Bitcoin’s halving event, which occurs every four years, is approaching and has a significant impact on the entire cryptocurrency market. So what is Bitcoin halving? How does the Bitcoin halving cycle work? How does this event affect the price of BTC?

What is Bitcoin Halving?

Bitcoin halving is the event of reducing the block reward for Bitcoin miners by half, which happens approximately every four years. 1 The purpose of cutting block rewards is to control the amount of new Bitcoin created, increasing mining difficulty, limiting the maximum supply of Bitcoin, and combating inflation.

How Does Bitcoin Halving Work?

The Bitcoin halving mechanism works as follows:

- When each Bitcoin block is mined, the miner receives a reward of a certain amount of BTC, known as the block reward. Initially, this reward was 50 BTC per block.

- Every 210,000 blocks mined (approximately every four years), the Bitcoin block reward is cut in half.

- This continues until the amount of Bitcoin created per block reaches its limit (almost zero). Then, no new Bitcoin will be created.

- Cutting the block reward makes Bitcoin scarcer as more and more miners join the network, while the total supply of Bitcoin is limited to 21,000,000 BTC.

- The Bitcoin halving mechanism has been pre-programmed with code on the Bitcoin protocol since the launch of the first block (genesis block), including functions to determine:

- When the halving will occur (every 210,000 blocks mined).

- When the halving will stop (the maximum number of halvings is set at 64).

- The initial block reward (50 BTC per block).

Bitcoin’s Halving Cycle

The protocol is programmed with a maximum number of 64 halvings to ensure that no more than 21 million BTC can be created. However, according to practical estimates, the total number of halvings can only reach 32. In other words, the block reward will gradually decrease and almost disappear after about 32 halvings.

The Bitcoin halving cycle is approximately four years. Thus, the estimated schedule for Bitcoin halving is as follows

The Importance of Bitcoin Halving

Bitcoin halving takes place to adjust Bitcoin’s inflation rate by reducing the block reward for miners. After the block reward runs out, they can still earn transaction fees as a reward for performing the task of securing the Bitcoin network.

Reducing Bitcoin Network Inflation

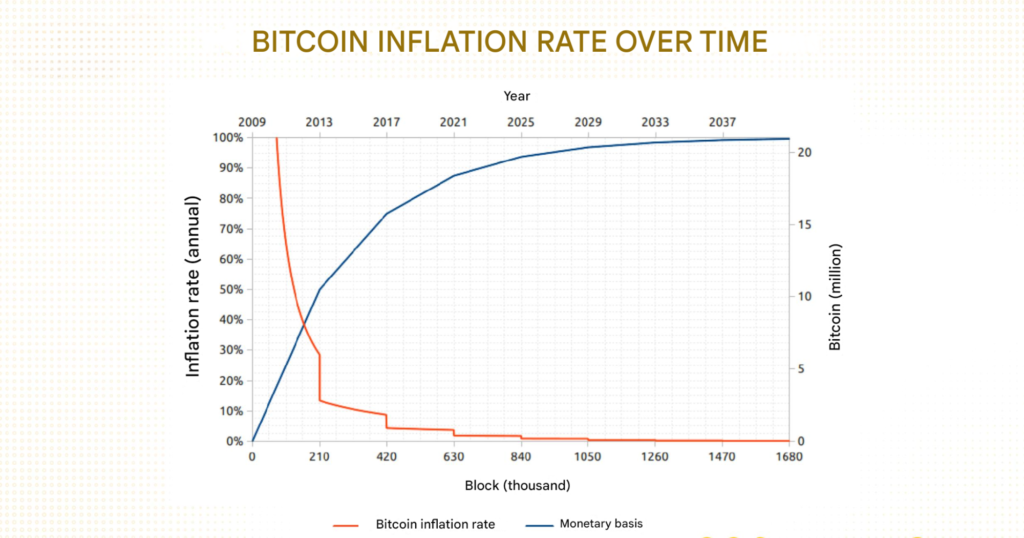

Bitcoin has a fixed supply, so it has a predetermined inflation rate and no one can print more BTC. Bitcoin’s initial annual inflation rate was 12.5%.

