A fee switch is considered one of the mechanisms that can increase token value. So how does a fee switch work? Why haven’t some projects implemented a fee switch yet? Let’s explore the fee switch mechanism in this article.

What is a Fee Switch?

A fee switch is a mechanism that allows a protocol to share a portion of its revenue with token holders. This mechanism can only be implemented with community consensus through a voting process.

The purpose of a fee switch is to increase the value of platform tokens, allowing holders to not only use tokens for governance and voting but also to receive profits/revenue as a benefit of participating in the project’s ecosystem.

Despite the significant benefits that a fee switch brings to the project community, many teams decide against sharing revenue. This is largely due to legal risks and drawbacks in the fee switch operating mechanism.

In the crypto market, many large projects have integrated a fee switch mechanism, such as GMX and Frax Finance. However, many projects have also repeatedly failed in proposing a fee switch, such as Uniswap and Aave.

How a Fee Switch Works

A fee switch is not a mechanism that is activated by default. Typically, implementing a fee switch requires going through some basic procedures. It starts with a proposal on the project forum, including information such as:

- Reasons for implementing the fee switch.

- Revenue sharing ratio.

- Form of token rewards (such as stablecoins, project tokens, etc.).

Depending on the project’s process, the discussion period can take 2-7 days. After finalizing the proposal and determining the fee switch mechanism, the project team will ask the community to vote “yes” or “no.” Most projects conduct voting on platforms like Tally or Snapshot. Additionally, once the fee switch is approved, projects will require users to stake platform tokens to receive revenue shares.

Overall, the fee switch operating model is relatively simple, but its only drawback is that the initial revenue allocation ratio must be changed. If the allocation ratio and risk calculation parameters are incorrect, the fee switch can create conflicts of interest within the community.

Take Sushiswap, for example – a DEX on the Ethereum network. Before implementing the fee switch, the platform allocated 0.25% of trading fees to liquidity providers (LPs) and 0.05% to the treasury. After implementing the fee switch, the revenue allocation to the Sushiswap treasury had to be reduced to share with SUSHI token holders.

Although Sushiswap is not a case of failure due to the fee switch, users will see that the fee switch is a mechanism that “sacrifices” some of the benefits of certain entities to redistribute them to token holders.

The Emergence of the Fee Switch

Between 2020 and 2022, most DeFi project tokens were labeled as having little value beyond governance and voting participation. However, according to a report by Keyrock, this was also a period of explosive growth for DeFi, with projects achieving revenues of nearly $500 million per month and the trading volume from DEXs compared to CEXs increasing from 2.5% to 7%-10%.

Despite the positive DeFi trend, the value of protocol tokens did not reflect this growth, leading to a demand for increased token utility. In this context, Uniswap, one of the leading DeFi projects, introduced a fee switch proposal. This proposal suggested redistributing a portion of LPs’ profits to UNI token holders. However, this proposal caused significant controversy within the Uniswap community, dividing it into two factions: UNI holders and LPs.

The assumption was that the protocol would increase the utility of the UNI token, but in return, it would reduce LP profits. Therefore, if LPs did not find the returns attractive, they would withdraw liquidity, leading to a shortage of users and revenue for the Uniswap protocol. Moreover, a decline in revenue would also diminish the motivation for users to hold UNI tokens, increasing the risk of a price decline.

As a result, the Uniswap proposal did not receive community consensus. Some individuals proposed reducing the revenue allocation to the Uniswap treasury and distributing it to token holders instead. However, inappropriate parameters and ratios also led to the proposal being rejected.

Despite the failed proposal, the concept and mechanism of the fee switch gained attention from other DeFi protocols. They learned from Uniswap’s experience and improved the fee switch model, aiming to maintain a balance of benefits between stakeholders within the protocol.

Some Projects Using Fee Switch

In the crypto market, many projects have adopted the fee switch, but the model has not brought much sustainability to the product, even for those holding their tokens. Therefore, below are some projects that have effectively improved the fee switch model, gaining attention and support from key individuals.

