The turbulent journey of SocialFi projects. This article is brought to you by Tiger Research.

Summary:

- SocialFi initially garnered significant attention by combining decentralized finance (DeFi) with social media, empowering users to monetize content and control their data. However, this initial boom was short-lived. Platforms struggled to maintain user engagement and failed to provide innovative experiences beyond token speculation.

- Platforms like Friend.tech exemplify the perils of over-reliance on initial FOMO. It experienced a steep decline in users after failing to deliver consistent updates, fresh content, or unique user experiences, leading to a significant drop in daily active users and platform relevance.

- For SocialFi to recover and achieve sustainable growth, ventures must move beyond replicating traditional social media models on the blockchain. Long-term success necessitates integrating innovative user experiences, fostering genuine engagement, and delivering real-world value beyond speculative investments, coupled with partnerships bridging Web2 and Web3.

From Hype to Reality

For a time, SocialFi was hailed as the “next big thing”, merging the worlds of decentralized finance (DeFi) and social media to create platforms that empowered users to 1) monetize content, 2) control their data, and 3) actively participate in governance.

This concept, combining blockchain with social experiences, promised a paradigm shift akin to the groundbreaking platforms we’ve seen with the likes of WeChat and TikTok in the APAC region. Just as platforms like ZEPETO and Roblox have captivated younger generations with immersive digital worlds, SocialFi aimed to revolutionize how people interact, transact, and create value online.

Despite its potential, the initial excitement surrounding SocialFi has dwindled due to declining user engagement, waning interest, and unsustainable project models. Consequently, projects that once held the promise of transforming social interaction have witnessed a severe downturn in user activity and participation.

Understanding the reasons behind this decline is crucial — not to assign blame, but to identify potential opportunities that could facilitate a resurgence.

This report will analyze the rise and fall of key SocialFi platforms and their business lifecycles, drawing out trends and challenges that companies need to be aware of to move forward. Brought to you by Tiger Research.

Lessons from pioneering SocialFi projects

Downfall: Relinquishing Control

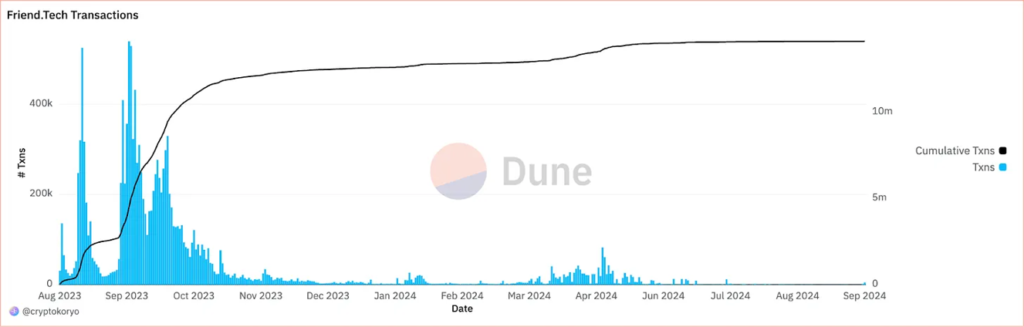

Friend.tech launched with high expectations, quickly attracting users through airdrops and its V2 update. Users were drawn to the platform’s unique model, which tokenized social interactions, creating an instant market for users to trade social credibility and engagement. Early adopters flocked in, generating robust activity and token speculation

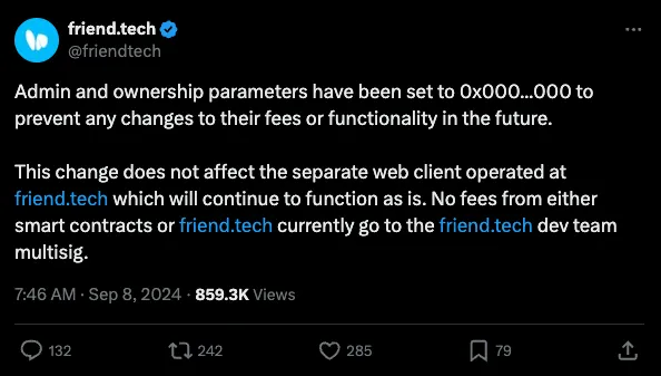

However, the situation changed after the initial success. Following the release of V2, the Friend.tech development team relinquished control of the smart contract on September 8th, transferring this control to a null Ethereum address. This decision effectively prevented any possibility of future updates or new feature implementations.

