“Stablecoins will ‘eat’ payments” is the conclusion of a16z crypto when discussing the potential development of stablecoins. From small retail transactions to multi-billion dollar cross-border deals, stablecoins are gradually asserting their position.

Comprehensive Payment Solutions for Businesses and Individuals

The applications of stablecoins are connecting the world, benefiting multinational businesses and workers abroad.

Remittances

This is the most prominent application of stablecoins. Do you have relatives abroad who want to send money back home? Instead of having to go through traditional money transfer channels with high fees and long waiting times, users can use stablecoins to transfer money almost instantly with significantly lower fees.

According to a report by a16z crypto (2024), sending $200 from the US to Colombia using stablecoins costs less than $0.01 in fees, while using traditional channels can cost up to $12.13.

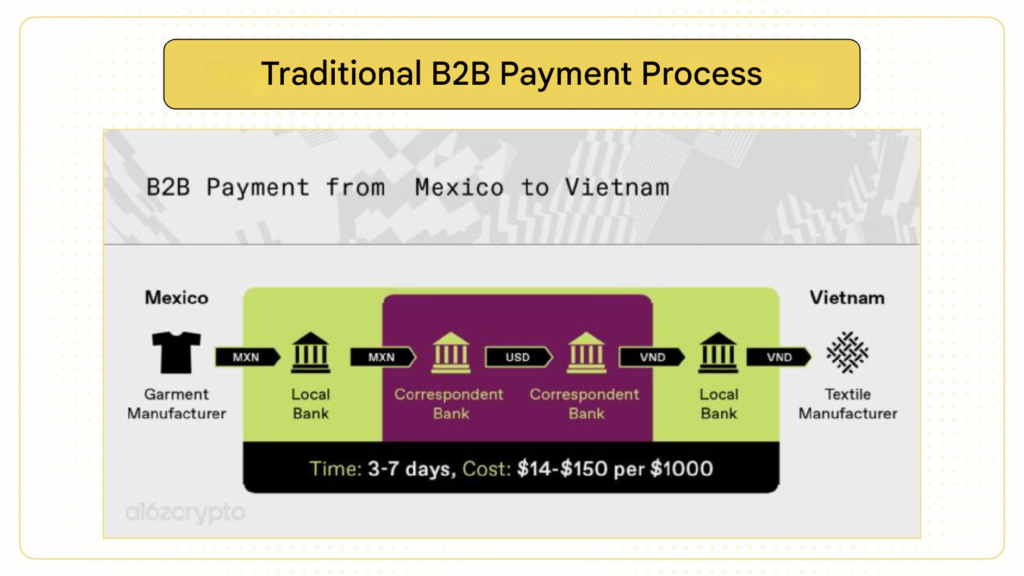

Cross-border B2B Payments

Businesses no longer have to struggle with cumbersome procedures and expensive fees for international payments. Stablecoins make payments between businesses in different countries easier and faster than ever.

“Stablecoins are emerging as an optimal choice for building robust payment systems on the blockchain platform. They not only make remittances easier but also contribute to significantly simplifying cross-border transactions,” said a report by Coinbase Institutional (2024)

Instead of taking several days, even a week, for money to reach your partner, you can complete the transaction in just a few minutes, 24/7/365, thanks to stablecoins.

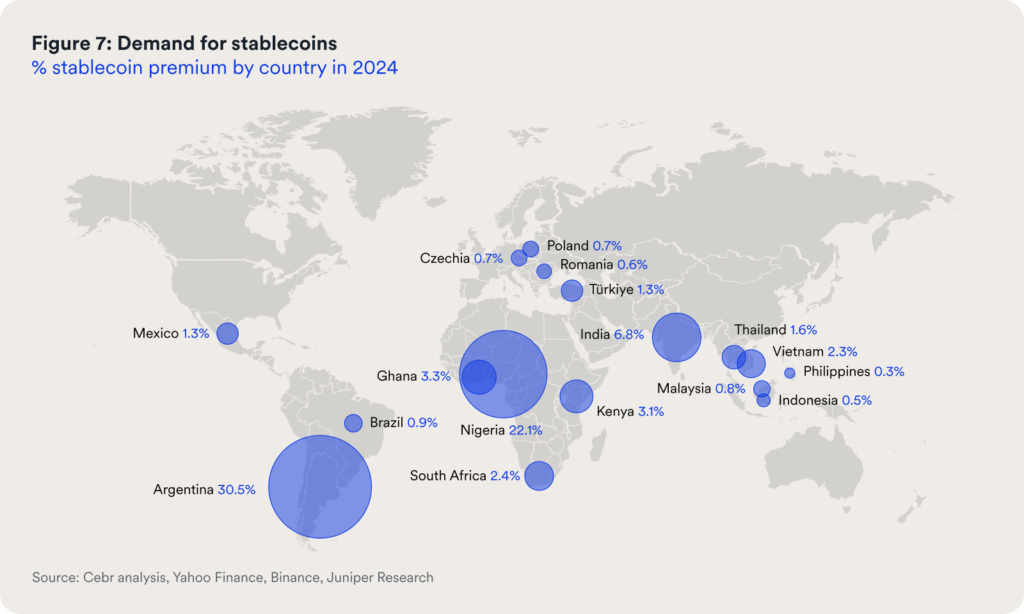

Demand for stablecoins is soaring, especially in emerging markets, as evidenced by businesses in 17 countries paying an average of 4.7% in fees to access this digital currency.