Ethena Protocol’s ENA Token

On November 7, 2024, the investment fund Wintermute submitted a proposal to Ethena’s forum, requesting the project team to “flip the switch” on a fee switch and share a portion of the revenue with ENA token stakers. Although at the time of writing, Ethena has not officially implemented the fee switch, the proposal has been approved and the fee switch will soon be applied to the protocol.

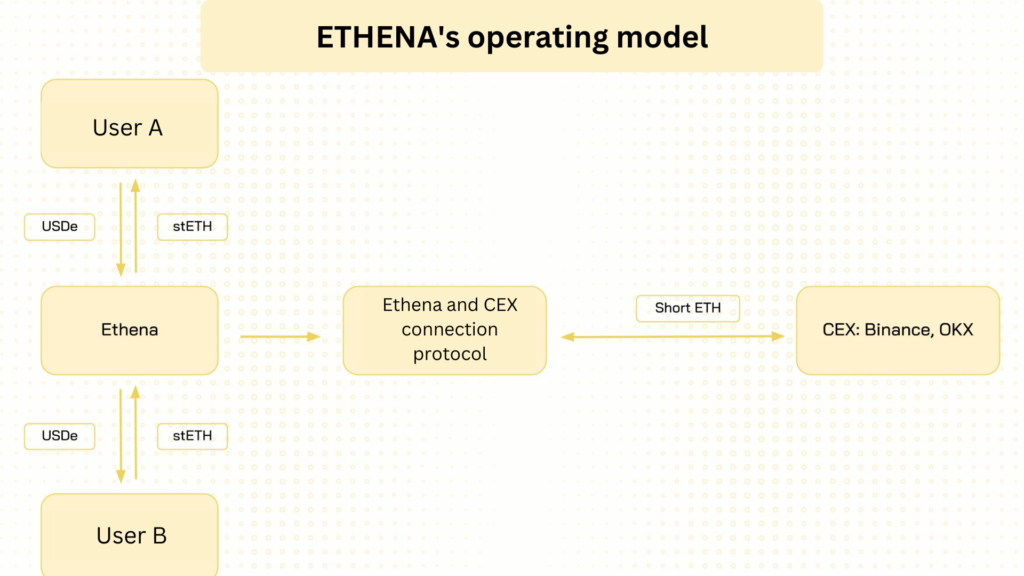

Previously, Ethena’s model operated as follows:

- Users utilize stETH tokens to mint the USDe stablecoin.

- Then, the protocol opens a short position on ETH with a volume equivalent to the amount of stETH used for minting.

With this model, Ethena’s profit comes from two main sources:

- Profits from the stETH liquid staking token.

- Funding rates from the short position or profits from the short position if the market is in a downtrend.

Read more: Ethena Analysis – Mechanism, Risks, and Opportunities with USDe.

However, 80% of the protocol’s profits are allocated to holders of the USDe stablecoin, and 20% goes to Ethena’s reserve fund. This means the ENA token receives virtually no benefits from Ethena’s revenue.

Therefore, in Wintermute’s proposal, a portion of the profit currently allocated to USDe holders would be redistributed to those staking ENA. While this mechanism risks creating a conflict of interest between the two groups, USDe and ENA holders, Wintermute successfully balanced the benefits between the two parties.

According to Bankless’ estimates, the APY for USDe holders would decrease from 12% to as low as 7.5% if the fee switch is implemented. However, this APY level is still attractive compared to other stablecoin projects in the crypto market, while still allowing revenue to be applied to the ENA token.

BLUR Token of the BLUR NFT Marketplace

Blur, one of the leading NFT marketplaces in the crypto market, has a daily trading volume ranging from $2 million to $4 million, capturing 60%-70% of the NFT marketplace market share. However, Blur does not generate any revenue for itself due to its 0% trading fee policy.