While the platform remains operational, the lack of new features has caused it to lose its novelty, leading to a significant drop in user engagement. This stagnation directly impacted user loyalty, prompting many early adopters to abandon the platform in the absence of continuous updates.

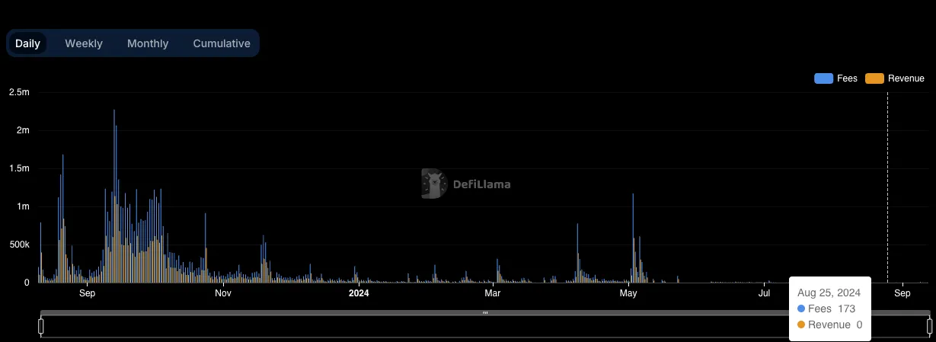

As the platform stagnated, the FRIEND token lost its utility and became just another memecoin in the SocialFi ecosystem. By September 2024, Friend.tech’s revenue had plummeted, dropping from over $2 million in fees on September 14, 2023, to a mere $71 a year later.

With no real use case remaining, the value of the FRIEND token crashed, marking the effective end of Friend.tech in the market.

The downfall of Friend.tech illustrates the risks of decentralizing too early when a platform has not yet established sustainability. This is a particular risk in nascent markets like SocialFi, where user interest can fade rapidly.

Projects need to strike a balance between decentralization and control to avoid stagnation. Retaining users requires continuous innovation and updates to maintain interest, even when a platform operates in a decentralized mode.

Stagnation: The Decline of SocialFi Platforms

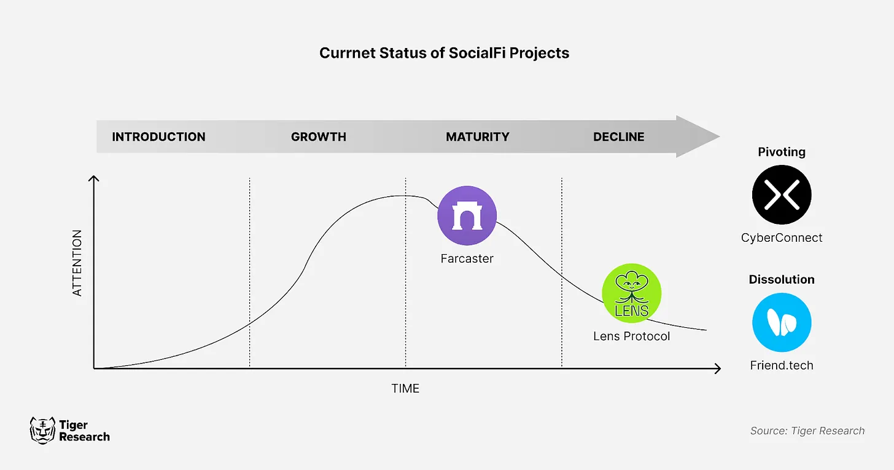

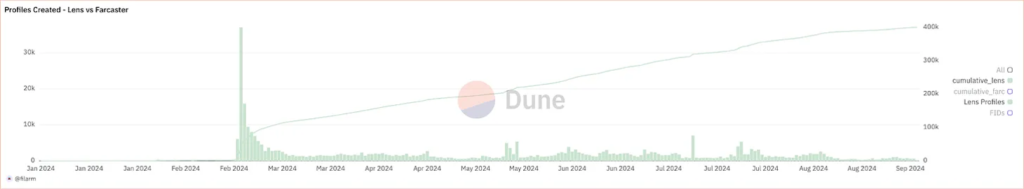

Despite showing great promise, SocialFi has faced significant challenges in sustaining long-term growth. Like other short-lived trends in the blockchain space, many SocialFi platforms struggled after the initial hype subsided. Lens Protocol, prominent during the 2024 boom, serves as a prime example.

