How did an empire once valued at $32 billion collapse in just 7 days?

FTX was founded in 2019 during Sam Bankman-Fried’s (Sam) business trip to Hong Kong. This marked the birth of the second-largest cryptocurrency exchange in the crypto market at that time. FTX’s development was considered to be on par with Binance, the top exchange in the market then.

However, FTX’s bankruptcy declaration on November 11th affected more than 134 related organizations and stunned the entire crypto community.

Background of FTX’s Establishment

To begin the story, we should know a little about Sam Bankman-Fried, the founder of FTX.

In 2014, he graduated from the prestigious MIT with a Bachelor’s degree in Physics and started working at Jane Street Capital, one of the largest quantitative investment funds and market makers in the traditional market.

To be recruited to work here, candidates must have an exceptionally sharp mind, so this is a stage for “masters” of mathematics or talented masters of physics and computer science.

In 2017, Sam decided to leave Jane Street Capital after three years and founded Alameda Research, a quantitative investment fund focused on crypto assets.

Initially, the company operated based on a very simple idea: Buy Bitcoin cheap in the US, sell it at a high price in Japan and other markets in Asia. Just by repeating such arbitrage trading, Sam’s company made huge profits.

But his ambition did not stop there. Less than two years after Alameda was founded, in 2019, Sam established the FTX exchange during a business trip to Hong Kong. At that time, the exchange only had a 20% chance of success because the market was “dominated” by formidable competitors such as Binance and Coinbase.

Sam’s launch of this new exchange caused internal turmoil within Alameda because although the company was profitable, they were extremely short-staffed

But FTX did it. The trading volume on the exchange increased, and it was ranked among the top exchanges by volume at the time.

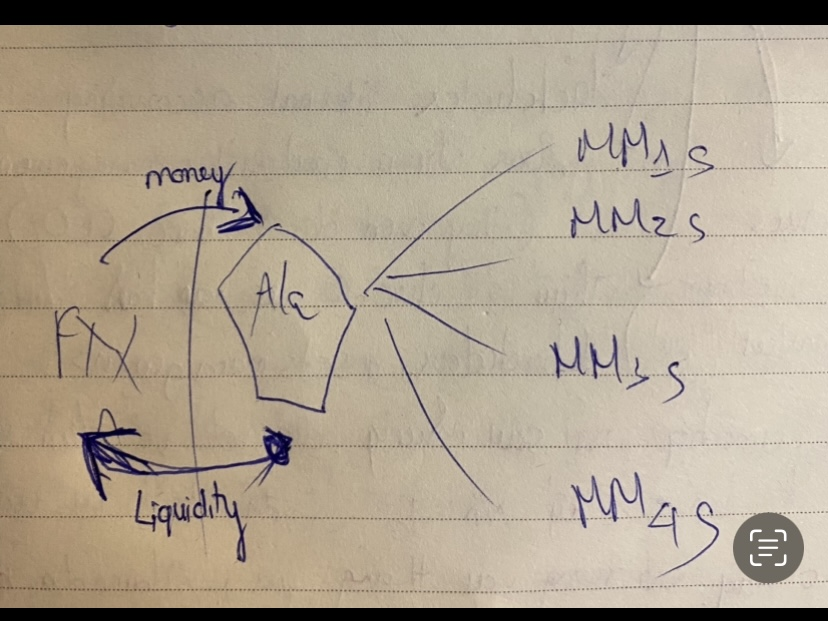

To achieve this, Alameda, with about 20 employees, played a significant role at FTX. They were the main liquidity provider, accounting for half of the trading volume on the exchange.