With no revenue and the BLUR token not generating much value, on November 12, 2024, a user named SplitCapital proposed enabling a fee switch mechanism for the Blur platform. According to the proposal, Blur should increase its trading fee to 0.5% of the total trading volume and redistribute all revenue to BLUR token holders.

Specifically, if the fee switch is implemented, Blur’s operating model would be as follows:

- 100% of the revenue from the Blur NFT marketplace would be shared with those staking BLUR tokens. Previously, the project did not charge trading fees, so sharing 100% of the revenue would not significantly affect the project team.

- Individuals staking tokens would receive veBLUR tokens. veBLUR token holders can vote on NFT collections. The more votes an NFT collection receives, the greater the rewards from the Blur airdrop points that will be distributed to individuals trading NFTs in that collection.

It can be seen that the fee switch mechanism in this proposal incorporates elements of ve(3,3). This model would incentivize more individuals to trade in the voted NFT collections. The more transactions, the more revenue increases, further motivating people to stake BLUR tokens.

At the time of writing, this proposal is still under discussion and has not been implemented, as the parameters are not yet suitable for the project. However, Blur’s community is quite receptive to the implementation of a fee switch, so it is highly likely that Blur will adopt a fee switch in the near future

In addition to the projects mentioned above, several protocols are expected by the community to introduce a fee switch mechanism, such as Aave (AAVE), LayerZero (ZRO), EigenLayer (EIGEN), and Raydium (RAY).

There is also a special case that most people want to “turn on” the fee switch for, which is Uniswap. However, legal issues, coupled with the team not yet finding an effective fee switch model, are the reasons why the team has not been able to implement the fee switch mechanism.

Disadvantages of a Fee Switch

Many projects have implemented fee switches, and some teams have achieved a certain level of success. However, many projects have also failed when implementing this model, so what are the reasons? And why are many large projects still hesitant to share revenue through a fee switch?

The first drawback of a fee switch is the confusion it creates in the traditional market. A fee switch shares a portion of the revenue with token holders. This is similar to how dividends work in traditional companies, leading to the consequence that tokens can easily be confused with securities. As a result, the unclear concept of a fee switch has led many countries to ban the fee switch mechanism to limit conflicts, such as China and the United States.

Besides legal barriers, the fee switch is a double-edged sword. This mechanism can bring sustainability to the community, but if not implemented correctly, the consequences can include:

- Conflicts of interest between parties, leading to users abandoning the project.

- Insufficient funds for product development due to reduced revenue allocation.

Typically, projects that successfully implement a fee switch have a stable operating model, good products, and an appropriate revenue allocation ratio between parties. The parties involved in receiving this revenue can include the project team, liquidity providers, and token holders.

Furthermore, for projects whose tokens and products have not generated much revenue, launching a fee switch will limit the development motivation for the project team itself.

Advantages of Using a Fee Switch

As mentioned above, the fee switch faces many barriers in terms of legal aspects. However, in 2024, the individual who frequently publicly supports the crypto market was elected President of the United States. Therefore, some believe that this individual will loosen and reshape the legal framework, especially regarding the fee switch mechanism.

If the legal situation becomes clear, large projects like Aave, Raydium, and Uniswap could easily integrate a fee switch.

Transparent legal frameworks could also be a sign that encourages “high-revenue but not yet issued token” projects to enter the profit-sharing phase with the community, starting with the launch of a token. Typical examples include Polymarket and Pump.fun.

Besides, implementing a fee switch not only helps the project share economic benefits with the community but also brings many other advantages:

- Increases token value: A fee switch motivates users to hold and stake tokens, contributing to increased demand and token value in the market.

- Reduces inflation: Many projects currently have to issue more tokens to attract users. A fee switch helps generate actual revenue, thereby reducing reliance on issuing new tokens.

Builds a sustainable community: When token holders receive direct benefits from the project’s revenue, they will be motivated to stay engaged for the long term, creating stability for the ecosystem and increasing decentralization.