When token inflation occurs, the value of each token will decrease, and the asset value of investors will also be affected if supply exceeds demand

What is token inflation?

Token inflation is the increase in the number of tokens in circulation over time. When token inflation occurs, the value of each token will decrease, and the asset value of investors will also be affected if supply exceeds demand.

Here are some factors that can lead to token inflation:

- Increased number of tokens in circulation due to token unlock activities according to the roadmap schedule.

- The project is attacked, hackers create more tokens to put into circulation.

- Project activities encourage users to lock, staking helps reduce a temporary amount of circulating tokens. If these policies are less attractive, the amount of new tokens put into circulation is greater than the amount of tokens locked, also leading to inflation.

In summary, the main factors leading to token inflation include increasing the number of tokens, lack of demand for use, changes in issuance policies, market impacts, being attacked, and not being synchronized with market demand.

Read more: What is Token Unlock & Vesting?

When inflation occurs excessively because the project does not know how to control or does not have a long-term development plan, it will leave great consequences for the protocol itself and token holders.

The image above shows that OolongSwap abused token incentives to attract liquidity in the early stages, which has left major consequences for later on. Specifically, when the project used OLO to reward LPs, the large amount of tokens paid out caused OLO to over-inflate.

Supply exceeding demand caused the value of the token to decrease, so the price of OLO decreased from the ATH of 0.47 USD to 0.000223 USD (divided by ~2,100 times). The consequences that Oolong Swap had not only affected the project, OLO holders, but also negatively affected the entire Boba Network ecosystem at that time.

Analysis of short-selling speculation when unlocking tokens

Taking advantage of the inflation of the token after unlocking, some traders have implemented a plan to speculate on short selling to seek profit. But is this always true?

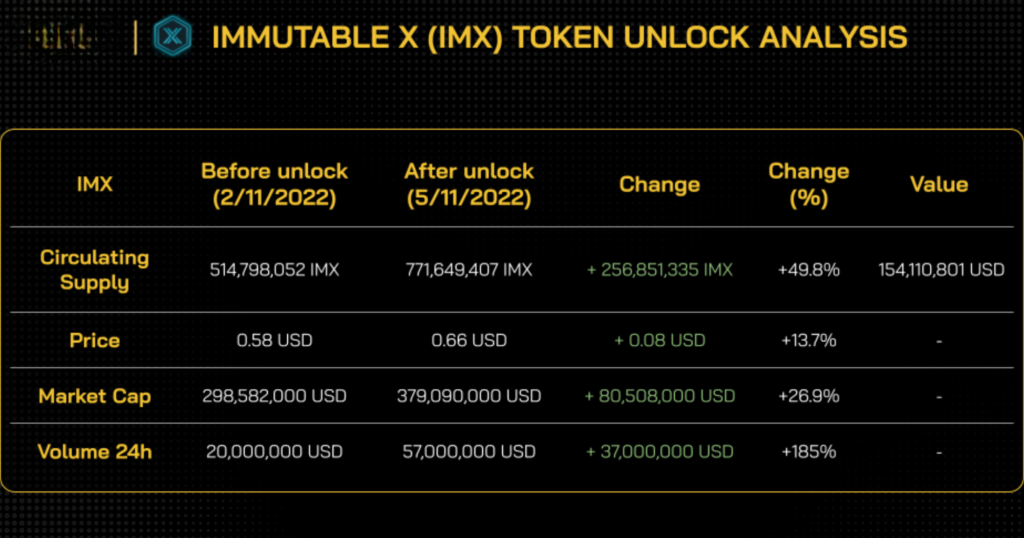

With a market capitalization of only 298 million USD, IMX has unlocked tokens worth up to 154 million USD (equivalent to ~52% of the market cap), while the 24-hour trading volume only reached 20 million USD. Will the price of IMX plummet as theorized?

