The degen strategy is popular in the crypto market because it offers great profit potential. However, investors pursuing this strategy face extremely high risks. Let’s learn about degen to have a reasonable investment strategy.

What is a Degen?

“Degen” is short for “degenerate.” While it generally means “to decline morally,” in the crypto context, it refers to reckless investors with high-risk investment strategies who are not afraid to pour money into new, unproven projects, often of a speculative nature.

They often don’t spend time thoroughly researching a project but instead make decisions based on emotions, FOMO (Fear of Missing Out), or short-term market trends.

The assets or projects that “degen” investors participate in typically include meme coins, DeFi projects with high-yield but risky yield farming protocols, or NFT projects without a clear use case.

The main characteristics of a degen investor include:

- High risk: They are willing to accept large risks, ignoring factors such as liquidity or technical analysis.

- Seeking quick profits: Degens aim to reap large profits in a short time, sometimes within days or even hours.

- Trend-based investing: Instead of relying on in-depth analysis, they often chase short-term trends on social media or breaking news.

Why are “Degen” Strategies Common in the Crypto Market?

The crypto market, with its highly volatile and unregulated nature, is fertile ground for high-risk speculative strategies that can yield big rewards. Factors attracting degen investors include:

Quick Profits, But Unforeseen Risks

In crypto, the opportunity to make short-term profits is huge. Part of the popularity of degen strategies comes from the potential for the value of coins or tokens to increase dramatically in a short period.

A prime example is Shiba Inu (SHIB), launched as a Dogecoin competitor. These dog-themed tokens were dubbed “Dogecoin killers” and quickly attracted investors thanks to support from the meme community.

In early 2021, the price of SHIB was almost worthless, but by October 2021, it had reached an all-time high of $0.00008845, recording growth of 40,000,000%.

Early investors witnessed this tremendous increase, multiplying their assets many times over in just a few months. However, the price of SHIB fell rapidly after peaking, clearly showing the risk of investing in coins without a solid foundation.

The Power of Community and the “Meme Coin” Craze

Degen strategies are not only driven by the expectation of large profits but also by the power of the community.

Meme coins like Dogecoin (DOGE) are prime examples of this. Dogecoin was originally created as a joke in 2013, but it became a real phenomenon in 2021 when its value soared thanks to support from Elon Musk and the online community.

Since the beginning of 2021, the price of DOGE has increased from under $0.01 to a peak of $0.74 in May 2021, equivalent to an increase of over 7,000%. This is a large number for any financial asset.

After Elon Musk appeared on Saturday Night Live in May 2021, the price of Dogecoin plummeted by more than 40%, from around $0.70 to $0.44, wiping out $22 billion of DOGE’s market cap. This shows the unsustainability of investing based on emotions and community trends.

DOGE’s massive growth stemmed mainly from trends on forums like Reddit and X, along with the FOMO mentality. Investors flocked to DOGE after seeing viral memes and hoping to double or triple their investment in a short period.

DeFi and Yield Farming: Opportunities and Risks

Not just meme coins, degen investors are also attracted to DeFi protocols and yield farming projects that offer “huge” interest rates. With yield farming, you can earn rewards in the form of tokens, with interest rates that can reach thousands of percent per year.

