In summary:

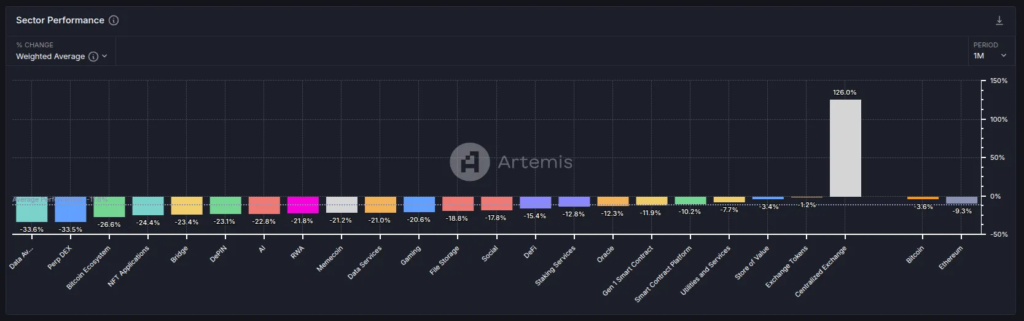

Exchange tokens have led growth during the market correction, achieving positive performance with a 126% increase over the past month, while other altcoins have declined sharply.

Increased trading volume supports the liquidity of exchange tokens, with spot volume on centralized exchanges (CEXs) holding at $150 billion, encouraging holding of exchange tokens due to benefits within the ecosystem.

Smaller exchanges have become a more attractive option, with tokens from smaller market share exchanges such as Bitget, MEXC, and Gate.io recording outstanding growth.

Trade with leverage, NO KYC required, and receive rewards up to $1030.Go to BingX now.

While the market is undergoing a correction, with many altcoins continuing to record deep declines and even returning to price levels from the beginning of last year, exchange-based tokens continue to be the top-performing group in the market. Centralized exchanges are showing signs of attracting and retaining traders with their own ecosystems.

Below are BeInCrypto’s findings and observations regarding the reasons why exchange tokens are holding their value in this context.

See more: Exchange-based tokens have the potential to surge as trading demand increases

Exchange tokens are the only altcoin group to show positive performance over the past month

According to BeInCrypto’s observations, exchange tokens led the market rally in December 2024. Entering 2025, the market’s upward momentum has stalled and is showing signs of correction. However, Artemis data shows that this altcoin group is the only one to maintain positive performance, with an increase of up to 126%. While the rest of the market shows negative performance, including Bitcoin.

As of this writing, the market capitalization has decreased by 14%, from a high of $3.7 trillion to $3.2 trillion. Of that, the altcoin market capitalization (TOTAL3) alone has dropped by 18%, from $1.16 trillion to $950 billion. Approximately $500 billion has flowed out of the market in the past two months. The fact that funds are still remaining in exchange-based tokens reflects the positive sentiment and expectations that investors have specifically for this group.

CoinMarketCap data shows that in the past three months, spot trading volume on centralized exchanges (CEXs) has consistently remained above $150 billion, twice the average for 2024. This has led to increased liquidity from exchanges, and traders are more inclined to buy and hold the exchange’s native token to receive benefits on trading fees or benefit from the exchange’s ecosystem.

Smaller exchanges become a potential option

According to CCData’s H2 2024 report, Binance continues to be the leading centralized exchange in the market with a 38.3% market share in both the spot and derivatives markets. This is also a record that the exchange has held for 57 consecutive months. OKX, Bybit, and Bitget follow with market shares of 14.0%, 13.0%, and 10.7%, respectively

However, if we observe the market, the exchange tokens that have increased in value the most are not those of exchanges with large market shares (such as Binance Coin (BNB) of Binance) but rather those of exchanges with smaller market shares. For example, Bitget only accounts for about 10% of the market share, but BGB has increased tenfold since August of last year.

According to observations of the crypto community in Vietnam, many investors tend to be interested in exchange tokens such as Bitget (BGB), MX Token (MX) from MEXC exchange, GateToken (GT) from Gate.io, CoinEx Token (CET) from CoinEx, OKB from OKX, HashKey Platform Token (HSK) from HashKey exchange, and Mantle Network (MNT) – a layer-2 solution from BitDAO that has ties to Bitget exchange.

Investors have a more favorable view of exchange tokens because they believe that as long as the exchange exists, there will be opportunities for growth, and the smaller the exchange’s market share, the greater the potential for price appreciation. Additionally, exchanges are also taking advantage of the recent uptrend sentiment by quickly listing newly launched tokens, attracting more users and investors to their native tokens.

See more: Top 10 best cryptocurrency exchanges for beginners in 2025

Join the BeInCrypto community on Telegram to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.

All information on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk