What makes Bitcoin valuable? The article helps readers understand the most basic information about Bitcoin, decoding misunderstandings about BTC for newcomers.

What is Bitcoin?

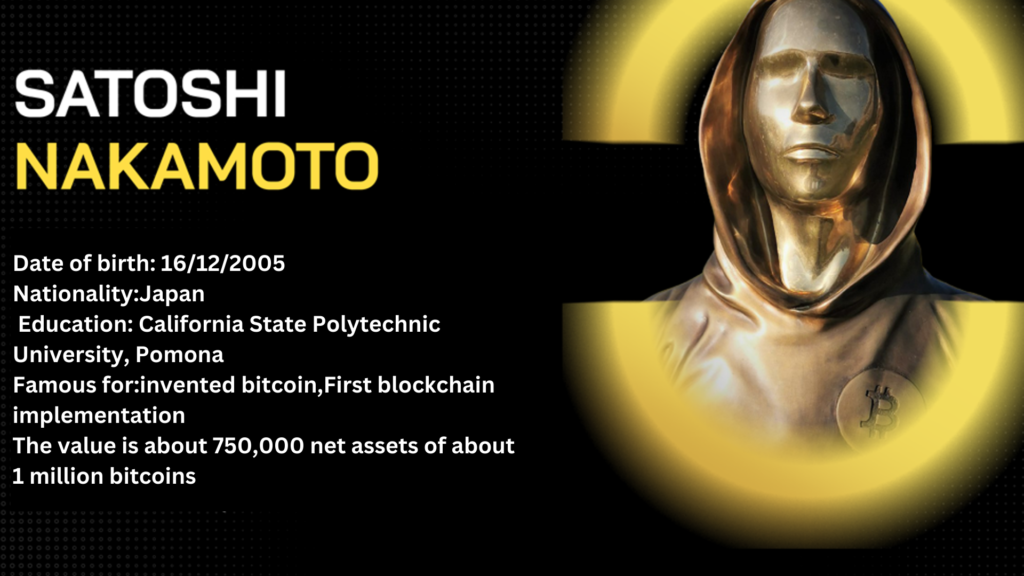

Bitcoin is the world’s first cryptocurrency, created in 2009 by an anonymous figure (or group of people) known as Satoshi Nakamoto. It is a digital currency built on blockchain technology, a decentralized and transparent ledger system that records all transactions across a network of computers.

Bitcoin utilizes a peer-to-peer (P2P) network, meaning that the sender transacts directly with the receiver without needing to go through any intermediary. This eliminates unnecessary fees and makes each transaction much cheaper compared to international money transfer services

There are a total of 21,000,000 BTC in existence. No one can change this number, not even the creator, Satoshi Nakamoto.

As of March 2024, approximately 19.6 million BTC have been mined, leaving only about 1 million BTC yet to be mined.

Bitcoin not only has its largest unit, Bitcoin (BTC), but also a smaller unit called Satoshi (or sats), named after the founder of Bitcoin.

Ratio of 1 BTC = 100,000,000 Satoshi, ie one Satoshi unit = 0.00000001 BTC.

How Does Bitcoin Work?

Bitcoin operates on blockchain technology, a decentralized and public system. Each Bitcoin transaction is attached to a block, and these blocks are linked together to form a blockchain. The Bitcoin network consists of thousands of nodes (computers) around the globe that are responsible for validating and recording transactions.

When a Bitcoin transaction is created, it is broadcast to the network and awaits confirmation from the nodes in the system. These nodes verify the validity of the transaction, including authenticating the source of the Bitcoin funds and checking the digital signature. Once the transaction is confirmed, it is packaged into a new block and added to the blockchain

The process of confirming and recording transactions is carried out by Bitcoin miners. These individuals use their computers’ processing power to solve complex mathematical problems, known as “mining.” Successful miners are rewarded with a certain amount of Bitcoin, and a new block is added to the blockchain.

This mechanism ensures the integrity and reliability of the Bitcoin system. Moreover, the use of blockchain helps prevent fraud and alteration of transaction history, as once a block has been added to the blockchain, it is nearly impossible to change.

In summary, Bitcoin operates as a decentralized cryptocurrency system, not owned by any single entity, and relies on blockchain technology to ensure the integrity and authentication of transactions.

What are the characteristics of Bitcoin?

Bitcoin is like all fiat currencies such as USD, Euro, VND… but is electronically encrypted. What makes Bitcoin different will lie in the following factors:

Decentralization

In traditional financial markets (Centralized Finance), fiat currencies are controlled by institutions like central banks or governments.