Lens Protocol saw a surge in account registrations, fueled by FOMO and initial excitement for its decentralized social media features. The influx of new users creating accounts was initially impressive.

However, as the novelty wore off, the growth rate slowed significantly. In recent months, only 142 new accounts have been created, a stark contrast to the initial flurry of activity.

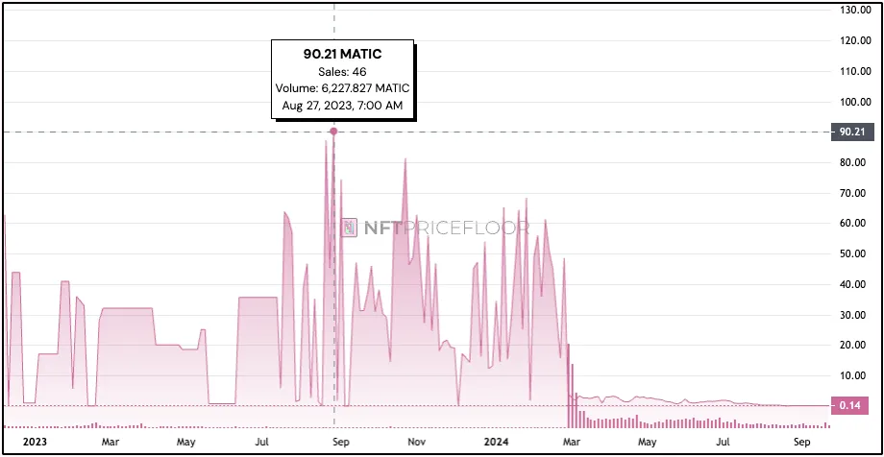

Another indicator of Lens Protocol’s decline is the considerable drop in the price of Lens accounts. At its peak, a Lens account could be valued at over $200, reflecting the high demand and excitement surrounding the platform.

Currently, this same account is worth less than $1. This signifies a sharp decline in both user interest and the perceived value proposition of the platform.

This dramatic decline highlights how quickly SocialFi can lose relevance if it fails to deliver continuous value to users. For SocialFi ventures to thrive, they need to not only attract users but also consistently engage them through meaningful content, community interaction, and real-world applications.

While Lens Protocol’s initial launch held much promise, its decline serves as a cautionary tale for ventures in this space. Without a clear strategy for long-term growth, even the most promising platforms can falter.

Maturity: But Too Fast

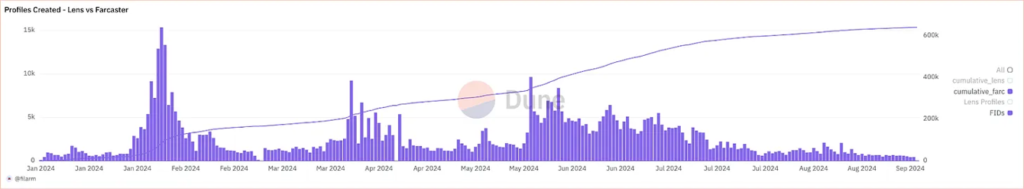

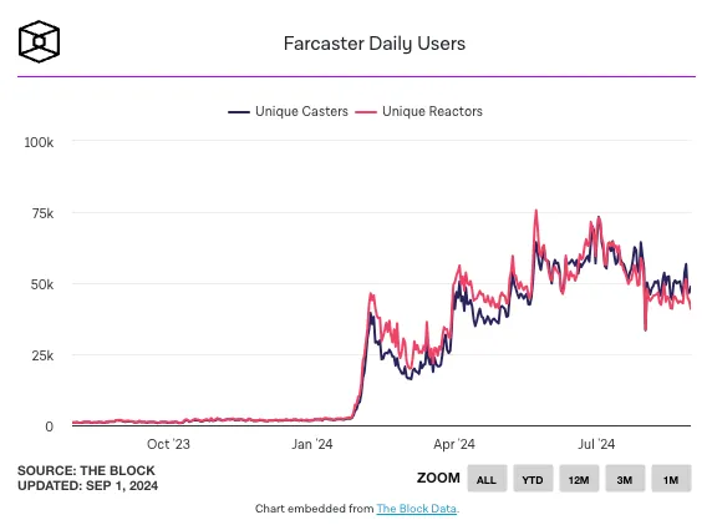

Farcaster, along with its application Warpcast, initially garnered significant attention when the project raised over $150 million in May 2024. The initial wave of FOMO fueled a substantial increase in daily active users, and the platform seemed poised for success.

