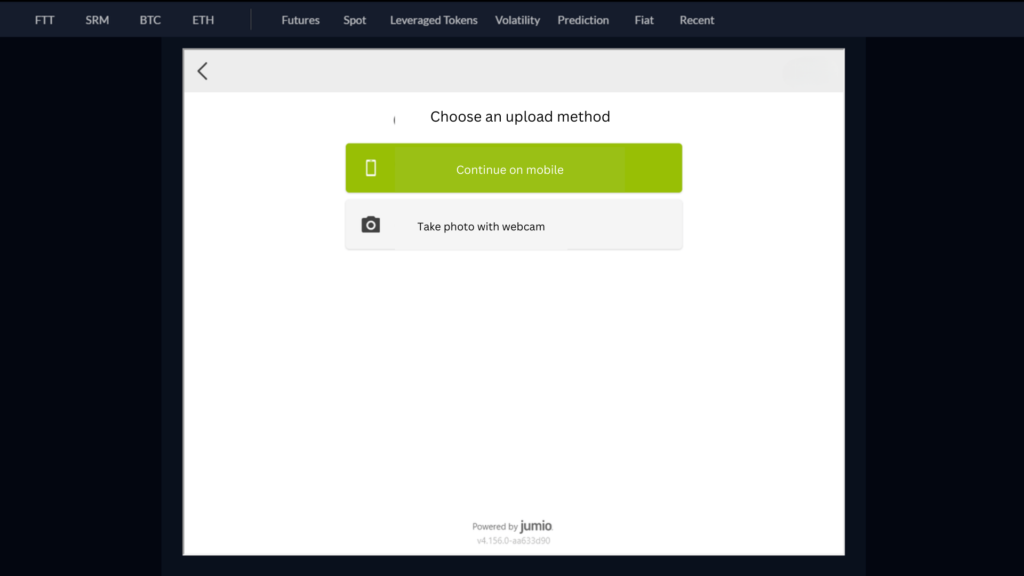

Next, choose a method to upload your ID photos using your phone or computer’s webcam. You’ll need to provide:

- A photo of the front & back of your ID.

- A photo of your face looking directly at the camera.

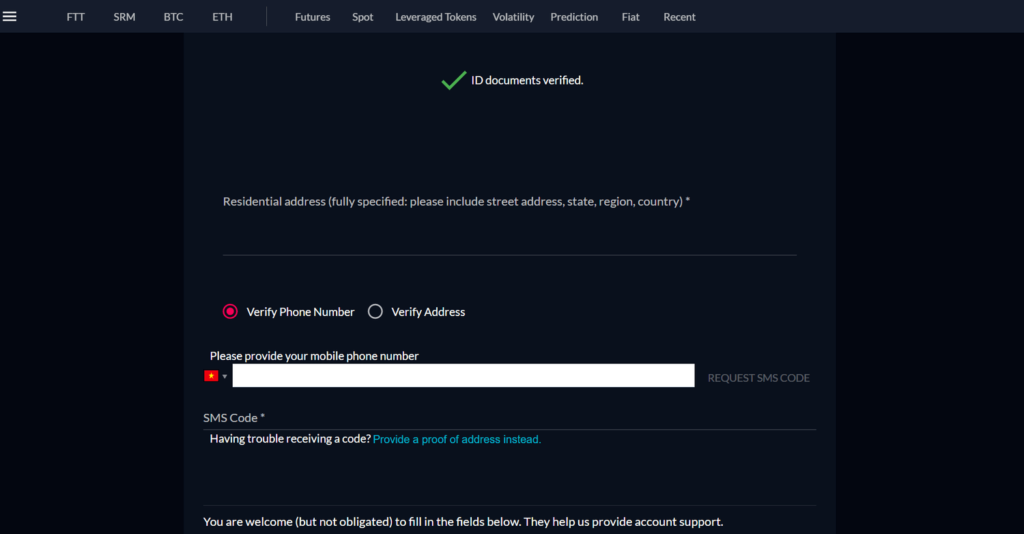

Next, enter your “Residential address“, including your specific address and the country where you live.

Verify your phone number by entering it in the field below, select “Request SMS code” ⇒ Enter the 6-digit code sent to your phone in the “SMS Code” field.

Scroll down and select “Submit Information“.

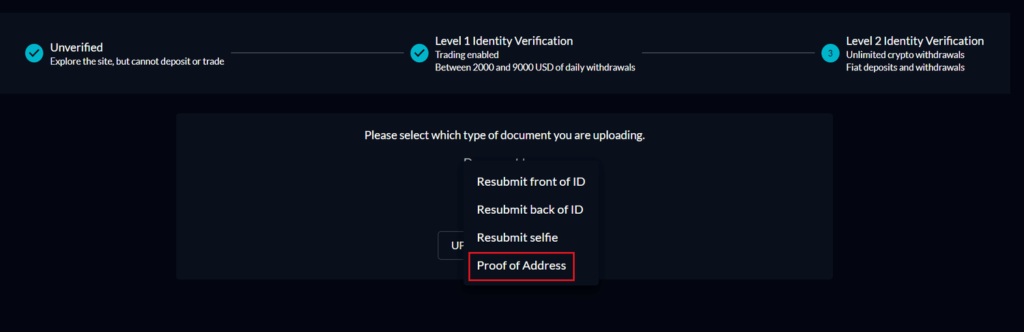

Select “Upload Additional Documents” to add any necessary verification documents.