Global Payroll

With the rise of remote work, paying employees around the world has become complex. Stablecoins address this issue by providing a fast, transparent, and low-cost payroll solution.

“Instead of paying salaries in fiat currency, employers can convert the funds to FDUSD and then pay them into each employee’s on-chain salary account. Employees can then exchange FDUSD for CBDC (national digital currency) in their home countries,” said Vincent Chok, founder of First Digital.

Avoiding Domestic Currency Inflation

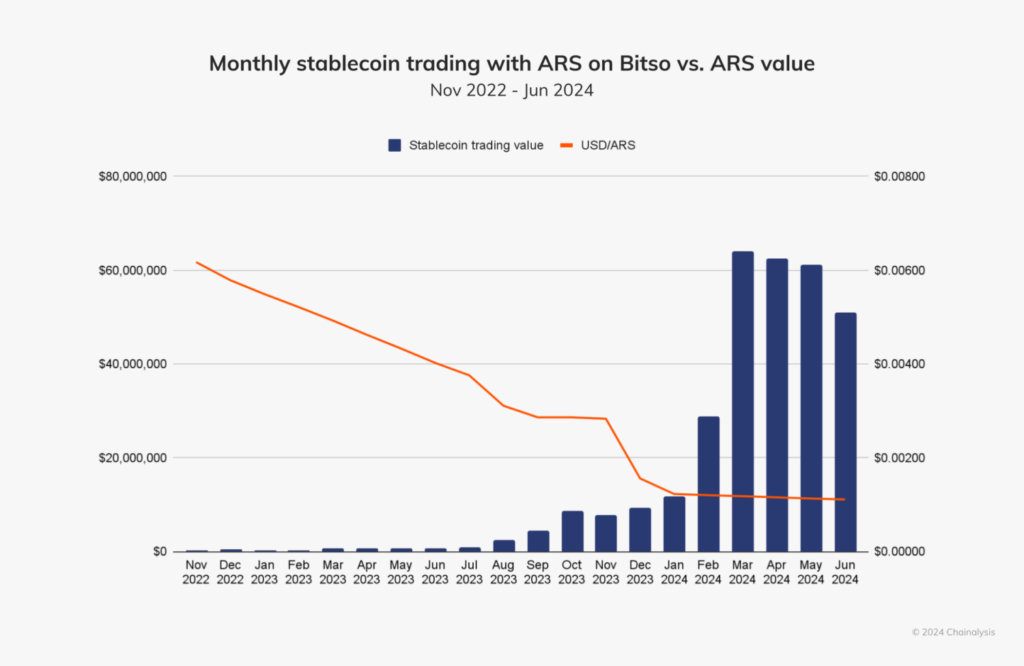

Every citizen in a country must hold a certain amount of cash to pay for daily transactions. However, for people in Argentina, holding the local currency ARS has become a “nightmare” with inflation reaching 143% in 2023.

In Latin American countries like Argentina, stablecoins pegged to the US dollar (such as USDC, USDT) are emerging as an alternative to the local currency, and now account for more than 60% of retail crypto trading volume

Stablecoin trading volume on Bitso, the leading crypto exchange in Latin America, has surged in correlation with the devaluation of the Argentine peso, especially after the “economic stimulus package” that caused the value of ARS to plummet by 50%.

E-commerce

E-commerce platforms are also gradually integrating stablecoins for payments and to settle merchant transactions. This helps save costs, shorten payment times, and create a more seamless shopping experience.

Research by Deloitte shows that 85% of merchants believe that digital currency payments will become mainstream within the next 5 years. Similarly, contactless payments, often using smartphones, are expected to grow by more than 210% in the next 5 years.

These trends will make it easier for millions of consumers worldwide to use digital currencies for online and in-person transactions, as digital wallets gradually become a more common way to store, spend, and exchange value.

Where do Stablecoins Outperform Traditional Payments?

Speed, cost, or accessibility are some of the advantages of stablecoin payments that traditional methods find difficult to match.

Instant Money Transfers

Traditional payment systems like SWIFT often take several days to complete international transactions, while stablecoins can complete transactions almost instantly.

