Do you have tokens on the Ethereum network, but don’t know how to transfer them to the Polkadot network to skin in the game? Check out this article!!!

If you’re interested in and using tokens from other chains but don’t know how to transfer them to the Polkadot network, then this article is for you. In the following article, Coin98 will provide detailed instructions on how to:

- Buy and store DOT.

- Transfer DOT tokens from a centralized exchange (CEX) to the Polkadot network.

- Use platforms for investing & earning within the Polkadot ecosystem.

Let’s follow along with the article below.

About the Polkadot Blockchain

Polkadot is a blockchain platform with multi-chain, heterogeneous, and highly scalable technology. Polkadot allows blockchains to connect with each other to share data and form a decentralized network (Decentralized Web).

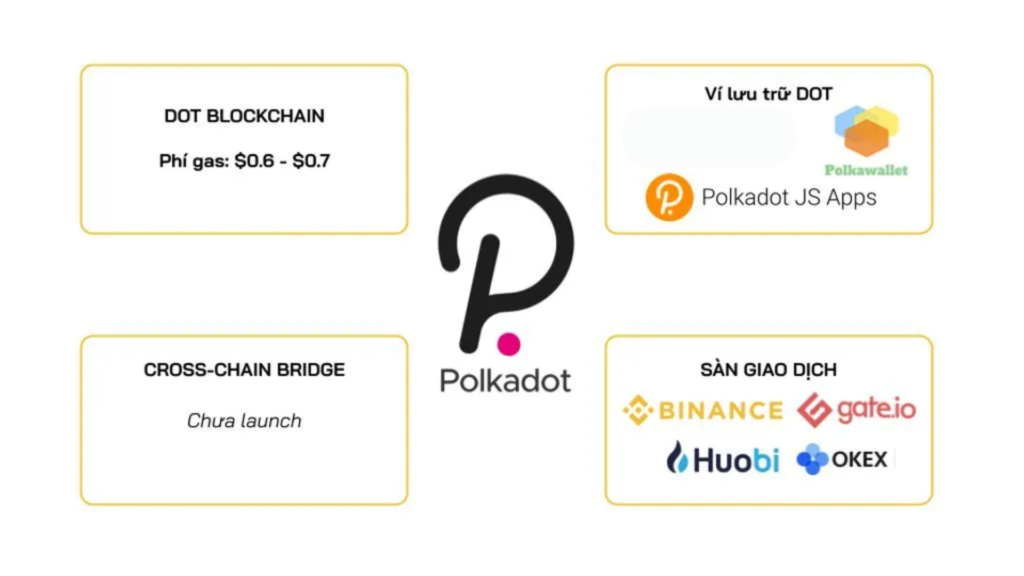

Polkadot is an open-source project, and anyone can contribute to the platform’s development. The main network consists of Validators, Collators, Nominators, and Fishermen. In recent times, Polkadot has also experienced rapid development, updating more pieces. Currently, the gas fee for DOT is around $0.6 – $0.7/transaction. With such a fee, you need to prepare about 0.2 DOT ($8) for transaction fees to be able to use it comfortably.

Step 1: Buy DOT on an exchange

Currently, DOT is supported on almost all CEXs, so you can freely choose from several prominent exchanges like Binance, Huobi, Gate.io, etc.

In the section below, I will provide more detailed guidance on which exchange you should buy DOT from.

Step 2: Store DOT on a supported Polkadot blockchain wallet

After buying tokens on a centralized exchange (CEX), you need a non-custodia wallet to store tokens and interact with the DeFi space. Currently, DOT ecosystem tokens can be stored in various wallets. You can store DOT with the following simple steps:

- Step 1: Click on the DOT wallet.

- Step 2: Select Receive.

- Step 3: Copy the wallet address or use the QR code.

Step 3: Transferring coins from another blockchain to the Polkadot network

After buying DOT and having a Polkadot wallet, you can participate in events or “skin in the game” within the DOT ecosystem on the Polkadot chain.