Select “Proof of Address“. This is a document that proves your address, such as a recent utility bill, bank statement, rental agreement, or ID card that includes your address.

Upload your photo and select “Upload“.

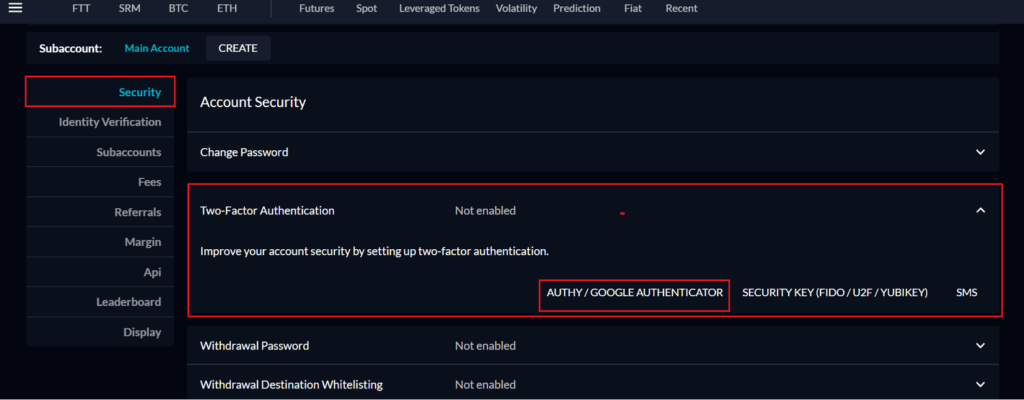

Step 3: Enable Two-Factor Authentication (2FA)

This step helps you enhance the security of your exchange account. I always recommend enabling 2FA.

Select “Settings” ⇒ “Security” ⇒ “Two-Factor Authentication” ⇒ “Authy / Google Authenticator“.

Download the Google Authenticator or Authy app to scan the code below, and be sure to save the 16-character key for backup purposes.

Additionally, you can also choose to secure your account using SMS verification. However, this method often takes time to wait for messages to arrive, or can be complicated when changing SIM cards.

Guide to Depositing, Withdrawing, and Trading on FTX

Depositing Funds

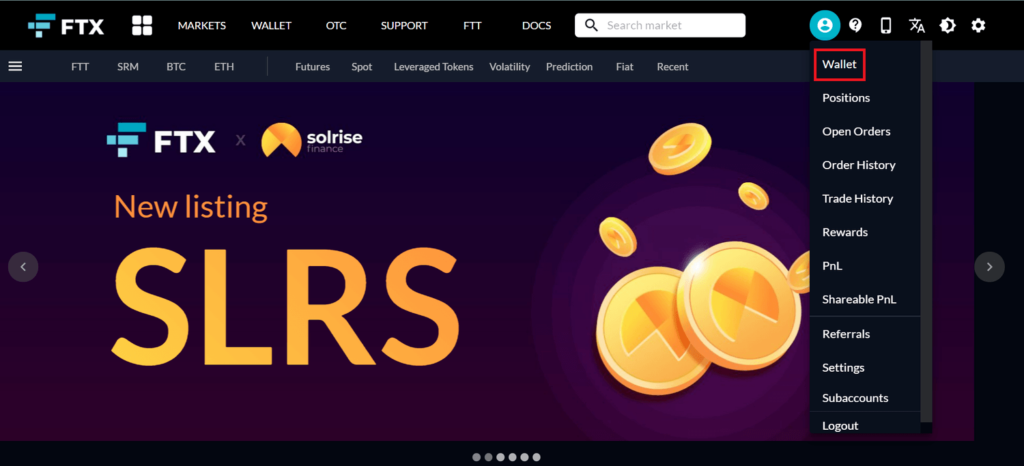

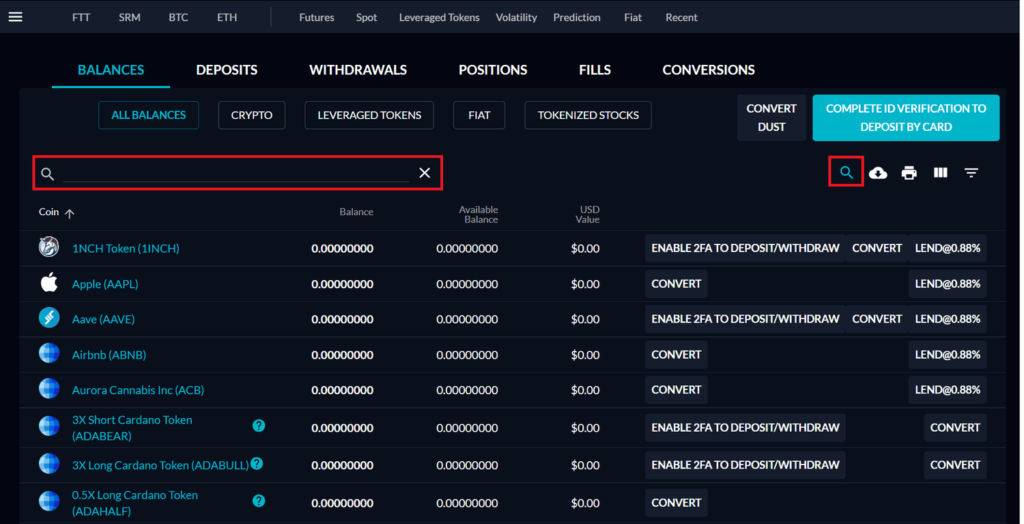

From the FTX homepage, select “Wallet” as shown below

To deposit a specific coin, simply enter its ticker symbol in the search bar.