Before the Unlock (November 2nd, 2022)

Circulating supply: 514,798,052 IMX

Price: 0.58 USD/IMX

Market cap: 298,582,000 USD

24h trading volume: 20,000,000 USD

After the Unlock (November 5th, 2022)

Circulating supply: 771,649,407 IMX

Price: 0.66 USD/IMX

Market cap: 379,090,000 USD

24h trading volume: 57,000,000 USD

Other Data

- Amount of tokens unlocked: 256,851,355 IMX

- % of tokens unlocked compared to total supply: 12.8% of the total supply of 2,000,000,000 IMX

- Market capitalization: Increased by 80,508,000 USD

- Value of unlocked tokens: ~154,110,831 USD (~0.6 USD/IMX)

The above data shows that despite facing the unlock pressure of up to 12.8% of the total supply with a value of about 154 million USD, the price of IMX still increased by 13% compared to before the unlock.

Conclusion

The case of IMX shows that unlocking tokens doesn’t always lead to a decrease in their price. On the contrary, the market capitalization of IMX increased by more than 240 million USD, helping the price of IMX increase by 13%. This could be a plan implemented by the ImmutableX team to avoid the significant impact of this unlock.

After a one-week unlock period, the price of IMX officially dropped to its bottom (0.382 USD/IMX). However, this did not last long as the price of IMX recovered thanks to the Layer 2 trend in the market (which took place from late 2022 to 2023).

Factors Affecting Token Inflation

Token unlock activities often affect the price of a project if their inflation rate is higher than market demand. Here are some factors affecting the inflation rate of tokens when they are issued.

