2025 is predicted to be the year for crypto to mature in terms of legality, welcoming more institutional investors and large-scale innovations before moving to the stage of widespread global adoption.

The year 2024 marked a significant turning point with the approval of Bitcoin and Ethereum ETFs, opening a transparent investment channel for institutions seeking access to the crypto market. Along with that, the stablecoin market capitalization continued its impressive growth, becoming a key driver for the recovery of the entire market.

According to a forecast from Forbes, the total crypto market capitalization could reach $8 trillion by 2025, thanks to the increasing participation of institutional investors.

Sharing this view, reports like The Crypto Theses 2025 (Messari), 2025 Crypto Market Outlook (Coinbase), along with opinions from large organizations such as Hashed, Bitwise, and VanEck, all emphasize that 2025 will be a special milestone when legal frameworks are finalized and implemented.

Timo Lehes, co-founder of Swarm Markets, stated: “2025 will be a challenging year with the emergence of legal regulations, bringing stability but also changing investor psychology.” All these factors indicate positive signs of an increasingly mature crypto market, ready to embrace large-scale innovations before entering the stage of widespread global adoption (mass adoption).

More ETFs May Emerge

While Bitcoin and Ethereum ETFs continue to attract investment capital, experts predict that 2025 will mark a further advancement of these products. Coinbase considers the US regulatory agency’s approval of crypto ETFs a “watershed moment,” opening up opportunities for both individual and institutional investors there.

According to Forbes, Bitcoin and Ethereum ETFs have attracted over $108 billion in assets under management (AUM) since their launch, demonstrating a huge demand with no signs of cooling down. Bloomberg further emphasizes: “These ETFs are in the top 0.1% of over 5,500 ETFs deployed over the past 30 years.”

Eric Balchunas, ETF analyst at Bloomberg, predicts “a new wave of ETFs” will explode in 2025, including Bitcoin-Ethereum combined ETFs, and even Litecoin, Hbar, XRP, and Solana ETFs. He also believes that the size of Bitcoin ETFs could “triple” and even surpass some gold ETFs, which are considered the standard of the traditional financial market.

“BlackRock, Fidelity and Ark Invest have been pioneering the way in bringing officially managed Bitcoin into the traditional financial system,” Forbes writes. This is the foundation for a wave of innovation with a focus on crypto-focused ETFs.

Stablecoins Will Penetrate Every Corner

2025 is expected to be a breakout year for stablecoins, when market capitalization could exceed $400 billion and daily trading volume could reach $300 billion, according to projections from VanEck and Bitwise Investments.

VanEck also believes that stablecoins will not just stop at a niche role in crypto transactions but will become “a core part of global commerce,” accepted by major tech companies like Apple, Google, and payment networks like Visa and Mastercard.

This development stems from four factors. First is a clearer regulatory framework, with the possibility that the US will enact comprehensive stablecoin regulations under the support of the current administration and with bipartisan consensus.

In Europe, the MiCA Law is expected to be officially implemented in early 2025, requiring stablecoin issuers to be licensed, while providing a legal corridor for financial institutions to participate in the market safely.

Furthermore, stablecoins have been deeply penetrating the fintech ecosystem. Stripe spent $1.1 billion to acquire the stablecoin platform Bridge, PayPal launched the PYUSD stablecoin, Ripple with the RLUSD stablecoin, while Robinhood announced plans to build a global stablecoin network. These advancements not only expand the scope of applications, but also contribute to increasing trading volume and total assets under management in 2025.

In addition to its traditional function as a financial tool, stablecoins now play a “central” role in innovating global payment channels. Michael Saylor, founder of MicroStrategy, stated: “If the US standardizes stablecoins, there’s no reason why banks and companies can’t issue $10 trillion backed by cash reserves.”

Kenneth Worthington, an analyst at JPMorgan, also shared: “Stablecoin regulation is a top priority for Congress, and if passed, it could create a breakthrough for the industry.”

With these drivers, stablecoins in 2025 will not only mature legally but also explode in scale and trading volume, gradually asserting their position as a “new asset class” in the global financial sector.

