This article guides you on how to use TOMO as collateral for a loan on Constant in a detailed and easy-to-understand manner for your convenience.

In the previous article, I introduced you to Constant as well as how to register an account and verify your identity with KYC. If you don’t have a Constant account or don’t know about Constant, please take 5 minutes to read my detailed guide to learn more about this platform: What is Constant? Guide to registering an account and KYC verification on Constant

In today’s article, I will explore with you how to use coins (crypto collateralized loans) on Constant. Constant currently supports quite a few crypto assets for collateralized loans. However, for simplicity, in today’s guide, I will take TOMO Coin as an example to use as collateral for a loan on Constant. You can do the same with other coins.

Let’s start!

What to prepare before borrowing?

KYC-verified Constant account

Of course! You can refer to how to KYC your Constant account here.

A Constant account that has successfully completed KYC will have the following notification in the Account section.

Linking a Bank Account with Constant

The purpose of this is for Constant to transfer the loan amount to your bank account, in case you want to receive the loan in fiat currency.

If you want to receive stablecoins (USDT, USDC, TUSD, etc.), then KYC and linking a bank account are not required.

TOMO Wallet Account

Here, I’ll take the example of using TOMO coin from TomoChain as collateral for a loan.

Download the TomoWallet app on your mobile device.

Remember to back up your wallet to avoid losing access if you delete the app!

Guide to Crypto Collateralized Loans Using TOMO Coin on Constant

On the homepage interface, click the Borrow button, or go directly to the link https://myconstant.com/borrow

Step 1: Set up loan parametersStep 1: Set up loan parameters

In this section, please pay attention to the following parameters:

(1) Loan currency: This is the type of currency you want to withdraw after getting the loan. Constant currently supports fiat currencies including USD (US Dollar) and VND (Vietnamese Dong). In this example, I will choose USD.

(2) Loan amount: Here you enter the amount you want to borrow corresponding to the currency unit selected above. I will take the example of borrowing the minimum amount of 50 USD.

(3) Collateral asset: Here I will choose TOMO Coin as an example for you.

In addition, Constant supports the following cryptocurrencies to be used as collateral: ETH, BTC, BNB (BEP-2), and several ERC-20 tokens: BAT, REP, OMG, HOT, ENJ, ZIL, DGD, DGX, KCS, FTM, IOTX, LRC, NULS.

(4) Corresponding collateral amount: Constant will automatically calculate this for you. In this example, I will have to use 119.3478 TOMO to borrow 50 USD.

(5) Tomo wallet address where you want to withdraw TOMO to after completing the loan repayment. Here, I will enter the TomoWallet address on the app that I prepared earlier.

(6) Interest rate that you can afford for this loan. This is the annual interest rate. In the image above, I set it at 6%. The higher the interest rate, the easier it is to match with a lender, and vice versa.

(7) Loan term that you want to borrow for. In this example, I will borrow for 1 month.

After filling in the loan information, double-check it and then click the Borrow Cash button.

Some notes when setting up the loan:

- You can also enter item (4) Collateral amount first. Constant will automatically calculate the amount of fiat currency you can borrow.

- Fee: Currently, Constant charges a 1% loan fee on the total amount you borrow. As in the image above, I will have to pay a fee of 1% of 50 USD (equivalent to 0.5 USD). This fee will be deducted directly from the amount I receive when the loan is successfully matched.

- After submitting the loan request with these parameters, Constant’s system will automatically match you with a suitable lender (investor).

Let me recap the above parameters: I want to borrow 50 USD for 1 month and am willing to pay 6% annual interest.

Thus, I will have to transfer 119.3478 TOMO to Constant. After the loan term expires, the total amount I have to repay is: 50 USD + 8% (of 50 USD)

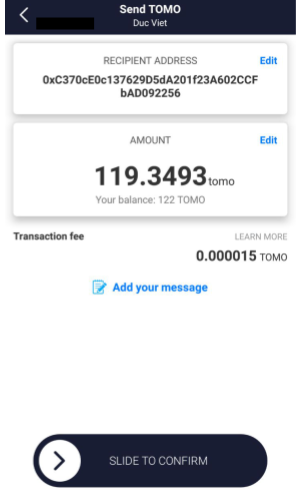

Step 2: Transfer the collateral amount of TOMO to Constant’s wallet

After clicking Borrow Cash, Constant will display their TOMO wallet address.