Token Unlock Period

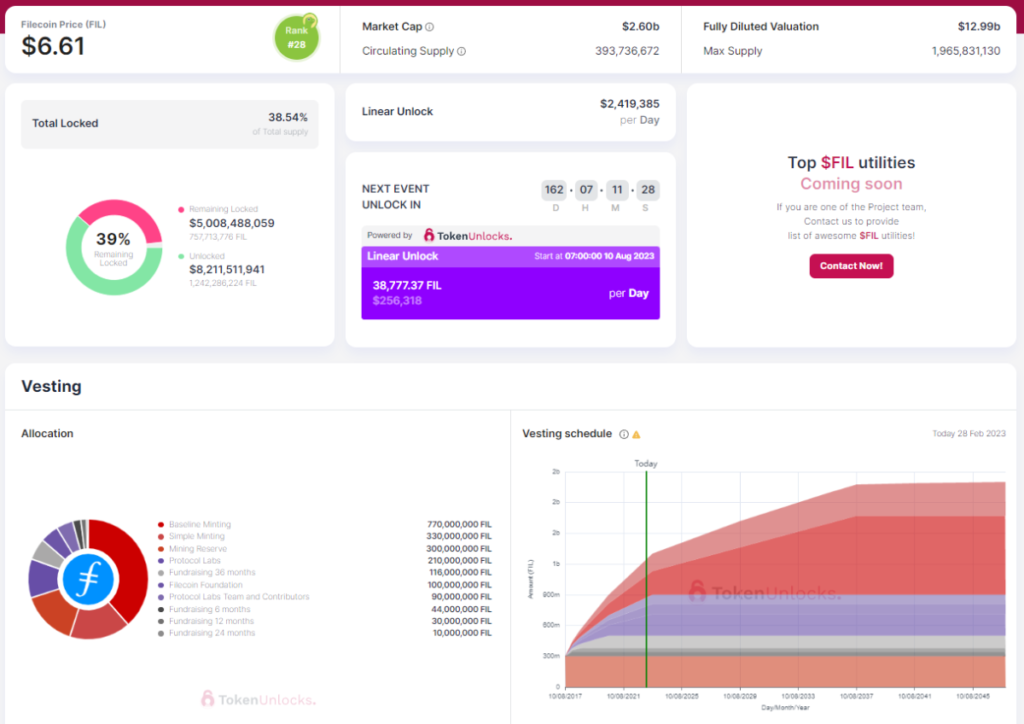

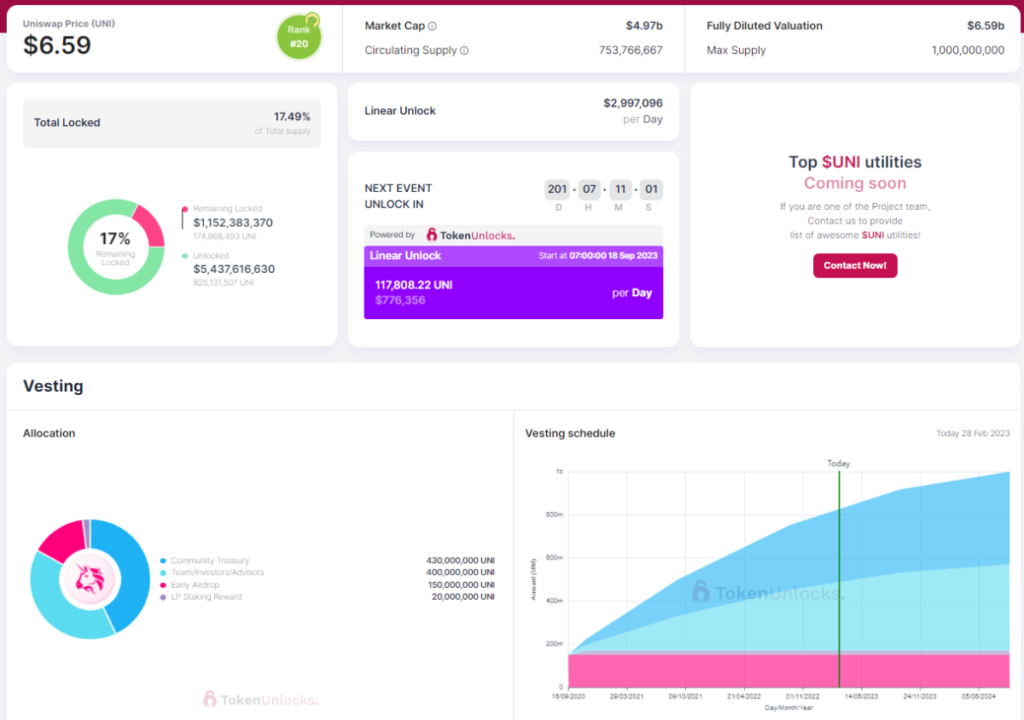

The token unlock period will partially reflect the inflation rate of that token in the near future. For example, the cases of Uniswap (UNI) and Filecoin (FIL) will clearly illustrate this.

Currently, Uniswap has unlocked 82% of its tokens, while Filecoin has only unlocked 63%. Theoretically, FIL will face more unlock pressure than UNI in the future. However, in reality, it’s the opposite because FIL’s vesting period is up to 40 years (until 2047 for a complete unlock), while Uniswap’s is only 4 years.

This results in UNI having higher unlock pressure per day than FIL until September 2024. After that period, FIL’s inflation rate will be higher than UNI’s. In fact, UNI has no total supply cap; Uniswap has set an inflation rate of 2% per year for UNI tokens.

Quantity & Value of Unlocked Tokens

The quantity and value of unlocked tokens will provide us with some data points for evaluation when combined with the following metrics:

- Market capitalization before the unlock.

- Fully diluted valuation (FDV) before the unlock.

- Trading volume of the token before the unlock.

- Number of tokens unlocked compared to the total supply.

If the value of unlocked tokens is too large compared to the market capitalization or trading volume, they will likely put significant downward pressure on the price. The following example will clearly illustrate this

From November 2021 to June 2022, Oasis unlocked 30% of the total token supply, equivalent to 2.9 billion ROSE (worth 667 million USD), while the market capitalization before the unlock was only 340 million USD and the trading volume was 50 million USD.

Compared to the market cap and trading volume at that time, this was a disproportionate unlock, causing the supply of ROSE to increase significantly while the demand was not sufficient to meet it. Therefore, after this unlock, the price of ROSE continuously slid from 0.5 USD to 0.066 USD (along with many other macroeconomic impacts).

Distribution Recipients

When tokens are unlocked and enter circulating supply, they are typically distributed to the following main groups:

- Development team and advisors.

- Project treasury.

- Community through incentive programs.

- Investors from Seed, Private, Public rounds, etc.

The same amount of unlocked tokens can have different impacts on the token’s price depending on the recipient. According to research by UnlockTokens, projects that allocate tokens to the core team and investors tend to have a higher market capitalization than projects that allocate more tokens to the community

Macroeconomic Conditions

In addition, token prices are also influenced by many other factors, especially macroeconomic conditions. Since 2022, macroeconomic flows have had an increasingly significant impact on crypto market flows.