RWA, Tokenization, and the Potential for 50x Growth

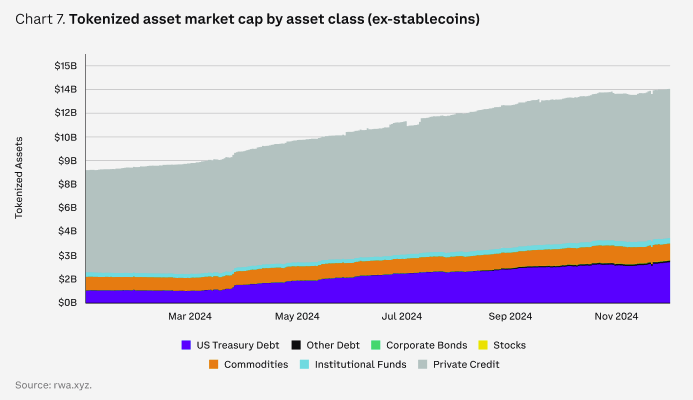

Real-world asset tokenization (RWA) demonstrated strong resilience in 2024, with a market capitalization increase of over 60% compared to the end of 2023, from $8.4 billion to $13.5 billion (excluding stablecoins), according to statistics from rwa.xyz and the Hashed Thesis 2025 report.

This trend is expected to explode further in 2025 as experiments enter the commercialization phase, paving the way for the “bring everything on-chain” trend of institutional investors.

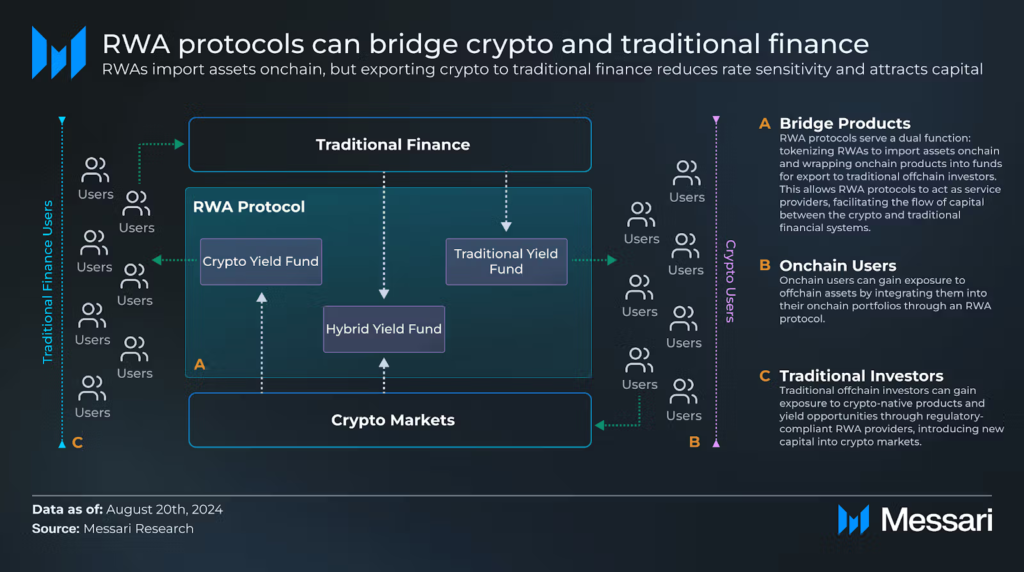

Tren Finance’s report sees the combination of traditional finance with blockchain technology not just as a trend, but also as a crucial transition towards a flexible and accessible financial ecosystem.

The tokenization sector could reach a valuation of “from a low of $2 trillion to $30 trillion in the next 5 years, depending on the interest rate environment and legal policies,” equivalent to a nearly 50x growth, according to Tren Finance.

Insights from Messari and Coinbase also indicate that tokenization is emerging as a bridge between traditional finance and the crypto world. Many banks and large investment funds have started bringing stocks, bonds, real estate, and even complex derivatives on-chain, creating 24/7 trading opportunities with lower costs and procedures.