After each halving, Bitcoin cuts the block reward in half. This leads to a decrease in the supply on the market, and Bitcoin’s annual inflation rate will also gradually decrease to 0 after 32 halvings.

Bitcoin’s inflation rate gradually decreases to 0 after Bitcoin halving events. Source: Bitcoin Block Half.

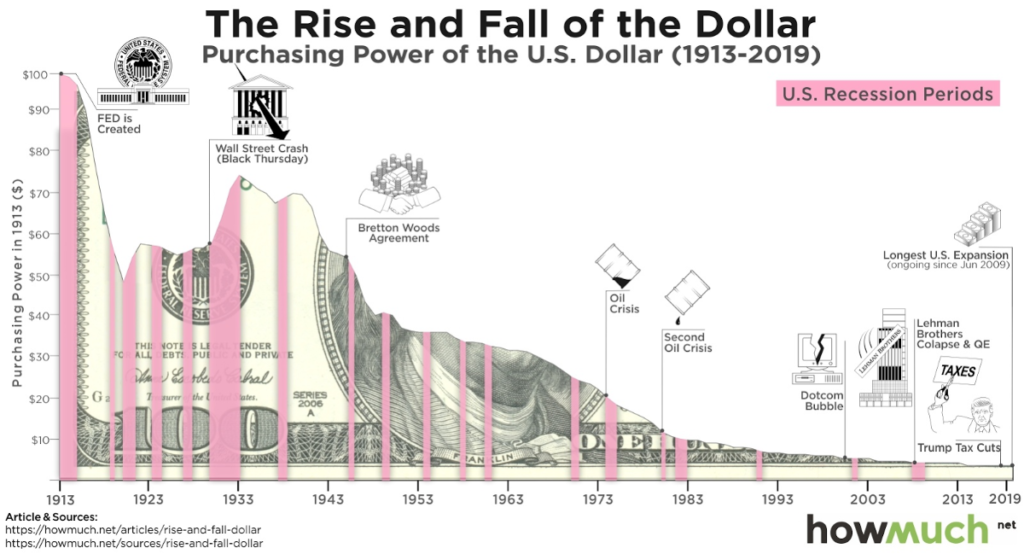

As Bitcoin’s inflation rate decreases and falls below the inflation rate of the USD, Bitcoin will gradually become a store of value in place of current fiat currencies.

Compared to Bitcoin, fiat money does not have a limited supply and can easily be printed by central banks, which increases inflation and decreases the value of fiat currency. The image below clearly shows the increase in the inflation rate of the USD, causing it to depreciate and reduce purchasing power.

Read more: Is Bitcoin the perfect solution to inflation?

Increasing Bitcoin Network Security

Transaction validation, security, and maintenance of the Bitcoin network are the responsibilities of miners. They are also the most affected when halving occurs because cutting the block reward in half also means halving their profit.

However, this will help cleanse the mining market as miners who lack resources and vision will leave the game, replaced by a new generation of miners with a longer-term vision for Bitcoin.

The profit that miners receive from validating transactions and ensuring network security will then rely entirely on network transaction fees. This simultaneously helps accumulate benefits for all 3 parties:

- Miners strive to do their job well to provide a fast, secure transaction network to attract more users.

- Users use the Bitcoin network and pay fees to miners.

- Bitcoin is widely used, widely accepted, and moves closer to “mass adoption.”

Impact of Bitcoin Halvings

BTC Price

Based on the basic law of supply and demand, anyone can predict that the Bitcoin halving event will positively impact the price of BTC. Because after each halving, the supply of BTC will decrease, leading to more demand than supply (if demand remains constant) and the price of BTC will increase.

