Governance tokens are more than just digital assets; they are the gateway to community power in the blockchain world. Let’s explore governance tokens in this article.

What is a Governance Token?

A governance token is a type of digital asset that represents voting rights or participation in governance within a blockchain ecosystem or crypto project.

Holders of governance tokens can provide input or participate in votes to decide on important project matters, such as protocol changes, budget allocation, or improvement proposals.

The more tokens a person holds, the greater their voting power, giving them a stronger voice in the community.

In addition to voting rights, governance tokens can also offer other benefits, such as receiving rewards, accessing special features, or benefiting from the project’s growth. With their vital role in democratizing governance and enhancing decentralization, governance tokens have become a core element in the development of blockchain projects.

Here are some examples of prominent governance tokens:

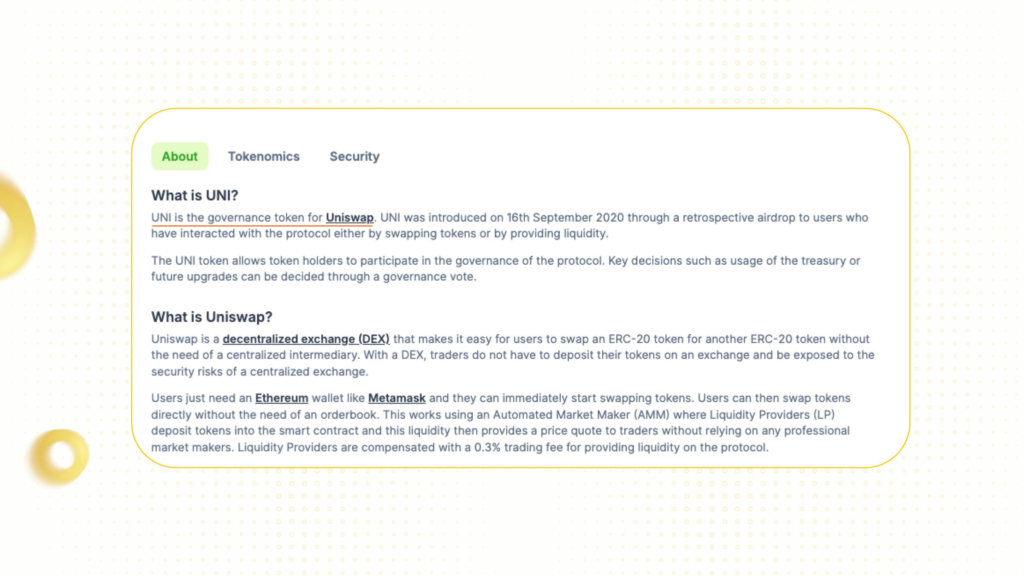

- Uniswap (UNI): The governance token of the Uniswap protocol.

- MakerDAO (MKR): The governance token of MakerDAO, the protocol behind the DAI stablecoin.

- Aave (AAVE): The governance token of the Aave lending and borrowing protocol.

- Compound (COMP): The governance token of the Compound DeFi protocol.

How to Find a Project’s Governance Token

A project’s token can play multiple roles simultaneously. It can be both a utility token and a governance token, or it can be separate for either role. Depending on the design of the tokenomics model and how value accrues to the token or its holders, the governance token of each project will differ.

How to identify a governance token?

You can identify a governance token through the following signs:

Governance tokens are typically used to participate in voting and project direction. If a token can be used to:

- Vote on protocol changes.

- Propose improvements.

- Decide on budget allocation or development funds.

=> This could be a governance token.

Alternatively, to find out which token a project uses for governance, you can do the following:

Visit the project’s official website

Most blockchain projects provide complete information about their tokens on their official website. Here, you can find:

- Token type: Governance, utility, or collateral.

- The role of the token in the ecosystem.

- How to use the token in voting or governance.

For example, Uniswap (uniswap.org) clearly states that UNI is the platform’s governance token.

Refer to the whitepaper or project documentation

Projects often clearly explain the role of their token in the whitepaper. The section related to tokenomics will provide detailed information on how the governance token works.

Look it up on data aggregator platforms

- CoinMarketCap

- CoinGecko

How Governance Tokens Work

Governance tokens operate on the principle of decentralization, allowing holders to participate in key decisions of a blockchain project or decentralized protocol. Here’s how governance tokens work in practice:

Voting and Governance Rights

When a project issues governance tokens, each token typically represents one voting right. The more tokens a person holds, the more influence they have in determining the project’s direction. These voting rights may include:

- Changing important parameters such as interest rates, transaction fees, or reward allocation.

- Approving or rejecting updates or new features within the protocol.

- Deciding on budget allocation from project funds or the DAO.

- Shaping expansion or marketing strategies.

Proposal and Voting Process

Governance token holders have the right to vote on important decisions within the project. Governance tokens often come with a transparent proposal and voting mechanism:

- Proposal Creation: The development team or community members can use their tokens to submit ideas or plans for project changes.