The report from Coinbase emphasizes that the participation of institutions like BlackRock and Franklin Templeton in the tokenization of US Treasury bonds is a key driver in propelling this sector forward.

With RWA or Tokenization, global capital will flow more freely, while bringing opportunities for both investors and businesses in need of capital raising. According to Bitwise, tokenization also holds the potential to become one of the “biggest investment waves” since the ICO boom of 2017, but this time with much higher transparency and sustainable growth potential.

DeFi – Phoenix Rising from the Ashes

In 2025, DeFi is expected to become one of the main pillars of the digital economy, especially as the sector has just undergone an impressive recovery in 2024.

Once just an experimental “wave,” followed by the explosion of the “DeFi Summer” in 2021, DeFi is now moving towards a new sustainable growth cycle with notable milestones in terms of trading volume, TVL, and widespread adoption.

According to John Paller, founder of ETHDenver, the support of the current administration could create the perfect “launchpad” for DeFi in the US, where decentralized projects have the opportunity to access large capital flows and a clearer legal framework.

The “The Year Ahead for DeFi 2025” report by Delphi Digital indicates that DeFi will enter a sustainable growth phase by collaborating with traditional finance. Banks, insurance companies, and investment funds are predicted to start using DeFi platforms to issue and trade financial products.

Not stopping at growth indicators, DeFi is also welcoming a wave of technological innovation. Chain abstraction and cross-chain interoperability are addressing challenges in transaction fees, scalability, and user experience.

Notably, Bitcoin is also gradually integrating into the DeFi space thanks to Layer 2 (L2) solutions. VanEck estimates that Bitcoin-related TVL on L2 solutions increased by more than 600% in 2024 with a total value exceeding 30,000 BTC, showing an increasingly close connection between Bitcoin and DeFi.

The participation of institutional investors acts as an important catalyst, especially after Bitcoin and Ethereum ETFs were officially approved. Along with that, the legal environment is forecast to become increasingly stable in the US and Europe.

However, to maximize its potential, DeFi needs a balanced legal framework that both protects innovation and creates confidence for investors. In a recent interview with The Block, Jawad Ashraf (CEO of Vanar) emphasized the importance of clearly defining “whether a token is a security or not,” thereby opening a legal door for DeFi protocols to share revenue as a form of dividend to token holders.

This not only promotes the development of fee-sharing models (typically Uniswap and Aave) but also helps DeFi move closer to the professionalism of the traditional financial market.

2025 – The “Hinge” Year for the Crypto Legal Corridor

2025 is also considered a “hinge” year in terms of policy, as the global legal framework is becoming more complete.

From Europe with the MiCA law (Markets in Crypto-Assets Regulation) officially taking effect, to the US government continuously promising to promote the Stablecoin Act and remove many legal barriers.

In Asia, Singapore, the UAE, and Hong Kong are racing to become global “blockchain hubs.” Singapore granted 13 licenses to crypto exchanges and companies in 2024, the UAE also quickly implemented the Payment Token Service Regulation (PTSR), while Hong Kong has granted 7 licenses this year.

These transparent policies both strengthen investor confidence and attract more institutional capital, bringing DeFi in particular and the entire crypto sector in general closer to mass adoption.

Forbes predicts that the US could even become a “haven” for blockchain startups, once the SEC changes its approach and ends overly stringent policies, thereby attracting capital and talent from around the world.

Clarity in legal terms not only promotes short-term growth but also lays the foundation for a period of sustainable development. With momentum from ETFs, stablecoins, and DeFi, the crypto market in 2025 promises to mark a significant transformation, where blockchain technology is finally deployed on a large scale, fundamentally changing the way people transact, invest, and interact online.

What Will Happen to Bitcoin, Ethereum & Other Layer 1s?

Bitcoin and the “unthinkable” numbers in 2025

Bitcoin, born in 2009, has always been seen as a symbol of a store-of-value asset in the crypto world. In 2024, Bitcoin surpassed the $100,000 mark thanks to impacting macro and political factors.