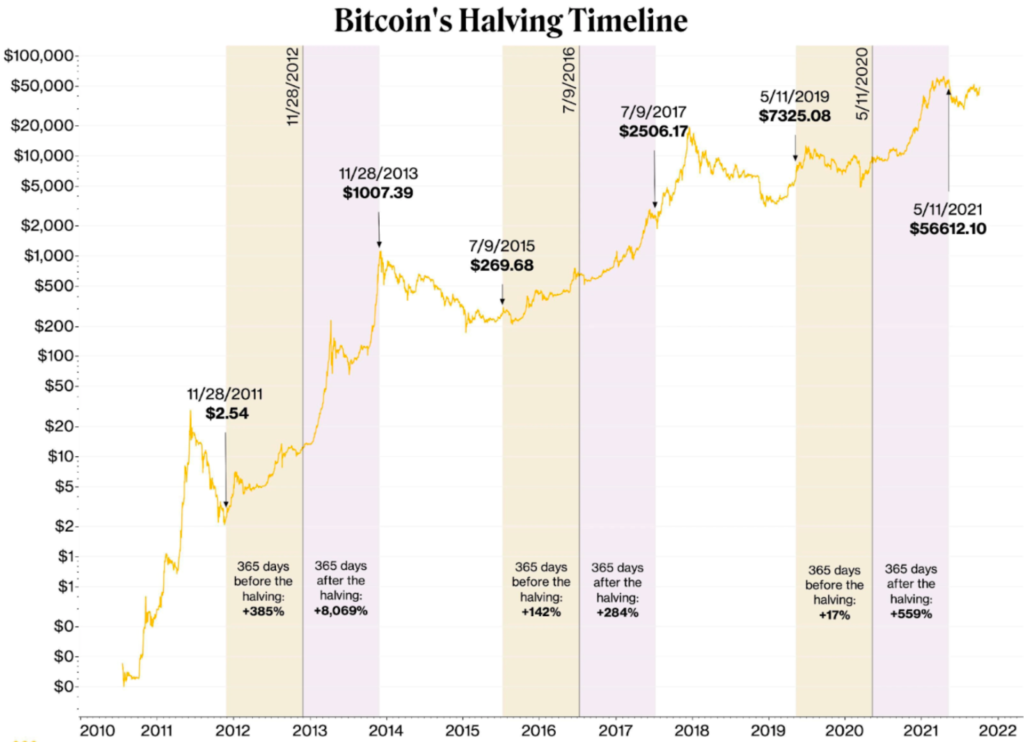

Historical BTC price data also shows that the price of BTC has increased significantly after each Bitcoin halving:

First Bitcoin Halving (November 2012): Bitcoin began to grow strongly (bull market), lasting from a year before to a year after the halving event. With a growth rate of 50,162%, BTC increased from $2.29 (November 2011) to $1,114 in early December 2013. Immediately after, Bitcoin entered a downtrend and fell to about $560.

Second Bitcoin Halving (July 2016): Bitcoin price entered a bull market nine months before the halving event and lasted until a year after the halving. At the end of the bull market, Bitcoin price increased by 9,000%, from $213 (August 2015) to $19,500 (December 2017). After that, Bitcoin continued into a downtrend cycle, causing its value to drop 80% from its peak.

Third Bitcoin Halving (May 2020): Bitcoin price continued to increase sharply from $8,700 (November 2020) to $56,600 (November 2021). Half a year before the third halving event, the price of Bitcoin was $7,300 (November 2019).

It can be seen that the price of BTC seems to always react positively to Bitcoin halving events. However, no one can be sure that this will always happen in the next halvings.