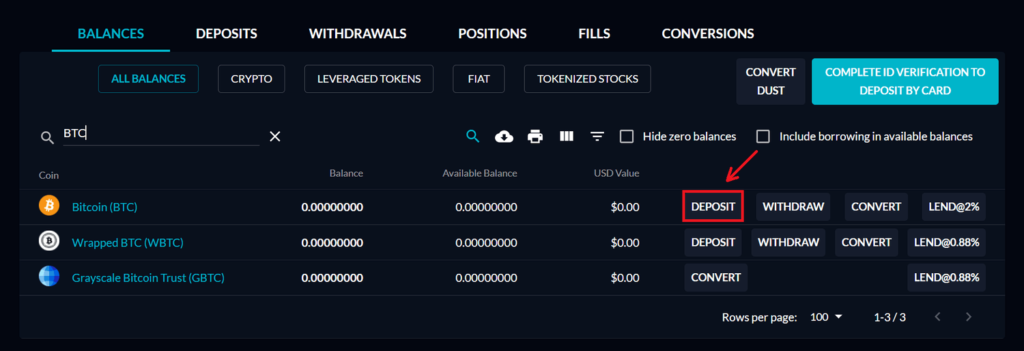

Here, I’ll use BTC as an example. For other coins, the process is the same.

Enter “BTC” and select “Deposit“.

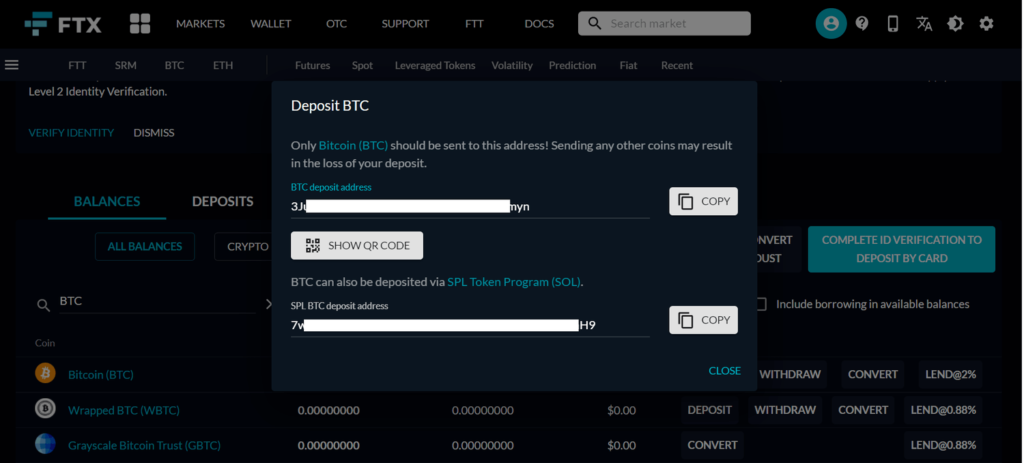

The next thing you need to do is deposit Bitcoin (BTC) to the displayed wallet address.

Important: Only deposit the corresponding coin to its specific wallet address. Do not send other coins to this address.

Withdrawing Funds

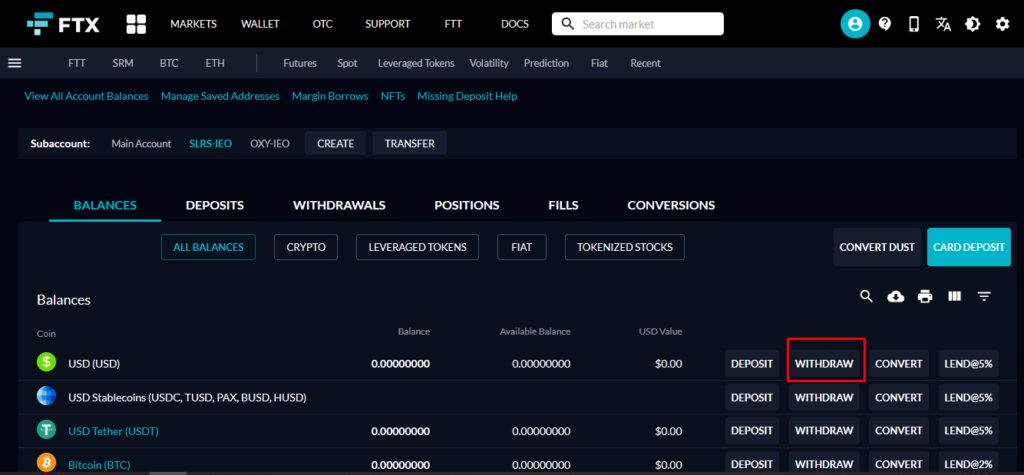

The withdrawal process is almost identical to depositing. However, instead of selecting “Deposit,” choose “Withdraw“

Next, enter your wallet address in the “Address” field and the amount you want to withdraw in the “Amount” field.