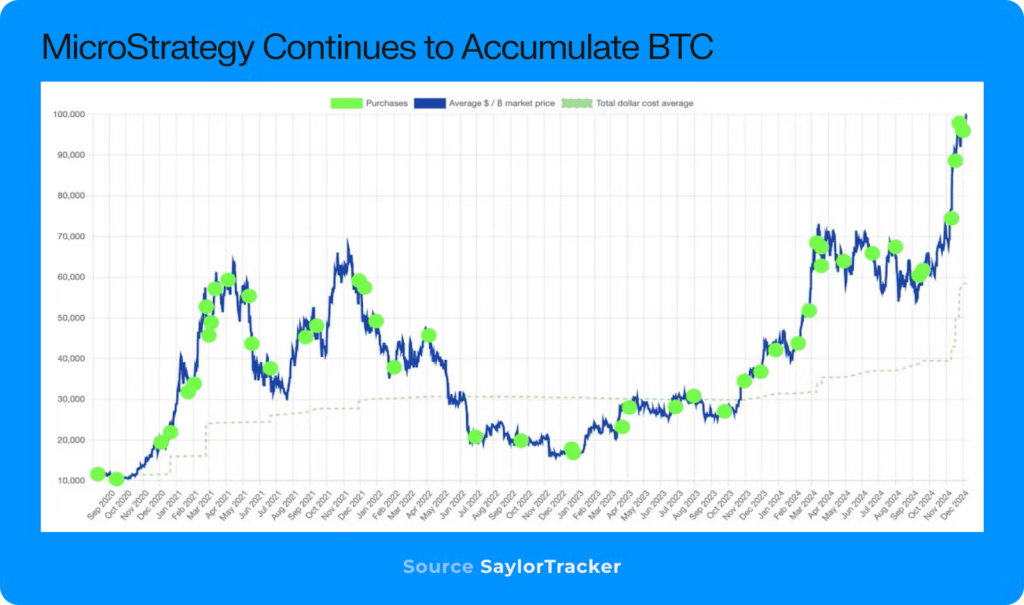

Michael Saylor and MicroStrategy continue to lead the wave of continuous Bitcoin purchases, with the statement “no limit” on the amount of Bitcoin they will hold. To date, MicroStrategy owns 444,262 BTC with an average purchase price of around $62,257, transforming Bitcoin from a purely speculative asset into “digital gold” – a safe haven in the face of global economic turmoil.

Entering 2025, reports from Messari and Bitwise suggest that Bitcoin’s store-of-value proposition could be further expanded, especially as more countries with unstable economies begin to add BTC to their national reserves. El Salvador pioneered this in 2021, but it wasn’t until 2024-2025 that other African or Latin American countries considered similar moves.

According to Forbes, Bitcoin will become a “strategic asset” for major nations in 2025. Notably, Forbes predicts that a G7 or BRICS nation could announce holding Bitcoin as a strategic asset, starting a “Bitcoin race” among the superpowers.

Not stopping at its role as a store of value, the Bitcoin ecosystem is expanding thanks to DeFi on Layer 2 solutions like Stacks, BOB, and Babylon with a TVL expected to far exceed $24 billion, attracting more capital compared to current wrapped Bitcoin solutions, breathing new life into this aging ecosystem.

Bitcoin Layer 2 solutions are considered to have advantages over wrapped Bitcoin because they minimize the risks of centralization and censorship, providing users with a safer and more efficient way to harness the potential value of Bitcoin.

Lightning Network has also made great strides in micropayment transaction speed and low fees, making the potential of Bitcoin for payment purposes clearer. In addition, a series of large investment organizations have given optimistic forecasts for the price of BTC. VanEck expects Bitcoin could reach $180,000 when the US officially recognizes BTC as a strategic reserve asset.

Bitfinex raised its forecast to $200,000, while Pantera Capital, based on the stock-to-flow model (a model for predicting Bitcoin price), is aiming for $114,000 by August 2025. Tom Lee (Fundstrat Global Advisors) alone believes Bitcoin could reach $250,000 if regulations continue to be supportive and the US government goes all-in.