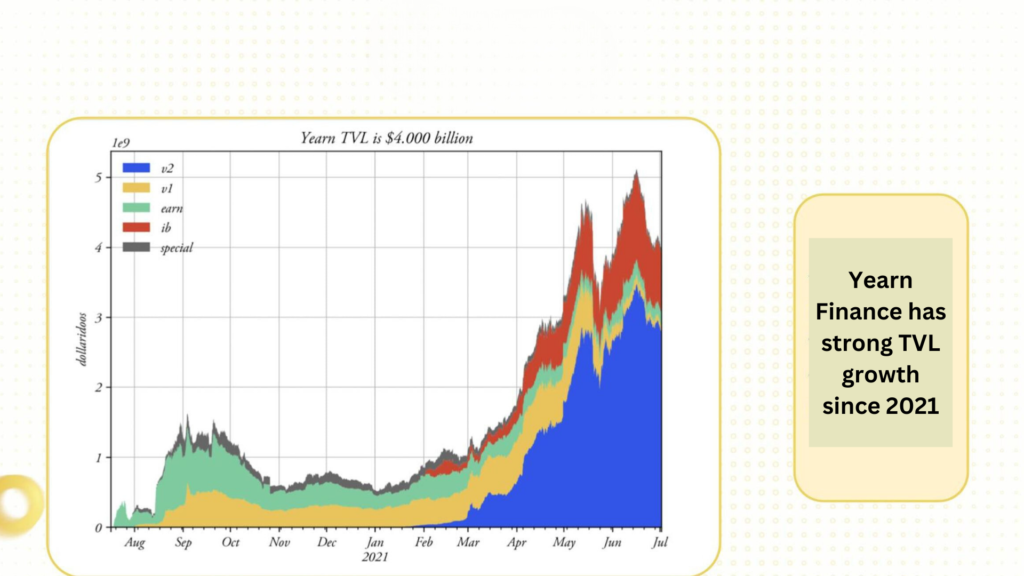

Yearn Finance (YFI) is one of the most prominent DeFi tokens. After its launch in 2020, the price of YFI increased from $3,000 to over $40,000 in just a few months. Early participants earned large profits from providing liquidity and staking, but the DeFi market is fraught with risks like rug pulls – where developers withdraw all liquidity and leave investors with worthless tokens.

In addition to successful projects, there have been a series of DeFi protocols that have failed or been attacked. In 2020 and 2021, DeFi hacks caused billions of dollars in damage. For example, in August 2021, the Poly Network platform was hacked, losing over $610 million, causing many investors to lose their entire investment.

FOMO Mentality and Lack of Transparency

The FOMO mentality plays a huge role in promoting degen strategies. When they see coins or tokens rising sharply, new investors are easily drawn into the temptation of quick profits and ignore the associated risks. In particular, projects that are not transparent about their development team, liquidity, or long-term goals are often the focus of degen investors.

Squid Game Token (SQUID), inspired by the hit Netflix series, skyrocketed to $2,861 in just a few days after its launch in October 2021. However, not long after, the development team performed a rug pull, causing the token price to drop to almost zero and thousands of investors lost all their assets.

Read more: Fear of missing out in crypto and the final realm of FOMO.

Unregulated Market and Decentralization

Crypto thrives in a decentralized environment that lacks oversight from traditional regulatory agencies. This allows projects to launch easily without adhering to strict regulations, attracting investors with novelty and the opportunity for quick profits.

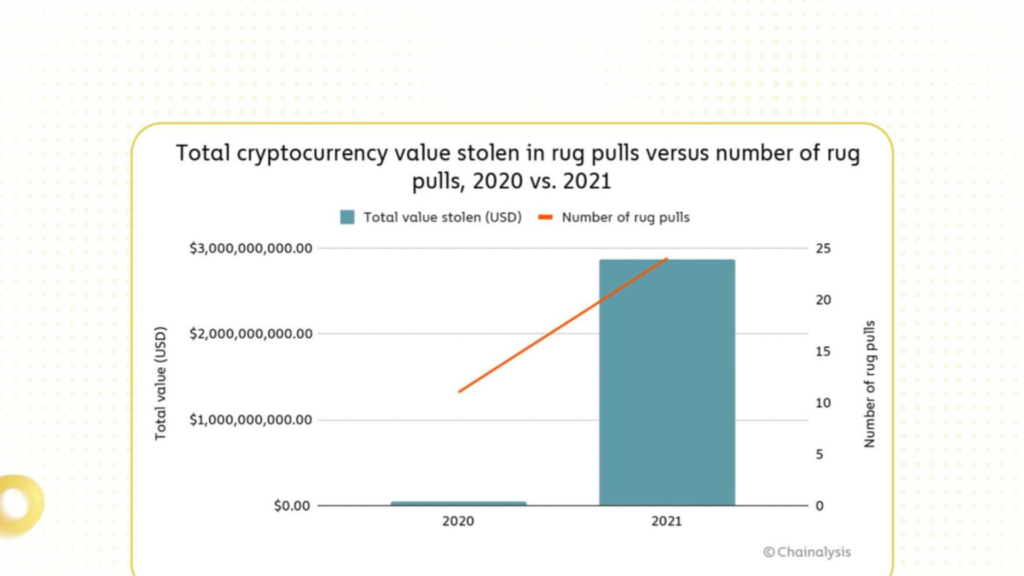

According to a 2021 report from Chainalysis, rug pulls accounted for more than 37% of all cryptocurrency scams, equivalent to about $2.8 billion that year. This shows that while profit opportunities are real, the risk of fraud and loss of money is also very high in this unregulated environment.

