The term “cryptocurrency” originated in 2009 with the emergence of Bitcoin, which is considered a significant milestone marking the birth of the crypto market. However, the technology behind this success is blockchain.

From an idea in research papers, blockchain was later widely developed and applied in cryptocurrency networks in particular and everyday life in general. Since then, blockchain technology has gone through many stages of formation and development to achieve its current widespread adoption.

This article will provide an overview of the history of blockchain, along with important milestones and events in its development.

Blockchain and Bitcoin

Some people mistakenly believe that Bitcoin and blockchain are the same thing, or even that Bitcoin and blockchain were launched simultaneously. In reality, blockchain was conceived before Bitcoin appeared, and was originally called “Chain of Blocks.”

Blockchain is a decentralized ledger that records and stores data from transactions that occur on a network. The purpose of blockchain is to create a network that is not managed by a third party, while ensuring the security and immutability of data.

In 2008, Satoshi Nakamoto released the Bitcoin whitepaper, which described Bitcoin as a network for transferring money between users without going through a third party like a bank. The technology Satoshi applied to the Bitcoin network was “Chain of Blocks.” He later changed the term “Chain of Blocks” to a more memorable term, “Blockchain.”

A Brief History of Blockchain

There have been many misconceptions that blockchain originated from two factors: Bitcoin and the ideas of Satoshi Nakamoto.

In reality, this technology originated with engineers in the field of cryptography. This is the field of computer science that allows information to be stored on computers in encrypted form through the encryption process.

The goals of cryptography include enhancing security and transparency in computer systems, similar to the goals of blockchain.

In 1982, cryptographer David Chaum proposed a network where users could build a system without needing to trust each other, an idea called “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups.” While this was just an idea (nothing more, nothing less), later generations used this proposal to create blockchain networks.

Since then, blockchain technology has gone through many stages of formation and development to achieve its current widespread adoption. Here’s a brief overview of the history of blockchain development:

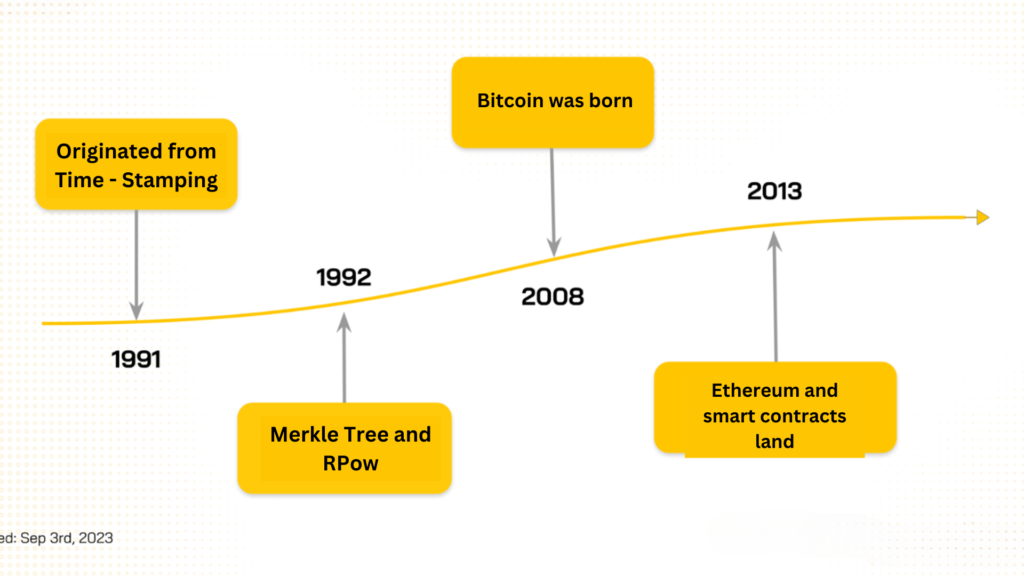

- 1991: The idea originated with Time-stamping, by Stuart Haber and W. Scott Stornetta.

- 1992-2004: Merkle Trees and Reusable Proof of Work emerged.

- 2008: Satoshi Nakamoto’s paper “Bitcoin: A Peer-to-Peer Electronic Cash System” was published, introducing the concept of Bitcoin and blockchain.

- 2013-2015: The Ethereum network was formed and launched on the mainnet.

- 2017-present: The world gradually embraces blockchain technology and Bitcoin.

The Early Years of Blockchain

1991: The Idea Originates with Time-stamping

The idea of time-stamping originated in the early 1990s with David Chaum’s initial definition.