Finally, select “Withdraw“.

Trading Coins

FTX is known as the best derivatives exchange currently available. However, that doesn’t mean its spot trading features aren’t high quality. Users can deposit funds through various chains like Ethereum, Solana, Tron, and more.

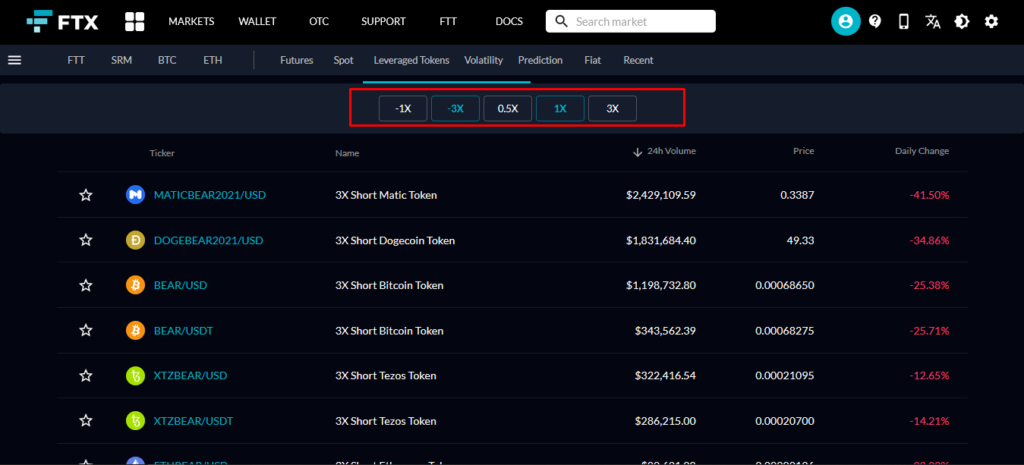

In addition, the exchange also supports a wide range of leveraged tokens: ETHBULL, SUSHIBULL, ETHBEAR, etc.

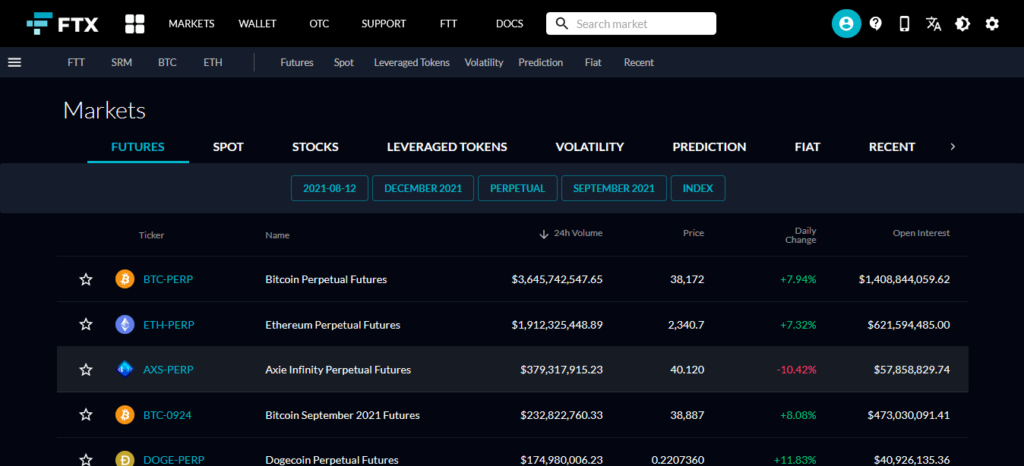

To buy and sell coins, select “Markets“.

You can choose from various types of coins to buy/sell, such as Futures, Spot, Stocks, Leveraged tokens, and more.