From a daily peak of over 15,000 users in early February, the number of new users has now dwindled to less than 500.

Despite Farcaster’s continuous infrastructure updates and the platform’s decentralization potential, they have been unable to expand their user base. This reflects a major issue in SocialFi—the ability to retain users after the initial hype fades. The number of new users has plummeted from over 15,000 sign-ups in February to just 545 in September.

While daily active users remain relatively stable, engagement has fallen by 60% from its peak. The primary cause is a lack of compelling content. As a social platform, Farcaster has struggled to provide enough content to sustain user interest over the long term.

Farcaster’s journey reveals a crucial truth for blockchain-based platforms: content quality and service matter far more than decentralization features. The core element for any successful social media application is generating ongoing content and encouraging user interaction. Blockchain-based social networks need to invest heavily in content creation and incentivizing meaningful contributions from users. From a business perspective, this is the time to prioritize building a diverse and engaging ecosystem where users feel motivated to return daily, rather than solely relying on airdrop speculation.

Pivot: Shifting to New Business Models

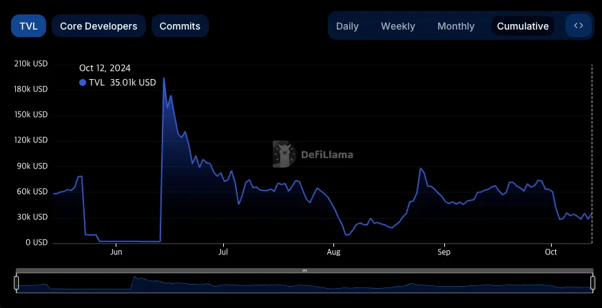

Faced with declining user engagement and waning relevance, some SocialFi platforms have attempted to pivot to new business models in hopes of regaining momentum. CyberConnect is a prime example. Recently, the platform rebranded itself as Cyber and shifted its focus toward Layer 2 blockchain solutions.

While this pivot may seem like a logical strategy, it has not garnered the user interest Cyber had hoped for. The platform’s Total Value Locked (TVL) has plummeted to a mere $35,000, significantly lower than its previous peak.

Despite efforts to shift focus and rebrand, Cyber’s struggles demonstrate that simply adapting to new technology or trends is insufficient to revive long-term user engagement.

This highlights another crucial lesson for SocialFi ventures: pivoting to new models or technologies must be accompanied by innovative and engaging user experiences. Without continuous innovation, even strategic shifts like Cyber’s rebranding may struggle to achieve success.

What Does the Future Hold for SocialFi?

The rise and fall of platforms like Friend.tech has exposed critical vulnerabilities within the SocialFi landscape. While initial excitement and FOMO can drive early adoption, long-term success requires more than just hype. Meaningful and engaging experiences are essential for sustained user interest. Unfortunately, many projects have failed to deliver on their promises, leading to disillusionment and a sharp decline in user engagement.

SocialFi projects grapple with several core challenges that have hampered their growth, including: 1) Lack of long-term user stickiness, 2) Over-reliance on decentralization, and 3) Lack of content and innovation.

In addition, several issues arise during the service planning phase, exacerbating these challenges:

- Inconvenience of using crypto wallets: Using wallets requires multiple extra steps, adding complexity to the service and often involving confusing terminology. This makes the user experience less seamless, creating barriers for newcomers unfamiliar with decentralized systems.

- Lack of competitive differentiation: Many decentralized social media platforms tend to resemble Web2 platforms, lacking significant differentiation. Without a distinct edge, they are often perceived as “inconvenient alternatives,” making it difficult to attract users. Just as TikTok revolutionized social media with short-form content and viral challenges, decentralized platforms need to identify their competitive strengths to stand out.

- Lack of native influencers: The success of platforms like TikTok and Instagram is largely attributed to the rise of native influencers. Influencers like the D’Amelio sisters, who rose to fame on TikTok, attracted new users and boosted engagement. The emergence of such native influencers is crucial for driving the growth of new platforms. However, decentralized social media platforms have yet to produce such influencers, limiting their potential for organic growth.

The key takeaway from SocialFi’s struggles is clear: simply replicating Web2 models on a blockchain platform is not enough. Success in this space requires platforms to offer truly novel experiences and deliver tangible value to users. Only those platforms that continuously innovate and adapt can achieve sustainable growth in the long run.