One of the early focuses was the research of Stuart Haber and W. Scott Stornetta in 1991. Their paper “How to time-stamp a digital document” proposed a way to use a chain as a timestamp to verify the authenticity and originality of an electronic document.

Time-stamping refers to the timestamp of an event that is stored by developers on a computer system. The purpose of time-stamping is to help users easily track the timestamps of events and important historical moments.

However, Haber and Stornetta’s initial work had two problems:

- Reliance on a third party for authentication: Before the timestamp information could be uploaded, these timestamps had to be authenticated by a third party. If the third party made errors in authentication, it would significantly affect the management and time recording of some businesses.

- Susceptibility to tampering: Third parties or users could alter the timestamps, leading to information distortion. This compromised the integrity and reliability of the information stored on the system.

Therefore, Stuart Haber and W. Scott Stornetta developed a dedicated network for time-stamping and contained it within a system called “Chain of Blocks”, a transparent network that could not be tampered with by external agents.

1992: The Emergence of Merkle Trees and Reusable Proof of Work

The emergence of Merkle Trees and Reusable Proof of Work in 1992 was not directly related to blockchain technology. However, both concepts played an important role in the development and improvement of blockchain technology later on.

Merkle Trees

A year after successfully developing the “Chain of Blocks” network, Stuart Haber and W. Scott Stornetta realized that “Chain of Blocks” had a drawback: as time went on, the network needed to hold more and more data. Therefore, the two engineers developed an additional structure called the Merkle Tree.

The idea for the Merkle Tree was proposed by Ralph Merkle in a paper in 1979, but it became popular after being used in the Chain of Blocks technology at the time and later in blockchain technology.

A Merkle Tree is a structure that consists of hashes of transaction data (transaction hashes) from the network, arranged in a “tree” diagram. The purpose of the Merkle Tree is to enhance the authenticity of the network to increase performance and improve security.

Combined with Chain of Blocks, Merkle Trees enabled this network to store more data in a block.

However, in 2004, the Chain of Blocks and Merkle Tree technology of the two engineers Stuart Haber and W. Scott Stornetta was not put into use due to legal issues when the patent expired.

Reusable Proof of Work

The story doesn’t end there. In 2004, research on Reusable Proof of Work (RPoW) was published by Hal Finney, a cryptographer and the first person to receive a Bitcoin transaction from Satoshi Nakamoto.

The idea behind RPoW was to use a reusable Proof of Work system to minimize the computing power and resources required. However, RPoW was only a proof of authentication for mining, not a payment system or with the usability of Bitcoin or today’s cryptocurrencies.

Although not directly related to blockchain, RPoW is considered one of the important steps in the development of blockchain in general and the PoW consensus mechanism in particular. At the same time, RPoW created a foundation for developing proof-of-work algorithms in later blockchain systems.

In addition, Reusable Proof of Work also addressed the issue of double-spending in electronic payments by registering token ownership for each individual, stored on a server. This server was designed to allow everyone the right to authenticate the accuracy and integrity of the data.

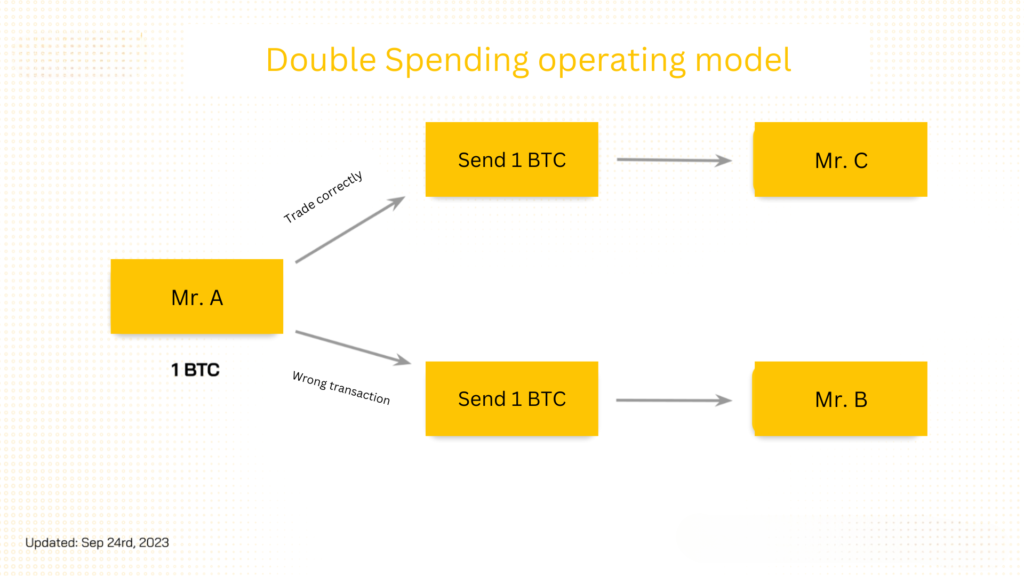

*Double-spending is an error in a blockchain network or payment system where a single coin can be spent twice.

