This article is for you! No matter where you start, no matter how long you have been participating in the crypto market, please join me!

Hey there! If you’re standing at the threshold of the crypto market, you’ve probably experienced a mix of excitement, confusion, and anticipation about the opportunities it offers. You might have heard stories of people who “made it big” by investing in Bitcoin, Ethereum, or even memecoins like Shiba Inu. That’s probably what motivated you to be here!

But hold on a second, do you really understand who you are in the crypto market? Are you aware that each group of market participants has different goals, motivations, and approaches? By identifying yourself, you’ll know what you need, where to start, and how to avoid unnecessary risks.

To start your journey from 0 to 1, join me in this article!

Who are you?

Before you dive headfirst into the crypto market, take a pause and ask yourself: “Who am I in this market? What are my motivations for starting?”

Your motivations will steer your journey through the volatile world of crypto. Clearly understanding your goals and true motivations will give you a clear perspective, prevent you from acting blindly, following the crowd, or getting caught up in risky price frenzies.

- Are you driven by the desire to get rich quick? Is your motivation fueled by stories of people who made millions overnight through crypto?

- Are you interested in blockchain technology and the changes it can bring to the world? Do you want to participate and contribute to the development of this technology?

- Do you crave financial freedom, seeking a long-term investment solution to build stability for your future and your family?

- Or are you simply curious, wanting to explore and understand the world of decentralized finance, learn and accumulate knowledge?

If you don’t belong to any of these groups, that’s perfectly fine! These are just some of the most common examples to help you define yourself.

If you desire all of the above, great! You know your needs, and now let’s find ways to address them.

So, what’s the purpose of asking who you are?

The answer will determine your path in the crypto market. There’s no right or wrong answer – the important thing is to know which group you belong to. From there, we can set up a plan, goals, and strategies that suit you.

Crypto isn’t a place to jump into impulsively; it’s a market that demands understanding, patience, and a clear strategy. Crypto is not just an opportunity, but also a challenge. Ask yourself, to find out “who am I in this market?”

And, why are you here?

Why are you here?

Be honest with yourself. Why do you want to enter the crypto market?

“I want to get rich quick”

One of the biggest reasons people are drawn to crypto is the potential for high profits in a short period. For many, especially the younger generation, crypto is not just an investment opportunity but a shortcut to wealth, especially after witnessing spectacular success stories.

According to statistics from Statista (2023), up to 78% of crypto users enter the market with the desire to earn high profits. This is not only happening in developed countries, but is also very common in developing nations like Nigeria, where 32% of people use crypto as a primary investment vehicle.

According to a 2022 Finder survey, up to 21% of Vietnamese people participate in the crypto market, a notable figure in Southeast Asia. Young Vietnamese are increasingly sensitive to blockchain technology and new opportunities, not wanting to miss out on the major waves of change in the market.

A prime example is Erik Finman – the young man who invested $1,000 in Bitcoin in 2011 when he was just 12 years old. By 2020, Finman’s assets had surpassed $4 million thanks to the explosion in Bitcoin’s price, making him one of the youngest millionaires from crypto. Finman once shared: “Bitcoin changed my life. It’s one of the biggest opportunities that any young person can have.”

I want “financial freedom” and to retire in my “twenties”

Many people participate in crypto not just for immediate profit, but also for the desire to achieve financial freedom. They want to earn money without having to work a 9-to-5 office job, and crypto seems to offer that opportunity.

According to a 2023 Gemini survey, 45% of crypto participants are looking to achieve financial freedom and escape traditional jobs. Of those, over 60% are office workers and freelancers.

