How does the Ponzi scheme work? Why, despite warnings, do many crypto investors still fall for Ponzi schemes?

What is Ponzi?

Ponzi is a form of financial fraud where the person at the top promises high returns to investors, but in reality, these returns are taken from the money of new participants. The Ponzi scheme collapses when the person at the top runs away or a mass of investors demand to withdraw their money.

In the crypto market, Ponzi is one of the most common forms of scams, causing serious losses of up to billions of USD for investors, such as OneCoin, BitConnect, FTX…

Why Do Ponzi Schemes Occur “Easily” in the Crypto Market?

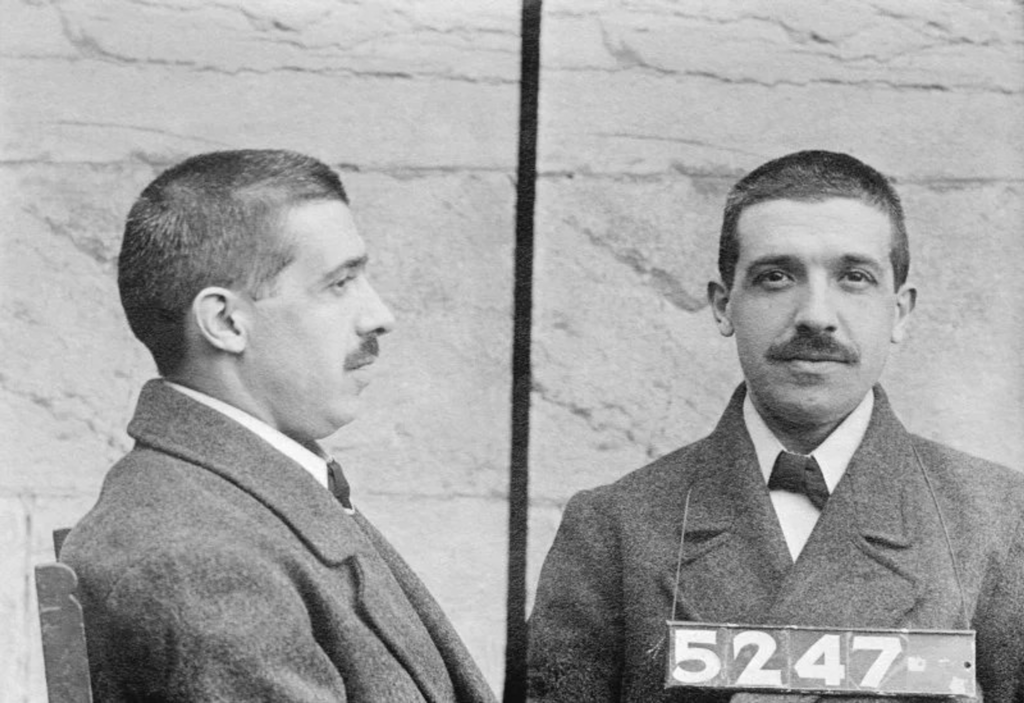

The term “Ponzi” first appeared in 1920 and was named after the infamous Italian fraudster “Charles Ponzi.” He defrauded over $15 million from thousands of victims across the United States through a postage stamp trading scheme.

Since then, the Ponzi scheme has become notorious and has occurred everywhere, such as the mega-fraudster Bernard Madoff with a scale of up to $20 billion, and Allen Stanford (an American billionaire) who defrauded over 30,000 people of approximately $7 billion…

When it comes to crypto, the amount of damage from fraudulent projects using the Ponzi scheme has increased dramatically over time, even though this market has only existed for 15 years.

According to data from Ponzi Tracker, in 2022, there were more than 60 alleged Ponzi schemes with a total fraud amount of up to $3.25 billion. In crypto alone, this number increased by nearly 200% from $907 million to $2.57 billion.

So what is the reason why the Ponzi multilevel model easily occurs in crypto?

- Security feature: The cryptocurrency market is considered a “haven for the anonymous” because of its user information security feature. This makes it easy for fraudsters to carry out their actions without being traced.