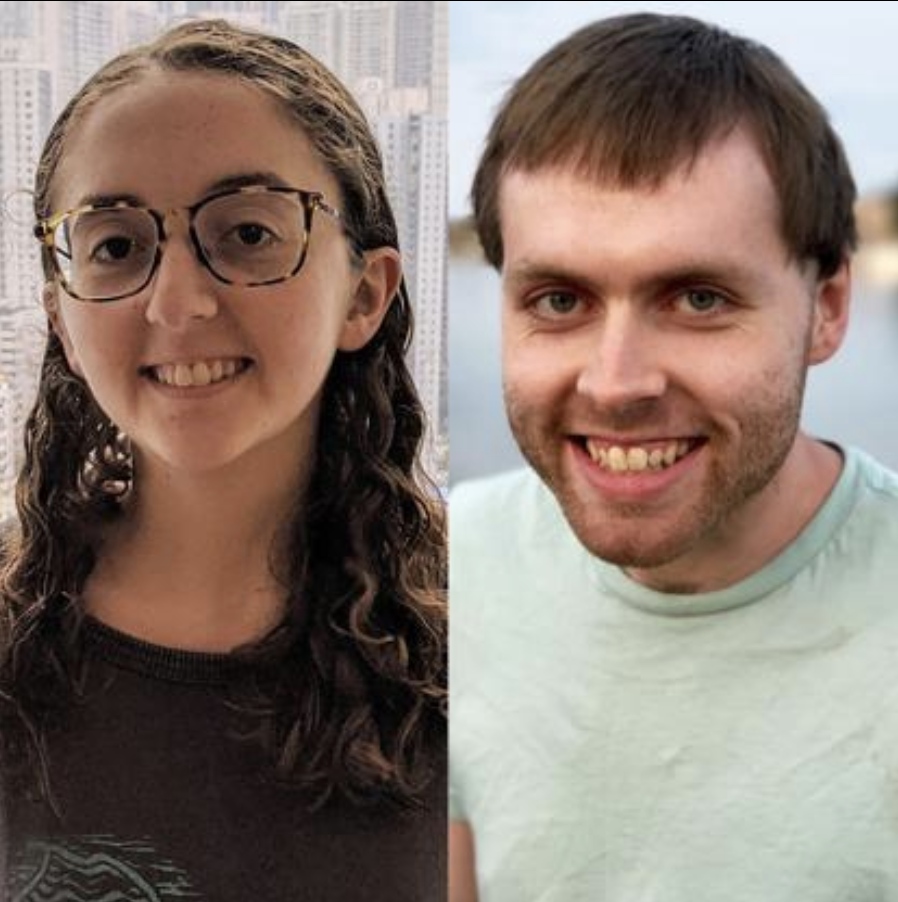

However, to focus on developing FTX, Sam stepped down and handed over the CEO position of Alameda Research to his two partners, Caroline Ellison and Sam Trabucco.

The Rise of the FTX “Empire” Under Sam

Meanwhile, FTX continued its fundraising journey. From June 2021 to early 2022, FTX raised over $1.8 billion from a number of renowned investment funds, such as:

- Sequoia Capital: The venture capital fund with the most unicorns in its portfolio (managing $85 billion).

- SoftBank Vision Fund: The conglomerate of Son Masayoshi – a Japanese tech billionaire with the motto “high risk, high return.”

- BlackRock: The world’s leading asset management company (managing $10 trillion).

- Tiger Global: A fund managing $125 billion.

And many other names like Temasek Holdings, Paradigm, Lightspeed…

This investment round raised FTX’s valuation to $32 billion and made Sam the youngest tech billionaire at the time.

At the peak of its fame and with abundant financial resources, FTX did not hesitate to spend lavishly on marketing activities. For example, it spent $135 million to acquire the naming rights for a sports stadium in Miami, renaming it FTX Arena; filmed commercials with Tom Brady and Larry David; and spent $1.4 billion to acquire Voyager.

In addition to marketing, Sam was also very active in political and lobbying issues. He donated over $40 million to the Democratic Party (President Biden’s side) and became the second-largest donor in the 2020 presidential election campaign. Thanks to this, Sam also met with many politicians and authorities in the US

But crypto wasn’t exactly a favorite among those in power. Take Binance, for example, the world’s leading crypto exchange, which had faced countless setbacks in negotiating operating licenses with authorities and lawmakers.

Yet, here was Sam, a fresh face at 29, representing a crypto exchange that was merely three years old, getting the opportunity to participate in a Congressional hearing to discuss digital assets at that time.

This privilege of Sam’s attracted media attention, further enhancing FTX’s image and making it appear almost “divine” in the eyes of the community. Most people believed that FTX was the future unicorn and would be on par with “empires” like Apple or Facebook in the traditional market

However, behind that glamorous facade lay a tangled web of complexities within FTX’s management structure. Their vulnerabilities silently grew larger and larger, until…

The Sudden Collapse in 7 Days

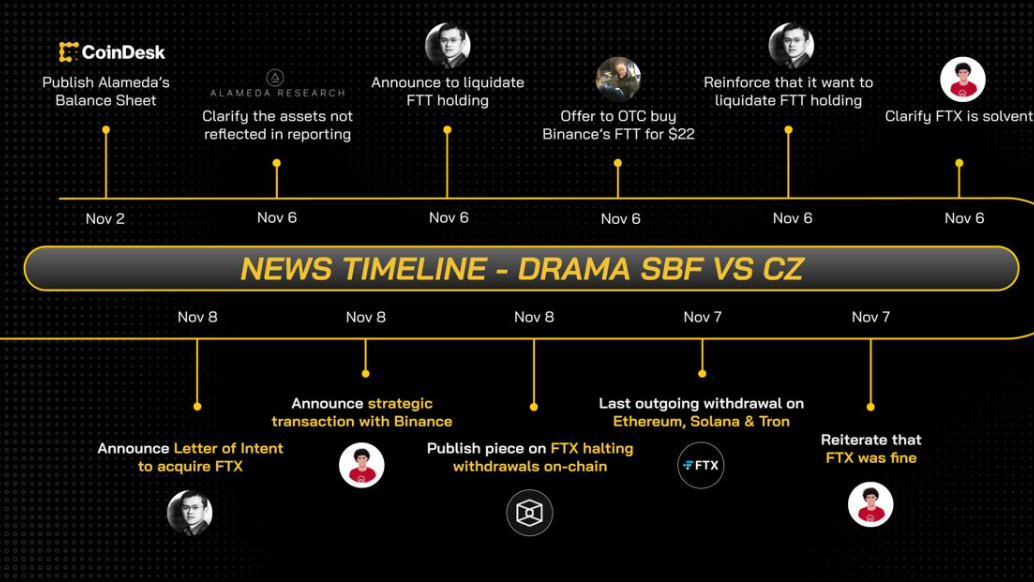

On November 2nd, CoinDesk, a renowned crypto news outlet, unexpectedly published Alameda’s financial report.

According to this report, Alameda’s existing assets were around $14.6 billion, but $8 billion of that was borrowed, along with a large amount of FTT, the token issued by FTX itself.

Furthermore, SRM and SOL were the next two largest tokens in this financial report. Among the many illiquid coins it held, Alameda only had $134 million in cash equivalents (or the most liquid assets).

After CoinDesk’s “bombshell,” Caroline – then CEO of Alameda – remained silent and declined to comment.

Developments between FTX CEO, Sam, and CZ

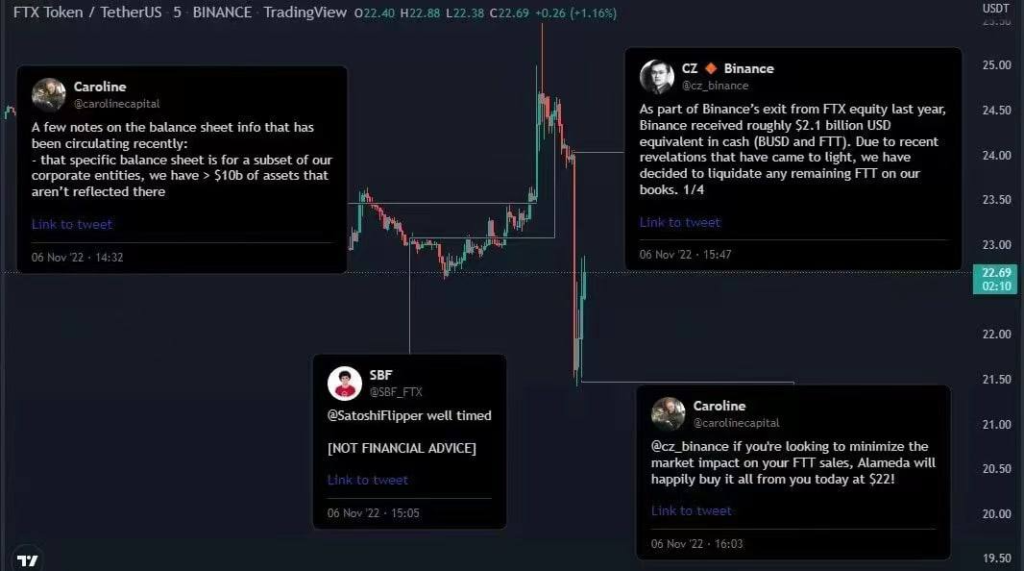

Four days later, Caroline clarified that Alameda still had $10 billion in assets not recorded by CoinDesk in the report.

But the situation escalated when CZ, CEO of Binance, unexpectedly announced the sale of all FTT tokens they had invested in FTX in 2019, then worth about $584 million.

CZ and Sam had publicly clashed several times, so this could be seen as an impulsive move by CZ, who was previously quite “displeased” with Sam “playing behind the backs” of competitors by pushing for regulations that could harm Binance and the DeFi market.

2022 was a “horrific” year for the crypto market with crises ranging from Terra-Luna to 3AC, along with the collapse of other major players. As a result, the community seemed to become increasingly wary of such sensitive events.

And FTX was no exception. CZ’s announcement was like “adding fuel to the fire,” causing a mass exodus of investors from the exchange. First, it was the large funds and market makers, followed by retail investors. They were highly alert and quietly tried to move their funds out of FTX as quickly as possible.

In this situation, Caroline responded to CZ, stating that Alameda was ready to buy back all the FTT that Binance planned to sell. Sam himself also spoke up to reassure the community. But all those efforts were not enough. Within just 72 hours, a total of over $6 billion in assets was withdrawn from the FTX exchange.

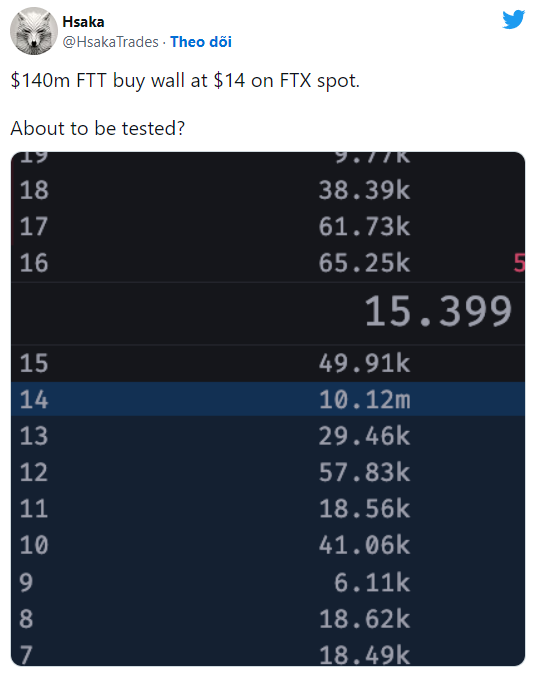

The situation worsened as FTT fell below $22, the price at which Alameda announced it would buy back CZ’s FTT holdings through an OTC deal to bolster user confidence in FTX’s liquidity. Alameda also spent $140 million to “build a wall” to defend FTT at $14, but this amount was still not enough.

The price of FTT continued to plummet, and panic truly set in when FTX announced the suspension of withdrawals

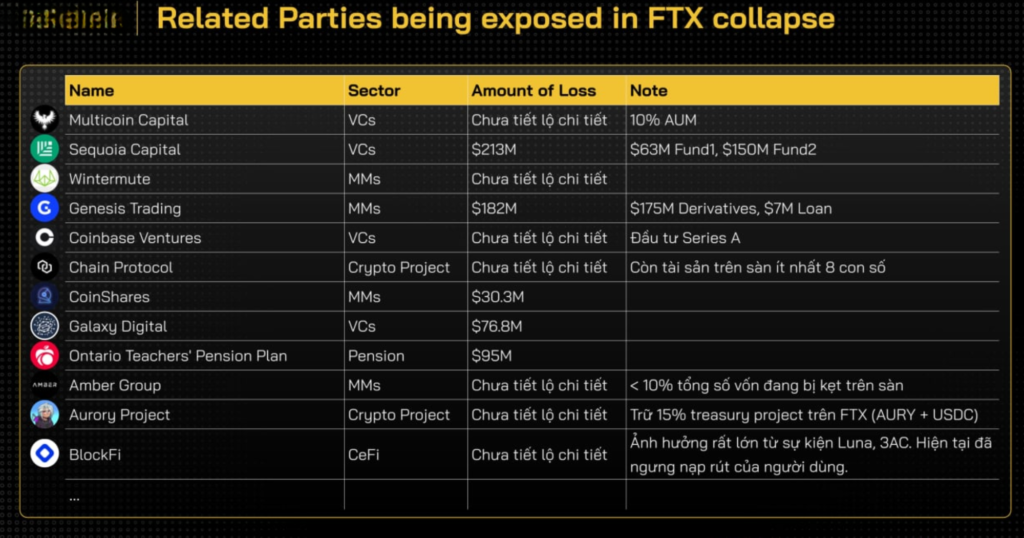

Investors began to despair as they couldn’t withdraw their funds, with victims including large funds and market makers.

On November 8th, Binance announced that it might acquire FTX. Given the feud between the heads of the two largest crypto exchanges, this unexpected news inevitably raised many questions within the community

CZ stated that his announcement to sell FTT was not intended to push FTX to the “brink.” He said that on the evening of November 8th, Sam suddenly called him. He initially thought Sam wanted to conduct the FTT sale through OTC to prevent the market from becoming more negative. But it turned out to be a “rescue” call from Sam.

Before signaling to Binance, Sam had desperately sought opportunities from billionaires on Wall Street and Silicon Valley, as well as countless others, including Justin Sun and OKX, hoping to raise $1 billion.

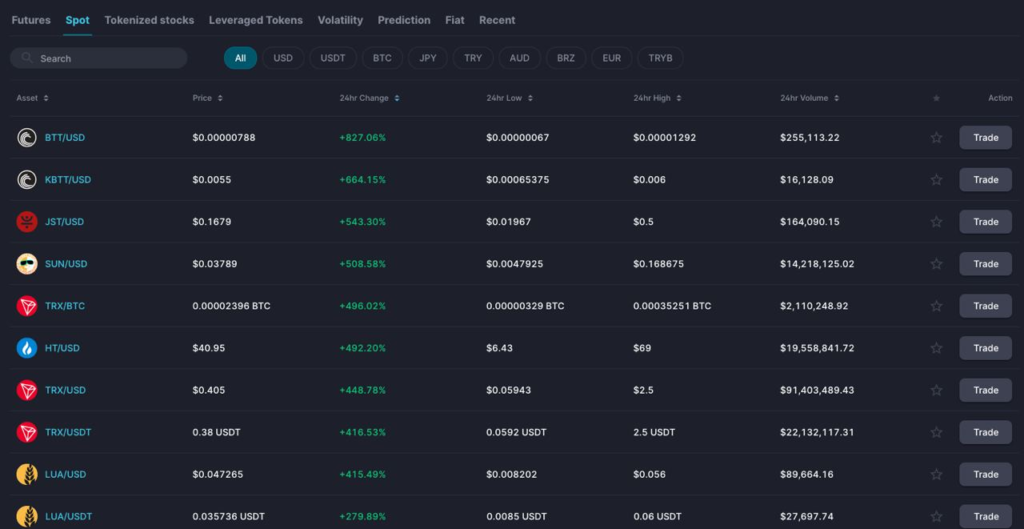

Justin Sun carried out a partial “rescue” by announcing support for FTX to transfer Tron ecosystem tokens like TRX, BTT, JST, SUN to Huobi. Immediately, the prices of Tron ecosystem coins on FTX surged by 400%-800%.

However, the community questioned whether Justin Sun genuinely wanted to help the victims or if he was simply taking advantage of the “troubled waters” to attract users to Huobi and collude with FTX to reduce the exchange’s billions of dollars in debt.

Specifically, Justin sold Tron ecosystem tokens to those trapped on FTX at 4-8 times the market price. This way, when they withdrew the tokens to Huobi, FTX’s debt would also be reduced by 4-8 times, as users accepted losses to withdraw their remaining funds from the exchange.

However, after conducting due diligence, Binance realized that FTX’s “hole” was beyond their control and decided to abandon the deal. As the No. 1 exchange in the market, Binance’s “rejection” seemed to be the end for Sam’s “brainchild.”

The Devastating Battlefield Left by FTX

According to the Wall Street Journal, FTX would need $8 billion to ensure customer withdrawals. This shows that as the market declined, FTX and Alameda suffered heavy losses, and they had “drained” up to $8 billion of user deposits on the exchange.

What had to happen eventually happened. On November 11th, FTX filed for bankruptcy protection, marking the “end” of an empire once worth billions of dollars.

The number of creditors mentioned in FTX’s bankruptcy filing amounted to over 100,000 (likely including users who deposited funds on the exchange) along with more than 130 subsidiaries. The debt obligations they now face are estimated to be between $10 billion and $50 billion.

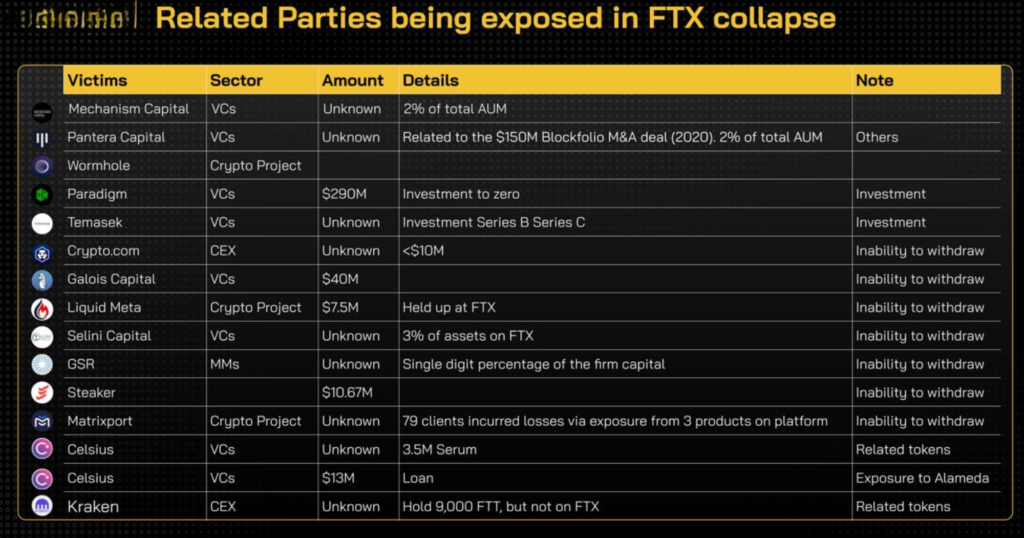

FTX investors, including Sequoia Capital, Lightspeed Venture Partners, and SoftBank, are likely to lose most or all of their investments. In addition, there are many other “unfortunate” victims (table below).

In addition, the Solana ecosystem was also severely affected. You can learn about the extent of FTX’s impact on this ecosystem in the following article: Chain Reaction of FTX to Solana.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented,” said John J. Ray III, the new CEO of FTX.

John J. Ray III has experience resolving many major corporate bankruptcy scandals in history, including the historic collapse of energy company Enron. But to him, it seems Enron was nothing compared to FTX.

Why did Alameda and FTX meet their end?

First: Big fish, little pond.

In the early days of crypto, when things were more chaotic, there weren’t many big players or people who really understood the inner workings of the market. Alameda, along with a few other fortunate market makers, gained a “veteran” advantage in this space. They thrived and earned huge profits with virtually no significant competition.

But as the market grew, competitors from the traditional financial market began to “jump in” more, and Alameda was no longer the only quantitative investment fund. They started facing market makers like Tower, XTX, and many other “tough” names.

This fierce competition gradually eliminated outdated, slow, and less innovative competitors. Alameda may have been able to beat retail traders, but they could hardly compete with other emerging market makers with strong potential. Thus, it can be seen that Alameda’s position and business operations began to decline.

Second: FTX’s valuation partly depended on the exchange’s current liquidity.

In reality, FTX’s liquidity was very good – second only to Binance. However, this liquidity mainly came from Alameda. It can be said that they were the liquidity machine of FTX, along with other market makers operating at FTX to profit from arbitrage.

2021 was the year that helped many trading funds get rich, and this meant that the game was no longer exclusive to Alameda. They themselves had to work hard to compete with other market makers right on their own “home ground.” One small mistake, and immediately others would “gain a mile” from their mistake. Many internal sources said that Alameda actually lost a lot from wrong trades.

But why didn’t Alameda stop even though they knew their way of operating was losing its edge? As mentioned above, the reason is that they were responsible for most of FTX’s liquidity. If they stopped, FTX’s liquidity would collapse. Therefore, even if Alameda was “burning money” daily, FTX still had to continue pumping money into the fund to try to keep the loop running smoothly

Alameda only really profited when they were the only big fish in a small pond

(but the pond has now grown larger, and more big fish have appeared).

Third: FTX’s collapse wasn’t simply due to their debts and over-collateralization.

Because the decline of FTT would only put FTX in crisis, it wouldn’t necessarily lead to their complete collapse. This collapse stemmed from deeper causes that had long been rooted in the operating mechanisms of Alameda and FTX.

The fact that Sam, Caroline, or Sam Trabuco had worked at prestigious quantitative funds like Jane Street or SIG didn’t guarantee their business management skills or that they would never make mistakes. FTX didn’t even have a CFO (Chief Financial Officer), a crucial position in any business, especially in the volatile environment of crypto.

It can be said that FTX’s collapse stemmed from long-standing financial and operational vulnerabilities that were never addressed, and these vulnerabilities grew larger as FTX used user funds to cover Alameda’s losses.

Heavy investment in marketing to polish the external image (while the internal structure was chaotic), lack of organization in business operations, excessively risky investment appetite, over-leveraged collateralization, backdoor trading and transfer of user funds, and many other reasons led FTX to its current fate.

Actions from Binance

In light of the serious consequences caused by FTX’s lack of transparency, CZ called on CEX exchanges to provide Proof of Reserves with the intention of publicly disclosing user assets. To date, excluding Binance, 6 other exchanges have confirmed their participation: Gate.io, Kucoin, Bitget, Huobi, OKX, and Poloniex

CZ also outlined 6 principles for CEX exchanges, including:

- Never using users’ funds for investments

- Never using native tokens as collateral

- Maintaining proof of reserves with transparency

- Ensuring strong reserves

- Avoiding excessive leverage

- Strengthening and enforcing security solutions

Binance also added $1 billion to SAFU, Binance’s insurance fund, to protect users from unforeseen events. Additionally, they established a Recovery Fund to try to mitigate the consequences left by FTX.

Conclusion

The aftermath of FTX is immense, causing widespread impact across the entire market, including falling token prices, user fund losses, and VC losses. The collapse of this exchange has led to a domino effect, bringing down big names in the market like Sequoia, Multicoin, Genesis Trading, BlockFi, Solana, and dozens of other institutions, big and small.

Furthermore, FTX and Alameda Research were backed by many powerful forces in the traditional financial world. Therefore, the collapse of the FTX empire may cause these investors to change their perspective on crypto. They may become more skeptical and hesitant before making investment decisions in the market.

In addition, the lobbying efforts of Sam and FTX in US politics seem to have become futile, and it will be even more difficult to convince lawmakers to trust crypto in the future.

After the FTX event, CZ sent the following message to all Binance employees:

“FTX going down is not good for anyone in the industry. Do not view it as a ‘win’ for us. User confidence is severely shaken. Regulators will scrutinize exchanges even more. Licenses around the globe will be harder to get. And we get the most regulatory scrutiny because we are the biggest. But that is what it is, and we will prove again to the world that we take user protection seriously.”

Is this truly the end for FTX? Let’s wait for new developments and actions from lawmakers in the coming time!