Therefore, when the FED raised interest rates from 0% to nearly 5%, the withdrawal of funds from the market caused Bitcoin’s price to drop, which also had a ripple effect on the tokens of other projects, even if their token inflation rate was not high.

Project Tokenomics

Tokenomics have the strongest impact on inflation, thereby affecting the token’s price. Good tokenomics can maintain the token price during unlock events by establishing an economy that can support maintaining the value of the token after it is unlocked.

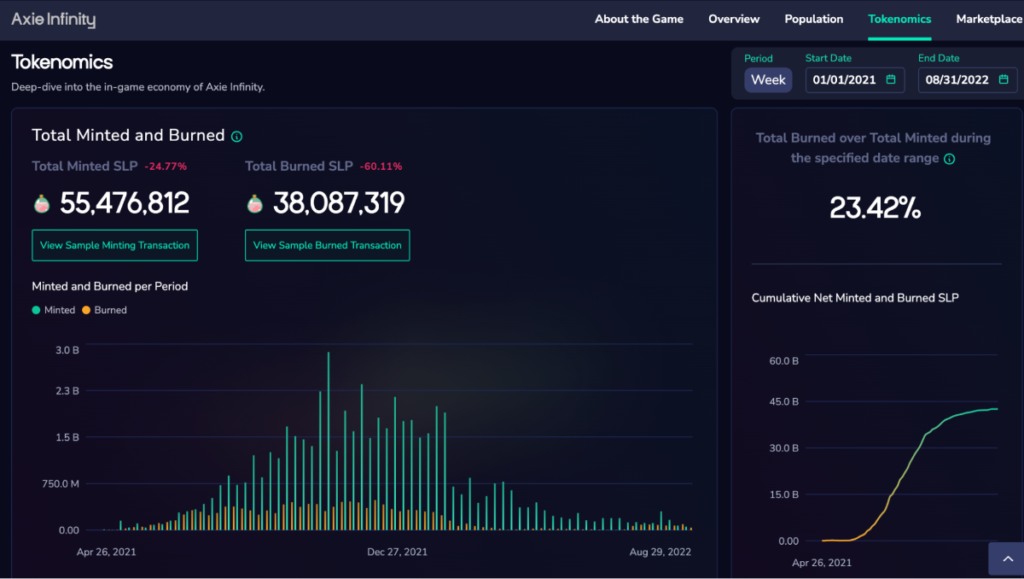

The case of Axie Infinity is a case study that shows the rapid rise and fall of GameFi projects when:

- Macroeconomic conditions are unfavorable.

- Funds are withdrawn from the market.

- Over-reliance on token incentives for growth leads to excessive token inflation

The image above shows the number of SLP minted from January 2021 to August 2022, which was also the period of Axie Infinity’s strongest growth, leading to the birth of hundreds of GameFi projects in the market.

During Axie’s golden age, a lot of SLP was minted to reward players (the blue column is much higher than the orange column). This was beneficial in the short term as it helped players earn more money, thereby attracting new players and bringing value to AXS – Axie’s native token.

However, when SLP experienced hyperinflation, causing its price to plummet from 0.3 USD to 0.015 USD (a 20x decrease), it also created a negative feedback loop, causing players, investors, and AXS’s market cap to decline sharply.

Recognizing the problem, the Axie team announced changes to the tokenomics of AXS and SLP in February 2022. However, this was not enough to improve the situation as the macroeconomic conditions worsened. Since May 2022, the FED has announced continuous interest rate hikes from 0% to 5%, causing capital flight from the crypto and GameFi markets.

Read more: Axie Infinity After x100 – Causes, Solutions, and Development Direction.

Solutions to Limit Token Inflation

Management, Monitoring, and Sustainable Project Development Measures

To avoid excessive token inflation, there are a number of solutions that token projects can apply, such as:

- Implementing long-term token lockups and distributing tokens in phases to limit the sudden release of tokens into the market.

- Strengthening token policy management to ensure that the number of tokens issued is in accordance with the plan and that the issued tokens are used for their intended purposes.

- Building a strong support community by creating a quality product, thereby enhancing community trust and support.