Altcoin Prices

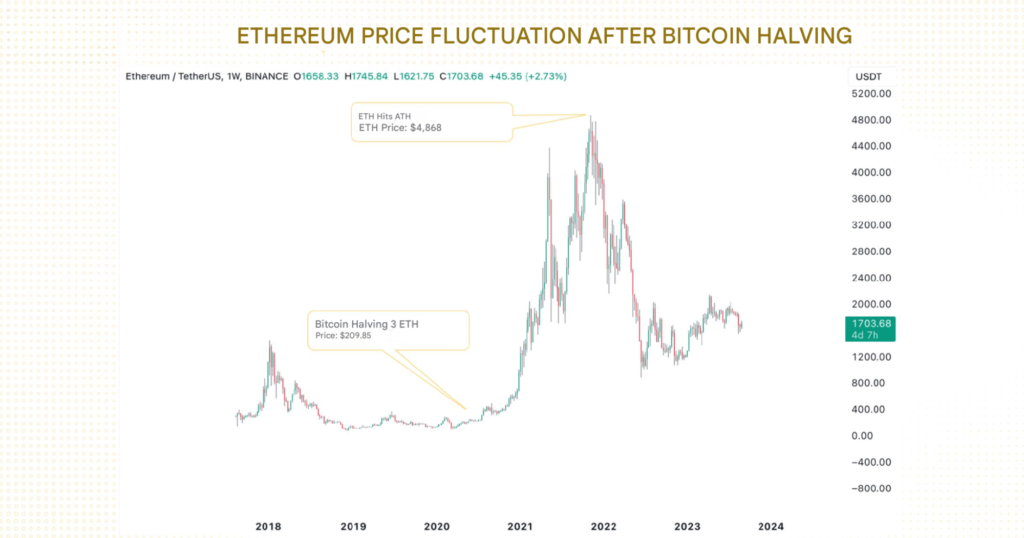

The Bitcoin halving event not only affects BTC but also impacts the prices of altcoins (cryptocurrencies other than Bitcoin).

Typically, altcoin prices will react in the same direction as Bitcoin’s price movements after a Bitcoin halving. When Bitcoin’s price increases significantly, many people become more cautious about investing in Bitcoin for fear of “buying the top.” Therefore, they will seek opportunities to diversify their portfolios by switching to altcoins. This leads to a significant increase in altcoin prices.

ETH is the second-largest cryptocurrency by market capitalization, after BTC. Therefore, ETH often starts an upward trend immediately after Bitcoin’s price increases.

However, altcoins often pull back in the short term when Bitcoin’s price increases. After Bitcoin’s price stabilizes, investors shift to altcoins and the altcoin season begins.*

*Pullback is a term that refers to the price moving against the main trend for a short period.

Is Bitcoin Halving Good or Bad?

Bitcoin halving is not entirely good or bad, but it depends on the subject (miner or investor) and many other factors to consider.

For Miners

Bitcoin miners have to spend a large amount of money to invest in specialized machines and electricity to run the miners, and this cost is offset by the block reward. What will happen to miners when Bitcoin halving occurs?

Consider the following factors:

- BTC Price: After the Bitcoin halving event, the increase in BTC price helps to increase the profit miners receive per BTC unit.

- Block Reward: Bitcoin halving cuts the block reward in half, meaning the profit miners receive will also be halved. In the event that the BTC price does not increase enough to offset the loss in rewards and mining costs, miners may have to suffer losses.

For Investors

Essentially, the increase in BTC price after the Bitcoin halving event is good for investors who hold Bitcoin from before. However, for investors who enter later and are affected by FOMO* due to the price increase, it is easy to encounter a “buy the top” situation, where they buy BTC at a high price and the price drops immediately after, leading to losses.

*FOMO (Fear Of Missing Out) is the fear of missing out on potential profits if you don’t buy a certain cryptocurrency as soon as possible, regardless of its current price.

Finding Tops and Bottoms with Bitcoin Halving

To date, Bitcoin has undergone 3 different halvings. However, the similarity between the 3 periods is:

- About 1 to 1.5 years before halving, the price of BTC will reach the bottom of that cycle.

- About 1 to 1.5 years after halving, the price of BTC will reach the peak of that cycle.

First Bitcoin Halving:

- November 28, 2011: BTC price was $2.54 (Cycle bottom price).

- November 28, 2012: BTC price was $12 (Bitcoin halving).

- November 28, 2013: BTC price was $1,007 (1 year after halving).

- November 30, 2013: BTC price was $1,128 (Cycle peak price).

Second Bitcoin Halving:

- August 25, 2015: BTC price was $210 (Cycle bottom price).

- September 7, 2015: BTC price was $269 (1 year before halving).

- September 7, 2016: BTC price was $610 (Bitcoin halving).

- September 7, 2017: BTC price was $2,506 (1 year after halving).

- December 17, 2017: BTC price was $19,200 (Cycle peak price).

Third Bitcoin Halving:

- November 5, 2019: BTC price was $7,325 (1 year before halving).

- March 11, 2020: BTC price was $4,900 (Cycle bottom price).

- November 5, 2020: BTC price was $8,600 (Bitcoin halving).

- November 5, 2021: BTC price was $61,000 (1 year after halving).

- November 8, 2021: BTC price was $67,000 (Cycle peak price).

Many investors have hoped that the fourth Bitcoin halving will be an opportunity for them to make a profit. Specifically, Bitcoin is expected to undergo its fourth halving in April 2024