“Ape In” Investment Strategy of Degen Investors

In the context of the crypto market, “ape in” is the act of investors pouring money into an asset or token without in-depth research or fundamental analysis.

Instead of considering factors like the development team, the token’s real-world applications, or liquidity, “ape in” investors often rely on news, FOMO, or hype on social media. Therefore, this strategy is extremely popular with degen investors.

“High Risk, No Return”

While the “ape in” strategy can bring huge profits, it often comes with significant risks. Investors are easily drawn in by hype and FOMO, leading them to invest in projects with high liquidity or security risks. Rug pulls like the Squid Game Token or the collapse of many DeFi protocols show that without careful analysis, investors can easily lose their capital.

Learn: Identifying signs & how to avoid Rug Pulls.

Or “High Risk, High Return”

However, in some cases, this strategy still brings large profits, especially if investors get in on projects early. Those who bought Dogecoin or Shiba Inu in early 2021 saw their assets appreciate by tens of thousands of percent, making them millionaires in a short time.

Risk Mitigation Strategies for Degen Investors

Capital Management and Limiting Investment Amounts

One of the most important principles is not to invest all of your capital in high-risk projects. Degen investors are often attracted by the opportunity for large profits, but with high volatility, it is necessary to determine the amount of money you are willing to lose if the situation turns bad.

Only 5-10% of the total capital should be allocated to risky projects such as meme coins or new DeFi projects. This amount must be an amount that the investor is willing to lose completely without affecting personal finances.

If you have $10,000 to invest, only use $500-1,000 for risky projects. The rest should be allocated to safer assets like Bitcoin or Ethereum, which have higher liquidity and are more stable.

If you have capital from $0-1000, the investment strategy in the crypto market will be significantly different from investors with large capital. With small capital, the ability to grow assets in a short time is the primary goal of retail investors.

Small-capital investors are often willing to take high risks to achieve large profits. Instead of investing in stablecoins like Bitcoin or Ethereum, which require large capital to generate significant returns, they often turn to highly volatile projects in the hope that a small investment can bring large profits.

In the case of investors with small capital, the “Ape In” strategy is somewhat more appropriate. However, make sure that you have the ability to identify and invest based on analyzing the factors of the project, not based on FOMO or ignoring DYOR.

Fundamental and Technical Analysis Before Investing

Many degen investors skip fundamental and technical analysis when making investment decisions. However, fundamental research on the project, the development team, and the liquidity of the token are important factors in mitigating risk.

- Fundamental analysis: Check information about the project, the development roadmap, and the real-world applications of the token.

- Does the project have a reputable development team?

- Does this token solve any real-world problems?

- Are the project’s tokenomics truly effective in the long run after inflationary factors take place?

- How does the token hold its value after the airdrop?…

- Technical analysis: Use analytical tools such as RSI, MACD, and support/resistance levels to determine reasonable entry and exit points.

Portfolio Diversification

Diversification is an effective strategy to spread risk. Instead of investing in just one risky project, investors should allocate capital to various assets to avoid losing everything if one token fails.

If you have $5,000 to invest, you can allocate it as follows: $4,500 to safe assets like Bitcoin and Ethereum, and $500 to high-risk projects like new DeFi tokens, meme coins, and tokens following market trends. This helps balance risk and potential reward.

Read more: How does portfolio diversification limit risk?

Be Cautious with New Projects and Avoid FOMO

New projects often lack complete information and can easily become targets of rug pulls or scams. FOMO often leads to irrational investment decisions, and investors need to be cautious before jumping into unproven projects.

The Squid Game Token (SQUID) project attracted many investors thanks to the popularity of the series, but this was essentially a rug pull scam. If they had researched the project carefully and recognized the lack of transparency, many investors could have avoided this risk.

Read more: 4 ways to overcome FOMO in crypto.