Tokenomics-Related Measures

The above are some solutions to help projects enhance their image and ensure long-term development. However, building effective tokenomics is still the best solution to help tokens avoid inflation and negative price impacts.

Here are some tokenomics-related solutions:

- Building comprehensive utility for the token, allowing it to be used to pay transaction fees, participate in launchpads, staking, liquidity providing, collateral for loans, etc. This is the model that Pancakeswap is applying for CAKE by creating many applications for CAKE

- If the token doesn’t have many use cases, create a mechanism for the project to capture value for the token. This is what Uniswap is doing with UNI. Instead of adopting Sushiswap’s revenue-sharing model, UNI holders only have governance rights. However, as Uniswap grows, UNI holders still benefit from the increase in token value.

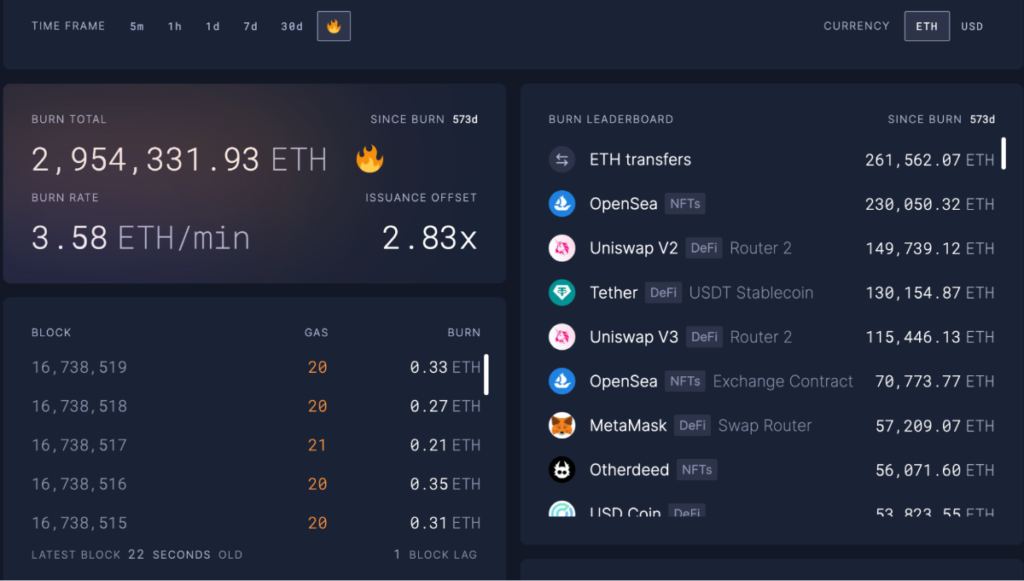

- Implement a burn mechanism to stimulate deflation. This model is adopted by many coins in the market, especially blockchain coins and CEX tokens. For the Ethereum network, they burn the base fee when users pay transaction fees. For BNB coin, they apply two burn sources: BEP95 and Accelerated BNB Burn.