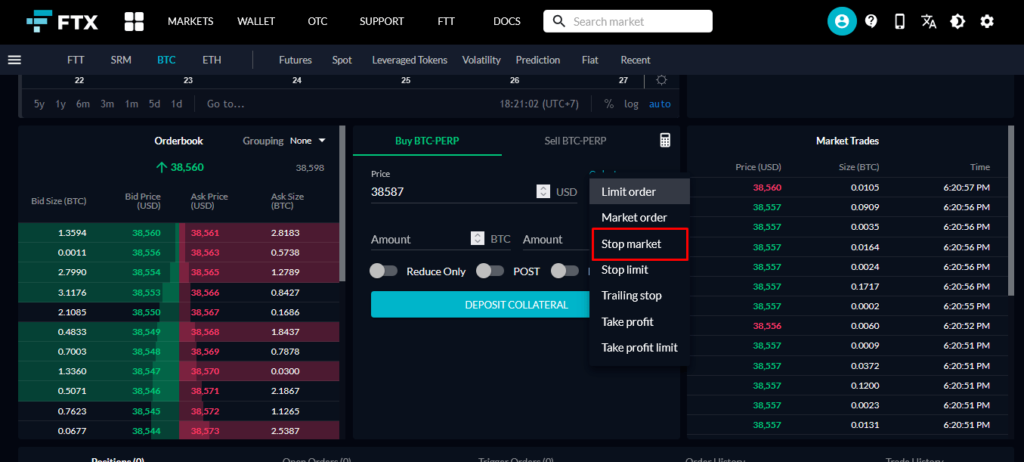

Order Types to Know When Trading on FTX

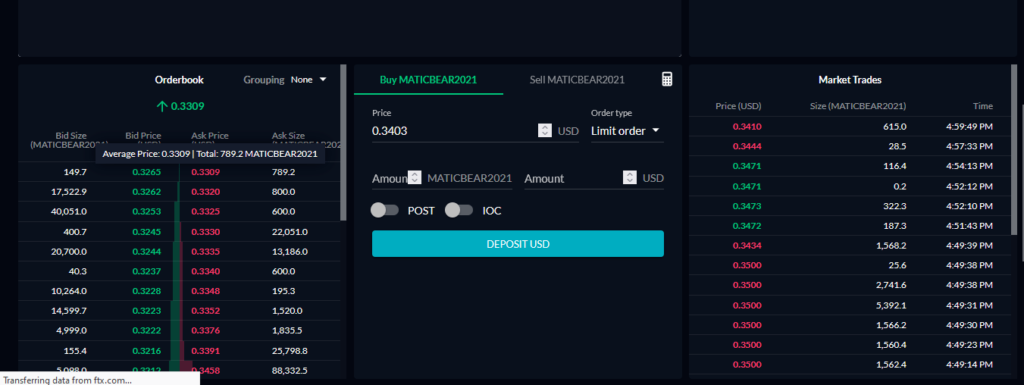

Limit Order: Allows users to set their desired buy/sell price. A limit order will only be executed when the market price reaches the preset limit price.

Market Order: Allows you to quickly buy an asset at the current market price. Market orders are usually filled immediately and become the top priority among all pending orders.

Stop Limit Order: This order has two price levels: Stop Price and Limit Price. When the price reaches the Stop Price, a limit order is immediately placed on the order book and waits to be filled.

Stop Market Order: This order also has two price levels: Stop Price and Market Price. When the price reaches the Stop Price, a market order is triggered and filled immediately.

Trailing Stop: Allows you to set a dynamic stop-loss order that moves with the trend of your position. For example, if your trade is profitable, you can set a Trailing Stop and the price will continue to move higher by a certain number of pips as your BUY order gains profit. Conversely, it will gradually decrease if your Sell order is profitable.

Guide to Other Trading Features on FTX

Margin Trading on FTX

Margin trading is also known as leveraged trading. This is a form of trading that uses financial leverage to allow users to buy and sell with a larger amount of capital than they have. This can generate higher profits, but of course, the risks are also higher than with regular trading.

As of July 25th, FTX only allows margin trading with leverage ratios of 1x, 3x, 5x, 10x, and 20x.

FTX does not require you to successfully complete KYC to trade on margin. You can only margin trade with USD. This means you can use USD as collateral to buy other coins or sell coins to receive USD.

To margin trade on FTX, follow these steps:

First, you need to convert your current coins to USD. Select “Leveraged Tokens”.

Then, select the desired leverage to filter for assets available with that leverage.

Now you have your Margin account ready.

Next, scroll down to see where you can buy and sell these tokens. However, you must deposit USD beforehand; otherwise, it will display “DEPOSIT USD”

Trading Futures Contracts on FTX

Futures are contracts to buy or sell a commodity, currency, or other instrument at a predetermined price at a specified time in the future.

However, these contracts do not have an expiration date, so traders can hold their positions for as long as they like.

To trade Futures on FTX, follow these steps:

On the main screen, select “FUTURES” and then choose the type of contract you want to trade.

Here, I will use BTC-PERP as an example.

Trading futures is similar to trading spot contracts.

However, because this is futures trading, you don’t need to hold the underlying crypto asset. You only need to have the corresponding collateral and trade based on its index.

Placing Stop-Limit Orders

Here you need to determine the price at which you want to start trading. Specifically, when creating a Stop-Limit order, you must directly enter the trigger price.

- If you are buying, the order will be placed on the order book when the market price exceeds your trigger price.

- If you are selling, the order will be placed on the order book when the market price falls below your trigger price.

Here’s an example to make it easier to understand: BTC-PERP is currently trading at $10,000. You use a Stop-Limit buy order with a trigger price of $10,500 and a size of 5. When the market rises to $10,500, your Stop-Limit order will be triggered and FTX will turn it into an order to buy 5 BTC-PERP.