In particular, Senator Cynthia Lummis’s draft “Strategic Bitcoin Reserve,” if approved, would make the US a pioneer in publicly accumulating Bitcoin, creating a foundation for the sustainable growth of Bitcoin and the entire crypto market.

Ethereum Is Sandwiched Between Bitcoin and Other High-Throughput Layer 1s

After successfully transitioning to the Proof-of-Stake mechanism and continuously upgrading the network with important updates (Shanghai, Dencun, followed by Pectra), Ethereum is expected to continue to play the “backbone” role of DeFi and many other decentralized protocols in 2025.

Currently, transaction fees have been significantly reduced after EIP-4844, coupled with the explosion of Layer 2 solutions, helping Ethereum handle millions of transactions per day without serious congestion issues, while attracting more new projects to join the ecosystem.

In addition, some reports predict that Ethereum will further benefit from a friendly regulatory environment, as the US government in 2025 will allow many financial institutions to confidently invest in DeFi, Restaking, and AI, which are areas where Ethereum is leading.

In particular, the approval of the Ethereum ETF (July 2024) has paved the way for institutional capital to access this ecosystem, helping ETH gradually gain recognition as a mainstream investment asset.

Although initially, the capital inflow cannot be compared to the Bitcoin ETF, the prospect of “deflation” thanks to EIP-1559 and the growth momentum of Layer 2 can push the price of ETH further in 2025, according to experts from Messari, Coinbase, and VanEck.

However, Ethereum also faces significant challenges. Some argue that Ethereum is being “sandwiched” between competing with Bitcoin in terms of “store of value” and confronting high-throughput blockchains like Solana, Avalanche, Sui, or Aptos in the decentralized application space.

Reports from Hashed and Delphi Digital indicate that to maintain its advantage, Ethereum must focus on improving the user experience while continuing to upgrade technology to ensure the network does not become too expensive or complex.

Therefore, if it can seize the opportunities from institutional investors, ETFs, DeFi, and AI, Ethereum can solidify its leading position as it enters 2025. But success also depends on how the network solves the problems of competition, scaling, and creating a more user-friendly experience for the millions of new users who will join the crypto world in the future.

Solana vs. Other Layer 1s: Maintaining the “Low Cost, High Speed” Advantage Amidst Fierce Competition

Solana enters 2025 with high expectations after the infrastructure improvement phase of 2023-2024, as the network continuously overcomes outages and attracts more developers.

Reports from Delphi Digital, Hashed, VanEck, Bitwise, and even Messari all emphasize that Solana is reaffirming its position as a “low-cost, high-speed blockchain,” ready to compete with Ethereum and many emerging Layer 1 and Layer 2 solutions.

Messari points out that fundraising activity on the Solana ecosystem reached $173 million in Q3 2024, the highest level since Q2 2022. This capital inflow seems to be reviving the Solana ecosystem, where users will benefit from a range of new on-chain products and services.

Messari also expects projects focused on prediction markets like MetaDAOs or DePIN projects like Energy Networks and Rome Protocol to lead the next wave of growth.

The report from Electric Capital shows that Solana has become the blockchain attracting the most new developers in 2024. Entering 2025, Solana not only continues to upgrade its core technology such as the full deployment of Firedancer (a new client developed by Jump Crypto), improvements in ZK Compression, and Token Extensions, but also expands to Layer 2 to maintain high speed and limit the risk of overload on the main network.

Notably, AI Agent is a prominent trend as some of the first AI Agent projects deployed on Solana, like ai16z, are a sign that the Solana ecosystem is not only embracing the AI x Crypto trend but also demonstrating a pioneering role in building next-generation decentralized applications.

Messari’s report also shows that institutions like VanEck, Bitwise, and 21Shares filed for Solana spot ETFs right after the US presidential election. This reflects the increasing demand for investment products related to SOL, especially in the context of Ethereum ETFs and Bitcoin ETFs having created a positive effect on the market.

If the Solana spot ETF is approved, analysts expect a large amount of institutional capital to flow into Solana, kicking off a new growth “wave” for the price of SOL and the entire ecosystem.