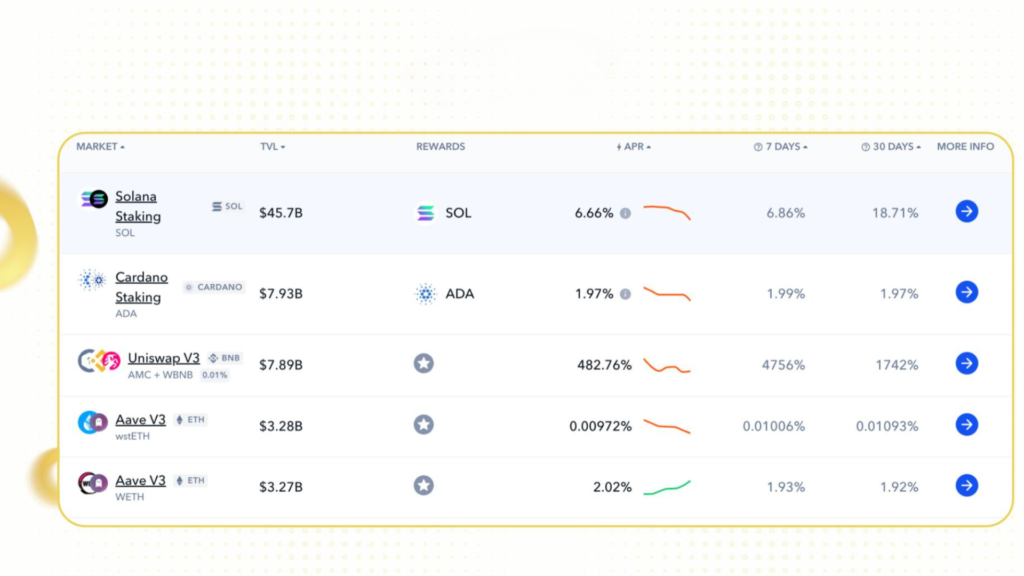

The yield opportunities in DeFi attract investors looking to generate stable and long-term profits.

Brandon Quittem, a former office worker, left his stable job to enter the crypto market. He started by staking and yield farming on DeFi protocols, earning steady returns from his assets.

Brandon shared, “I haven’t had to work full-time since entering crypto. Passive income from DeFi has helped me escape the traditional job cycle, giving me financial freedom and time to pursue other passions.”

I am a professional investor

Experienced investors in traditional financial markets such as stocks and real estate are gradually shifting to crypto to diversify their portfolios.

Bitcoin, considered “digital gold,” has become an important tool for investors to protect their assets against inflation. With a limited supply of only 21 million coins, Bitcoin cannot be “printed” like fiat currency, making it a hedge against inflation and currency devaluation.

Fidelity (2023) reported that over 60% of traditional financial investors have added Bitcoin or Ethereum to their portfolios. They consider these assets as a means to diversify risk and protect asset value during times of economic hardship.

Paul Tudor Jones, one of the world’s most renowned investors, has added Bitcoin to his portfolio to combat inflation.

He commented, “Bitcoin is a great hedge against the devaluation of traditional currencies. I believe it will play an important role in the future of finance.” Paul Tudor Jones is not alone. Elon Musk and many other major investors have also publicly owned Bitcoin as part of their asset allocation strategies.

Find out: Is Bitcoin the perfect solution to the inflation problem?

Paul Tudor Jones emphasized in an interview with CNBC about his desire to add Bitcoin to his portfolio.

Opportunities for Traders – “I’m here for the charts”

In the crypto market, strong price volatility creates golden opportunities for traders – those who don’t seek long-term profits but instead, profit from short-term trades. With its 24/7 operation, the crypto market is completely different from traditional markets like the stock market. This allows traders to take advantage of constant fluctuations to optimize profits, day or night.

According to a Binance survey (2023), over 40% of crypto users are professional traders or short-term traders. Platforms like Binance Futures have become a place where many traders utilize derivatives and leverage to maximize profits from strong market swings. This proves that there is no shortage of opportunities for those with the skills.

“I’m here for the tech”

Besides financial factors, many people participate in the crypto market simply because of their passion for technology. They see the potential of blockchain technology in transforming many fields such as finance, art, and even entertainment.

According to DappRadar (2023), the number of users participating in applications within the crypto market has grown by more than 60% in the past year, with over 3 million active wallets daily on platforms like Ethereum, BNB Chain, and Solana.

Beeple, a digital artist, made a splash by selling his NFT artwork for $69 million in 2021. This is one of the biggest milestones in digital art, ushering in a new era for the creative industry.

