The crypto market is gradually attracting the attention of many people, causing more and more newcomers to join. However, which crypto exchange is reputable enough for newbies to trade on? Below are the top 5 reputable crypto exchanges in the cryptocurrency market.

What is a Crypto Exchange?

A crypto exchange, or cryptocurrency exchange, is a platform that allows users to buy, sell, and trade various tokens in the market. They also offer other services such as staking, farming, borrowing and lending to meet the diverse needs of today’s crypto market.

Crypto exchanges are divided into two types:

- Centralized Exchange (CEX): Managed by an organization or company. Assets are controlled and traded according to regulations that users must comply with, similar to banks or stock exchanges.

- Decentralized Exchange (DEX): Not managed by a third party, allowing users to freely trade without having to follow regulations like on CEXs. However, DEXs often carry more risks than centralized exchanges because there is no managing organization.

Criteria for Choosing a Reputable Crypto Exchange

Because crypto exchanges are divided into two types, the criteria for evaluating and selecting them will also depend on the type of exchange that users are trading on.

For centralized exchanges (CEXs), investors in the market often evaluate them based on the following criteria:

- Must comply with KYC and AML (anti-money laundering) regulations.

- High daily trading volume (in my opinion, a good enough exchange should have a trading volume of at least around 5 million USD).

- Customer support team that is attentive and available 24/7 to assist customers.

- User-friendly and easy-to-use interface.

- In addition, the three mandatory products that every CEX should have to attract users are Spot, Futures and Margin trading.

For decentralized exchanges (DEXs), the evaluation and selection criteria are relatively different from CEXs, due to the potential for high risk in the absence of third-party management. Here are some criteria for choosing a DEX:

- The liquidity of the DEX must be high.

- Suitable transaction fees are also a criterion for choosing a DEX.

- High level of security.

In addition, Insights has written a thorough analysis to better understand the criteria for choosing an exchange here. You can refer to it for more information: 5 Criteria for Choosing a Reputable Exchange.

Top 6 Crypto Exchanges

Binance (CEX)

Register a Binance account here to receive a 100 USDT trading fee discount:

Binance is a CEX exchange that has been a leader in the crypto market for nearly a decade, with a trading volume reaching $4 billion/day and 72 million daily visits.

In addition to offering Spot, Futures, and Margin products across 650 token trading pairs, Binance also provides users with an ecosystem that includes an NFT Marketplace, Binance Research, Binance Launchpool, and more.

However, in the years 2020-2023, Binance has faced legal troubles related to AML and operating illegally in some countries, causing many investors to fear that Binance could collapse similarly to FTX. Therefore, users should also limit storing all of their assets on Binance, as a collapse is still possible.

Read more: Guide to using Binance exchange effectively.

OKX (CEX)

Register an OKX account here to receive rewards for new registrants:

After Binance, OKX is a CEX exchange that is quite active in marketing to attract new users. And their strategies are relatively successful as the trading volume on OKX is increasing, peaking at $7 billion/day in 2024.

OKX currently has some notable products, such as the OKX Web3 wallet and OKX Ordinals, which allows users to easily participate in the Inscription trend.

On the other hand, OKX has a relatively difficult-to-use interface compared to exchanges like Binance and Bybit. Also, for an exchange with top trading volume in the market, OKX supports relatively few token pairs for users to trade (currently only over 300 trading pairs).

Bybit (CEX)

Register a Bybit account here to receive rewards for new registrants:

Bybit is also one of the top 5 CEX exchanges in terms of trading volume, reaching $1 billion/day.

Bybit’s highlights include a suite of tools that serve all trading features for users, such as Copy Trading, DCA Trading Bot, Futures, and Margin.

Compared to top exchanges like OKX and Binance, Bybit is less attractive in terms of its difficult-to-use interface and less attractive launchpad compared to Jumpstart or Binance Launchpool. However, Bybit has the advantage of a greater number of token pairs, incentives, and events compared to the two exchanges mentioned above.

Bitget (CEX)

Bitget is a cryptocurrency exchange known for its diverse range of services and trading platforms, including spot trading, futures contracts, copy trading, and pre-market trading.

In recent years, Bitget has continuously implemented campaigns to promote brand recognition and attract users, becoming one of the top cryptocurrency exchanges in the crypto market.

As of Q2 2024, Bitget has recorded impressive growth:

- Trading volume: Futures trading volume on Bitget increased by 146%, reaching $1.4 trillion in Q1 2024, while spot trading volume also increased by 100%, from $28 billion in Q1 to $32 billion in Q2 2024.

- Number of users: The exchange has reached 25 million users globally, adding 2.9 million new users in the first six months of 2024.