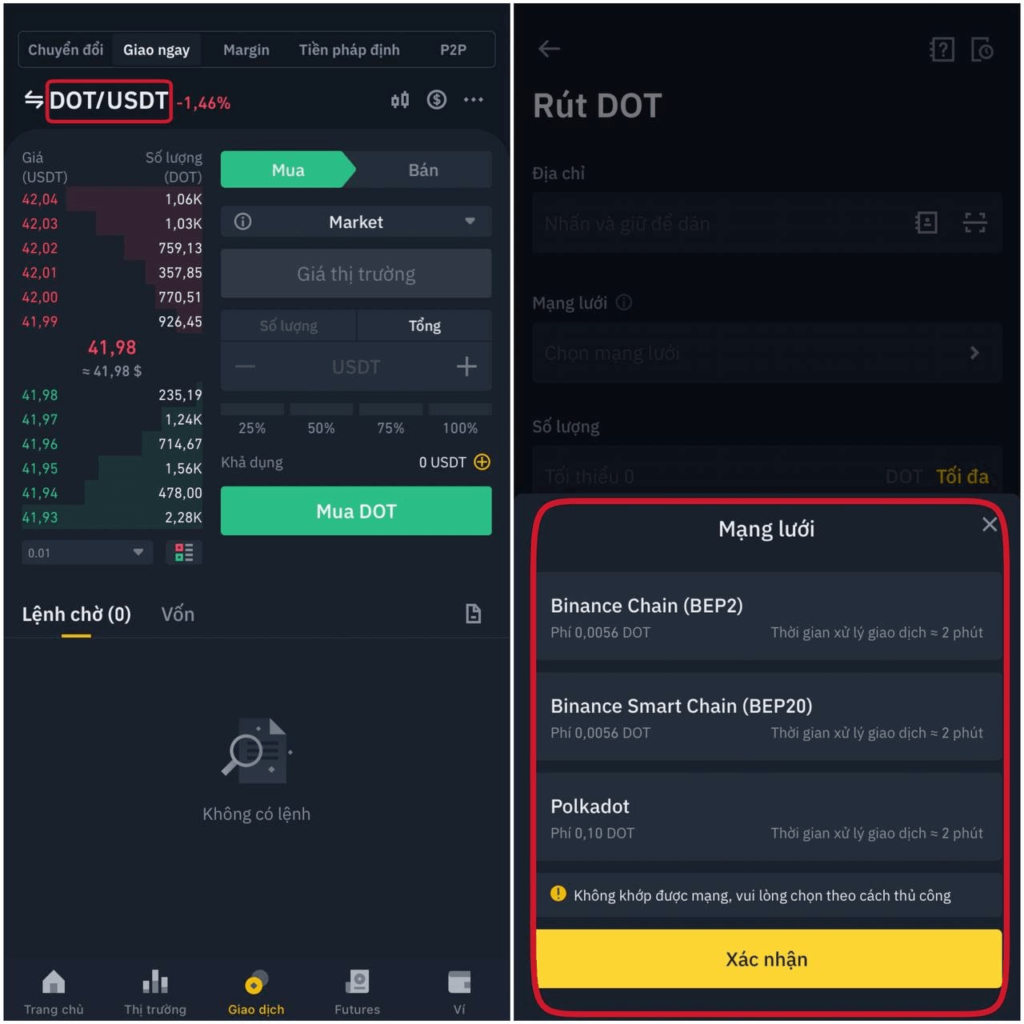

Typically, there are two ways to convert tokens from any network to another. However, the Polkadot ecosystem has not yet launched a cross-chain bridge within its platform. Therefore, those interested in DOT can store native tokens directly in their wallets or deposit tokens on an exchange and withdraw them to the corresponding chain, such as Polkadot, Binance Smart Chain (BEP20), and Binance Chain (BEP2).

Therefore, you can buy tokens on a CEX and transfer them to a Polkadot blockchain-supported wallet by following these steps:

If you don’t know how to buy stablecoins (USDT, USDC) with Vietnamese Dong (VND), you can read the article here.

After you have USDT, you will buy ETH on any exchange like Binance, Gate.io, etc., and transfer the tokens to your with the following steps:

- Step 1: Use USDT to buy DOT on Binance.

- Step 2: Transfer DOT to your Polkadot wallet by entering the wallet address.

Step 4: Add Tokens of the DOT Blockchain

When you create a Polkadot wallet, the DOT token will be displayed by default. Note that the Polkadot wallet only allows storing DOT and tokens of the Polkadot blockchain standard. Each coin’s address will store that specific coin; do not transfer any other coins into the Polkadot wallet to avoid unfortunate loss of funds.