Not only Beeple, but thousands of other artists, developers, and creators have also ventured into the world of NFTs and the Metaverse, where they can explore the endless possibilities that blockchain offers.

For tech enthusiasts, crypto is more than just an investment – it’s a technology playground, a testing ground for innovative and groundbreaking ideas.

Where should you start?

[If you’re completely new and don’t have much knowledge about the crypto market, the first thing you shouldn’t do is pour money into buying coins just because they’re trending. It might be tempting, but the crypto market not only offers profit potential but also carries significant risks if you’re not prepared.

If you’re not exactly brand new, maybe you have a few months of experience, or you’ve been a successful trader in traditional markets… Whoever you are, when you step into a new field…

Invest in Knowledge – The Safest Investment

The crypto market is highly volatile, and those without basic knowledge often fall prey to short-term trends and lose money. Even seasoned professionals with years of experience can fall into these “traps.”

The most important thing before you enter the market is to learn and equip yourself with foundational knowledge. This is an indispensable step, regardless of which group of participants you belong to, as we discussed earlier.

- Learn about blockchain technology: Understanding how the underlying technology of crypto works will give you a long-term perspective and help you properly assess the potential of projects.

- Understand different types of cryptocurrencies: Know the difference between Bitcoin, Ethereum, and millions of other altcoins. Each has its own uses, features, and goals.

- Market analysis: Learn how to read price charts, understand market cycles, and grasp the factors that influence the value of cryptocurrencies.

- Investing – in any market, whether it’s stocks, real estate, or crypto – requires time, effort, and money. It also requires “knowledge, experience, and expertise.”

Remember: Investing in knowledge is the safest investment.

Learn to manage emotions and avoid FOMO

Greed and emotions will certainly lead to bad investment decisions. To succeed in crypto, you need to learn to control your emotions. One of the biggest mistakes is being driven by FOMO (Fear of Missing Out).

People see those around them making money from crypto and rush in with the desire to “get rich overnight.” However, this can lead to wrong decisions, like buying coins at their peak or investing all your assets in a volatile coin.

- Don’t let FOMO or greed cloud your judgment. Short-term volatility can be very attractive, but true success lies in building a long-term and sustainable strategy.

- Cultivate a patient mindset. Crypto is a new market, and successful investors are often those with a long-term vision who know how to patiently wait for the right opportunities.

Always remember: Don’t rush into the market just to make quick money.

Read more: What is FOMO? 4 ways to overcome FOMO in crypto.

Risk Management is a Must

Risk management is a survival factor for any investor, especially in the crypto market – where price fluctuations can be strong and sudden. Unlike the traditional Vietnamese stock market, crypto has no limit on price fluctuations, meaning prices can skyrocket or plummet in a very short time. This creates opportunities but also carries the risk of significant losses if you don’t manage risk properly.

- The golden rule is to never invest more than you can afford to lose. Because the crypto market is volatile, losing all your capital overnight is entirely possible.

- Make sure your investment is a small part of your total assets, and if you lose it, it won’t seriously affect your financial life.

- Manage risk by diversifying your portfolio. Never put all your money in a single coin, no matter how much you believe in it.

Don’t Fall into “Pump and Dump” Schemes

The crypto market is always rife with misleading advice, misinformation, and scams aimed at attracting newcomers. “Pump and dump” schemers often take advantage of the greed of uninformed individuals, leading them to invest in high-risk projects without fully understanding them.

- Don’t listen to all advice from unknown sources. When someone tells you to buy a coin, do your own thorough research before making a decision. If you can’t determine why you should buy it, then you shouldn’t do anything!

- Build a solid knowledge base. If you have a good understanding of the market, the concept of “pump and dump” will never be in your vocabulary. You will confidently make informed investment decisions.

Crypto is not an easy market, it has never been easy, and from now on, it will not be “easy.” But with a solid foundation of knowledge and patience, you can absolutely take advantage of opportunities to build your financial future.

Read more: Financial Nihilism: The Shift in Investment Psychology of Young People Through the Lens of Bitcoin and Memecoins.