Lark Davis, an expert in the crypto field, predicts that Solana could reach a price of $300 to $600 by 2025. Meanwhile, VanEck has projected that Solana could reach a low of $200 and a high of $3,211 by 2030, however, the price of SOL could stabilize around $450 in 2025.

Solana also demonstrates its development potential by attracting new users and many prominent projects in the DePIN sector. Grass, Helium, and Render have considered Solana an ideal place to deploy decentralized physical infrastructure due to its low transaction fees and fast transaction processing speed. In addition, memecoins on Solana continue to be a hot topic, at one point accounting for 40-80% of the network’s daily trading volume.

Despite leading in the “low cost, high efficiency” segment, Solana cannot ignore the competition from emerging Layer 1s like Sui, Aptos, Monad, Berachain, Sonic, or the rising wave of Layer 2s on Ethereum. Messari notes that these competitors will focus on DeFi, AI, and Consumer dApps – three areas where Solana also has a leading advantage in 2024.

It can be seen that Solana’s advantage lies in “hitting the jackpot” of three major trends: memecoins, DePIN, and AI Agent. In addition, the SEC’s consideration of removing Solana from the list of “tokens that may be considered securities” helps reduce the regulatory burden, creating a friendly environment for innovative projects.

To anticipate the upcoming growth wave, Solana perhaps has to prove that the network is robust enough to handle large transaction volumes and avoid repeating outages. Solana’s success in 2025 and beyond will likely depend heavily on maintaining its speed, cost, and expanding the ecosystem “beyond memecoins,” while capturing support from institutional investors.

Which Narratives Will Lead the Market in 2025?

AI Agent x Crypto: A Breakthrough Model in the Crypto World

In 2025, AI Agent projects combined with blockchain technology are predicted to move beyond the experimental stage, getting closer to practical applications on a large scale. According to Messari’s analysis, “the emergence of AI Agents in crypto not only creates investment opportunities but also changes the way users interact with blockchain platforms.”