Guide to Using Additional Features on FTX

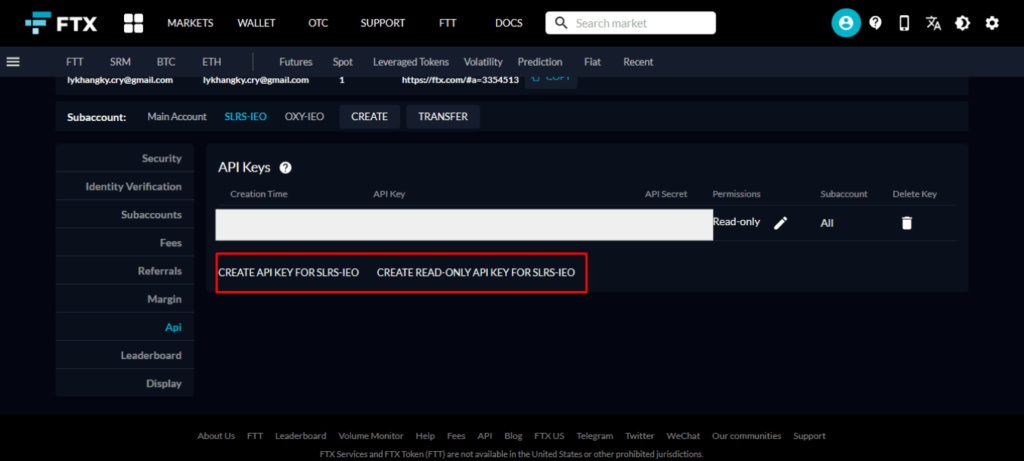

Obtaining API Keys

For those who need to use tools to trade or manage their portfolio, API keys are essential.

To activate API keys for your account, select “SETTINGS” as shown below.

Then select “API“.

Click “Create API” to generate an API key.

Getting your FTX referral link

On the main FTX interface, go to “SETTINGS” as above. You will see your referral link in the middle of the screen.

You will receive 30% of the trading fees from the people you refer. The people you refer will receive a 5% fee discount for their first 30 trillion dollars traded.

With this policy, the more people you invite and the more they trade, the greater your passive income will be.

Creating Subaccounts

A subaccount is a secondary account used to hold assets, similar to your main account. The benefits of a subaccount are:

- Convenient for users who want to allocate capital without creating another account.

- If your main account is in debt, you can deposit funds into a subaccount to continue trading.

- Participate in FTX IEOs.

How to create a subaccount:

From the main screen, click on “Wallet”. This will display an interface like the image shown below.

Click “Create” to create a subaccount. Next to the “Create” button are the names of the subaccounts I have already created to participate in FTX IEOs.

After that, you just need to name the subaccount.