Example: Person A has 1 BTC and transfers the entire amount to Person C, but Person A does not lose the BTC, and Person C still receives 1 BTC. Therefore, double-spending allows Person A to keep the entire amount of BTC that should have been spent.

Stages of Blockchain Development

Stage 1 (2008): The First Cryptocurrency – Bitcoin

In 2008, Satoshi Nakamoto released the whitepaper “A Peer to Peer Electronic Cash System”, also known in the community as the Bitcoin whitepaper. Its main content focused on creating a network for transactions between users without the need for a third party like a bank or payment application.

Furthermore, Satoshi applied the Chain of Blocks technology by Stuart Haber and W. Scott Stornetta to operate the Bitcoin network, but changed the name to Distributed Blockchain. Satoshi Nakamoto also modified the Merkle Tree structure, making the Bitcoin network more secure and able to hold more data.

On January 3, 2009, BTC emerged when the first Bitcoin block was mined by Satoshi Nakamoto. On January 12, 2009, Hal Finney became the first person to receive a block reward for validating a transaction on the network, receiving a reward of 10 BTC.

Here’s an interesting story about Hal Finney. Since Bitcoin mining from 2009 to 2013 was mostly unprofitable, he threw away a hard drive containing Bitcoin equivalent to $127 million while cleaning his house and computer.

Stage 2 (2013): The Emergence of Smart Contracts and the Ethereum Network

In 2013, Vitalik Buterin began working as co-founder of Bitcoin Magazine – a publication researching the Bitcoin network – and spent two years continuously studying Bitcoin technology. He realized that:

“Bitcoin is a perfect example of a cryptocurrency, but there is too little technology to be able to build on this network.” – Vitalik Buterin

Therefore, Vitalik Buterin came up with the idea of changing Bitcoin’s programming language to serve financial purposes. However, this idea was met with much opposition.

Vitalik Buterin remained steadfast in his belief, leaving Bitcoin Magazine to develop the Ethereum network with a developer-friendly programming language. Ethereum is not just a cryptocurrency system like Bitcoin, but also a platform for building decentralized applications (dApps) and smart contracts.

At the same time, Vitalik developed smart contract technology on the blockchain – the starting point of the DeFi market – to serve financial purposes.

The idea of smart contracts was proposed by Nick Szabo in 1996 but only became a reality with the emergence of Ethereum in 2013. Smart contracts were then used to help developers build decentralized applications (dApps) on the Ethereum network.

In addition, smart contracts are also used by Microsoft and UBS to reduce transaction costs and secure systems.

Stage 3 (2017-Present): The World Embraces Blockchain and Bitcoin

From 2017 to the present, the crypto market has welcomed much positive news. Blockchain, which was just an idea on paper in 1991, has become one of the most promising technologies for future development:

- April 2017: Japan became the first country to implement updates and changes to its legal framework to make Bitcoin a legal currency.

During this same period, blockchain attracted the attention of investors and businesses. The emergence of ICOs (Initial Coin Offerings) helped blockchain projects earn enormous profits.

- December 2017: Bitcoin reached $20,000 per BTC, and the entire crypto market entered a strong growth trend.

- 2018: The cryptocurrency market experienced a downturn, with the price of many cryptocurrencies declining significantly.

- 2019-2020: Marked the return of cryptocurrencies, attracting many large businesses to participate in the crypto market, such as MicroStrategy, Fidelity, Tesla, etc.

- June 2021: El Salvador became the second country in the world to recognize Bitcoin as legal tender and accept it as an official means of payment.

In addition to the gradual adoption and acceptance of cryptocurrencies by people and governments, the crypto market has gradually made prominent strides. Financial applications began to appear, and new blockchain networks emerged.

- 2018: Many projects emerged and attracted many investors, including NEO (a Chinese blockchain network that reached $300 million in TVL), IOTA (a project serving the Internet of Things), etc.

- 2020: Stablecoin projects started receiving more attention from the community and outside investors as they addressed volatility issues in the market. Since then, many stablecoin projects have emerged, such as FRAX (Frax Finance), DAI (MakerDAO), etc.

- 2022: Ethereum underwent the “Ethereum Merge” upgrade, switching its consensus mechanism from Proof of Work to Proof of Stake, reducing the network’s energy consumption by over 99%.