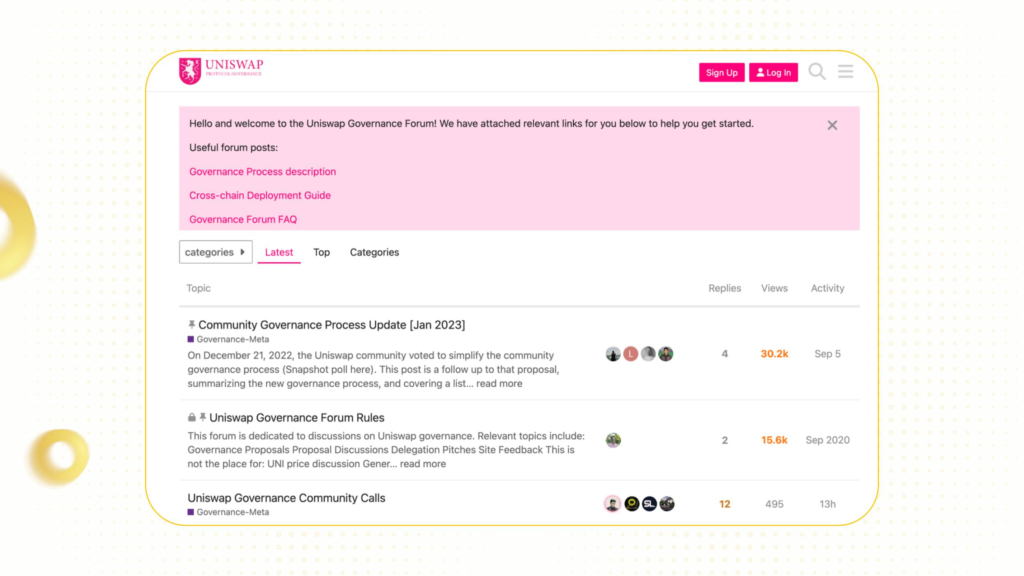

- Discussion: Proposals are publicly discussed on platforms like Discord, Snapshot, or the project’s dedicated governance forums – DAO Forums.

- Voting:

- Token holders vote in favor or against a proposal.

- The final decision is typically automatically executed via a smart contract if a sufficient number of votes is reached.

- Voting power is often proportional to the number of tokens a user holds. For example, if you own 10% of the total tokens, you have 10% of the voting power.

- Results and Execution: If the majority of votes (according to the defined threshold) agree with the proposal, the change is implemented.

Governance tokens help decentralize power within the community instead of concentrating it in a single development team. All important decisions are made through collective will, increasing transparency and trust in the project.

Governance token holders not only have the right to participate in voting but can also receive rewards such as additional tokens or special benefits from the project. This encourages active participation and long-term contribution from the community.

Read more: Token Governance: A Bright Spot of DeFi or a Mask?

How to Acquire Governance Tokens

Purchasing on Exchanges

Governance tokens of most major projects are listed on centralized (CEX) and decentralized (DEX) exchanges. You can buy them by exchanging popular coins like BTC, ETH, or stablecoins.

Examples:

- CEXs: Binance, Coinbase, etc.

Tokens like UNI (Uniswap), COMP (Compound), or AAVE (Aave).

- DEXs: Uniswap, SushiSwap, PancakeSwap, etc.

Tokens like MKR (MakerDAO) or SUSHI (SushiSwap).

Participating in the Protocol and Earning Rewards

Many projects reward governance tokens to users who contribute to the ecosystem.

- Liquidity Providing: Provide assets to liquidity pools on DEXs to receive governance tokens.

Example: Provide liquidity on Uniswap to receive UNI.

- Staking: Stake other tokens to earn governance tokens as rewards.

Example: Stake ETH on Lido Finance to receive LDO token rewards.

- Lending or Borrowing: Participate in DeFi platforms like Compound or Aave to earn governance tokens as rewards.

Participating in Airdrop Programs

Some projects distribute governance tokens for free through airdrop programs to encourage early user adoption.

Uniswap (UNI): Airdropped 400 UNI to each wallet address that had used the protocol before September 2020.

ENS (Ethereum Name Service): Airdropped ENS tokens to users who had registered .eth domains.

Advantages of Governance Tokens

Governance tokens offer numerous benefits, particularly in promoting decentralization and democratization within a blockchain ecosystem. One of the biggest advantages is transparency and fairness. Token holders can directly participate in the decision-making process, fostering a stronger sense of ownership and connection to the project.

Governance tokens also contribute to sustainable project development. Instead of relying on a centralized team, the community takes responsibility for guiding the project’s direction. This not only minimizes the risk of manipulation but also encourages active participation and innovation from members.

- Staking for Governance Participation: Many projects require users to lock up (stake) their tokens to participate in voting. This helps reduce the risk of manipulation by accounts holding tokens temporarily.

- Governance Rewards: Some projects offer rewards in the form of tokens or staking interest to those who participate in governance.

Challenges of Governance Tokens

Despite the many benefits, governance tokens also face several challenges. One of the biggest issues is the centralization of power, where those holding large amounts of tokens can control decisions, undermining decentralization.

In 2021, during a Sushi DAO vote on transferring all SushiSwap trading fees to the protocol’s treasury, two large entities dominated the voting outcome.

GoldenChain, the digital investment arm of venture capital firm Golden Tree, and a wallet closely linked to cryptocurrency trading firm Cumberland, together contributed 10 million sushipowah tokens (the governance token of Sushi DAO), accounting for 91% of the total 11 million votes in favor of the proposal.

Furthermore, a lack of community participation is a major obstacle, as many token holders are either uninterested or lack the understanding to participate in voting. This can easily lead to poor quality decisions that may hinder the project’s development. Moreover, governance tokens also face conflicts of interest, as some users make decisions for personal gain rather than for the common good.

In addition, the risk of vote manipulation by large individuals or organizations and token price volatility also reduce the stability and effectiveness of governance. Unfair token distribution from the outset, along with security issues and the potential for attacks on the governance system, are factors that can threaten the sustainability of a project.

In 2020, the Steem community experienced a controversial event when Justin Sun, the founder of TRON, acquired the majority of STEEM tokens and used them to control the governance process, leading to complete control of the protocol. This caused division within the community and led to the creation of a new blockchain, Hive.

To overcome these challenges, it is necessary to implement a fair token distribution mechanism, increase transparency in the voting process, encourage community participation, and continuously improve security technology to ensure long-term success for the blockchain ecosystem.

Learn more: What is a Utility Token? The Role of Utility Tokens in Crypto