However, Bitcoin is different. Instead, for transactions to be executed and validated, they require consensus from multiple nodes participating in the Bitcoin network.

These nodes in the network are controlled by various individuals or organizations (called miners), and they are located all over the world. When more than 50% of the nodes in the network accept a transaction, creating a general consensus, that transaction is considered successful.

As you can see from the figure above, the Bitcoin network is not excessively controlled by any single entity. The most powerful organization, Foundry USA, only holds 22% of the hashrate.

Therefore, Bitcoin is considered a decentralized blockchain that cannot be attacked.

Security

Theoretically, you could hack the Bitcoin network to reverse transactions or carry out malicious actions for profit. However, in reality, no one has been able to do this because Bitcoin has a very high level of security.

Bitcoin’s security is ensured by two factors:

- Decentralization: To infiltrate the Bitcoin network, you would need to control 51% of the network’s hashrate at that time. However, this is impossible because the cost of acquiring that much computing power would be extremely high. It is estimated that the cost of attacking Bitcoin for one hour is over 700,000 USD, not including other risks.

- SHA-256 Algorithm: This is a secure hashing algorithm used to create irreversible hash functions. According to calculations by experts from the University of Sussex, for a quantum computer to be able to break Bitcoin in one hour, it would need 317 million qubits, while the most powerful computer currently has only 127 qubits. This is also why once a transaction is made, you cannot undo it or get your money back, as the information is recorded on the network, and no one can change or edit that information.

Transparency

With the US dollar circulating in the market, we cannot know exactly how much has been issued. All figures are only released by the government and may be inaccurate due to the inability to control the integrity of paper money after a period of use.

However, with Bitcoin, all information is recorded on the blockchain ledger. This means that anyone can become a miner, and anyone can read the network’s data.

Low Transaction Fees

Compared to the cost of international money transfers through institutions like banks, Bitcoin transaction fees are relatively low.

In practice, each bank will have a different fee structure. However, most banks calculate fees based on a percentage of the amount you need to send, while blockchain fees are calculated based on the number of transactions.

For example, if you send around 10,000 USD overseas, the fee will likely be no less than 100 USD, not to mention the time you’ll spend on paperwork. With Bitcoin, the fee is only 1 USD per transaction with a waiting time of about an hour.

Finiteness and difficulty to exploit

These are two characteristics that contribute to Bitcoin being seen as digital gold. Just as gold is a finite resource on Earth, Bitcoin is finite on the blockchain (limited to 21 million Bitcoin).

Because of this, the rarity of mining BTC is also becoming increasingly challenging. To mine Bitcoin, miners have to constantly upgrade their mining rigs as the difficulty of the Bitcoin network (hashrate) continues to increase.

Disadvantages of Bitcoin

Despite having the largest market capitalization in the crypto market, Bitcoin still has several limitations:

- Low block size of 1MB

- Slow network

- Transaction fees are not too high, but not low enough to compete with other blockchains

- Lack of advanced functionality due to the absence of smart contracts like Ethereum

Since Bitcoin’s inception, numerous solutions have been introduced to address these limitations. However, hard forks haven’t yielded significant value for Bitcoin, leading to the development of solutions with more direct impact: SegWit, SegWit2x, and the Lightning Network.

How to profit from Bitcoin

Bitcoin Mining

Bitcoin mining is the act of becoming a node in the Bitcoin network, also known as a “miner.” Miners use specialized computers (mining rigs) to solve complex mathematical problems and receive rewards.

These rewards come from two sources:

- Transaction fees paid by users to the network: When users make transactions, miners earn fees for processing and confirming those transactions.

- Block rewards from the Bitcoin network: This is a set amount of Bitcoin awarded to the miner who successfully adds a new block of transactions to the blockchain.

According to Satoshi Nakamoto’s vision, block rewards serve as an incentive to attract early adopters and miners to operate the Bitcoin network. Once Bitcoin becomes sufficiently large and established, with a thriving community and high BTC value, the network will be self-sustaining, eliminating the need for block rewards.

Read more: What is Bitcoin Halving? The event that reduces Bitcoin block rewards.

Buying and Holding Bitcoin

Essentially, holding Bitcoin means that investors buy BTC at a low price, hold it for a long period, and wait for the price to rise before selling for a profit. The decision to buy or sell is mainly based on fundamental analysis, evaluating and predicting the project’s future, rather than solely relying on technical analysis.