- Lack of government recognition: Most governments around the world have not yet recognized and have a clear legal framework for the crypto market. Therefore, when users fall into the trap of fraudulent Ponzi projects, they almost lose all their assets.

- New and immature market: As a result, knowledge about the market is constantly being updated and is not yet widespread, leading to investors participating in the market with a FOMO mentality without being fully equipped with knowledge. Lack of experience and expectations of high returns make investors easily fall into Ponzi schemes.

Why do many people still fall for Ponzi schemes?

Most individuals invest in the crypto market with the aim of seeking profit and often focus on two issues:

- ROI (Return of Investment), also known as the rate of return, represents the amount of profit investors can earn from their initial capital. The ROI rate has a direct impact on the investment decisions of participants. If the ROI is high, participants tend to easily expand their investment portfolio. Conversely, when the ROI is low, investors will be more “cautious” in making decisions. Usually, fraudulent Ponzi projects will offer high ROI to attract investors to pour in capital.

- The risk rate when making that investment. When the risk rate is too high, investors may lose part or all of their investment, in which case the ROI will have a negative value.

In essence, any investment carries a certain risk rate. Especially with the Ponzi scheme, the risk rate is very high. But because the promised ROI is too attractive, many investors still fall into the trap and often ignore the risk rate.

The Life Cycle of a Ponzi Scheme

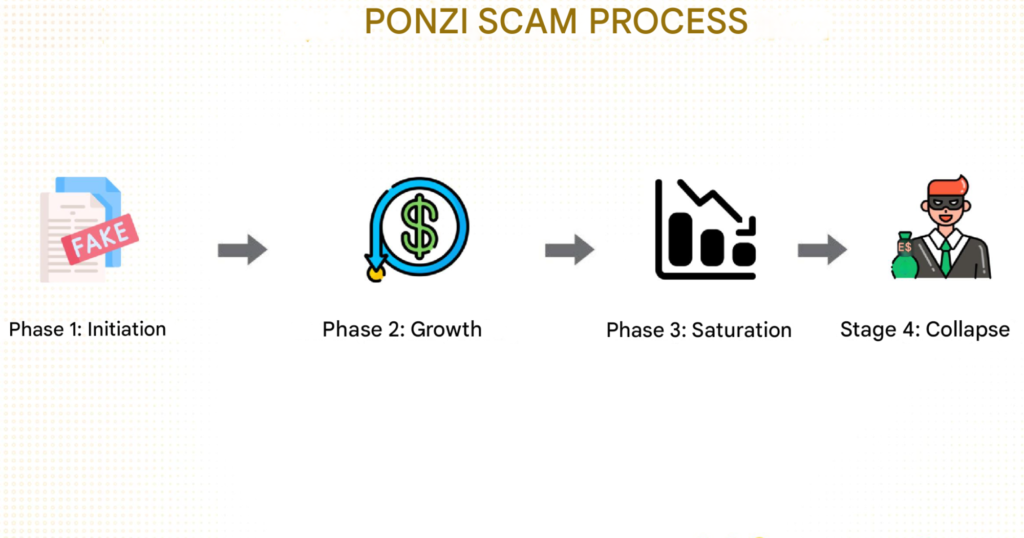

Most Ponzi scheme scams usually take place in four main stages, including: inception, expansion, saturation, and collapse.

In the beginning stage, the Ponzi schemer plans a hypothetical investment opportunity or business model and continuously advertises them to many people with a commitment to high returns but low risk.

Moving to the expansion stage, the fraudster uses the money of later investors to pay returns to earlier participants. At this time, investors will be attracted, causing them to continue reinvesting and attracting new people.

The third stage, saturation, occurs when the number of new investors gradually decreases and the cash flow begins to slow down.

Finally, there is the collapse stage. This is when investors gradually realize the abnormality or no longer receive the promised returns, causing them to request mass withdrawals. When this happens, the fraudster usually disappears with all the participants’ money.

Let’s take the OneCoin case, which was accused of being a Ponzi scheme in 2017, as an example to illustrate the above stages:

In the first stage, OneCoin presented itself as a cryptocurrency business with a technology different from Bitcoin. The project’s main business model was selling technology courses, and OneCoin promised that 5% of the total revenue would be paid to participants if they recruited new people

This plan gradually expanded and moved into the development stage when the project earned $4.3 billion from over 3.5 million participants between 2014 and 2016.