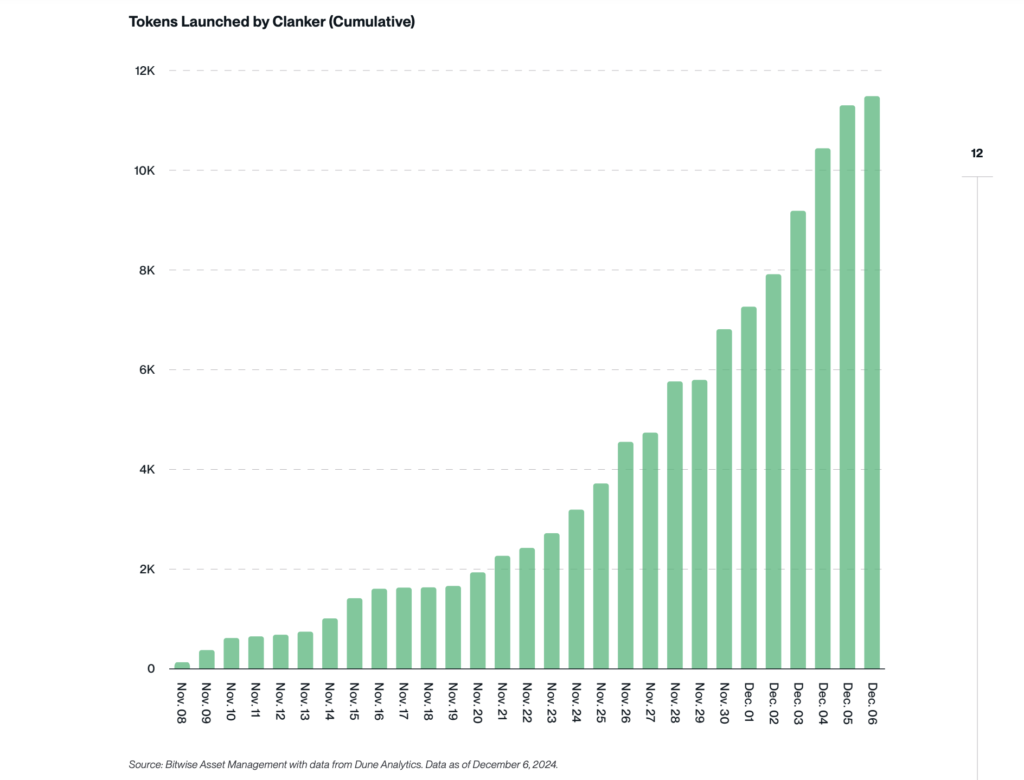

According to Bitwise’s forecast, “tokens generated by AI Agents will lead the memecoin craze even bigger than in 2024.” Also according to this report, Clanker – an AI Agent deploying automatic tokens on Layer 2 Base is the most “groundbreaking” application.

Users just need to tag Clanker on Farcaster, name and image the token, and the AI will automatically issue this token. In less than a month, Clanker has created over 11,000 tokens and generated over $10.3 million in revenue. This is expected to fuel a new memecoin wave in 2025.

Besides Clanker, a series of other AI Agents also contribute to shaping the AI x Crypto trend. Phenomena like ai16z, GOAT memecoin, or Agents like Terminal of Truths demonstrate the unique intersection of internet culture, memes, and AI technology.

Many projects have seized this opportunity to launch tokens, create communities, and even drive market capitalization up to hundreds of millions of dollars in a short time. Rishabh Goel, CEO of Credgenics, believes that “AI Agents will become an essential tool in optimizing decision-making processes in finance, especially in the crypto environment.”

Besides the “meme” factor, AI Agents are also expanding into the application space. Some Agents act as on-chain data analysts (AiXBT), others take on roles like AI-powered hedge funds (ai16z), along with many other applications.

These Agents are increasingly enhancing their ability to “self-learn” and “self-act” without human intervention. This presents both opportunities and risks, as tokens associated with Agents do not always possess sustainable growth value, with some trend-following tokens quickly experiencing a decline in market capitalization.

In this context, many experts predict that the AI x Crypto market can play a “dual” role: both as a tool for community building and fundraising, and as a representative channel for the broader AI trend.

While it is too early to say where this model will go, with the growth rate of the AI industry and the expansion of the crypto market, AI Agent is likely to become a focal point for innovation, attracting capital and creative ideas from both developers and investors in 2025.

DePIN 2025: Pioneering the Connection Between Real-World Infrastructure and the Crypto Market

According to data from Messari, 2024 marked an explosive phase for DePIN as the total market capitalization of this sector increased by more than 132%, exceeding $40 billion.

Projects like Helium, Render, Arweave, and Akash experienced impressive growth, while a series of emerging newcomers like grass, io.net, or DAWN also attracted hundreds of millions of dollars in market capitalization. Early-stage investment also increased by 326% year-on-year, suggesting a new DePIN lineup will soon launch in 2025

According to VanEck, “DePIN will become an important part of the blockchain ecosystem, helping to optimize the management of physical infrastructure and attract millions of new users to Web3 in 2025.”

This view coincides with the opinion from Bitget, the exchange stating: “In 2025, DePIN will witness an explosion in the application of blockchain technology to infrastructure projects, from renewable energy to data storage, creating a new economic model.”

The stories of Helium and Filecoin are testaments to the potential of infrastructure “crowdsourcing” – a model in which resources and infrastructure services are provided by a decentralized community. “DePIN networks like Helium and Filecoin are opening up great opportunities for crowdsourcing physical infrastructure, helping to reduce costs and enhance sustainability,” according to Chaincatcher.

Meanwhile, KuCoin emphasizes the governance aspect: “DePIN is not just a trend; it will reshape how we interact with physical infrastructure through the combination of tokenization and decentralized governance.

The report from Messari predicts that the total market capitalization of DePIN projects could exceed $50 billion by the end of 2025, as practical applications become more evident. “DePIN will become one of the fastest-growing sectors in crypto,” especially as the community recognizes the decentralized value of resource sharing.

In addition, the capital flowing into this sector is also substantial. Borderless Capital confirmed that it has “invested $100 million in the DePIN fund,” demonstrating confidence in the long-term development potential of this sector, not just in the coming year but also beyond. With the expansion of infrastructure and the support of institutional investors, DePIN in 2025 promises to contribute significantly to the development of global physical infrastructure.