However, investors must have strong faith in Bitcoin and a high degree of patience

How to store Bitcoin (BTC)?

Storing Bitcoin on an Exchange

Most centralized exchanges (CEXs) support Bitcoin trading, so you can also store your Bitcoin on an exchange. However, for investors with large amounts of assets, storing assets on an exchange is not recommended.

The collapse of FTX is a prime example of the significant risks associated with storing assets on exchanges. Therefore, you should consider storing your Bitcoin using non-custodial wallets to have full control over your assets.

If you need to keep assets on an exchange for convenient trading, you should choose large and reputable exchanges like Binance, Bybit, Coinbase, OKX, etc.

Bitcoin Wallets

To store Bitcoin, you need a Bitcoin wallet. Non-custodial wallets are the most secure type of wallet, giving investors full control over their assets.

Each Bitcoin wallet consists of:

- A public address (similar to a bank account number and account holder name) called a Bitcoin address.

- A private key (similar to the password for your online banking account), which can be in the form of a private key or a seed phrase.

One important note is that non-custodial wallets cannot recover your private key or seed phrase. Therefore, it is imperative that you store your private key or seed phrase carefully and do not disclose it to anyone, even the support team of the wallet provider such as Coin98 Super Wallet, MetaMask, Trust Wallet, etc.

Read more: Guide to creating and using a Bitcoin wallet

Risks when holding Bitcoin that investors need to know

Market Risks

Like the broader crypto market, Bitcoin carries high risk due to its price volatility. Therefore, you should only invest with a small amount of capital to minimize risk. Bitcoin has a history of “crazy” price fluctuations:

- 1/2016-2/2017: 400-1000 USD/BTC

- 12/2017: Reached a peak of 17,000 USD/BTC

- 8/2018: Hit a cycle low of 3,400 USD/BTC

- 4/2021: Reached a peak of 63,000 USD/BTC

- 7/2021: Dropped to 31,000 USD/BTC

- 11/2021: Reached an all-time high (ATH) of 67,000 USD/BTC

- 1/2023: Slid to 16,000 USD/BTC

Read more: 6 of Bitcoin’s (BTC) most memorable and deepest price crashes

Security Risks

Security is a factor that the vast majority of Bitcoin holders are concerned about. If accounts are not properly secured, investors could lose all of their held assets.

Read more: 4 Tips to Securely Protect Your Crypto Assets

Legal Risks

The level of recognition for Bitcoin varies from country to country. Therefore, investors need to carefully research the regulations of the country they live in to ensure their Bitcoin investment activities are compliant.

Why was Bitcoin created and has value?

According to recently updated data from Coingecko, BTC reached an all-time high of 73,737 USD/BTC on March 14, 2024. However, this doesn’t represent the true value of BTC, but rather reflects the market’s supply and demand dynamics.

As mentioned above, Bitcoin’s greatest value stems from its decentralization. It is one of the few assets not controlled by any agency, organization, or government, and it cannot be suspended or eliminated due to the decisions or laws of any one country.

For billionaires or tycoons, finite assets like Bitcoin, gold, and real estate are considered true assets, while fiat currencies are always subject to inflation. Therefore, Bitcoin is being considered as an investment channel or a safe haven against currency inflation.

Although Bitcoin cannot be held in your hand like gold or have a certificate of ownership like real estate, this is also an advantage because Bitcoin cannot be counterfeited or controlled. Conversely, Bitcoin can be accessed anywhere as long as you have an internet connection.

Institutions buy & hold Bitcoin

Besides individuals holding BTC, companies have also disclosed their Bitcoin holdings. However, it’s difficult to track this through Blockchain Explorers because they might be using third-party custody services like Coinbase or BitGo, or they could be splitting their holdings across multiple smaller wallets.

The number of wallets with a Bitcoin balance is recorded at 43 million. Of those:

- The top 10 holders account for 5.4%

- The top 20 holders account for 7.4%

- The top 50 holders account for 10.7%

- The top 100 holders account for 13.5%

With ownership distributed relatively evenly, this demonstrates that Bitcoin is an asset not controlled by any single entity.

The top Bitcoin holders often change; you can track them here. Based on the data above, we cannot definitively determine who owns the majority of Bitcoin because most of the largest wallets belong to exchanges, which hold the assets of many investors.

Read more: Instructions on how to invest in Bitcoin for newbies

Pingback: Blockchain Technology: A Comprehensive Guide - coinrin.com