The CEBR (Centre for Economics and Business Research – UK) estimates that using stablecoins can help reduce payment times by 3-6 days. This is especially important in the business world, where speed and efficiency are core factors.

Low Costs

Traditional payment systems often come with various fees, including transaction fees, foreign exchange fees, and intermediary fees. Meanwhile, stablecoins can significantly reduce these costs.

As mentioned, sending money with stablecoins can save up to 99% in fees compared to traditional channels. This is an advantage for stablecoins to penetrate retail transactions and emerging markets.

Accessible to Everyone

Anyone with an internet connection can use stablecoins, regardless of geography, income, or bank account status. This creates access to financial services for millions of unbanked people worldwide.

“Due to the cost and complexity of complying with global KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, many banks do not offer accounts to low-income individuals.

In countries like the Philippines and Indonesia, more than half of the adult population is unbanked. Therefore, stablecoins have become a way to build a personal financial foundation,” said Vincent Chok of First Digital.

Transparency and Programmability

Stablecoin transactions are recorded on the blockchain – a public and transparent ledger. This helps enhance the transparency and auditability of transactions compared to traditional banking systems.

In addition, stablecoins can be programmed to automatically execute transactions when certain conditions are met. This characteristic opens up many innovative applications in the future, from smart contracts to automated payment systems.

The founder of First Digital envisions a future where “musicians compose music in the form of NFTs, and every time someone downloads the music, royalties are paid back to the author’s wallet using stablecoins.”

The Future of Global Payments?

The stablecoin market has witnessed impressive growth, with the total market capitalization reaching $210 billion by the end of 2024, a 61% increase from the beginning of the year. A report by Coinbase Institutional predicts that this figure could reach $3 trillion in the next 5 years.

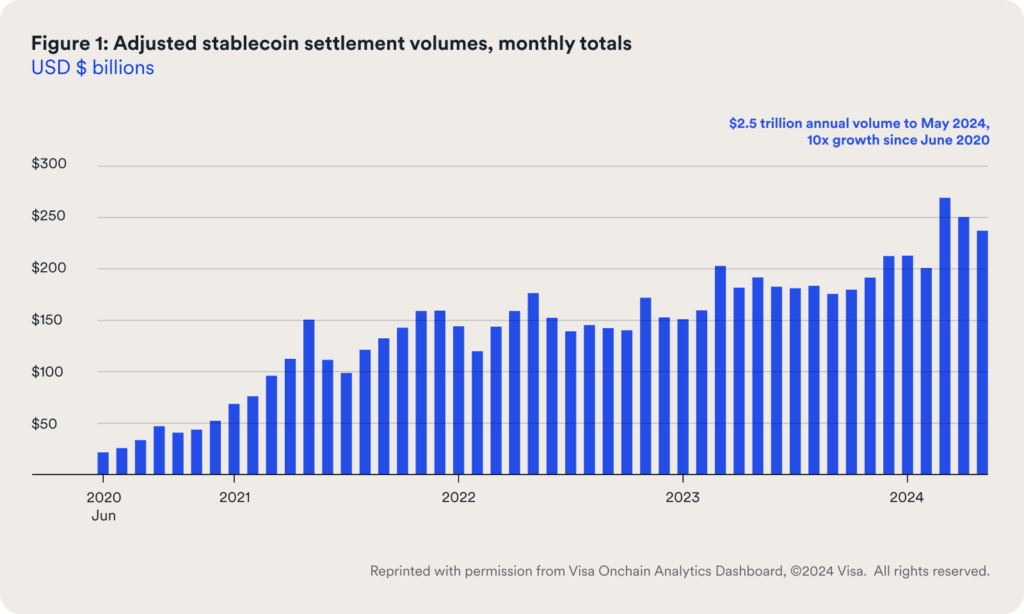

Furthermore, stablecoin trading volume has nearly tripled, from $9.3 trillion in the first 11 months of 2023 to $27.1 trillion in the same period in 2024, showing that the demand for using stablecoins is increasing rapidly.

Visa also released data showing that $2.5 trillion in stablecoin payment volume was made (including inside and outside the crypto market) in the 12 months to May 2024, a 10-fold increase from June 2020.

To fully exploit the potential of stablecoins in payments, developers need to overcome regulatory and infrastructural challenges. Currently, regulations on stablecoins are not yet uniform globally, causing instability and difficulties for businesses operating in this field.

However, regions like Europe are leading the way with MiCA (Markets in Crypto-Assets Regulation), creating a comprehensive legal framework for stablecoins and opening up opportunities for innovation. In Brazil and Mexico, the banking system has also integrated USDC, allowing citizens to easily convert between their local currencies (peso, real) and this stablecoin.

With these outstanding advantages, could stablecoins truly be the future of global payments, replacing traditional methods?