Will Memecoins 2025 Attract More Newcomers?

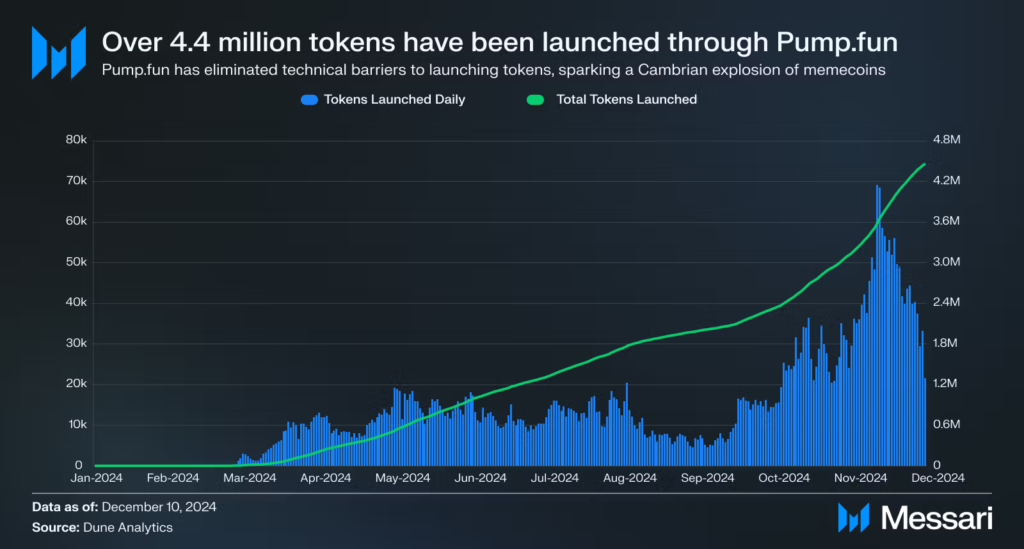

In 2024, memecoins were a focal point of attention in the crypto market, accounting for 6-7% of trading volume (excluding stablecoins) and recently reaching 11%, according to data from Messari. New trends such as political memes “Jeo Boden,” “Doland Tremp,” or TikTok (MOODENG, CHILLGUY) and AI Agent (GOAT, AI16Z) have driven trading volume on various chains to soar.

2025 is predicted to witness a new wave of memecoins even larger than the previous period, as Bitwise believes the emergence of tokens issued by AI Agents will create a new craze. Many experts also believe that memecoins will retain their appeal, although the market is seeing many trends such as AI and DePIN.

According to Forbes: “Memecoins will continue to maintain their appeal in 2025, with Dogecoin and Shiba Inu leading the list of the most beloved coins.” This view is consistent with BitDegree’s perspective: “2025 could be a breakout year for memecoins as many new projects emerge, attracting attention from both investors and the community.”

Meanwhile, Messari observes that “young investors” will continue to be attracted to the entertainment value, potential for quick profits, and accessibility of memecoins. For Coinbase, “memecoins were the best-performing sector in 2024 with tremendous growth (in terms of total market capitalization), and memecoin trading activity on Solana’s DEXs skyrocketed throughout Q4 2024.”

Despite the high risks, memecoins continue to grow steadily thanks to the power of the community. CoinDesk believes that “the combination of memecoins and DeFi can create new investment opportunities,” while CryptoSlate says 2025 may see the emergence of many memecoins integrating unique features.

All of these factors suggest that memecoins remain a significant highlight, attracting speculative capital and drawing new investors to the crypto market. Balancing risk and reward, along with the ability to apply memecoins in real-world scenarios, will determine whether they are just a temporary trend or become a long-term segment, developing sustainably alongside the market.

In particular, if they can effectively leverage the development of blockchain infrastructure and the AI Agent trend, memecoins can absolutely maintain their position as a launchpad to attract investors, contributing to expanding the user base for the entire crypto market

thank you