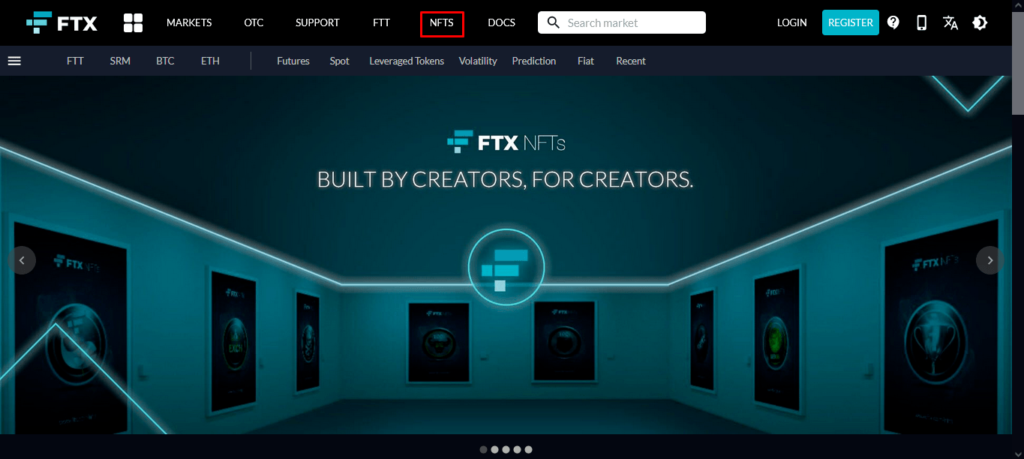

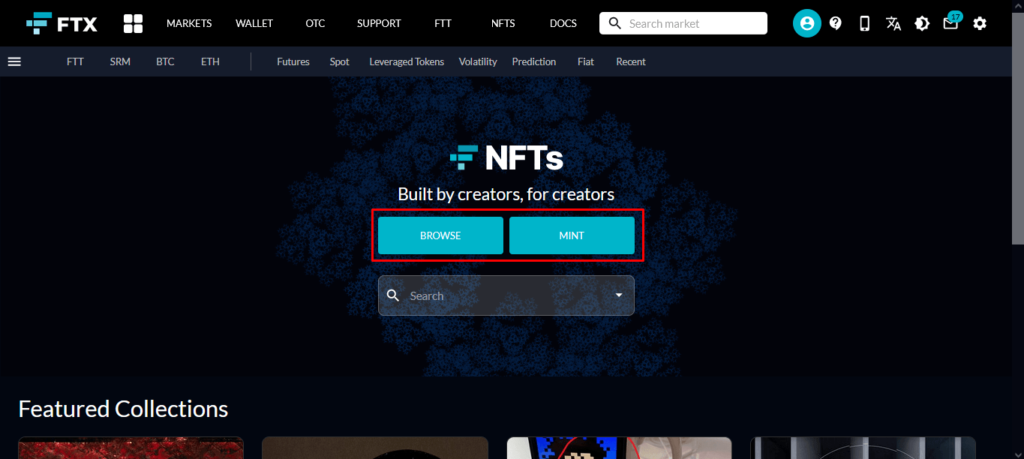

Buying and Selling NFTs

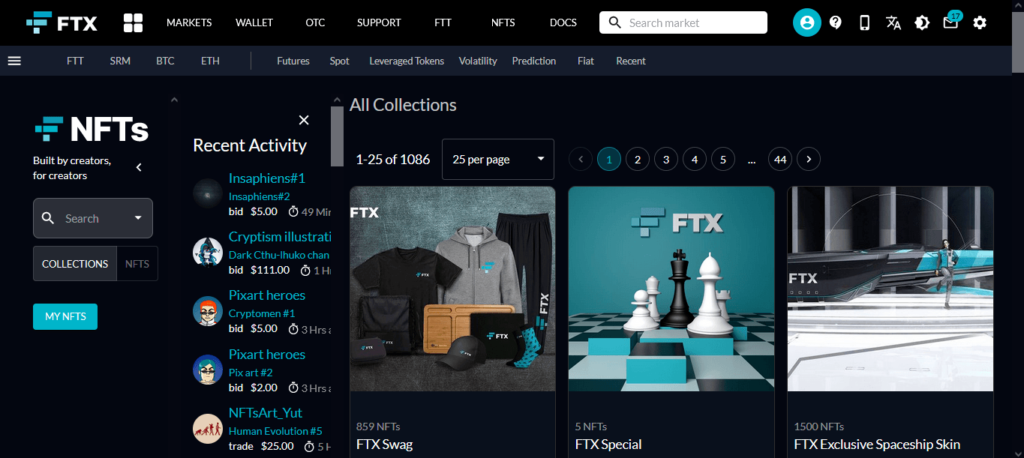

In early September 2021, FTX launched an NFT marketplace where users can list their NFTs for sale or buy from others, similar to OpenSea.

The buyer’s fee is 0%, and the seller’s fee is 2%. While this number is quite high compared to trading on DEXs (usually 0.3%), it is still generally cheaper than OpenSea (2.5%).

NFTs minted on FTX will be listed in USD, SOL, or ETH.

To participate in NFT trading on FTX, click “NFT” on the homepage.

To view other people’s NFTs, click “Browse“. If you want to mint an NFT, click “Mint“.

After clicking on “Browse”, you can search for your favorite collections.

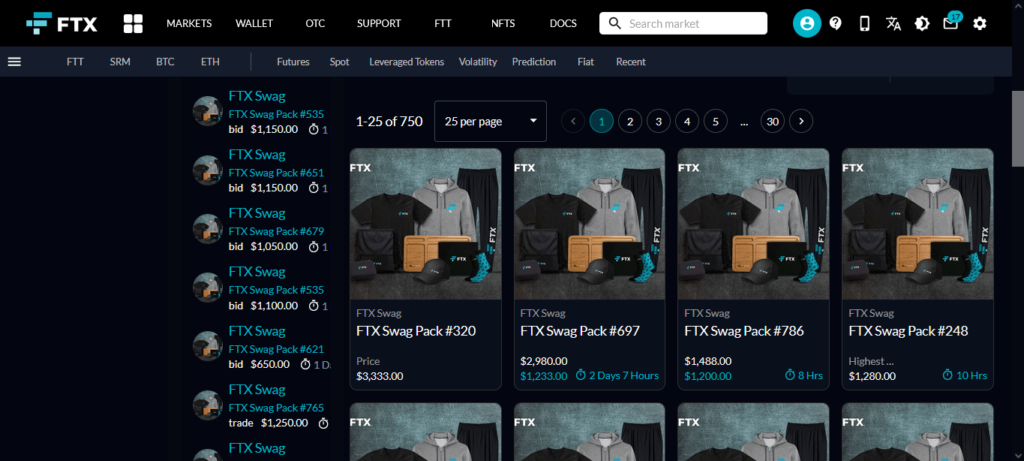

Then click on it to see specifically how many people are selling. For example, if I click on FTX Swag, it will appear as follows:

Select the seller with the appropriate price, then click “Buy”.

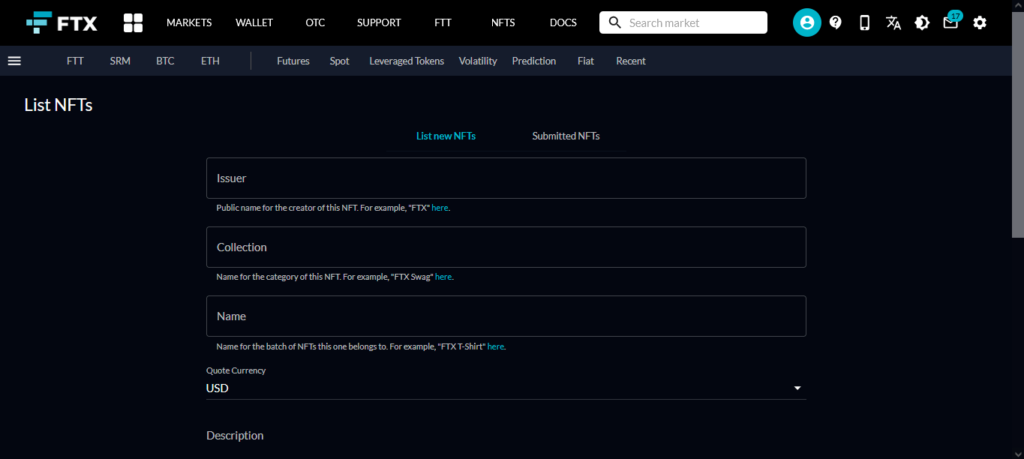

If you want to mint an NFT, after clicking “Mint”, enter the information as instructed, then upload the image to complete the process.

