The entire crypto market, especially Bitcoin, is suffering a sharp decline – a consequence of the Fed’s tough stance in 2025.

“FED Has No Plans to Hold Bitcoin”

Recently, the Federal Reserve (FED) cut interest rates by 0.25%, and Chairman Jerome Powell signaled that the pace of rate cuts would slow in 2025.

Although this rate cut was anticipated, the announcement of only two 0.25 basis point cuts in 2025 – lower than the 3-4 cuts expected by the market – has caused concern among investors.

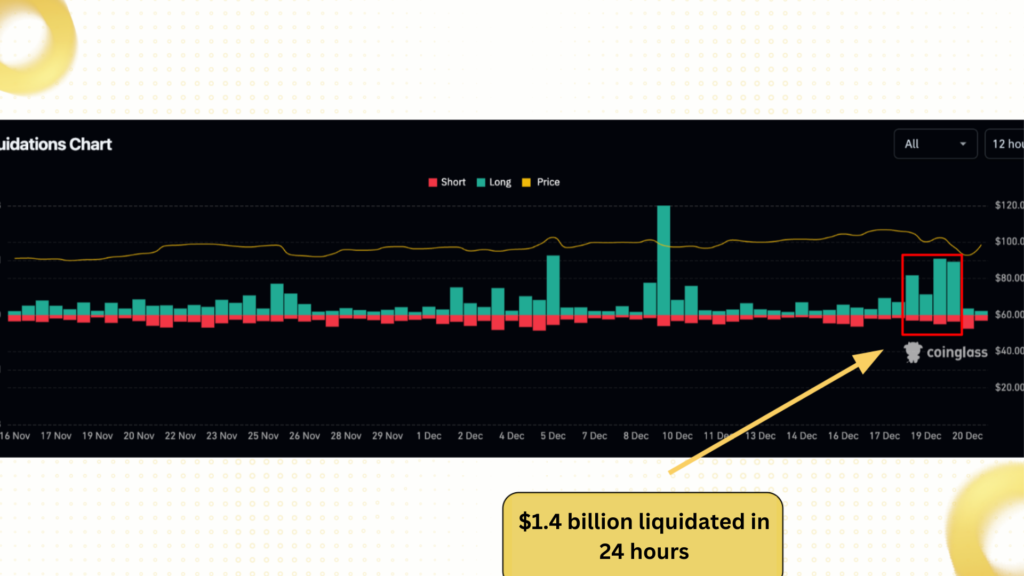

Immediately following the FED’s move, Bitcoin plummeted from a high of $108,000 to a low of $95,587 during the trading session. According to data from CoinGlass, on December 19th, over $1.4 billion in assets were liquidated in the derivatives market, while Bitcoin Spot ETFs recorded a net outflow of up to $680 million – marking the most dismal trading session since the beginning of this year.

“The ETF sell-off is the clearest evidence that institutional investor sentiment is wavering. They don’t want to take on more risk with the Fed maintaining a more cautious stance on interest rates,” said an expert at The Block.

This effect was not limited to Bitcoin; altcoins also experienced a sharp sell-off, with Ethereum dropping 12% to $3,245. Additionally, on December 19th, XRP, BNB, Solana, Dogecoin, Cardano, and Tron all saw declines of up to 22% within 24 hours. According to data from CoinGlass, position liquidations were the main cause of the widespread altcoin price drop, leading to panic across the market.

Furthermore, at the Federal Open Market Committee (FOMC) meeting, Powell also stated: “The Fed has no plans to hold Bitcoin. This falls under the authority of Congress, and the Fed is not currently advocating for any changes to the law.”

Powell’s comments were not just aimed at Bitcoin, but also highlighted broader economic challenges. In his speech, he warned that inflation remains a “persistent challenge” and that interest rate cuts will be implemented cautiously. This dampened expectations that monetary policy would become more accommodative in 2025.

Notably, these statements have cast doubt on one of the main drivers of the recent market rally: the expectation of greater institutional participation.

Read more: Why Does MicroStrategy Keep Buying Bitcoin?

Investors Remain Optimistic About 2025

Furthermore, the Fed’s assertion that it is not allowed to own Bitcoin has raised concerns among investors that the US government’s plan to build Bitcoin reserves may face difficulties. Meanwhile, this is something that many people hope will help the US combat inflation, as stated by Senator Cynthia Lummis, who proposed the Strategic Bitcoin Reserve Act of 2025.

“The integration of Bitcoin into the financial reserves of US states can help fight inflation and strengthen financial resilience in the face of global economic uncertainty,” she said.

The integration of Bitcoin into the financial reserves of US states can help fight inflation and strengthen financial resilience in the face of global economic uncertainty.” – US Senator Cynthia Lummis

This year has been a strong growth year for Bitcoin, with a 130% increase. This was driven by expectations that the incoming Trump administration would ease regulations on the crypto industry. Although the Fed’s move has dampened this belief, some investors remain optimistic about Bitcoin’s prospects for next year.

“Bitcoin is cyclical. As in previous cycles, we have seen hesitation before psychologically important price milestones at the end of the year. This time it is the $100,000 mark and the growth that follows – driven by both hype and the liquidation of short positions,” said analyst Alex Kuptsikevich of FxPro. “Such cyclical repetition sets the stage for further Bitcoin growth next year.”

Meanwhile, traders at Singapore-based QCP Capital said: “Don’t exit your positions even if the price drops. With the market predicted to rise in 2025, especially when Trump takes office, maintaining your previous investment roadmap could give you an advantage.”

Read more: Is Bitcoin the Perfect Solution to Inflation?