At this point, you just need to use the TomoWallet you prepared from the beginning and transfer the corresponding amount from step 1 to this address.

Note that the conversion process will incur a fee. So when entering the amount of money you want to transfer, pay attention to see if the transfer fee has been charged yet!

As in my case above, the system requires sending 119.3478 TOMO.

However, I actually transferred 119.3493 TOMO because I included the TomoChain transaction fee in this amount.

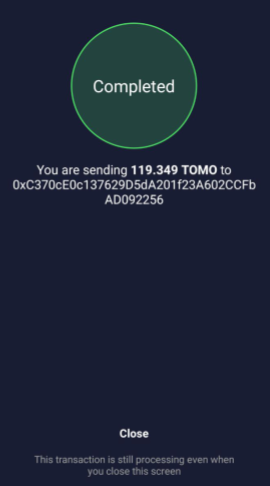

Select SLIDE TO CONFIRM to complete the transaction.

At this point, Constant’s system will automatically find a lender that matches the requirements you have set up from the beginning.

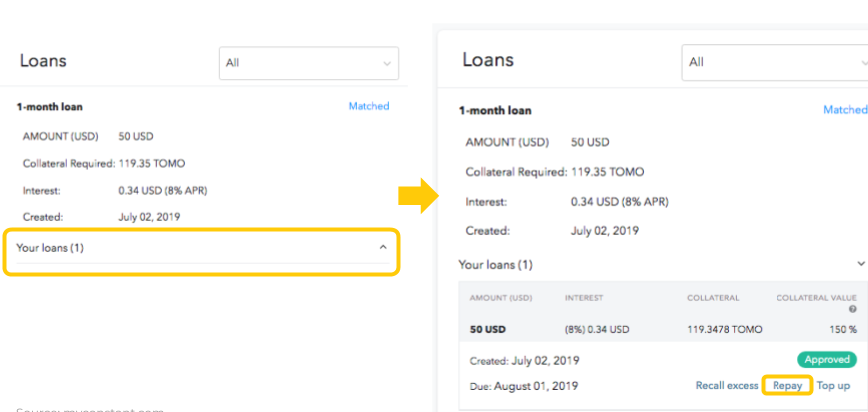

When the system shows “Matched,” it means your loan request has been matched.

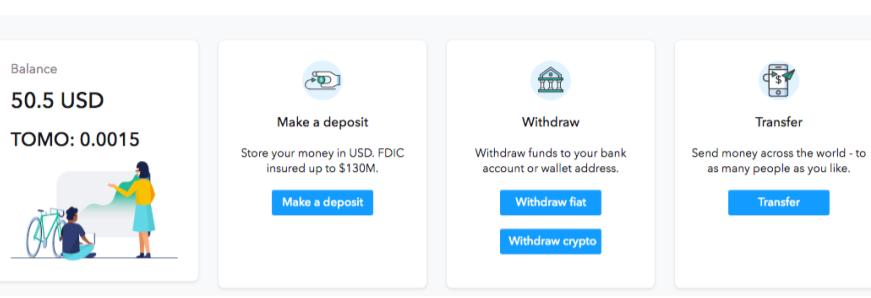

Go back to the Account section, and you will see your balance (USD). Now you can receive your loan!

Step 3: Receive the Loan in the Loans Section

You can transfer the money you borrowed to your personal wallet.

Constant gives you 2 options to withdraw money: Withdraw in Fiat or Crypto.

Withdraw Fiat

In this section, you should pay attention to the following items:

(1) Select the amount of money you want to withdraw.

Calculated in USD.

(2) Select the bank you want to withdraw to.

Here you can choose to send via Zelle bank as shown above, or click to select a Vietnamese bank.

You also need to fill in your bank information so that Constant can transfer this amount.

Finally press the Send button to confirm Withdraw Fiat.

Withdraw Crypto

(1) Enter the amount you want to withdraw.

(2) Enter the type of crypto you want to withdraw.