Frequently Asked Questions About Trading on FTX

Should I trade on FTX?

Although it hasn’t been around as long as Binance, Huobi, etc., FTX is currently one of the largest exchanges with an impressive growth rate, especially in providing users with a great experience for derivatives and spot products.

Therefore, you can add FTX to your list of preferred exchanges.

Is FTX a scam? Has FTX been hacked?

As of now, FTX has not been accused of being a scam. Theft of assets has also never occurred on FTX.

Has FTX been hacked? Does FTX often experience maintenance issues?

As of now, FTX has never been hacked.

Currently, there is no information about FTX undergoing maintenance or any announcements about upcoming maintenance.

I will update you with more information when there are maintenance announcements.

What should I do if I lose my 2FA on FTX?

If you lose your 2FA on FTX, first check to see if you saved the 16-digit key when activating Google Authenticator.

If you saved the key, you can simply enter those 16 digits back into the Google Authenticator app to automatically regenerate a new code for you.

Which country is FTX from?

FTX is owned by FTX Trading LTD, a company incorporated in Antigua and Barbuda.

What is the FTX platform coin?

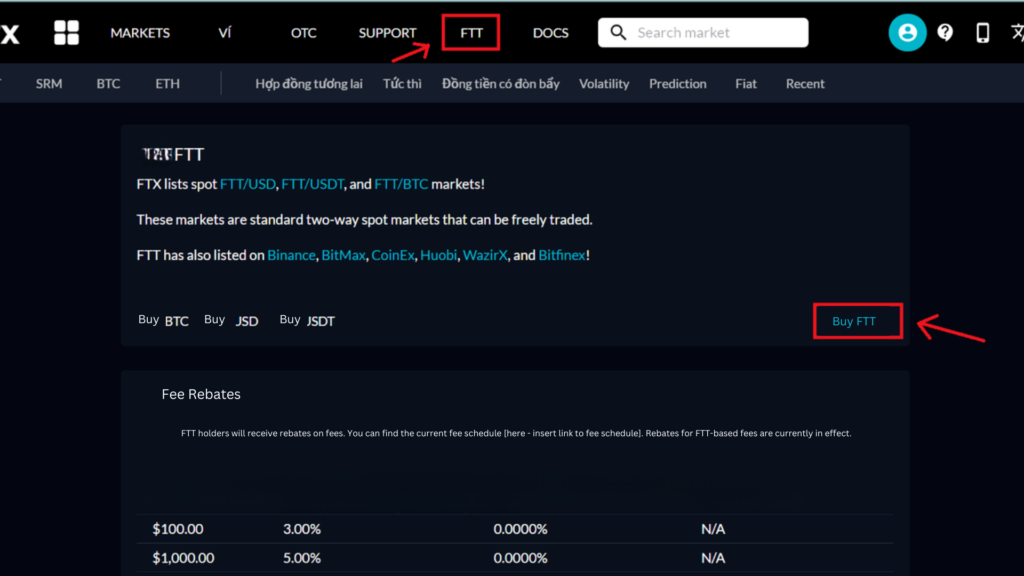

On July 29, 2019, FTX launched its own token, FTX Token (FTT). You can buy FTT tokens on FTX by going to the “FTT” section ⇒ “Buy FTT“.

FTT is an ERC-20 & SPL token that will be used to:

- Allow FTX to buy and burn FTT with one-third of all exchange fees.

- Serve as collateral on FTX.

- Receive socialized gains from the FTX insurance fund.

- Provide holders with fee discounts and tighter OTC spreads.

- Offer various benefits to those who stake FTT, as mentioned above.

Implement a burn mechanism for FTT tokens, which will continue until at least half of the FTT tokens are burned.

Is KYC required to withdraw funds from FTX?

With FTX, you do not need to complete KYC to withdraw up to $2,000 per day. This is a great policy for those who are trying out the platform or trading with small amounts.

However, I always recommend completing KYC and enabling 2FA to better protect your account.

What are the deposit and withdrawal limits on FTX?

- Deposits: There is no deposit limit.

- Withdrawals: For accounts that have not completed KYC verification, the limit is $2,000 per day. For accounts that have successfully completed verification, there is no withdrawal limit.

Does FTX have IEOs?

To date, FTX has conducted several IEOs, and these projects are all within the Solana ecosystem, such as Maps.me, Solrise, Mercurial, etc.

For those who are not familiar with IEOs, an IEO (Initial Exchange Offering) is a form of crowdfunding through the sale of tokens on crypto exchanges. With an ICO, you would buy tokens directly from the project. With an IEO, the tokens are sold on a particular exchange, and anyone who wants to invest can go to that exchange to buy them.

Summary

FTX is an exchange that can meet the needs of traders from basic to advanced levels, especially those who want to participate in crypto derivatives trading. Free deposits and withdrawals are a prominent advantage of the exchange.

With the increasing number of crypto exchanges appearing today, it is not too difficult to find a quality exchange.