Case Study: Changing Tokenomics

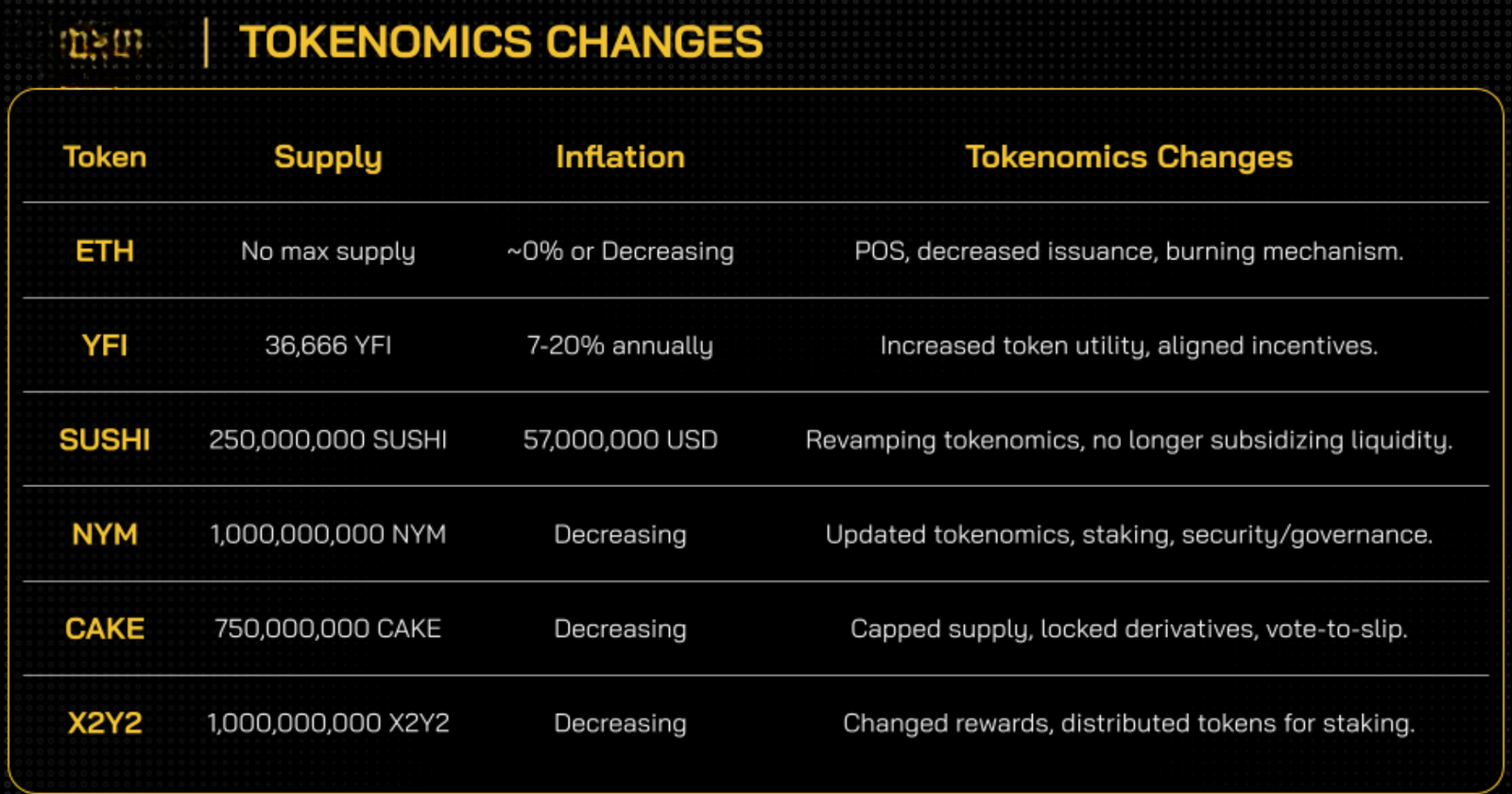

Factors within tokenomics such as supply and demand, transaction costs, supply limits, distribution, vesting schedules, and token burning all affect token value. Therefore, if there are issues with the tokenomics, the development team will make changes to adjust them

Here are some examples of projects changing their tokenomics to reduce inflation:

- Ethereum: After the EIP-1559 upgrade and the completion of The Merge, ETH’s inflation rate is close to 0% or even deflationary if the amount of ETH burned is high.

- Pancakeswap: Initially, CAKE was a token with no total supply cap. The amount of CAKE minted mainly came from staking rewards, and the burn mechanism came from user utilization of CAKE. However, the team switched to a mechanism with a limited supply of CAKE and increased the utility of CAKE to avoid excessive inflation.

- Sushiswap: Sushiswap’s operating model initially shared a portion of revenue with SUSHI holders and used SUSHI to reward pools. However, they removed the SUSHI reward mechanism due to the excessive inflation caused by rewarding pools.

Currently, it’s impossible to calculate the effectiveness of tokenomics changes on the token’s price, as the price is influenced by various factors, especially overall market sentiment. However, these changes do affect the token’s supply.

Conclusion

Therefore, token unlocks are not the main cause of price declines, but they can contribute significantly if the number of tokens unlocked is excessive, creating inflation. In addition, token prices are also influenced by other factors such as tokenomics, macroeconomic conditions, and overall market sentiment. Therefore, you should not rely solely on token unlock events to short a token without additional supporting data.