Note: Constant currently supports withdrawing the following stablecoins: USDT (Tether), CONST (Constant), USDC (USD Coin), and TUSD (TrueUSD).

Also, withdrawing in both crypto and fiat incurs withdrawal fees. Please pay attention to these fees.

Step 4: Repay the Loan with Interest and Receive TOMO Back

The Accounts section contains all the information about your loans.

To repay a loan, select the loan you want to repay and click the arrow button to display the actions.

Select Repay.

The image below shows the information about the repayment amount that you have to pay. Specifically, in my case:

- Loan amount: 50 USD.

- Interest accrued during the loan term: 0 USD. Since I am making an example for you, the loan term is within the day and I am repaying it immediately. Therefore, the interest to be paid is 0 USD. If you repay on the due date, of course, you will still be charged the full interest.

- Matching Fee: 0.5 USD. This is the fee charged by Constant for matching borrowers and lenders on their platform.

- Early Repayment Fee: This fee I will explain below.

Therefore, my total repayment amount will be: 50 + 0.5 + 0.17 = 50.67 USD

Advantages of Collateralized Loans on Constant

Constant currently supports a wide range of cryptocurrencies as collateral:

- Top coins: BTC, ETH

- BEP2 Token: BNB

- TOMO Coin (TomoChain)

- ERC-20 Tokens: BAT, REP, OMG, HOT, ENJ, ZIL, DGD, DGX, KCS, FTM, IOTX, LRC, NULS.

It supports fiat withdrawals for users who want to withdraw VND, or you can withdraw in crypto for other purposes.

Constant currently supports withdrawing the following cryptocurrencies: CONST, USDT, TUSD, USDC.

Constant can also be used as a secure storage wallet. You can deposit VND or your crypto to your Constant account.

Then, flexibly invest in the Invest section or simply store it there. Constant has FDIC insurance of $130,000,000.

Users can flexibly set their desired interest rates to suit their needs, both for borrowers and investors (lenders).

Important Parameters to Optimize Your Loan

Loan Limits

- For VND, the minimum loan limit is 1,000,000 VND (1 million VND).

- For USD, the minimum loan limit is $50.

Can I repay the loan before the loan term expires?

The answer is YES!!

- Repayment earlier than 75% of the loan term: Interest is calculated in full for the borrowed period plus 50% of the early repayment period.

- Repayment within 75% of the loan term: Interest is calculated in full.

What happens if I can’t repay the debt?

If you do not repay the loan plus interest and late payment interest within 3 days from the due date, your assets will be liquidated to cover the loan plus interest to ensure full repayment to the investor.

The remaining collateralized crypto will be returned to you. You keep the original loan amount. Constant will send you an email notification about the due date.

What if the price of the collateralized crypto goes down?

Constant always sets the asset limit at 110% of the loan value to ensure the safety of investors.

Before the value of the collateralized crypto falls to 110% of the loan + interest, Constant will notify you at levels of 115%, 120%, 125% so you can choose to repay the loan early or add more collateral.

If the borrower does not choose the above options, the collateral will be liquidated at the corresponding market price equal to 110% of the loan value + interest.

What if the price of the collateralized crypto goes up?

At this time, you can choose to withdraw the increased portion to your personal wallet. This increase is clearly displayed in the Account section for you to withdraw via the “Recall excess” button.

Risks?

Risks for investors and borrowers are almost completely eliminated based on Ethereum’s smart contracts and $130,000,000 of FDIC insurance.

What are the Fees?

Constant charges a 1% fee from borrowers when they take out a loan. This amount is deducted directly from the loan when it is matched.

Referral Program

Yes!!

You can access your Referral section to send to friends and receive preferential interest rates based on the loan or investment amount.

Conclusion

Hopefully, this article has helped you understand how to take out a crypto-collateralized loan on Constant to take advantage of idle crypto assets.

If you want to safely and sustainably grow your assets, you can participate as a lender. Your assets (stablecoins) will be lent to others, and you will earn interest based on your initial investment.

In the next article, I will guide you on how to invest safely and stably on the Constant platform, as well as how to optimize profits through the article: Guide to Earning Profits with the Invest Feature on Constant.