In 2016, OneCoin entered the saturation stage when the cash flow into OneCoin began to slow down as many investors questioned the real business model. The suspicion began to spread, leading to mass withdrawals by investors. In late 2016, the US Department of Justice began to investigate.

Finally, in October 2017, OneCoin was accused of Ponzi scheme fraud because the product was not real, and the courses were also accused of plagiarism. The project collapsed, and the leader of OneCoin fled with all the investors’ money.

In summary, the life cycle of a Ponzi scheme will follow the exact sequence above, and collapse is inevitable. Therefore, understanding each stage of a Ponzi scheme is essential, helping users identify and guard against promises of “high returns with low risk.”

Ponzi Events in the Crypto Market

Besides the prominent Ponzi events in the traditional market such as the mega-fraudster Bernard Madoff or the fraudulent billionaire Stanford… the crypto market has also witnessed Ponzi schemes that shook the world.

Some of the most notorious Ponzi schemes in crypto include:

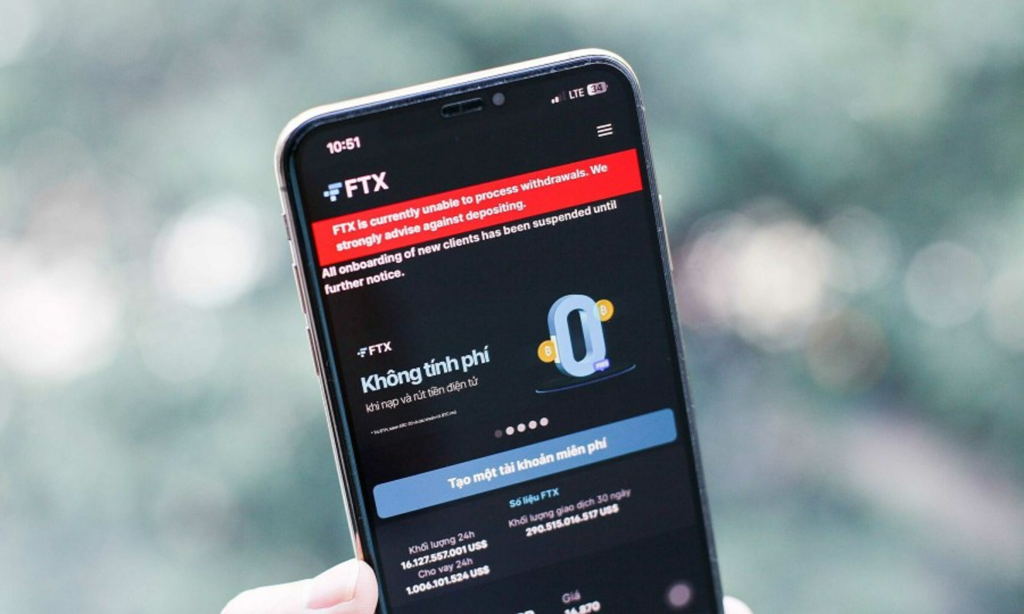

FTX – The Collapse of the Second Largest Empire in the Crypto Market

FTX was a cryptocurrency exchange founded by CEO Sam Bankman-Fried. Before facing a series of accusations and bankruptcy, FTX had the second-largest trading volume globally in 2022. The FTX Ponzi scheme event can be summarized as follows:

First, in 2019, FTX introduced itself to users as a cryptocurrency exchange and issued the FTT token to attract investment capital (in the form of an ICO).

After that, FTX continuously promoted through various marketing campaigns, both large and small. FTX’s campaigns often collaborated with celebrities and promised investors who bought FTT tokens could earn profits of up to 100 times (here).

The campaigns were indeed effective as more and more customers opened accounts on FTX to buy FTT tokens. By January 2022, the company reached a valuation of $32 billion.

However, the growth of FTX came to an end in November 2022 when CoinDesk published an article stating that Alameda Research – a company affiliated with FTX – had used users’ investment funds for unclear activities. Through the report, many investors discovered that all the returns they received were from the money of previous participants.