- Capital inflow: In the first half of 2024, Bitget had the ‘biggest growth’ in market share with an increase of 38.4%, attracting about $700 million in new capital, with the amount of BTC, USDT, and ETH in user accounts increasing by 73%, 80%, and 153% respectively.

- Security and reserves: Bitget has maintained a high reserve ratio, with a total reserve ratio reaching 176%, of which the reserve ratio for BTC is 335% and ETH is 229%. In addition, the Bitget Protection Fund has an average valuation of $429 million, holding 6,500 BTC as of June 2024, the second largest among CEX exchanges.

- Bitget Token (BGB) was ranked by Forbes as one of the 10 best performing tokens in the first half of 2024 with an increase of 100%.

Although Bitget supports very low trading fees on the exchange, with fees for makers at 0.02% and takers at 0.06%, withdrawal fees are relatively high. In addition, Bitget’s 24/7 customer support has been reported to be slow and has not completely resolved account issues. Improving the quality and responsiveness of customer support is a point that needs improvement.

Uniswap (DEX)

Uniswap is the first and largest DEX in the crypto market, with a TVL that once peaked at $10 billion and a daily trading volume of over $1.2 billion.

The project is not only a leader in the crypto market, but Uniswap was also a pioneer in integrating the CLMM (Concentrated Liquidity Market Maker) mechanism for adding liquidity.

Currently, Uniswap supports 8 EVM networks such as Ethereum, Optimism, Arbitrum, Base, and BNB Chain, and the project also has a mobile version of Uniswap.

However, Uniswap is an AMM project with a large trading volume, so it is suitable for regular investors and liquidity providers. For “airdrop hunters”, Uniswap is currently not suitable.

In addition, the biggest disadvantage of Uniswap is that it serves relatively few networks, and even only supports EVM-compatible networks.

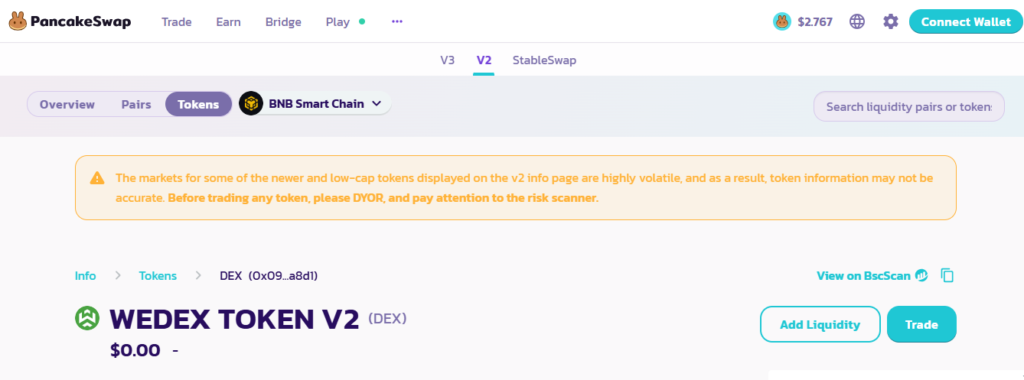

PancakeSwap (DEX)

PancakeSwap is the first DEX exchange on BNB Chain and was forked (copied source code) from Uniswap. According to DefiLlama, PancakeSwap once reached $8 billion in TVL and $600 million in daily trading volume.

Unlike Uniswap, PancakeSwap supports 9 networks, including both EVM and non-EVM networks like zkSync Era, Linea, and Aptos. PancakeSwap is also one of the few AMMs with a relatively wide range of services for users, such as IFO (a fundraising model similar to IEO), Lottery, Binary Options, and derivatives.

However, similar to Uniswap, PancakeSwap is not suitable for airdrop hunters but is only suitable for regular investors or liquidity providers.

Read more: Popular DEX exchanges in the crypto market.

Frequently Asked Questions about Crypto Exchanges

Are there other types of crypto exchanges besides CEX and DEX?

Depending on the needs of users, the crypto market has exchanges such as:

- Derivatives: These are exchanges that offer derivative products to users, such as Futures, Lending/Borrowing, and Margin trading. Some examples include: Aave, Drift Protocol…

- P2P: These are exchanges where users trade directly with each other without going through a third party. However, P2P exchanges are currently falling out of favor because their services do not adequately meet user needs. Some examples include Aliniex, Remitano…

Crypto Exchange Search Tools

If the exchanges above do not support the token pair you want to trade, you can go to CoinGecko, DexScreener, etc. to find exchanges that support the token you want to trade.

Crypto Exchange Ranking Tools

If you want to see the most popular exchanges on certain networks, you can visit CoinGecko, DefiLlama, etc. For example, on the Solana network, DefiLlama will show the top exchange as Orca, followed by Raydium.