Step 5: Investing and Earning in the Polkadot Ecosystem

Learn more: Overview of the Polkadot Ecosystem

Lending

Lending is a way for you to lend your assets to earn interest.

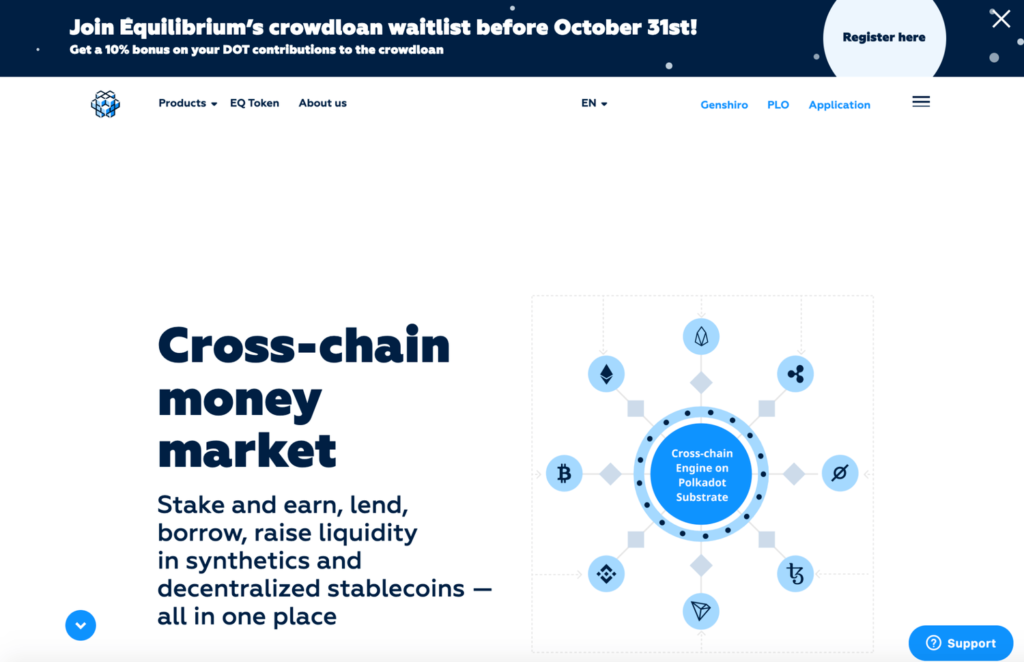

Currently, there are many lending projects on Polkadot, with a notable name being Equilibrium – a cross-chain money market (Lending, Borrowing & Yield Farming) that combines lending with the creation and trading of synthetic assets.

Staking

Staking is the act of holding and locking a certain amount of coins to earn rewards from them. The rewards will depend on the time and amount of coins that you stake.

In the Polkadot ecosystem, you can refer to the Stafi project. This is a DeFi protocol that can create liquidity for staked assets. This means that users’ staked assets can now be traded, and they will still receive rewards as usual.

Margin Trading

Margin trading is a form of trading that uses financial leverage, allowing users to buy, sell, and trade with more capital than they actually have. Due to leverage, the generated profits are also higher than usual, and naturally, the risks are also proportional.

In the Polkadot ecosystem, the Laminar project is a protocol that represents synthetic asset trading, margin trading, and even lending & borrowing. Those passionate about this field can learn more about the project to “skin in the game” in the DOT ecosystem.

Two helpful videos about the Polkadot ecosystem you shouldn’t miss

Tracking the Polkadot ecosystem is super convenient with DotMarketCap and Parachains.info here.

Stake DOT & KSM to Participate in Parachain Auction Slots. Profit Opportunity or Potential Risk?

Conclusion

Skin in the game is one of the very good ways for you to earn from DeFi. However, there are also some risks involved. Don’t miss the article “How to Farm and Play DeFi Safely, Avoid Getting Your Wallet Hacked”

Hopefully, after reading this article, you can easily access the DeFi market on Polkadot, as well as find the best ways to optimize your profits.

Read more: Guide to transferring coins to the Ethereum network to skin in the game