Finally, the US court intervened to conduct an investigation. On November 2, 2023, Sam Bankman-Fried was charged with 7 counts of fraud. According to the Securities and Exchange Commission (SEC): “FTX used investors’ money for personal purposes and to fund advertising campaigns to continue attracting new investors.”

After the incident, FTX announced that it had stopped withdrawals. This led to many investors being unable to get back their initial capital, with estimated losses of up to $1.9 billion, along with a series of related consequences when FTX went bankrupt.

BitConnect, the “Mega-Fraud” Ponzi Scheme

Besides the FTX event, a project nicknamed “mega-fraud” called BitConnect also caused $2 billion in losses for a series of investors.

Previously, at the end of November 2016, a project called BitConnect was launched to Vietnamese investors and approached users in the form of an ICO, through the BCC token. More than 1 million BCC tokens were sold at a price of about $1.84.

After 6 months of operation, on June 10, 2017, the BCC token reached a price of about $59.24, growing more than 50 times since its launch. This led to a series of investors starting to FOMO and participating in this deal.

However, on January 4, 2018, BitConnect suddenly received an emergency cease and desist order from the Texas Securities Board, with accusations that this organization had activities related to a Ponzi scheme.

Immediately after, BitConnect’s website continuously announced maintenance, restricting users’ withdrawal rights. Finally, on January 16, 2018, BitConnect announced it was shutting down and disappeared with all the investors’ money.

Learn more about the BitConnect scam here:

Signs of a Ponzi Scheme

The Ponzi scheme has existed for over 100 years and appears in many forms all over the world. However, Ponzi schemes often have these telltale signs:

- High investment returns with low risk: In reality, any investment carries a certain risk rate. In the case of OneCoin, users could have recognized this as a Ponzi project from the stage where OneCoin committed to huge returns but no risk.

- Consistent rate of return: No financial market guarantees stable returns. For example: Saving money in a bank is a safe form of investment, but returns can still fluctuate due to many factors such as supply and demand, economic situation…

- Vague product/business strategy: Ponzi schemers usually focus on psychology rather than concrete and detailed business plans. Therefore, any project that cannot demonstrate clear business operations or products and services is definitely a scam!

How to Avoid Ponzi Scams

In the traditional market, governments have issued many regulations to punish projects that defraud investors’ money, with penalties depending on the severity of the violation.

However, the crypto market does not have clear regulations and legal frameworks. Therefore, from an individual perspective, investors should still pay attention to some ways to limit the risk of falling into a Ponzi trap.

First, always be cautious of opportunities that seem too good to be true. Any investment opportunity has inherent risks. The principle of high risk – high return is almost always true in all markets.

Second, always question and thoroughly research information (Do Your Own Research) before making an investment decision, avoiding hasty investments based on calls from KOLs, relatives, family, etc. Be a wise investor and understand the opportunities you participate in by: researching the whitepaper, project information, team, technology, etc.

Finally, equip yourself with knowledge before actually investing in a model or product. Don’t let advertisements about profits or attractive invitations make you FOMO and decide to invest.

These are just a few tips that can help investors limit the risk of encountering Ponzi projects. Therefore, investors should always seek out other effective ways to protect themselves.

Some Frequently Asked Questions about Ponzi

Is crypto a Ponzi scheme?

No! Some people think that crypto is a Ponzi scheme, but this is a completely wrong ধারণা.

With a Ponzi scheme, the returns participants receive are based on the capital of new investors, while the profits investors earn from crypto come from participating in various activities such as trading, staking, farming, mining, etc.

Is a Ponzi scheme the same as a pyramid scheme?

In essence, both Ponzi and pyramid schemes are financial fraud by taking money from later investors to pay earlier investors, with a commitment to large returns.

The biggest difference between the two models is the requirement for investors to spend money. While the Ponzi scheme only requires investors to put out money to receive returns, the pyramid scheme requires investors to pay a fee or buy a product to participate.

How long do Ponzi schemes usually last?

The time this model operates depends entirely on investors. If there are still new investors participating, the model will continue to operate.

Read more: 19 Prominent Scam Types in Crypto